Emerging Markets Daily - November 29

Oil Rebounds Strongly, Africa Business Forum Cancelled Due to Omicrom, Ashmore Still Bullish on China Property, Dark Clouds Over EM, Saudi Tadawul IPO

The Top 5 Stories Shaping Emerging Markets from Global Media - November 29

Oil Rebounds, Shrugging Off New Covid Variant Concerns

Reuters

“Oil rebounded by more than 5% on Monday to above $76 a barrel as some investors viewed Friday's slump in oil and financial markets as overdone while the world awaits more data on the Omicron coronavirus variant.”

“Top officials from the Organization of the Petroleum Exporting Countries (OPEC) and its allies, known as OPEC+, echoed that view, with the Saudi energy minister quoted as saying he was not worried about the Omicron variant.”

“The World Health Organization has said it could take weeks to understand the variant's severity, though a South African doctor who has treated cases said symptoms seemed to be mild so far.”

“Brent crude was up $3.66, or 5%, at $76.38 a barrel by 1444 GMT, having slid by $9.50 on Friday. U.S. West Texas Intermediate (WTI) crude was up $4.36, or 6.4%, at $72.51, having tumbled by $10.24 in the previous session.”

“Friday's slide, the biggest one-day drop since April 2020, reflected fears that travel bans would hammer demand. The plunge was exacerbated by low liquidity owing to a U.S. holiday and the expected demand hit does not justify such a fall, analysts said. 'The fear factor had its grip on financial markets on Friday,’ said Norbert Ruecker of Swiss bank Julius Baer. ‘Fundamentally, the announced and enacted international air travel constraints cannot explain such a sharp slump.’”

“A semblance of calm also returned to wider markets on Monday as investors awaited more information about the new variant. European and Wall Street shares rose while safe-haven bonds lost ground.” Reuters reports.

Major Africa Investment Forum Nixed Due to Omicrom Variant

African Business

“Three days before the event, the African Development Bank (AfDB) has postponed the 2021 Africa Investment Forum as delegates prepare to travel to Abidjan. This marks the second year running that the vital investment forum has been disrupted due to the coronavirus, with last year’s event cancelled.”

“A buffet of deals worth $110 billion to help economies on the continent rise to their feet after a bitter recession will have to wait, President Akinwumi Adesina told reporters in Abidjan, at a pre-event press conference on Monday. ‘It’s very important that we put the lives of people first. We have to be sensitive and we have to be responsible,’ he said.”

“Several billion dollars of investment projects were scheduled for investment board rooms with project sponsors and investors at this edition of the Africa Investment Forum. Unfortunately, with rising global travel restrictions due to the Covid-19 Omicron variant, and heightened concerns for health and safety, it is necessary, regrettably, to postpone the event. The health and safety of everyone comes first.” African Business reports.

Ashmore Doubled Down on Evergrande Debt as Others Hit the Exits

Bloomberg

“The news was bad and about to get worse. Property developer China Evergrande Group appeared to be buckling under its massive debt load and investors were headed for the door. For Ashmore Group Plc, though, it looked like a buying opportunity.”

“From July to September, as headlines battered Evergrande’s stock and bond prices, London-listed Ashmore bought almost another $100 million of bonds issued by the developer or its subsidiaries. The trades brought its holdings of the debt to more than $500 million at the end of September, according to data compiled by Bloomberg. The total level held by the asset manager may be even higher since 75% of Ashmore’s assets are held in segregated mandates, for which data may not be available.”

“In a story full of superlatives, the emerging markets-focused asset manager holds at least one of its own. Before the selloff, Ashmore was already the biggest holder of the developer’s dollar-denominated bonds. Since other big holders, including Prudential Plc and the Royal Bank of Canada, cut their exposure when it was buying, that title looks to be firmly held.”

“A spokesperson for the company, which manages $91.3 billion of assets, declined to comment and would not disclose whether the firm had increased or decreased its holdings since the end of September. …A Morningstar report from October said Ashmore was still ‘generally positive’ on the Chinese real estate sector at the end of September.” Bloomberg reports.

