Emerging Markets Daily - November 17

How the BRICs Fared 20 Years Later, Pakistan's Booming Tech World, Oil Could Hit $120 in '22, India's Fastest Unicorn, Metaverse Stocks Buzzing in Korea

The Top 5 Stories Shaping Emerging Markets from Global Media - November 17

How the BRICs Have Fared - Twenty Years Later

Bloomberg

“Jim O’Neill wasn’t trying to change the way investors and executives looked at the world twenty years ago. He just wanted to prove he was up to his new job…”

“With the 9/11 attacks already shaking up the American-centric view of how the global economy worked, he launched a project built around a simple premise: the economic heft of Brazil, Russia, India and China was set to grow massively. The result was Global Economic Paper Number 66: ‘Building Better Global Economic BRICs,’ published on Nov. 30, 2001.”

“The central thesis: The global economy would in the following decades be driven by the growth of these emerging markets which had large populations to harness. It argued global policymaking forums such as the Group of Seven should be re-organized to incorporate BRIC representatives.”

“It took a second note from Goldman in 2003 before the idea really took off. It stretched the vision to 2050 and detailed how China’s economy could become as large as the U.S.’s by 2039 with India subsequently passing Japan to become the third-biggest economy.”

“Two decades on and the BRICs are displaying a mixed performance, as O'Neill himself acknowledges. China soared in strength and India climbed, though both face headwinds in the pandemic era. Russia and Brazil, however, stumbled after good starts.”

"‘I got China very right, and Brazil and Russia very right in the first decade, but the second decade for Brazil and Russia has been close to a disaster,’ says O'Neill.”

“When the 2008 collapse of Lehman Brothers sparked the global financial crisis, the BRICs initially proved more resilient than their developed peers, marking what would end up being a high point for their combined relative performance on the global economic stage.”

“The BRICs more than doubled their share of the global economy from 8% in 2000 to 19% in 2011, according to Bloomberg Economics. But the going has been tougher since.” Bloomberg reports.

Pakistan’s Tech Ecosystem Booming, But Likely to Slow Next Year

Rest of World

“Pakistan’s tech ecosystem has seen unprecedented growth this year. Startups in the country raised over $244 million in the first three quarters of 2021, which is more than the previous six years combined. But experts suggested to Rest of World that the momentum is unsustainable and likely to slow in 2022.”

“Multi-million-dollar funding rounds this year included those for digital freight marketplace BridgeLinx, quick-commerce startup Airlift, and e-commerce platform Bazaar. Some experts believe this might be a watershed moment for the country’s tech startup ecosystem, with several funding rounds being led by first-time investors into Pakistan.”

“‘A cataclysmic change is coming for Pakistan: an opportunity to disrupt the hold of capital from traditional business families who have been a limiting factor because they control regulation, influence bureaucracy, policy, and grow by stifling competition,’ Faisal Aftab, co-founder of Zayn Capital, Tazah’s lead investor, told Rest of World. Aftab estimates the current collective market cap for all Pakistani startups to be between $1.5 billion and $2 billion. He expects this to rise to $6 billion in the next five years and touch $30 billion by 2031.”

“Part of the boom is being driven, according to Aftab, by the success of Pakistan’s first startup wave, which began in 2012-13 with the launch of Foodpanda, Careem, and Daraz. The success of those companies provided the capital and know-how for the current generation. Bajwa and Zaka of Tazah Technologies, for instance, worked at Careem. Bajwa also worked at Swvl for about six months after he quit Careem.”

“The global economic slump in the early months of Covid-19 also helped supercharge Pakistan’s startup ecosystem, says Aftab.”

“Pakistan is still awaiting its first homegrown unicorn; quick commerce startup Airlift, which recently raised $85 million in a series B financing round in August, could be a strong contender. Still, Lakhani says there are multiple questions.”

“As 2021 draws to a close, the general consensus among most of the experts and entrepreneurs who spoke with Rest of World is that this year’s momentum is unsustainable and unlikely to continue at the same pace in 2022.” Zuha Siddiqui reports.

OPEC+ Under-Investment Could Lead Oil Prices to Hit $120: Rosneft

Arab News

“Global oil prices may rise to $120 in the second half of 2022, due to OPEC+ under-investments, Bloomberg reported citing a Rosneft executive. ‘Today OPEC+ countries can’t increase production to the extent necessary to meet demand,’ the Russian company’s Vice President for Commerce and Logistics, Otabek Karimov said.”

“‘As a result, there is a very serious deficit of energy resources in the whole world today. Naturally, this cannot but affect the price,’ he added. As OPEC+ is gradually boosting supply, crude oil prices have climbed almost 60 percent to above $82 a barrel this year, as recovery boosts demand.”

“Karimov’s comments come following OPEC+ members' expectations that prices would decline, as the global market is to become oversupplied soon, and the International Energy Agency’s forecast that the end of the price rally is in sight.” Arab News reports.

Meet MENSA: India’s Fastest Unicorn

Nikkei Asia

“India's Mensa Brands has breached the billion-dollar valuation mark in just six months from launch, making it the fastest startup in the country to become a unicorn, boosted by tail winds of recovering consumption after the COVID-19 pandemic.”

"‘Our deep focus on technology and digital brand building, as well as our people, has allowed us to grow 3X of our initial plan,’ Ananth Narayanan, founder and CEO of Mensa Brands, said in a statement on Tuesday.”

