Emerging Markets Daily - November 9

Global Holdings of China Securities: $1 Trillion+, Saudi Fast Growth, Bolsonaro Says: Carve Up Petrobras, Indonesia SE Asia Start-Up Fund, The West and Ethiopia War

The Top 5 Stories Shaping Emerging Markets from Global Media - November 9

Global Holdings of China Stocks, Bonds Jumps $120 Bln in 2021, Exceeds $1 Trillion Total

Financial Times

“Global holdings of Chinese stocks and bonds have jumped by about $120bn in 2021 as foreign investors chase returns in the country’s markets despite recent volatility and regulatory crackdowns by Beijing. International investors held Rmb7.5tn ($1.1tn) of equity and fixed income securities priced in renminbi as of the end of September, up about Rmb760bn from the end of 2020, according to Financial Times calculations.”

“The climb highlights how investors are reaching into mainland Chinese markets directly, rather than through financial instruments listed in global financial hubs such as New York and Hong Kong. It comes at a time when some analysts and investors worry that strong returns in developed markets may be exhausted, leading them to pursue opportunities elsewhere.”

“China’s offshore listings have had a tumultuous year, with a succession of regulatory crackdowns knocking investor confidence in sectors ranging from technology to education. A liquidity crisis at property developer Evergrande, meanwhile, has prompted a round of heavy selling for internationally traded, high-yield dollar bonds from Chinese issuers.”

“But global capital has grown ever more intertwined with domestic Chinese finance in pursuit of greater diversification and higher returns.” Hudson Lockett and Tabby Kinder report.

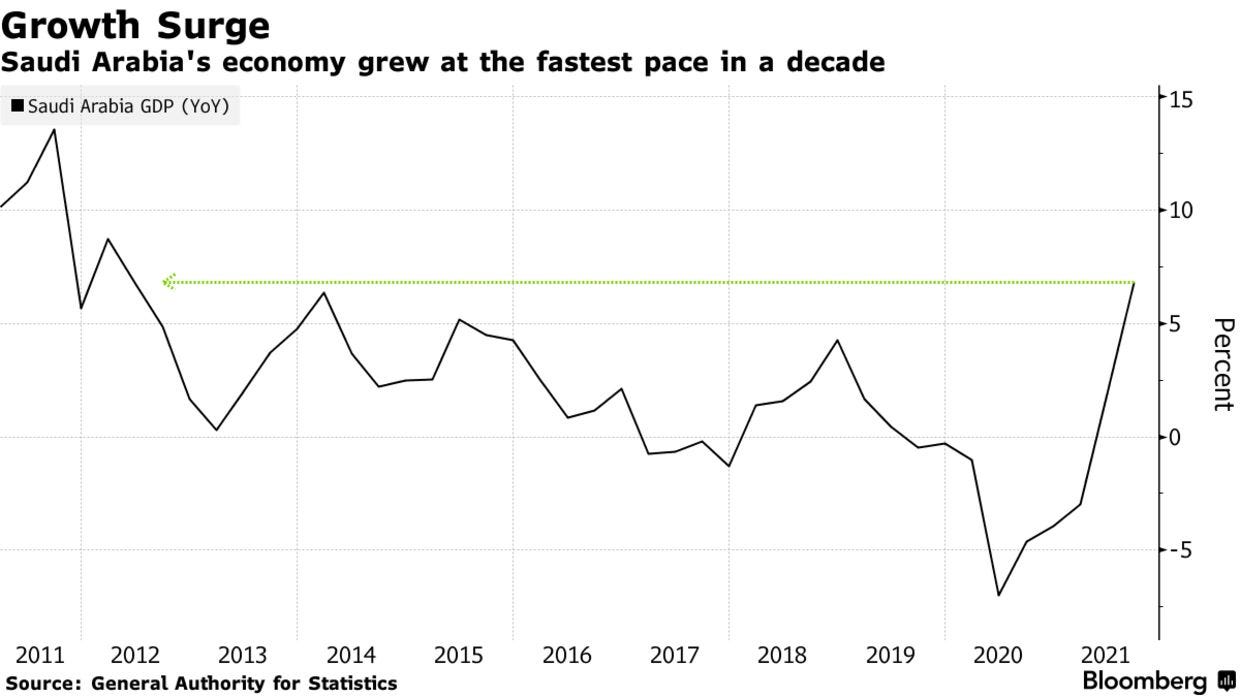

Saudi Economy Grew at Fastest Rate in Nearly a Decade

Bloomberg

“Saudi Arabia’s economy grew at its fastest pace in nearly a decade in the third quarter, boosted by higher oil prices, according to preliminary estimates from the government.”

