Emerging Markets Monitor - April 23

Global Oil Demand and China Travel, Kenya New $2B Eurobond, Container Ship Rates Up 4%, China Property Revives But Boom Over, Saudi Hotel Construction Sizzles

The Top 5 Stories Shaping Emerging Markets from Global Media - April 23

World Oil Demand Key Question: How Much Will Chinese Travel?

Bloomberg

“Global oil traders are fixated on the next milestone in China’s economic recovery, when travelers pack their bags and head to the airport for the Golden Week holiday in early May.”

“Some 170 million Chinese holidayed abroad in 2019, before the pandemic struck. That figure sank to less than 9 million last year at the height of China’s lockdowns. The likelihood of dramatically more air travel explains why jet fuel consumption in China is widely seen as the single biggest driver of world oil demand growth this year, according to JPMorgan Chase & Co.”

“The signs are encouraging. Overseas ticket searches for Golden Week are 120% of the level in 2019, state media reported, citing an estimate from Trip.com. As of April 18, actual bookings were more than 10 times that of last year, the Securities Daily reported.”

“‘Mainland China’s domestic jet fuel demand has almost fully recovered, while international jet fuel demand has recovered to close to 70% of pre-Covid levels,’ said Fenglei Shi, a director covering Chinese oil markets at S&P Global Commodity Insights. As such, it’s possible that Golden Week could mark a near-complete recovery in China’s total consumption of the fuel, she said.”

“The global oil market has been caught between two competing themes this year: advanced economies teetering on recession, and the promise that China’s reopening could dramatically lift demand after a three-year blight on consumption due to Beijing’s Covid restrictions. Crude has fallen in recent days as the US economy stalls and the prospect of more interest rate hikes adds to headwinds for prices.”

Kenya Seeks Advisors for $2 Billion Eurobond

The East African

“Kenya plans to raise up to $2 billion from the international capital markets in the next financial year to repay its 10-year Eurobond that is maturing in June 2024.”

“Last week, in an advertisement in the government publication MyGov, the National Treasury invited expression of interest from reputable financial institutions to provide transaction advisory services for the proposed Eurobond.”

“Treasury director of debt management Haron Sirma told The EastAfrican that ‘theoretically,’ they are looking for up to $2 billion to settle the amount due on the 2024 Eurobond.”

“…Domestically, the government is facing difficulty meeting its revenue targets, with the International Monetary Fund ruling out restructuring of Kenya’s debt.” James Anyanzwa reports.

World Container Index up 4% This Week

Hellenic Shipping News

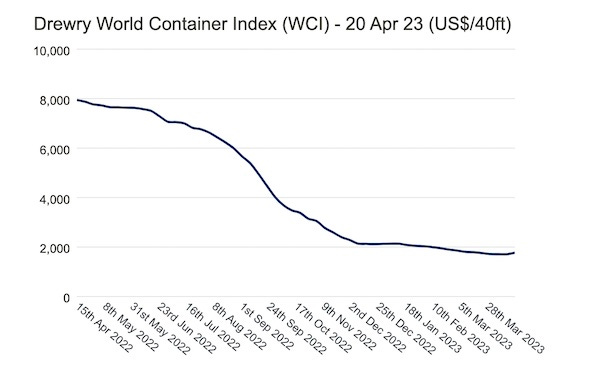

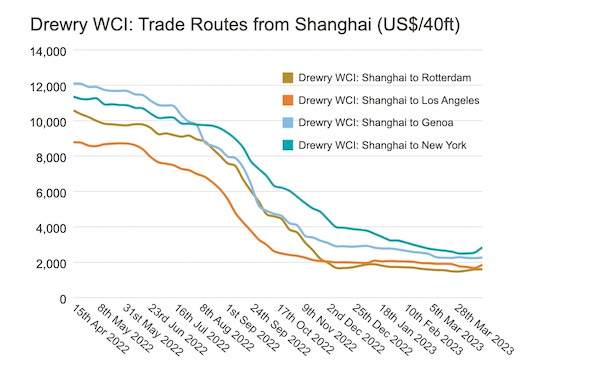

“Drewry’s composite World Container Index increased by 4% to $1,773.58 per 40ft container this week – the first increase in 15 weeks.”

Thursday, 20 April 2023

“The composite index has increased by 4% this week, but has dropped by 77% when compared with the same week last year.”

“The latest Drewry WCI composite index of $1,774 per 40-foot container is now 83% below the peak of $10,377 reached in September 2021. It is 34% lower than the 10-year average of $2,688, indicating a return to more normal prices, but remains 25% higher than average 2019 (pre-pandemic) rates of $1,420.” Hellenic Shipping News reports.

China Property Market Revives, but Boom Days Are Over: Analysts

Channel News Asia

“Pummelled by a housing crisis that caused a record-breaking slump last year, some Chinese property developers are starting to see light at the end of the tunnel, but analysts warn the sector is still on course to slow down in the long term.”

“The real estate industry grew at lightning speed after restrictions were eased in 1998 across China, a country where buying a home is a common prerequisite for marriage, as well as an investment.”

“For two decades, developers have been able to build at breakneck speed thanks to easy bank loans, but their debts swelled so much that authorities put a stop to that access to cash from 2020. Since then, availability of credit has been slashed and demand for property has fallen as a result of the economic downturn and a crisis of confidence.”

“That was exacerbated by the near bankruptcy of the former industry leader Evergrande and has spread to other developers, who are in turn shunned by potential buyers for fear of similar setbacks.”

“…But after a dark year, ‘China's property market has shown signs of stabilising’ since the beginning of 2023, according to Fitch Ratings. In March, a representative survey of major cities across China recorded a significant increase in property prices, according to figures released last Saturday by the National Bureau of Statistics (NBS).” CNA reports.

Saudi Arabia Leads MidEast Hotel Construction, Ranks Third in the World

Arab News

“Saudi Arabia leads the Middle East and Africa’s hotel construction activity with over 40,000 rooms under construction as of March, the latest data from hotel industry monitoring firm STR showed.”

“With 42,033 hotel rooms, the Kingdom accounts for 35.1 percent of 119,505 total keys under construction in the region. That places Saudi Arabia only after China and the US — which currently have 299,458 rooms and 154,284 rooms under construction respectively — making it one of the biggest hotel construction markets in the world despite a global slowdown.”

“The report indicated that the Middle East and Africa was the only region to have an increase in total rooms under contract by 6.4 percent to 249,150 in March 2023 compared to the same period last year.”

“The region has 84,116 rooms in planning and 45,529 rooms in the final planning stages. The UAE also played a role in the region’s hotel sector growth, with 22,325 rooms in construction, accounting for 18.6 percent of the total number.”

“The Kingdom has the third highest number of rooms under construction in the world surpassing Europe’s leaders Germany and the UK. This comes as the Kingdom’s hospitality sector is witnessing steady growth in key performance indicators. For instance, Riyadh’s hotel occupancy rate hit 75.5 percent in February, the highest figure since 2008, according to data released by STR last month.” Arab News reports.

"Smooth seas do not make skillful sailors." - African Proverb