Emerging Markets Monitor - August 30

Flood-Ravaged Pakistan Gets IMF Bailout, India Economy Faces Test, Hawkish Fed Brings Copper Down, China Vs. US in Lat-Am, Morocco Fertilizers

The Top 5 Stories Shaping Emerging Markets from Global Media - August 30

As Floods Devastate Pakistan, IMF Approves $4 Billion Bailout Plan

Wall Street Journal

“Pakistan is facing its heaviest rains in 30 years, the prime minister said Monday, unleashing a calamity that will ravage the country’s fragile economy, hit at its food supply and dent exports.”

“‘There is an ocean of floodwater everywhere,’ said Prime Minister Shehbaz Sharif. The country’s climate minister, Sherry Rehman, said that a third of the country is underwater.”

“The districts hit by flooding are home to 33 million people, according to the country’s disaster management agency, or 15% of the population. The death toll climbed Monday to 1,061 people. Almost 1 million homes have been destroyed or damaged in torrential monsoon rains since mid-June, with the southern province of Sindh hit hardest.”

“A dam being constructed in the northwest of the country, in the Mohmand region, partially collapsed under the volume of floodwaters at the site, officials said. The dam, being built by Chinese and Pakistani contractors, is designed to provide 800 megawatts of electricity, provide water for irrigation and control flash floods.”

“The International Monetary Fund said Monday that its board had approved a bailout for Pakistan, a deal hammered out before the floods.”

“The IMF agreement provides $4 billion for the current fiscal year, which began on July 1. It unlocks at least a further $33 billion in additional financing for Pakistan, which was in danger of defaulting on its foreign debt repayments. Allies China, Saudi Arabia, the U.A.E. and Qatar are providing loans and investment, and multilateral agencies including the World Bank are also giving loans, all dependent on Pakistan being in an IMF program.” Saeed Shah reports.

Robust India Economy Faces Resilience Test Amid Rising Rates

Bloomberg

“India’s economy probably grew at the fastest rate in a year last quarter driven by healthy consumption, but the pace of expansion is seen slowing as policymakers prioritize rising prices over growth.”

“Gross domestic product is estimated to rise 15.4% in the three months to June from a year ago, according to a Bloomberg survey of economists. That’s the fastest reading since the April-June quarter of 2021 and compares with a 4.09 expansion in the previous three months.”

“The Statistics Ministry is due to release the data for the first quarter of the fiscal year that started April 1 at 5:30 p.m. India time on Wednesday. Stock and bond markets will be shut on the day for a local holiday.”

“Resumption of activity in India’s dominant services sector, following the lifting of pandemic curbs, and a record jump in exports added to the momentum. The pace will likely moderate in coming quarters as the central bank raised rates by 140 basis points this year to bring price gains under its 6% target ceiling.”

“‘The resilient growth backdrop means the RBI will retain its focus on containing inflation,’ said Rahul Bajoria, an economist with Barclays Bank Plc. ‘That makes its policy choices relatively clear, in the short term,’ he said, projecting another 50 basis points of rate hikes over two meetings in September and December.” Vrishti Beniwal reports.

Copper Prices Dips Below $8,000 As Hawkish Fed Outweighs Supply Risk

Mining.com

“The copper price fell on Monday as a hawkish Federal Reserve crimped the outlook for demand, outweighing supply risks.”

“Federal Reserve Chair Jerome Powell signaled higher-for-longer interest rates to curb inflation at the Fed’s Jackson Hole symposium on Friday, sparking broad declines across financial assets.”

“The worsening sentiment on copper demand took precedence over further signs that supply is under threat, with Codelco becoming the latest major producer to cut output guidance.”

“Copper for delivery in December fell 3.5% on the Comex market in New York, touching $3.56 per pound ($7,832 per tonne).”

“‘The recession fears are still there in the background,’ said WisdomTree commodity strategist Nitesh Shah in a note. ‘As long as supply is being destroyed by the energy crisis at a faster rate than demand is being destroyed by hawkish policies of central banks, that could really tighten the fundamentals for base metals,’ Shah said.” Mining.com reports.

China Slowly Undercutting US Influence in Latin America

South China Morning Post

“China stands to secure prized natural resources while vying with the United States for allies through five potential new trade deals with countries in Latin America, which was once mainly a US backyard, analysts believe.”

“Officials from Beijing kicked off talks with Ecuador in June, the government’s trade ministry said, and South American media reports point to Uruguay pursuing its own trade agreement with China – despite blowback from the Mercosur or Southern Common Market negotiating bloc to which it belongs with the likes of Argentina, Brazil and Paraguay.”

“A deal with Panama is ‘under negotiation’, according to the Chinese Ministry of Commerce website, and China is conducting a joint feasibility study toward a pact with Colombia. China and Nicaragua last month signed an ‘early harvest arrangement’ for a free-trade deal, the ministry said.” SCMP reports.

Morocco’s OCP Fills in For Russia Fertilizer Shortfall

“One of the few viable alternatives to Russian fertilizer is Morocco, which already accounts for 40% of Europe’s imports of phosphate, said Jacob Hansen, Director General of Fertilizers Europe.”

“Hansen made the remarks to European press as the global battle for fertilizer, a vital commodity for food production, has emerged as one of the by-products of the Russia/Ukraine conflict, leaving states in Europe and elsewhere scrambling for alternative suppliers.”

“Mineral fertilizers are used for 50% of the food production in Europe….OCP officials have said that production could increase by 50% over the next four years.

“‘The most obvious solution is to buy more fertilizers from North Africa – particularly Morocco – and the Middle East, maybe South Africa,’ said Hansen. So obviously, Morocco is encouraged to step up their production to fill the gap.” North Africa Post reports.

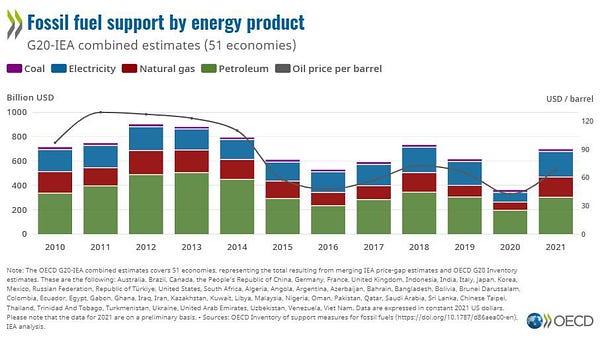

Tweet of the Day: Govt’s Doubling Down on Fossil Fuel Subsidies

“Life isn't about finding yourself. Life is about creating yourself.”

― George Bernard Shaw