Emerging Markets Daily - November 23

Turkish Lira Hits New Low, U.S To Tap Into Oil Reserves to Tame Gas Price, Alibaba Nears Record Low, Peru vs Mining Companies, Mubadala's Investment Strategy

The Top 5 Stories Shaping Emerging Markets from Global Media - November 23

Turkish Lira Hits New Bottom as Erdogan Doubles Down on Interest Rates - “It’s Like a Horror Film”

Financial Times

“The Turkish lira suffered a historic retreat after President Recep Tayyip Erdogan praised a recent interest rate cut and declared that his country was fighting an ‘economic war of independence’.”

“The currency, which is down more than 40 per cent against the dollar this year, plunged as much as 15 per cent on Tuesday — a drop that eclipsed even Turkey’s currency crisis of 2018 — and broke through the symbolic threshold of 13 to the dollar after Erdogan used a combative speech to expound his vision for the country’s economy.”

“The fall eased to around 11 per cent in mid-afternoon dealings in London. ‘It’s like a horror film,’ said Enver Erkan, an analyst at the Istanbul-based Terra Investment, adding that it was hard to say how much further the currency would plunge given that policymakers appeared willing to simply let it fall.”

“‘This is the inevitable consequence of Erdogan’s war on rates,’ said Uday Patnaik, head of emerging market debt at Legal & General Investment Management. ‘The thing that would stop the freefall is some sign of an independent central bank in Turkey. But there’s not much prospect of that. Erdogan’s the type of guy who likes to keep doubling down.’”

“Erdogan, a life-long opponent of high interest rates, declared in an address on Monday night that he was ‘pleased’ the central bank had cut rates for the third consecutive month last week, despite warnings from economists that it would stoke inflation, which is already running at an annual rate of 20 per cent, and further destabilise the currency.”

“Painting a picture of a dark global conspiracy aimed at subjugating Turkey, Erdogan said the country would not give in to economists, ‘opportunists’ and ‘global financial acrobats’ calling for interest rate rises.”

“The government was prioritising growth, he said, in order to encourage investment, production, exports and employment. ‘That’s why we pay no attention to the clamour of the doomsayers,’ he said. He compared the struggle to the one the nation fought against foreign occupiers in the aftermath of the first world war, which culminated in the foundation of the modern Turkish republic in 1923.” Laura Pittel and Tommy Stubbington report.

Biden To Tap into U.S Oil Reserves to Tame Gas Prices; A Shot Across the Bow at OPEC-Plus

New York Times

“Working in concert with five other countries, President Biden on Tuesday ordered the release of oil from the nation’s emergency stockpile as Americans face rising gas prices amid a jump in inflation ahead of the holiday season, according to senior administration officials.”

“The administration will tap into 50 million barrels of crude in the Strategic Petroleum Reserve. Britain, China, India, Japan and Korea will also open up their oil reserves in an effort to combat soaring global prices on oil.”

“The Department of Energy’s release of the reserves, which is set to be detailed in remarks by Mr. Biden on Tuesday afternoon, is meant to address fluctuations in supply and demand for oil, administration officials said.”

“The move by Mr. Biden is a shot across the bow of OPEC Plus, the name for the Organization of the Petroleum Exporting Countries along with Russia and other countries. Mr. Biden has pushed OPEC Plus to increase production, but has been rebuffed.” Zolan Kanno-Youngs and Stanley Reed report.

