Emerging Markets Monitor - August 26

Powell Hawkish on Inflation, Deal Saves NY-Listed Chinese Stocks, India and JP Morgan Bond Index, EU-Mercosur Trade and Brazil Election, IMF's Egypt Loan

The Top 5 Stories Shaping Emerging Markets from Global Media - August 26

Powell Talks Tough, Warns Rates Will Stay High For a Long Time

Bloomberg

“Federal Reserve Chair Jerome Powell signaled the US central bank is likely to keep raising interest rates and leave them elevated for a while to stamp out inflation, and he pushed back against any idea that the Fed would soon reverse course.”

“‘Restoring price stability will likely require maintaining a restrictive policy stance for some time,’ Powell said Friday in remarks prepared for the Kansas City Fed’s annual policy forum in Jackson Hole, Wyoming. ‘The historical record cautions strongly against prematurely loosening policy.’”

“He said restoring inflation to the 2% target is the central bank’s ‘overarching focus right now’ even though consumers and businesses will feel economic pain. He reiterated that another ‘unusually large’ increase in the benchmark lending rate could be appropriate when officials gather next month, though he stopped short of committing to one.”

“‘In one line: Nothing for doves,’ Ian Shepherdson, chief economist with Pantheon Macroeconomics, wrote in a note to clients. ‘The Fed can’t ease until inflation is clearly headed back to target, and wage growth has slowed markedly. The Chair’s message today is that the Fed thinks these conditions are unlikely to be met as soon as markets expect.’” Bloomberg reports.

U.S and China In Audit Deal That Could Save NY-Listed Chinese Companies

Wall Street Journal

“Washington and Beijing reached an agreement for U.S. accounting regulators to inspect China-based audits, laying the groundwork for a months-long process that could prevent numerous Chinese companies from being booted off American stock exchanges.”

“The deal, which was negotiated over many months, comes after a decadelong standoff between regulators in the two countries over the audit working papers of New York-listed Chinese companies. It appears to mark a rare concession from Beijing at a time when the U.S. and China are locked in disagreements over issues such as trade and human rights.”

“The agreement allows Public Company Accounting Oversight Board inspectors to travel to Hong Kong or mainland China for inspections. U.S. regulators said they expect American inspectors to be on the ground by mid-September. They will have to work swiftly to complete an assessment of whether China is compliant with U.S. law by the end of the year, officials cautioned.”

“…More than 200 U.S.-listed Chinese companies are facing the prospect of being booted off American stock exchanges starting in early 2024, if their auditors can’t be inspected by the PCAOB for three consecutive years. Around 160 companies—including Alibaba Group Holding Ltd., JD.com, and Baidu Inc.—have so far been identified as noncompliant with the Holding Foreign Companies Accountable Act, which took effect last year.”

“There were 261 Chinese companies listed in the U.S. with a combined market value of roughly $1.3 trillion as of March this year, according to the U.S.-China Economic and Security Review Commission.” The WSJ reports.

India Tipped to Join Key JP Morgan Bond Index. $30B in Flows Expected

Financial Times

“JPMorgan is sounding out big investors on adding India to its widely tracked emerging-market bond index, setting the stage for tens of billions of dollars of inflows as the country’s domestic market opens up to foreign capital.”

“The Wall Street bank is seeking investor views on whether to make a large chunk of India’s $1tn rupee-dominated bond market eligible for inclusion in the GBI-EM Global Diversified index of local currency debt, according to two people familiar with the matter.”

“It opened the consultation this summer with fund managers accounting for 85 per cent of the $240bn in assets under management tracking the benchmark. A decision to add Indian debt to one of the bank’s flagship indices would mark an inflection point for global investor exposure to the world’s fifth-largest economy and the fruition of years of discussions between India’s government, index providers and investors.”

“The consultation with asset managers comes as a growing chorus of investors and analysts are tipping India’s sovereign bonds for inclusion in the influential benchmark, a move that would drive an estimated $30bn in passive investor inflows, according to Goldman Sachs.”

“‘We think there is now a momentum from the investor side for inclusion,’ said Jayesh Mehta, India country treasurer at Bank of America. The Indian government’s wariness of hot money flows — which can quickly move into and out of markets — has also been allayed, Mehta added.” The FT reports.

EU-Mercosur Trade Deal Hinges on Fate of Brazil Election. Bolsonaro-Macron Feud Stalling Deal.

Politico

“EU trade officials will be paying close attention to Brazil's election race this October in the hope that far-right leader Jair Bolsonaro will be booted out and they can resurrect a landmark trade deal with South American countries.”

