Emerging Markets Monitor - August 17

Tencent Sales Falls Amid China Slowdown, Egypt CB Governor Resigns, Poland Economy Contracts, UAE Firms Eyes EM Investments, Iran Nuclear Deal?

The Top 5 Stories Shaping Emerging Markets from Global Media - August 17

Tencent’s Sales Fall for First Time as China Economy Sinks

Bloomberg

“Tencent Holdings Ltd. logged its first-ever revenue decline after online advertising sales fell by a record, underscoring the extent to which China’s worsening economy is hurting its biggest corporations.”

“The country’s most valuable company slashed 5,000 jobs or nearly 5% of its workforce -- the first quarterly drop in staffing since 2014 after layoffs rippling through the global tech sector finally hit the WeChat operator. Revenue fell a deeper-than-projected 3% to 134 billion yuan ($19.8 billion) while net income also missed estimates, plunging 56% in the June quarter.”

“Tencent is grappling with a deepening downturn in the world’s No. 2 economy, the product of a property slump and ad-hoc coronavirus lockdowns from Shanghai to Shenzhen. The uncertainty is wreaking havoc on businesses from advertising to cloud computing and gaming. Alibaba Group Holding Ltd. this month reported its first quarterly revenue drop on record, though the results were better than feared.”

“…The company, which once relied on a network of investments spanning hundreds of firms to create opportunities and new markets, has since last year signaled it will begin paring stakes in major internet investees including JD.com Inc. That may help appease Beijing, which has sought to curb the influence that Tencent and Alibaba wield over the Chinese internet economy through backing hundreds of startups and tech firms.” Bloomberg reports.

Egypt Central Bank Governor Resigns Amid Economic Woes

Africa News

“Egypt's central bank governor resigned Wednesday as the country struggles to address its economic woes. President Abdel Fattah al-Sissi accepted the resignation of Mr. Amer, who had been in office since 2015 and whose term ran until 2023, and then appointed him as presidential adviser, the daily Al-Ahram reported.”

“The brief statement offered no reasons for Amer's resignation. He had been appointed as governor of the central bank in November 2015. No replacement was immediately named.”

“Amer has been criticized over handling the country's financial challenges which have seen the local currency slide against the U.S. dollar in recent months. The pound has lost much of its value. The U.S. currency has been traded at over 19.20 pounds in Egypt's banks, up from average of 15.6 pounds for $1 before the central bank's decision to devalue the pound in March.”

“…Amer's resignation came as the government is in talks with the International Monetary Fund for a new loan to support its reform program and to help address challenges caused by the war in Europe.” Africa News reports.

Poland Economy Contracts As Recession Looms in Eastern Europe

Financial Times

“Russia’s war in Ukraine looks set to trigger a recession in eastern Europe later this year, as energy price increases, disruptions in supply chains, low consumer confidence and austerity measures weigh on output. The region’s largest economy, Poland, surprised analysts by contracting in the second quarter, falling by 2.3 per cent, according to preliminary data from its statistics office.”

“‘We see it as a first step into recession,’ said Katarzyna Rzentarzewska, chief analyst for central and eastern Europe at Erste Group. ‘The economic growth in Poland is a massive surprise to the downside . . . [it] wiped out expansion from the beginning of the year.’”

“The economy grew 5.3 per cent between the second quarter of 2021 and the same three months of 2022 — also a smaller rise than anticipated. Consumer confidence in Poland is at its lowest level since the first weeks of the coronavirus pandemic, while inflation is at a 25-year high of 15.6 per cent, driven by soaring food and energy prices.”

“That has prompted the central bank to raise its benchmark interest rate for six consecutive months, to 6.5 per cent from near zero in the autumn. While Poles are struggling with the higher cost of living, they are also facing problems with their housing costs.”

“Last month, the government introduced a moratorium on mortgage payments to help ease the pain. Poland’s economy was likely to contract year on year by late 2022 or early 2023, according to Marcin Kujawski, an economist at the Polish subsidiary of BNP Paribas.” The FT reports.