Alibaba Slides Toward Record Low as Rival JD.com Extends Recovery

Bloomberg

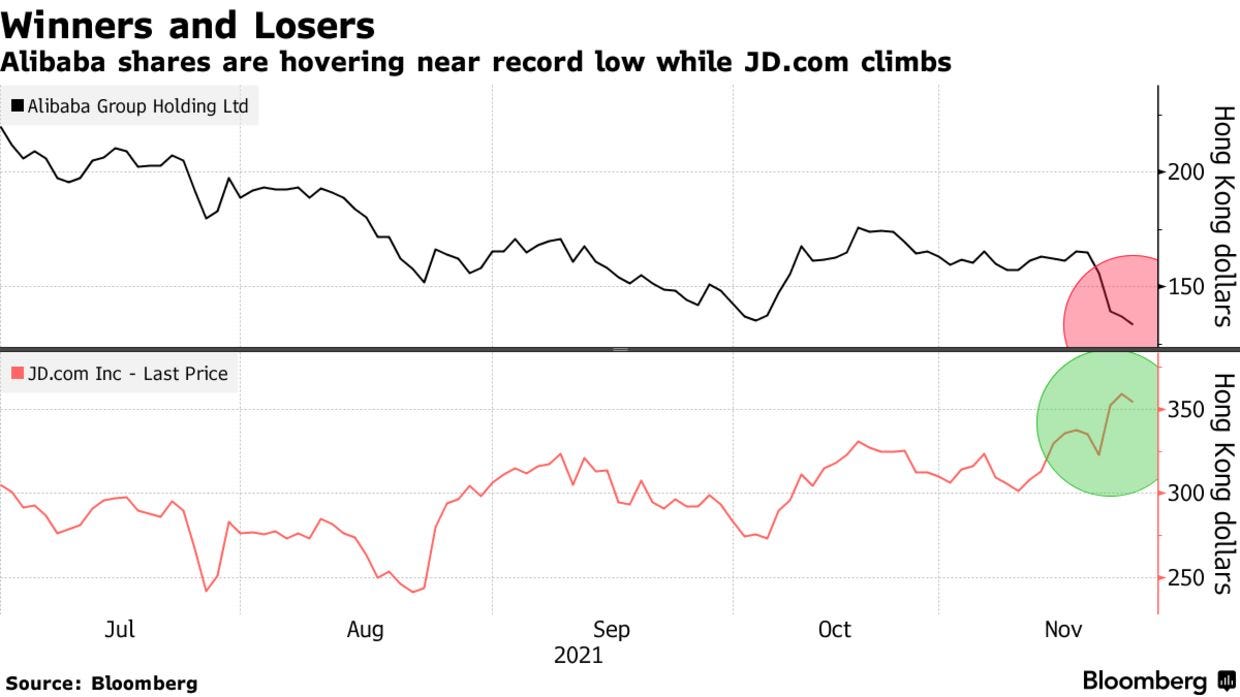

“Alibaba Group Holding Ltd.’s October rally has given way to a renewed slump that has the stock heading for a record low while technology rival JD.com Inc. is extending its recovery and winning favor with analysts.”

“Deutsche Bank AG’s Leo Chiang cut his target price for Alibaba’s Hong Kong stock by almost 4% on Monday, citing ‘near-term challenges,’ while raising his target for JD.com by 16%, noting ‘resilient growth amid macro uncertainties.’”

“Morningstar Inc.’s Chelsey Tam echoed similar views in a Nov. 19 note, arguing that ‘Alibaba’s challenges go beyond the economic cycle’ and that JD.com offers ‘more clarity on the long-term margin improvement.’”

“Alibaba shares were down 3% at HK$132.90 at 11:06 a.m. in Hong Kong on Tuesday, taking their decline to 18% this month and more than wiping out all of October’s gains. While JD.com was also down on the day, in line with the wider market, it is up about 46% from its August low.”

“Chinese tech shares including Alibaba fell on Tuesday on concerns over possible renewed regulation of online platforms. The Hang Seng Tech Index was down as much as 2%.”

“Beijing’s tech crackdown means Alibaba will have to shift about 5% of its e-commerce revenue to its competitors, including JD.com and Pinduoduo Inc, said Ramiz Chelat, a senior portfolio manager at Vontobel Asset Management.” John Cheng reports.

Peru Gov’t. in ‘Productive’ Talks with Hochshcild Amid Dispute; Global Miners Watching Results Closely

Reuters

“Shares of Hochschild Mining (HOCM.L) collapsed 27% on Monday after Peru's government ruled out any operational extensions for its flagship Inmaculada silver mine, but mining executives and government officials also said they had had a ‘productive’ late night meeting to ease tensions.”

“Mining is key to the economy of Peru, which is the world's No. 2 producer of copper and silver.”

“Peru's prime minister, Mirtha Vasquez, said on Friday that a group of four mines - including two owned by Hochschild - would not be granted any further operational extensions due to environmental concerns and would instead close down in the near future.”

‘We haven't discussed anything specific,’said Raul Jacob, who heads the National Society of Mining, Energy and Oil, following a meeting with Vasquez. ‘I do want to say there was very good open dialogue, very productive.’

“The original announcement triggered a furious reaction from mining executives over the weekend and caused Hochschild's shares to plummet as much as 57%, before paring losses for a 27% drop, the worst for the London-listed miner.”

“Vasquez's new statement follows remarks from Peru's vice minister of mines, who appeared to backtrack on the closure decision in an interview on Sunday night.”

“Peru is currently in the process of proposing higher taxes on miners, and socialist President Pedro Castillo has said the additional revenue will be crucial to fund social programs. The announcement triggered broader remarks about the sector.”

"‘No information suggests that the government will close other mines but we cannot rule out it will go after large(r) mines,’ Bank of America said in a note, in which it also downgraded Hochschild. Reuters reports.

Mubadala To Stick With Investment Strategy Despite Headwinds, CEO Says

“Mubadala Investment Company, Abu Dhabi’s strategic investment arm, expects short-term challenges stemming from rising interest rates and inflation, however, these headwinds will not change the company’s investment strategy or its view on sectors it invests in, its chief executive said.”

“‘When I look at 2022, for us as Mubadala ... there’s no shift in terms of our strategy, in terms of themes in which we are investing in [and] in terms of how we look at the next five to 10-year cycle,’ Khaldoon Al Mubarak said at the Global Manufacturing and Industrialisation Summit (GMIS 2021), which started in Dubai on Monday.”

“Inflation is on the rise in many parts of the world and tightening of monetary policy will have ‘implications’, however, their impact will vary from market-to-market, he told delegates. ‘From a short-term perspective, yes, there are challenges ahead,’ he said. ‘I expect there would be some adjustments here and there, but not to the point where I would change my perspective, or our perspective as Mubadala, from an investment and thematic view…’

“Mubadala is at the heart of the government’s plans to diversify Abu Dhabi's revenue base and generate income from sources other than oil. The company’s portfolio of investments spans five continents with interests in aerospace, information and communications technology, semiconductors, metals and mining, renewable energy, oil and gas, and petrochemicals.”

“At home, it holds stakes in Emirates Global Aluminium, aerospace manufacturing company Strata, satellite communications company Yahsat and Mubadala Petroleum.” Sarmad Khan reports.

“There is no such thing as normal. Normal is just another word for lifeless.” - Shah Rukh Khan, Bollywood star