“Mensa buys majority stakes in digital-first brands, which primarily sell their wares on the internet, acting as an umbrella company that owns and operates them. The firm, which claims to be profitable, said in a statement that it has invested in 12 brands across the fashion, home, beauty and personal care categories.”

“Mensa's march to a billion-dollar valuation follows a $1 billion fundraiser by the U.S. brand-aggregating unicorn Thrasio, at a valuation north of $5 billion, in October. Thrasio is also said to be chalking out its India foray.”

“Thrasio shot to prominence in the U.S. by buying out small brands that sold on Amazon. In the three years since its launch in 2018, Thrasio claims to have orchestrated more than 150 acquisitions, worth $600 million. The firm's portfolio spawns 22,000 products from over 200 brands.”

“Investors are particularly hot on startups that have replicated the Thrasio model in India. 10Club raised $40 million from Fireside Ventures and HeyDay, a Thrasio competitor in the U.S., in June. SoftBank-backed child care retailer FirstCry raised $150 million for its Thrasio-style venture, GlobalBees, in July, while Tiger Global Management and Walmart-owned Flipkart invested $36 million in Goat Brand Labs. UpScalio, another Thrasio clone, has raised $42.5 million in a round led by Presight Partners.” Sayan Chakraborty reports.

Metaverse Stocks Buzzing in Korea With Multiple ETF Launches

Bloomberg

“Metaverse stock fans are finding that South Korea is a go-to Asian market to bet on the technology, with a host of exchange-traded products and shares up for grabs.”

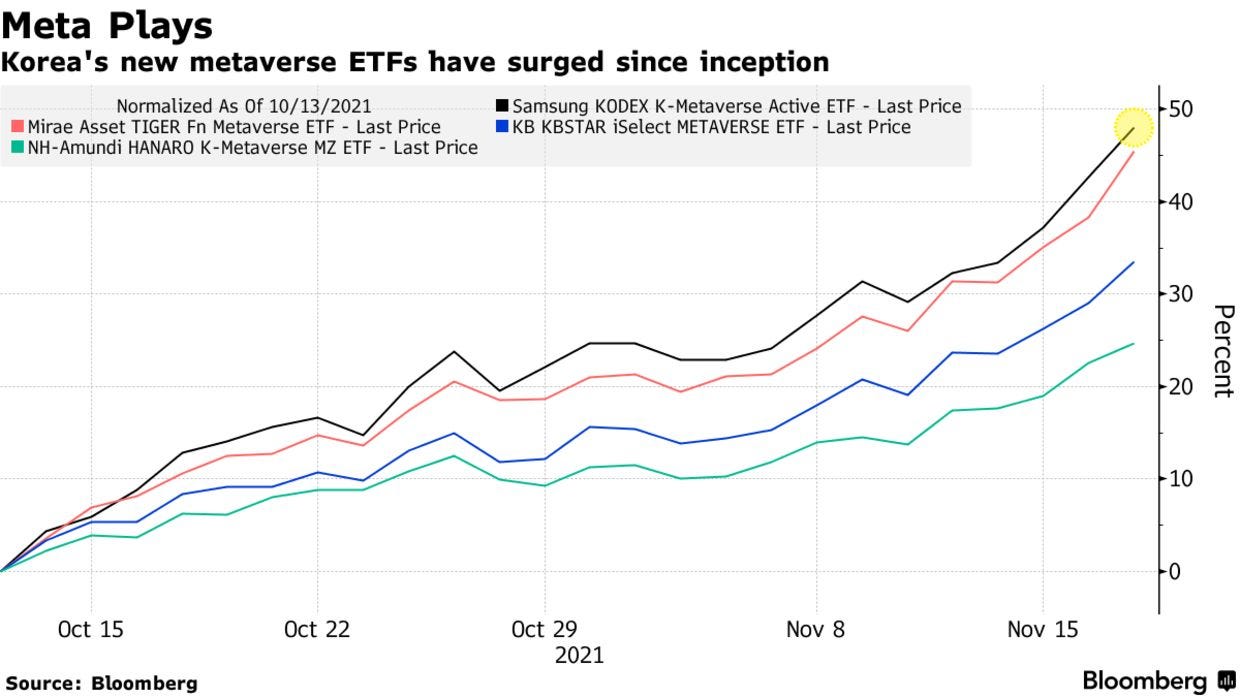

“Korea’s ETFs focused on the metaverse, many of them newly listed, have seen double-digit gains this month to trump the Kospi benchmark’s 0.3% decline. Aside from the popular U.S.-listed Roundhill Ball Metaverse ETF, most other vehicles focused on the concept are hosted in South Korea, according to Bloomberg-compiled data.”

“Prices for Mirae Asset Tiger Fn Metaverse ETF -- the largest in the country by market value, Samsung Kodex K-Metaverse Active ETF, NH-Amundi HANARO K-Metaverse MZ ETF and KB KBSTAR iSelect Metaverse ETF have jumped by at least 24% since they all launched on Oct. 13.”

“South Korea is the fastest-growing metaverse ETF market globally, reaching $100 million in assets in just under two weeks,” said Bloomberg Intelligence analyst Rebecca Sin. “Flows are driven by retail demand and this trend may continue in the region with Australia and Taiwan to follow.” Ishika Mookerjee reports.

“You are never too old to set another goal or to dream a new dream.”

— C.S. Lewis