Emerging Markets Daily Oct 11

Hot EM Pick: Russia, India IPO Rush Fuels Booming Stocks, Global Rebound Slows, Qatar Says Nat Gas Prices At 'Unhealthy' Levels, China's Didi Probe and Nat'l Security

The Top 5 Stories Shaping Emerging Markets from Global Media - October 11

Global Energy Chaos Turns Russia Into Top Emerging Markets Pick

Bloomberg

“Surging energy prices are kindling bullish bets on developing-nation exporters, with Russia emerging as traders’ favorite investment destination.”

“Russia’s ruble has gained more than any other emerging-market currency this month, bolstered by the prospect of higher oil revenues, while the nation’s stocks outperformed as a broad gauge of developing equities sank. OPEC’s monthly report will be closely watched this week as investors seek further clues on the outlook for the oil industry.”

“It marks an abrupt change of pace for emerging-markets investors who’ve spent the last few weeks alternately worrying over the threat of cascading debt delinquencies from China’s Evergrande crisis and the looming prospect of tighter policy from the Federal Reserve. That’s soured demand for the stocks, bonds and currencies of emerging economies across the board -- until now.”

“Investors have switched to weighing the assets of energy exporters from Russia to Colombia -- whose peso is the No. 2 performer this month -- to determine which offer the best bet.” Bloomberg reports.

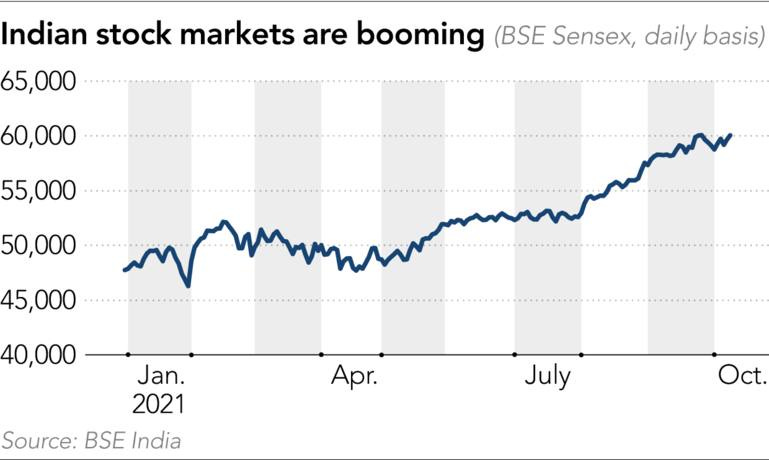

The Great Indian IPO Rush Fuels a Booming Market

Nikkei Asia

“The Indian stock markets are witnessing an unpreceded boom, fueled by an influx of new retail investors and optimism for the country's economic recovery. That sent the benchmark BSE Sensex index to an all-time high above 60,000 last week and opened a window of opportunity to Indian companies to raise funds to reduce debt and plan new ventures…”

“In the Great Indian IPO Rush, companies as varied as edible oil sellers and hotel booking apps are launching offers in the next few months…And the pace is accelerating. Over 60 more companies have filed for IPOs. Filings records maintained by research firm Prime Database suggest that in the current fiscal year ending March 2022, Indian companies' fundraising will exceed Rs 1 trillion.”

“A signal that sellers will receive a welcome reception came when Ant Group-backed food delivery firm Zomato raised Rs 90 billion in July, with an offering that was 38 times oversubscribed. Since then, Zomato's market valuation has crossed Rs 1 trillion at Rs 138 a share -- far higher than its IPO price of Rs 76 a share.”

Global Rebound Hit by Supply Squeezes, Energy Costs and Inflation

Financial Times

“The sharp global rebound from the coronavirus recession ‘appears in danger of stalling’ amid supply bottlenecks, surging energy prices and rising inflation, according to an exclusive research for the Financial Times.”

“Global growth showed historic momentum earlier in 2021 but is now slowing in China and the US, the world’s two largest economies, as the threat of Covid-19 still hangs over the global economy, according to the latest Brookings-FT tracking index.”

“The findings indicate that policymakers will no longer simply be able to boost spending power without serious risks…The latest twice-yearly update shows a sharp snapback in growth since March across advanced and emerging economies as confidence surged with the success of Covid vaccinations…”

“Advanced economies have hit these bumps in the road as they came close to recovering lost output from the crisis which had suggested a historically promising recovery. But in emerging and low-income countries, the signs of longer-term scars are becoming more evident, especially where governments and central banks cannot easily boost demand without running into even more difficult inflationary pressures.” Chris Giles reports.

Top LNG Exporter Qatar Warns Natural Gas Prices at “Unhealthy” Levels

Bloomberg

“Qatar, the world’s biggest exporter of liquefied natural gas, warned that prices have climbed to ‘unhealthy’ levels.”

“‘While natural gas prices are an outcome of basic market fundamentals including supply and demand, the current price levels observed in global markets are unhealthy for both producers and consumers,’ the Gulf nation’s Energy Minister Saad Al-Kaabi said after a virtual discussion with Kadri Simson, the European Union’s commissioner for energy.”

His comments come amid a crisis in gas markets, with prices in Europe and parts of Asia having surged in recent weeks. They eased on Wednesday following comments from Russia’s President Vladimir Putin suggesting that Moscow could raise exports.

Qatar is spending around $30 billion to increase production, though that will take years. Kaabi said last month the country would struggle to boost output in the near term as it was pumping at maximum capacity. Paul Wallace and Dana Khraiche report.

China’s Didi Probe on Nat Security Grounds, Xinhua Reports

South China Morning Post

“China’s cybersecurity probe into Didi Chuxing is aimed at addressing possible national security risks stemming from the ride-hailing giant’s overseas listing, the official Xinhua news agency said in a report on Sunday.”

“This is the first time that an official Chinese media outlet has provided further details on why Beijing launched an investigation into Didi, which began just two days after the company’s US$4.4 billion June 30 initial public offering in New York. At the time, the Cyberspace Administration of China (CAC) said that the investigation was carried out in an effort to “prevent data security risks and protect national security”.

Sunday’s Xinhua report said that China’s new rules on critical information infrastructure facilities as well as probes into Didi, Full Truck Alliance and Boss Zhipin, were aimed at “effectively preventing potential national security risks relating to procurement, data processing and overseas listings”.

“The South China Morning Post reported earlier that Chinese authorities initiated the probe because Didi had ‘forced its way’ to a US listing in the face of government concerns. CAC said in a short statement on July 4 that Didi’s app, often referred to as the Uber of China, had seriously violated the country’s laws and regulations through the improper collection and usage of user information, without providing further details.” Josh Ye reports.

“I learned to make my mind large, as the universe is large, so that there is room for contradictions.” - Maxine Hong Kingston