“Brussels struck an initial deal with the Mercosur countries — Brazil, Argentina, Paraguay and Uruguay — in June 2019, but the pact has effectively been on ice since then, not least because of a bitter political and personal clash between Bolsonaro and French President Emmanuel Macron.”

“Macron was willing to throw his support behind the deal in June 2019, but only on the understanding that Bolsonaro would take action on the deforestation of the Amazon. By August, everything had unraveled. With global headlines dominated by blazing Amazon fires, Macron accused Bolsonaro of having "lied" to him and the enmity became irredeemably toxic when the Brazilian leader mocked the looks of Macron's wife, Brigitte.”

“Bolsonaro's main competitor in the election battle, former left-wing President Luiz Inácio Lula da Silva, is casting himself as a more natural partner to resuscitate trade ties with the EU. He's more in tune with Europe's goal when it comes to combating deforestation, although he is insisting on renegotiating parts of the 2019 accord.”

“In particular, the former lathe operator and union boss is keen to extract more concessions from the EU side to promote the development of Brazilian industry, tilting the emphasis of the trade relationship away from Brazil simply acting as a giant beef and soybean farm for European consumers.” Luanna Muniz reports.

IMF Egypt Loan to be Approved Soon, Former Senior Official Says

Al Masry Al Youm/Egypt Independent

“Economist and former Deputy Assistant Governor of the Central Bank of Egypt, Hani Geneina, expected that the International Monetary Fund (IMF) will approve a loan to Egypt soon at the Fund’s experts’ level.”

“On the economic analyzes that link obtaining financing from the IMF and depreciating the price of the Egyptian pound, Geneina explained that there will be no agreement with the Fund on the pound depreciation in relation to obtaining the loan.”

“An exchange rate system may be developed in the medium term, between five and ten years, with the central bank intervening only in determining exchange rate in major crises.”

“…Moody’s credit rating agency expected the CBE to gradually devalue the pound instead of a sharp flotation to avoid new increases in inflation rates. These expectations came hours before Prime Minister Mostafa Madbouly announced that the government is in the stage of final agreements on new financing from the IMF.” Egypt Independent reports.

DubaiEye Radio Business Breakfast: Podcast Tip of the Week

Your humble correspondent/editor was pleased to be on Dubai Eye’s Business Breakfast show on August 25 to talk about Jackson Hole, the global economy, emerging markets, and food security in the Middle East. I highly recommend putting the Business Breakfast on your podcast rotation. It’s really one of the best global business broadcasts out there. They tap into a wide range of specialists from commodities traders to economists to visiting officials and UAE luminaries. The hosts - Brandy Scott, Richard Dean and Tom Urquhart - are also very sharp and plugged into emerging world currents.

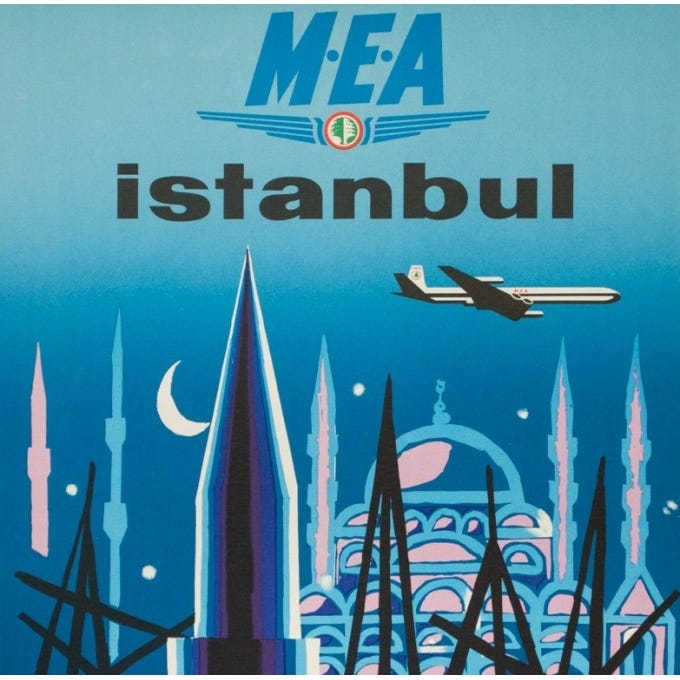

Vintage Poster of the Week: Istanbul and Middle East Airlines - 1960.

“We are what we repeatedly do. Excellence, then, is not an act, but a habit.” —Aristotle