UAE Firm Tied to Top Royal To Invest Billions in Emerging Markets

Bloomberg

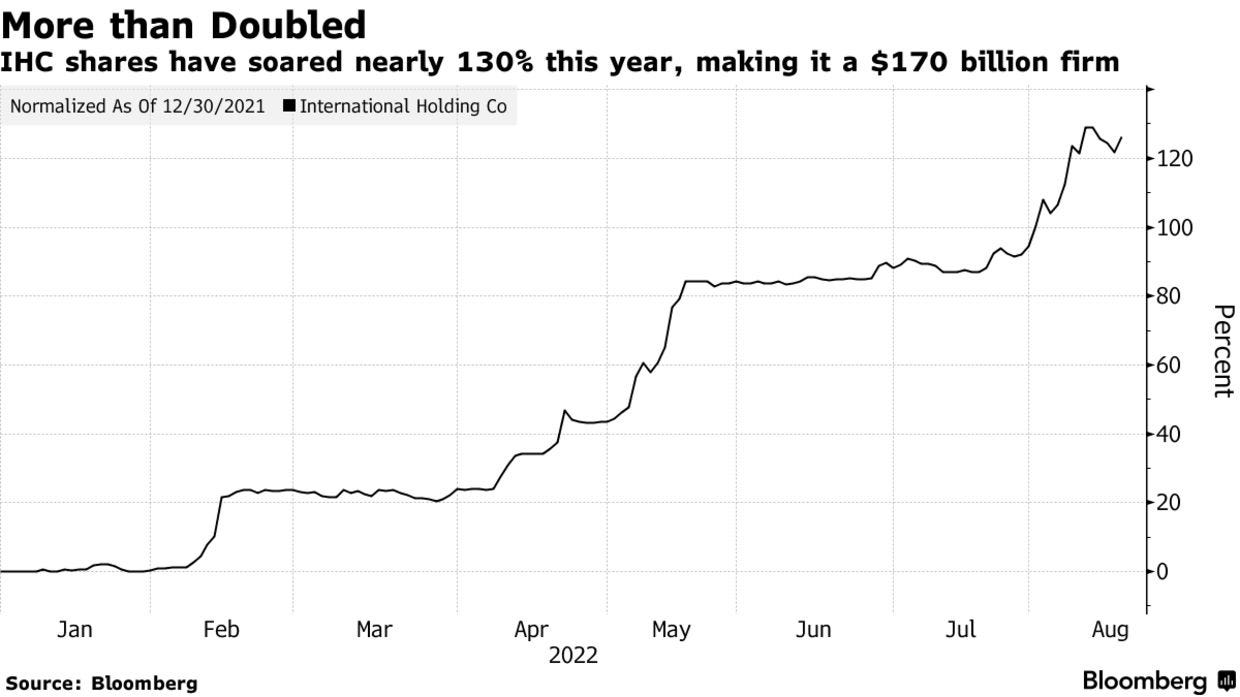

“International Holding Co. plans to invest billions of dollars in markets including Indonesia, Colombia, Turkey and India as the United Arab Emirates firm controlled by the country’s national security adviser steps up its breakneck expansion.”

“IHC, the UAE’s most valuable listed firm, will target sectors such as food, infrastructure and health care across these countries and investments will range from $1 billion to $5 billion depending on the country and opportunity, Chief Executive Officer Syed Basar Shueb said in an interview.”

“‘These new markets are more lucrative for us because they give decent returns and it gives us exposure to that country,’ Shueb said. ‘Double-digit growth is the minimum of what we’re looking for.’ With investments ranging from Elon Musk’s SpaceX, to a local fishery and Abu Dhabi’s largest property developer, IHC is at the forefront of a drive to diversify the UAE economy and deploy its oil windfall overseas.”

“The company, whose market capitalization has rocketed to $170 billion within a matter of months, is controlled by the Royal Group, a conglomerate that lists Sheikh Tahnoon bin Zayed al Nahyan -- the UAE’s national security adviser and brother to the president -- as chairman.”

“Shares in IHC have soared 127% this year, leading a 21% gain on the FTSE ADX General Index and putting it among the top ten performing equity benchmarks in the world this year.” Farah Elbahrawy reports.

Iran Renews Demands for U.S Guarantees in Nuclear Talks

Wall Street Journal

“Iranian demands for guarantees from the U.S. have once again stalled efforts to revive a 2015 nuclear pact, leaving Washington and European capitals unsure if a deal is possible.”

“Tehran on Monday sent a response to the European Union, which chairs the nuclear talks, neither accepting nor rejecting an EU draft text of a deal but raising several issues Iran wanted incorporated into the agreement. The EU had said its draft was the ‘final text’ of a possible deal when it sent it out, announcing that negotiations were over.”

“Central to Iran’s response, the Iranian negotiating team has said, are assurances it seeks that Western companies investing in Iran would be protected if the U.S. withdrew from the pact again as it did under former President Donald Trump. Iran has also floated mechanisms in the agreement that would allow Tehran to quickly increase its nuclear work if Washington quit the deal.” WSJ reports.

“Be yourself; everyone else is already taken.”

― Oscar Wilde