Dark Clouds Over EM As New Covid Variant Haunts Global Economy

Bloomberg

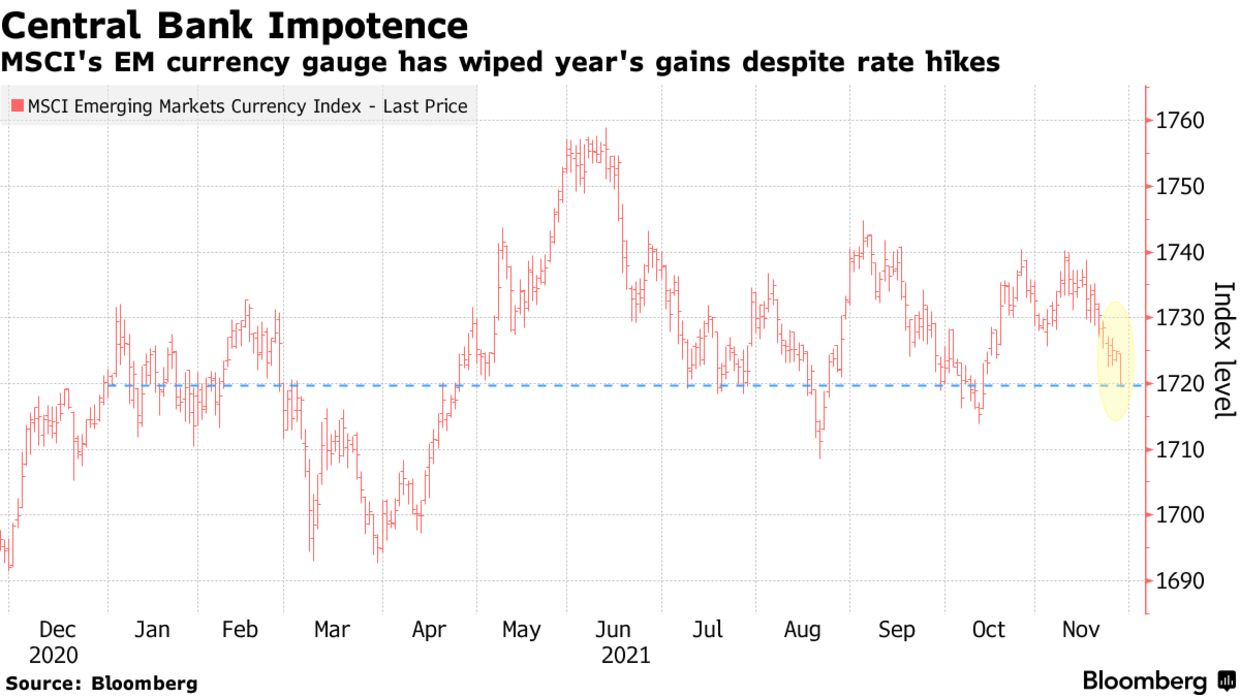

“If emerging-market central banks were having a tough time shoring up their currencies as the Federal Reserve steps up its scaling back of monetary stimulus, their task just got a whole lot harder.”

“Worries over the emergence of the omicron Covid-19 variant sent risk assets into a tailspin Friday, tipping MSCI Inc.’s gauge of developing-world currencies into deficit for the year and potentially on track for its first annual decline in three years.”

“Central banks in the developing world were being enfeebled by the dollar’s renewed vigor long before omicron was identified, with policy tightening from South Korea to Russia and Brazil doing little to stem the currency losses that are fueling inflation. The biggest losers this month are Mexico’s peso, South Africa’s rand and Hungary’s forint, all currencies from countries that have raised interest rates in November. That’s put bearish investors in the ascendant.

“Any factors which limit visibility makes life more difficult for central banks,” said Viktor Szabo, a senior investment manager at abrdn plc in London. ‘But an increasing number of emerging-market central banks start to realize that the question of whether inflation is transitory or not is not really relevant at this stage. Inflation is high and sticky, even if caused mainly by supply-side shocks, and can de-anchor inflation expectations and put pressure on currencies.’” Bloomberg reports.

Saudi Tadawul IPO Set at Top of Range

The National

“Saudi Tadawul Group, the owner and operator of the kingdom’s stock exchange, set the final price of its initial public offering at the top end of the range, valuing the company at 12.6 billion Saudi riyals ($3.36bn).”

“The final offer price was set at 105 riyals per share, Saudi Tadawul Group said in a statement on Sunday following the book building process. It had earlier set the price range of its IPO between 95 riyals and 105 riyals per share.”

“Saudi Tadawul Group is selling 36 million shares, or 30 per cent of its 120 million issued share capital, to the public. The company, which received approval for the public float from Saudi Arabia's Capital Markets Authority on November 4, said individual subscribers will be able to subscribe for shares in the offering between Tuesday and Thursday next week (November 30 and December 2)…”

“Saudi Tadawul Group's shares will be listed on the main index of the Saudi Exchange once offering and listing formalities are completed, the company said earlier this month. Citigroup, JP Morgan Chase and SNB Capital are financial advisers and global co-ordinators for the IPO.”

“Tadawul, which is among the top 10 global stock markets with a market capitalisation of about $2.8 trillion, will become the third publicly traded regional stock exchange, after the Dubai Financial Market and Boursa Kuwait, once it is listed.” The National reports.

Life isn't about finding yourself. Life is about creating yourself. - George Bernard Shaw