Emerging Markets Monitor - April 17

IMF Raises India Growth Forecast, Powell Signals Higher for Longer Rates, Gulf States Seek to Avert Wider War, China SOE's Rising, Emerging Markets and the Global Economy

The Top Stories Shaping Emerging Markets from Global Media - April 17

IMF Raises India Growth Forecast to 6.8%

Reuters

“The International Monetary Fund (IMF) has raised India's growth forecast for 2024-25 to 6.8% from 6.5% on the back of strong domestic demand and a rising working-age population.”

“The Reserve Bank of India, the country's central bank, estimates the economy to grow at 7% in the current financial year that started on April 1. The IMF estimates Asia's third largest economy's gross domestic product to grow at 6.5% in the next financial year, it said in the World Economic Outlook released on Tuesday.”

“The agency also revised upwards the growth figure for 2023-24 to 7.8% from 6.7% it had forecast in January. India's own official estimates had pegged growth at 7.6%.”

"‘Global economy remains remarkably resilient, with growth holding steady as inflation returns to target,’ the IMF said while predicting the global real GDP growth at 3.2% for 2024 and 2025, the same rate as in 2023.”

Powell Signals U.S Interest Rates Will be Higher For Longer

Bloomberg

“Federal Reserve Chair Jerome Powell signaled policymakers will wait longer than previously anticipated to cut interest rates following a series of surprisingly high inflation readings.”

“Powell pointed to the lack of additional progress made on inflation after the rapid decline seen at the end of last year, noting it will likely take more time for officials to gain the necessary confidence that price growth is headed toward the Fed’s 2% goal before lower borrowing costs.”

“If price pressures persist, he said, the Fed can keep rates steady for ‘as long as needed.’”

“‘The recent data have clearly not given us greater confidence and instead indicate that is likely to take longer than expected to achieve that confidence,’ Powell said Tuesday in a panel discussion alongside Bank of Canada Governor Tiff Macklem at the Wilson Center in Washington.”

“…Powell’s remarks represent a shift in his message following a third straight month in which a key measure of inflation exceeded analysts’ forecasts. It also shows officials see little urgency to cut rates and suggests that any reductions in 2024 may come relatively late in the year, if at all.”

“Policymakers narrowly penciled in three interest-rate cuts in forecasts published last month, but investors are now betting on just one to two cuts this year, futures markets show…The US economy continues to surprise Fed officials with its resilience. Employers added over 300,000 jobs in March — the most in nearly a year — and retail sales topped expectations. Bloomberg reports

‘Bad for Business’ - Gulf States Scramble to Avert Wider War

Channel News Asia/AFP

“Gulf states are grappling with the widening Middle East conflict as hostilities between Iran and Israel threaten their security and ambitious plans to reshape their economies.”

“Leaders of the resource-rich Gulf monarchies engaged in a rapid round of diplomacy after last weekend's Iranian drone and missile strikes on Israel raised the spectre of a regional conflagration.”

“The Gulf countries share an ‘overall realisation that conflict is bad for business and avoiding conflict comes now almost at any cost’, said King's College London Middle East analyst Andreas Krieg.”

“On Monday (Apr 15), Qatar's emir, Sheikh Tamim bin Hamad Al-Thani, spoke to the Iranian president about the ‘need to reduce all forms of escalation and avoid the expansion of conflict in the region’, the official Qatar News Agency reported.”

“And on Sunday, UAE President Mohamed bin Zayed spoke to Qatar's emir and the kings of Jordan and Bahrain, state media said, while Saudi Arabia's de facto leader Crown Prince Mohammed bin Salman talked with Iraq's prime minister.”

“Saudi Arabia's foreign minister spoke with his counterpart in Iran, and the Saudi defence minister held discussions with his US counterpart. Much is at stake for the wealthy, US-friendly Gulf states, whose expensive economic diversification plans, aimed at securing their futures post-fossil fuels, rely on a peaceful environment for business and tourism.”

“Washington has reaffirmed ‘ironclad’ support for Israel, but a US official said it would not join any potential Israeli counterattack against Iran.” Channel News Asia/AFP report.

Buoyed By Reforms, China’s State-Owned Enterprises Win Back Investors

Financial Times

”China’s unfashionable state-owned enterprises are getting a second look from investors, as their stocks beat the broader market and Beijing judges executives on share price performance.”

“A sub-index of SOEs with minority listings in Hong Kong has outperformed the city’s benchmark index by 40 per cent since the start of 2021, although it is flat in absolute terms amid an extended stock market rout.”

