Emerging Markets Monitor - April 3

OPEC+ Shakes Oil Market, Emerging Markets Grind, Putin's New Doctrine, Oil Surges on OPEC+ Move, Shipping Forecast: Another Bumper Year

The Top 5 Stories Shaping Emerging Markets from Global Media - April 3

OPEC+ Agrees to Oil Output Targets As Members Pledge Voluntary Cuts

The National

“The Opec+ alliance of 23 oil producers has agreed to stick to oil output cuts after some of its members moved to voluntarily reduce more than one million barrels per day of production collectively in a surprise move ahead of their meeting.”

“…The announcement comes after Opec+ members Saudi Arabia, the UAE, Iraq, Kuwait, Oman and Algeria said on Sunday evening that they will implement voluntary oil production cuts of 1.16 million bpd from May until the end of 2023.”

“The precautionary measure is aimed at supporting the stability of the oil market, they said. In October, the Opec+ alliance, led by Saudi Arabia and Russia, slashed its collective output by 2 million bpd in a bid to support sagging oil prices amid weaker global economic outlook.”

“The Opec+ move ‘has the potential to push the market into a deficit in the second quarter, versus earlier expectations of a surplus’, said Vandana Hari, founder of Vanda Insights in Singapore.”

“The announcement about the voluntary cuts came as a surprise for the market, which was broadly expecting the group to continue rolling over production cuts and maintain its wait and see policy. Both Brent, the benchmark for two thirds of the world’s oil, and West Texas Intermediate, the gauge that tracks US crude, jumped more than 6 per cent on Monday morning.”

“Saudi Arabia, the world’s biggest oil exporter and Opec's largest producer, said it would cut its output by 500,000 bpd as a ‘precautionary measure’. The UAE will cut its output by 144,000 bpd, ‘to ensure market balance and ... in alignment’ with other Opec+ members, UAE Minister of Energy and Infrastructure Suhail Al Mazrouei said.”

“…Global oil demand is set to reach record levels this year, with the International Energy Agency (IEA) estimating that China will account for nearly half of its 2023 oil demand growth forecast of 1.9 million bpd.”

“…Goldman Sachs estimates the reopening of China’s economy and a full recovery in the country's domestic demand will be a boon to the global economy, boosting world gross domestic product by about 1 per cent in 2023 and lead to a rally in oil prices.” Sarmad Khan reports.

Emerging Markets More Grind than Go-Go After Rough Start

Bloomberg

“A turbulent end of the easy-money era has deflated expectations for a boom year for battered emerging-market assets.”

“Brought down to earth by a volatile first quarter, the much-hyped EM investment story for 2023 is turning into one of resilience and hopes for decent returns — that is if fundamentals, not contagion risk, drive flows.”

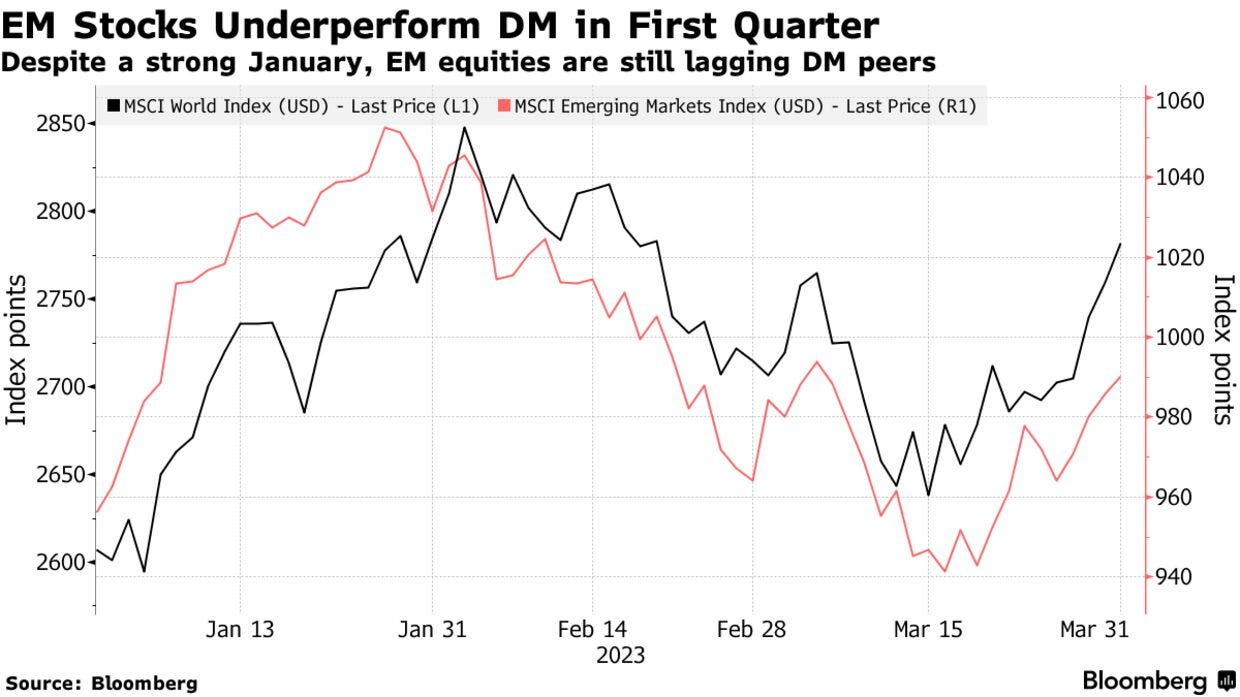

“A turn-of-year rally, spurred by odds of a less-aggressive Federal Reserve and Chinese growth, soon turned tenuous as global banking turmoil shook investor confidence. Those jitters caused developing stocks to pare an early gain, ending the quarter up just 3.5% — about half the return of developed-market peers. EM dollar debt gained 1.7%, less than other global fixed-income segments.”