“Gross domestic product in the kingdom expanded by 6.8% compared to the same quarter of 2020, the General Authority for Statistics said Tuesday, its fastest pace since 2012, when oil prices averaged $122 a barrel. It grew 5.8% compared to the previous three months.”

“The oil sector grew 9% year-on-year, while the non-oil economy -- the engine of job creation -- expanded by 6.2%. It grew 1.6% from the previous quarter, when non-oil activity performed worse than expected.”

“Saudi Arabia, the largest Arab economy, saw a sharp contraction in 2020 due to the double shock of lower crude prices and the coronavirus pandemic. This led the government to take measures to cushion the fiscal impact, including tripling the value-added tax, cutting expenditure plans and raising import duties.” Vivian Nereim reports.

Bolsonaro Says He Aims to Carve up Brazil’s Petrobras

Reuters

“Brazilian President Jair Bolsonaro reiterated on Monday that he would like to privatize state-run oil company Petroleo Brasileiro SA (PETR4.SA), saying his ideal plan would be to carve it up rather than selling it to one buyer.”

“Grappling with the political fallout from rising fuel prices, Bolsonaro has repeatedly suggested in recent weeks that he would like to privatize the company known as Petrobras.”

“Some of the president's key supporters, such as truckers, want him to do more to control the company's fuel pricing policy, but such moves would be expensive for Petrobras and could dent Brazil's fiscal credibility.”

“In a radio interview on Monday, the president once again blamed a state-level tax for high fuel prices, while calling the company's dividend payment ‘absurd’.”

"‘For me, the ideal thing is to be rid of Petrobras,’ he said. ‘Logically, it's best to sell it to many companies, not to go from a state monopoly to a private monopoly. Cut it up.’”

“In a security filing last week, Petrobras repeated that it would maintain its current fuel pricing policy and that price adjustments were made in line with business needs and international price fluctuations.” Reuters reports.

Indonesia VC Closes Largest Early Stage SE Asia Fund

Nikkei Asia

“Indonesian venture capital company Alpha JWC Ventures has closed what it calls the ‘largest early-stage fund in Southeast Asia’ at $433 million, it announced on Tuesday.”

“The VC has had three portfolio companies achieve unicorn status -- a startup valued at more than $1 billion -- this year and will be looking to replicate the feat with its new fund as the region's internet economy carries on growing despite the COVID-19 pandemic.”

“The fund initially aimed to raise $300 million, but was oversubscribed, said Jefrey Joe, the co-founder and managing partner of Alpha JWC. ‘We had a lot of interest from investors around the world, especially U.S. investors,’ he said.”

“The World Bank's International Finance Corporation invested, as did Hong Kong tycoon Li Ka-shing's Horizon Ventures and China's CTBC Bank, among others. A total of 20% of the fund's limited partners came from Indonesia, 50% from other parts of Asia and 30% from the U.S. and Europe.”

“Alpha JWC is the latest regional VC to announce a fund closure in recent months, underscoring investor appetite in Indonesia and the region.”

“Intudo Ventures, a VC investing exclusively in Indonesian homegrown startups, closed its $115 million fund in early September, while Jungle Ventures, one of Southeast Asia's oldest VCs, said in mid-September that it had achieved a first close of its fourth fund at $225 million.” Shotaro Tani reports.

Western Nations Ramp Up Sanctions Threats on Ethiopia Amid Widening Civil War

Africa Confidential

“In the wake of the United States warning on targeted sanctions and ejection of Ethiopia from Washington's free trade deal in Africa, the European Union is discussing plans for hard-hitting measures against leaders in Addis Ababa and Tigray region.”

“‘The EU remains ready to use all its foreign policy tools, including restrictive measures, to promote peace, adherence to international humanitarian and human rights law, and help end conflict,' said Josep Borrell, the EU's High Representative on foreign affairs on 4 November.”

“There is unanimity among EU foreign ministers who have condemned Prime Minister Abiy Ahmed's handling of the Tigray war. This follows splits in Brussels over whether to impose sanctions on Turkey, Russia and Belarus. The Ethiopian government has no one to plead its case in Brussels.”

“Although relations between the EU and Abiy are ice cold, Borrell stipulated the bloc 'supports the stability, unity and territorial integrity of Ethiopia.' That supports Addis Ababa's position and criticises the TPLF's political statements on secession.”

“Economic sanctions and travel bans can be imposed under the EU's Human Rights Sanctions regime, which is modelled on the US's Global Magnitsky Act.”

“Few expect that sanctions will contribute to persuading Abiy to drop his 'all-out war' policy. Pressure on that is coming from the federal forces' reversals on the battlefield last month. Over the last few days, with concerns growing about a possible attack on Addis Ababa, negotiators have stepped up their efforts.” Africa Confidential reports.

“Stop acting so small. You are the universe in ecstatic motion.”

― Rumi