Emerging Markets Monitor - August 22

China $29B Loans to Ailing Developers, Kenya New Prez and the Economy, Saudi Arabia Booms, Coffee Prices to Rise, China Forgives 17 Africa Loans

The Top 5 Stories Shaping Emerging Markets from Global Media - August 22

China Plans $29 Billion in Loans to Troubled Property Developers

Bloomberg

“China will offer 200 billion yuan ($29.3 billion) in special loans to ensure stalled housing projects are delivered to buyers, people familiar with the matter said, ramping up financing support for its beleaguered property sector.”

“The previously unreported size of the lending program, which was announced with scant details by China’s housing ministry, finance ministry and the central bank late Friday, would make it the biggest financial commitment yet from Beijing to contain a property crisis that’s seen home prices slump and real estate sales plummet.”

“Hundreds of thousands of middle-class Chinese have been caught in limbo after making down payments and taking out loans on properties that cash-strapped developers are now struggling to complete. Some homebuyers have started to boycott mortgage payments, a threat to social stability during the politically sensitive run-up to the Communist Party’s leadership transition later this year.”

“The People’s Bank of China and the Ministry of Finance will channel the money through policy banks such as China Development Bank and Agricultural Development Bank of China, said the people, who asked not be identified discussing private information. The special loans will only be used on homes that have already been sold but are yet to be finished.” Bloomberg reports.

New Kenya President Promises To Turn Economy Around

African Business

“William Ruto’s victory in Kenya’s hotly contested presidential election – billed as a battle between ‘hustlers’ and ‘dynasties’ – will herald a new dawn for East Africa’s most stable democracy, assuming the result is upheld by Kenya’s courts.”

“In an election of contradictions, Ruto, the current deputy president, framed himself as an anti-establishment outsider and his opponent, the veteran opposition leader and five-time candidate Raila Odinga, as a product of the dynasties that have dominated Kenya’s post-independence politics. A wealthy businessman himself, Ruto said he would improve the lot of Kenya’s working class.”

“…Promising a bottom-up economic model, Ruto said he would issue small loans and subsidies to Kenya’s army of casual workers, or hustlers, turning the economy – which many feel serves the wealthy – on its head.”

“He promised to publish government contracts with China signed during Kenyatta’s infrastructure building spree, which has seen Kenya’s public debt as a proportion of GDP almost double since 2013. This was red meat to his working-class base.”

“In the days following the result, the markets have adopted a wait-and-see strategy, which will likely endure until Ruto is officially sworn in. In the immediate aftermath of the result, Kenya’s shilling – battered recently by coronavirus and economic headwinds – fell slightly but was largely unaffected. Some are even betting on the shilling strengthening because the mostly peaceful election defied doomsayers.” Charlie Mitchell reports.