“Last year, EM dollar debt handed investors losses of 15% and stocks declined 22%, the worst showing since 2008. The 2023 early comeback was interrupted by tremors in the global financial system.”

“Despite this hiccup, and potential further bouts of instability as the world grows accustomed to higher borrowing costs, EM fundamentals remain appealing: a superior growth outlook, an expected inflation decline and China’s reopening from Covid restrictions.”

“…A net $40.9 billion flowed into global EM equity funds through March 29, the most in a year, with Chinese funds accounting for nearly a quarter of that, according to EPFR Global data. Bond funds, meanwhile, saw net withdrawals of $1.6 billion in the period, following a $13 billion exodus in the last three months of 2022.” Selcuk Gokoluk reports.

Geopolitics: New Putin Doctrine Calls US “Main Source” of Threat to Russia

Financial Times

“The Kremlin has adopted a new foreign policy doctrine which identifies the US as the ‘main source of threats’ to Russian security while describing Russia as a ‘distinctive state-civilisation’ with a ‘unique historical mission’.”

“The document is the first update to the doctrine since 2016 and reflects the ‘radical changes in the international affairs’, President Vladimir Putin told a meeting of his Security Council on Friday.”

“Presenting the new strategy, foreign minister Sergei Lavrov said Russia faced an ‘existential threat’ from ‘unfriendly countries’. The new doctrine describes the US as the ‘main source’ of security threats to Russia and alludes to an ‘era of revolutionary changes’ towards a ‘more just multipolar world’ — wording intended to reflect the rising power of China under President Xi Jinping.”

“…Moscow has in recent weeks raised tensions with the US and its allies. Earlier this month, Putin ordered the stationing of Russian tactical nuclear weapons in Belarus by this summer. And this week, Russian security agents detained Evan Gershkovich, a US reporter based in Moscow, on espionage charges.”

“While Russia’s new foreign policy strategy acknowledges the US’s role as ‘an influential development centre’, it portrays Washington as ‘the organiser and executor of anti-Russian policy of the collective west’. It marks a sharp contrast to the last doctrine, which expressed a desire to build ‘working relations with the US’.”

“According to the concept, China and India are seen as ‘friendly sovereign global centres of power’ that share Russia’s view of the ‘future world order’. Iran, Turkey, Saudi Arabia and Egypt are also seen as key allies. ‘Just like Stalin, Putin sees the world divided into the spheres of influence, into which the great powers compete to gain more allies,’ said Andrei Kolesnikov, a senior fellow in the Carnegie Endowment for International Peace.” Anastasia Stognei reports.

Oil Prices, Oil Stocks Surge on OPEC+ Move

Reuters

“Oil prices surged on Monday after Saudi Arabia and other OPEC+ producers announced a surprise cut in their output target, a move that rippled through stock markets, though the dollar failed to hold onto its early gains.”

“Brent crude futures looked set for its biggest daily percentage gain in around a year, jumping 5.77% to $84.52 a barrel on news OPEC+ would aim to cut output by around 1.16 million barrels per day. U.S. crude climbed 6.22% to $80.38.”

“Goldman Sachs lifted its forecast for Brent to $95 a barrel by the end of the year and to $100 for 2024 following the oil output change, which was announced on Sunday, a day before a virtual meeting of an OPEC+ ministerial panel including Saudi Arabia and Russia.”

“…OPEC+'s move also played out in currency and rate markets at least first thing, as, said ING FX strategist Francesco Pesole, it had ‘fuelled fears that inflation will prove to be a longer-lasting problem for central banks.’” Reuters reports.

Liner Shippers to Make $42 Billion+ in 2023: Forecast

Splash 24/7

“A usually reliable source of container financial forecasts has made a call on 2023 fortunes for the liner industry, suggesting this year could be the third-best combined annual results in the history of the sector.”

“John McCown, whose Blue Alpha Capital quarterly liner profit reports have become essential reading during box shipping’s record earnings run since 2020, has forecast liner shipping will make a combined net income this year of $43.2bn on revenues of $327.bn. While this would mark an 80% drop over last year’s record profits, it would still prove to be another sensational year of earnings, helping to explain carriers’ continued amassing of tonnage in the first three months of 2023.”

“…Analysts remain divided on liner profitability in 2023, a year which has started with many doom and gloom headlines. UK consultants Drewry estimated in Splash’s annual container forecast report published at the start of the year that the sector would make a profit of $15bn this year.” Sam Chambers reports.

Too much sanity may be madness and the maddest of all, to see life as it is and not as it should be. - Miguel de Cervantes