“Many unloved SOE stocks have single-digit price-to-earnings ratios, while offering healthy dividend yields that averaged 7 per cent for the Hang Seng China Central SOEs index in 2023, compared with 4 per cent for the broader Hang Seng China Enterprises index.”

“Rekindled investor interest in China’s state-owned behemoths would also reflect their continued economic prominence and an ongoing campaign by Beijing to improve financial performance. As their biggest shareholder, the central government stands to benefit from higher valuations and larger dividends.”

“‘SOEs used to have lower revenue growth, lower returns on equity and much higher balance sheet leverage than private companies. But after 2020, we’ve seen SOEs improving,’ said Winnie Wu, a strategist at BofA Securities in Hong Kong.”

“There are parallels with government campaigns in Japan and Korea to improve stock market valuations, she said, noting also that buying into SOEs may suit fund managers whose benchmark requires exposure to China.” The FT reports.

Emerging Markets Are Exercising Greater Global Sway

IMF Blog

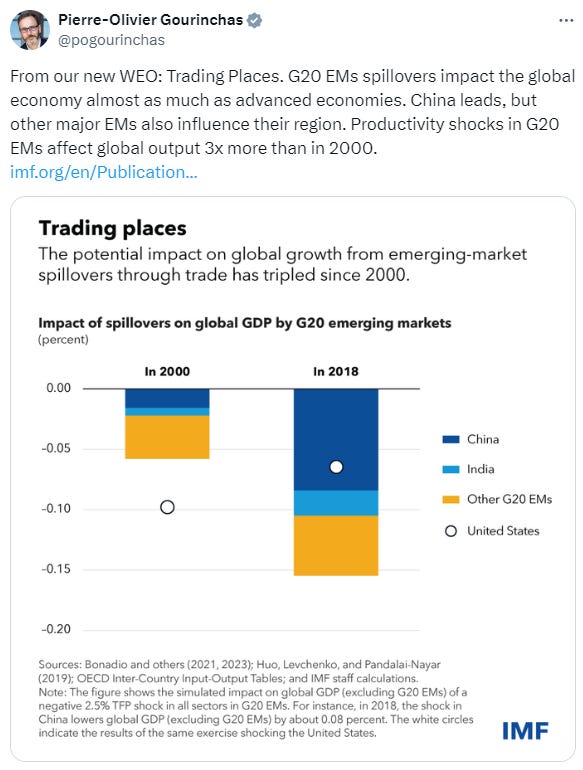

“The global economy is increasingly influenced by the Group of Twenty’s large emerging markets. Over the past two decades, these economies have become much more integrated with global markets and are generating larger economic ‘spillovers’ to the rest of the world.”

“Growth spillovers from domestic shocks in G20 emerging markets have increased over the past two decades and are now comparable to those from advanced economies…Spillovers are largest from China and they now explain just as much of the variation in emerging-market output as those from the United States. But other G20 emerging markets—such as India, Brazil, Russia, and Mexico—also play an important role in the economic performance of their neighbors.”

“Our simulations—using a multi-country multi-sector trade model—suggest that a decline in productivity in G20 emerging markets can lower global output three times more than would have been the case in 2000.”

“Since China’s accession to the World Trade Organization in 2001, G20 emerging markets have doubled their share of world trade and foreign direct investment and now account for one third of global GDP. They have become large importers of manufactured products as well as large exporters of intermediate goods, notably in manufacturing and mining.”

“…Positive growth surprises can boost the revenue growth of foreign firms in sectors such as electrical equipment, machinery, and metal products that are more dependent on demand from G20 emerging markets. Faster growth in emerging markets—such as Indonesia and Türkiye—can also help foreign firms in sectors that are more reliant on cheaper inputs.”

“But faster growth among emerging markets can also mean that they expand their productive capacity downstream to make and export new goods that compete directly with those goods made by firms overseas. This import-competition effect from lower-wage countries, such as China and Mexico, appears to dominate in sectors that are highly dependent on foreign suppliers—for example, textiles and chemicals.”

“…Negative spillovers from a G20 emerging market growth slowdown, especially following supply-side shocks, could put at risk the downward path in inflation for advanced economies. And in other emerging market and developing economies, spillovers can be larger, putting growth and income convergence at risk.”

“A slowdown in China could be especially costly given its role as a manufacturing powerhouse and its high integration. Yet the growing role of all G20 emerging markets means that others can help support the world economy. A plausible growth acceleration in these countries could generate positive global spillovers and boost world growth by half a percentage point.” IMF Blog - Nicolas Fernandez-Arias, Alberto Musso, Carolina Osorio-Buitron, Adina Popescu, write.

“Be not afraid of growing slowly; be afraid only of standing still.” - Chinese Proverb