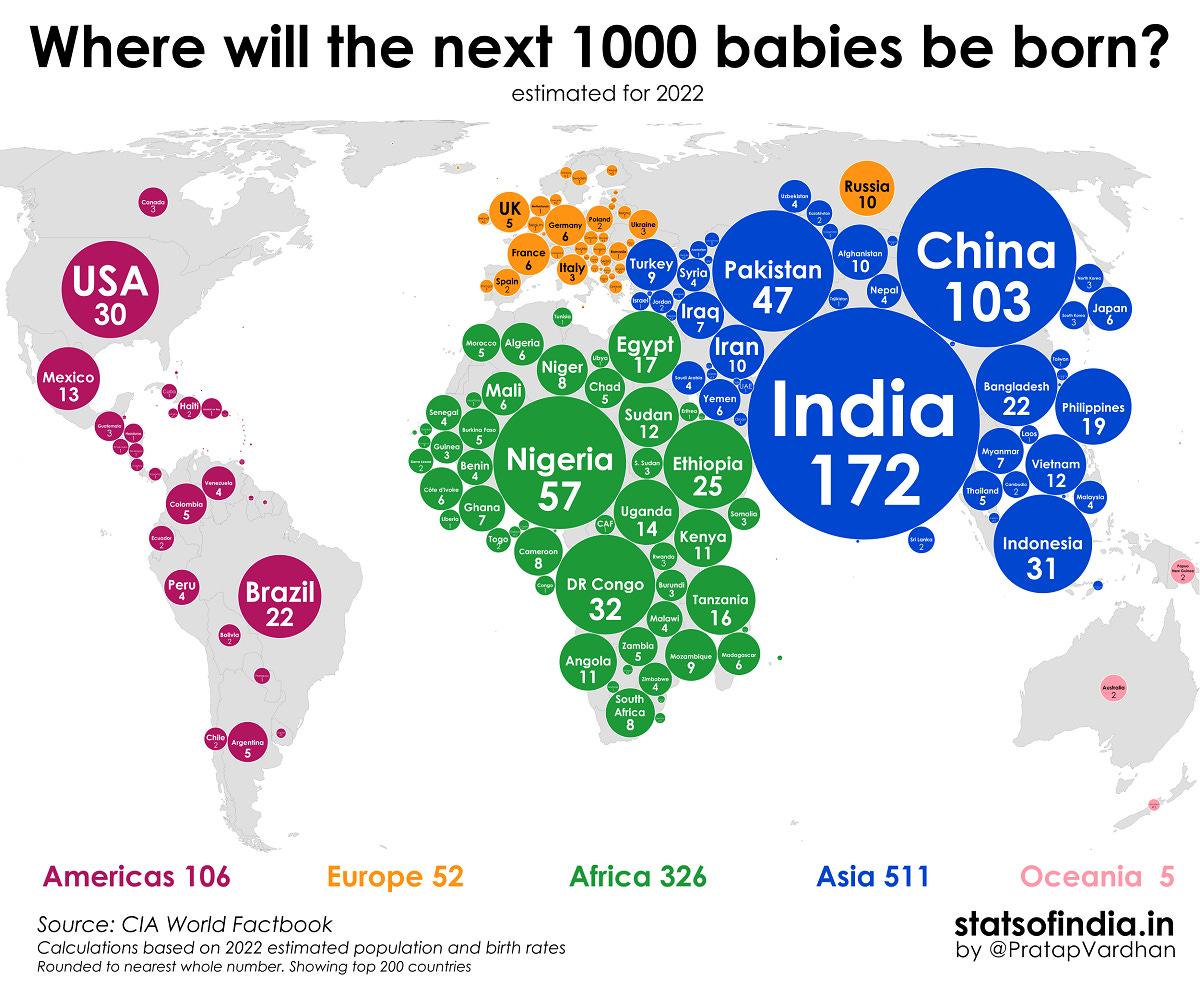

The Next 1000 Babies: Demographics Watch

Here at Emerging World, we are always interested in demographics as well as cool infographics. Here’s an example of both in one: Visual Capitalist just published a great infographic, created by the talented Pratap Vardhan, on where the next 1000 babies will be born. India, China, Nigeria, Pakistan, and DR Congo round out the top five. Check it out below:

Saudi Arabia is Booming and This Time It’s Not Only About Oil

Bloomberg

“As much of the world is fretting about spiraling inflation fueled by Russia’s war in Ukraine and potential recessions, oil averaging more than $100 a barrel this year means Saudi Arabia’s economy is the fastest growing in the Group of 20.”

“Gross domestic product expanded 11.8% in the second quarter, when the non-oil economy grew 5.4% and is now larger than at the end of 2019, before the pandemic struck.”

“State energy company Saudi Aramco has reported the biggest quarterly adjusted profit of any listed company globally. Billions of dollars are flowing into Saudi coffers and raising state investments, boosting sentiment in a private sector reliant on government contracts.”

“…Summers typically send Saudi elites off to cooler climes in Europe, but Riyadh’s newest high-end restaurants are packed. At Coya, a Latin American chain, the most popular dinner seatings -- 8:30 to 9 p.m. --- are fully booked a month ahead.”

“Combined cash withdrawals and points of sales transactions, an indicator of consumer activity, have bounced back, increasing an annual 9% in June after a record high in March. Inflation last month was 2.7%, about a third of the rate in the US or eurozone.” Vivian Nereim reports.

Coffee Could Get Even Pricier As Brazil Harvest Falters

Wall Street Journal

“A poor harvest in the world’s largest coffee producer threatens to push the cost of a cup of joe even higher.”

“Farmers in Brazil are dealing with the fallout from freakish weather last year, where plantations endured first drought and then frost. Some say that their crop of higher-end arabica coffee beans will be less than half what it could be in a good year.”

“Some of that bad news is already priced in for investors, coffee companies and drinkers. Brazil’s poor weather helped push coffee futures to multiyear highs in 2021, in one of a string of disruptions to global commodity markets. But if this year’s resulting crop proves even smaller than feared, that could exacerbate an international supply shortfall and help fuel new price gains.”

“Brazil matters to the global coffee market because it is by far the world’s biggest exporter. The upset is worse because its arabica coffee production runs in a two-year cycle, yielding a bigger crop in even-numbered years. Meanwhile, bad weather has also hurt the coffee industry in neighboring Colombia, another major producer.” WSJ reports.

China to Forgive Loans for 17 African Countries

News.com.au

“China will forgive 23 loans for 17 African nations, China’s foreign minister Wang Yi has announced. ‘China will waive the 23 interest-free loans for 17 African countries that had matured by the end of 2021,’ Mr Wang said at the Forum on China-Africa Cooperation according to a statement.”

“He pledged that China would continue to actively support and participate in the construction of major infrastructure projects in Africa through financing, investment and assistance. ‘We will also continue to increase imports from Africa, support the greater development of Africa’s agricultural and manufacturing sectors, and expand co-operation in emerging industries such as the digital economy, health, green and low-carbon sectors.’”

“Mr Wang also pledged that China would provide food assistance to the 17 African nations….Kenya, South Africa and Uganda are among numerous African states that have borrowed heavily from Chinese lenders.”

“According to World Bank data from 2020 cited by Forbes, the African nations with the highest external debt to China as a percentage of gross national income are Djibouti (43 per cent), Angola (41 per cent) and the Democratic Republic of Congo (29 per cent).” Andrew Backhouse reports.

“The most important decision you make is to be in a good mood.” - Voltaire

ICYMI, great reporting from Meaghan Tobin below:

Popular Chinese Smartphone Brands Hounded by Indian Authorities

Rest of World

“In 2014, Chinese smartphone brands Vivo, Oppo, and OnePlus entered India, followed by Realme in 2018 and iQOO in 2020. These brands — all offshoots of Chinese parent company BBK Electronics — played an important role in helping India overtake the United States as the world’s second largest smartphone market. But now, these wildly popular brands are at the receiving end of the Indian government’s wrath amid political tensions with China.”

“…These moves came just a few months after the government seized more than $700 million from Chinese smartphone maker Xiaomi’s India subsidiary over accusations that it remitted money to its own China-based parent company under false pretenses. Earlier this month, Bloomberg reported, citing unnamed sources, that the Indian government was mulling a ban on sales of devices priced below 12,000 rupees ($150) for all Chinese smartphone makers. A third of all devices sold in India during the second quarter of this year were at that price point, according to Hong Kong–based consultancy firm Counterpoint Research.” Meaghan Tobin reports.

Link of the Day: Emerging Markets ETF Scorecard

Seeking Alpha’s

Emerging Market ETS Scorecard - Seeking Alpha