Emerging Markets Monitor - August 31

Turkey Economy Powers Forward, Dollar Surges on Fed Hikes, Hungary Forint Rallies, Brazil Brain Drain Accelerates, Bearish EM ETF UP Big

The Top 5 Stories Shaping Emerging Markets from Global Media - August 31

Shrugging Off High Inflation, Turkey Economy Powers On

Bloomberg

“One of the world’s worst inflation crises has yet to derail Turkey’s economy, as an upswing in consumer spending and tourism propels growth to among the fastest in the Group of 20.”

“Cheap money has added an extra kick to the $800 billion economy that’s expanded at a clip of over 6% every quarter since it roared back to life with the easing of coronavirus lockdowns in 2020.”

“Although inflation has kept climbing this year to levels unseen for over two decades, gross domestic product rose an annual 7.4% in the second quarter, a slight increase from the prior three months, according to the median forecast of 18 economists surveyed by Bloomberg.”

“Data due Wednesday will also show GDP growth accelerated to 1.5% in seasonally and working-day adjusted terms, a separate poll found. Facing a tradeoff between growth and inflation ahead of elections next year, President Recep Tayyip Erdogan has championed an economic model that prioritizes exports, production and employment at the expense of price stability and the currency.”

“Turkey’s longest-running leader -- an advocate of low interest rates -- is leaning on the resilience of households and companies in coping with annual inflation that will likely peak past 80% with the lira at a record low.” Beril Akman reports.

‘King Dollar’ Surges As Fed Moves Ahead With Rate Rises

Financial Times

”The dollar is on the cusp of its third straight month of gains after reaching a 20-year high against peers, in a stark reflection of diverging outlooks for interest rates and growth in the world’s largest economies.”

“The dollar index, a measure of the currency’s value against a basket of others, has risen 14 per cent since the start of the year. It has continued to climb on expectations that the Federal Reserve will not back down in raising US interest rates to tamp down inflation, as emphasised by its chair Jay Powell at the annual Jackson Hole symposium last week.”

“The US currency’s lead on others also reflects worries that soaring energy prices in Europe stoked by Russia’s war in Ukraine will drive inflation higher and push economies into recession. ‘Everything is pointing towards a stronger dollar,’ said Christian Kopf, head of fixed income at Union Investment.”

“…The Fed has led big central banks in forging ahead with aggressive monetary policy tightening. Higher yields on US government bonds push the dollar up as investors sell debt denominated in other currencies in favour of the better premiums on US Treasuries.” The FT reports.

Forint Rallies As Hungary Central Bank Hikes Rates 100 Basis Points

bne IntelliNews

“The Monetary Council of the Hungary National Bank (MNB) raised the base rate by 100bp to 11.75%, in line with analysts’ consensus and at the same clip as a month ago as it bid to continue the fight against surging inflation, which could hit 20% at the end of the year. The forint rallied on the news, closing its best day in seven weeks with a gain of 1.5% against the euro.”

“The MNB has lifted the base rate by 1,100bp from 0.75% since June 2021, when it began its monetary tightening, being a frontrunner among European central banks. The base rate stands at its highest level since April 2004 and at present it is the highest in the CEE region.”

“Headline inflation in July soared to 13.6%, while core inflation rose to 16.7%. The MNB will need to keep its powder dry for the period ahead, as inflation could soar to 20% at the end of 2022 and in a period when the current account and budget deficits are widening due to soaring energy prices in Europe, brokerage Almundi said in a note.”

“The forint, which has underperformed regional peers by losing 8% to the euro this year, rallied after the MNB rate-setting meeting. It gained more than 1.6% to the dollar and 1.5% to the euro.” bne IntelliNews reports.

Brazil’s Brain Drain Is a Bad Omen

Americas Quarterly

“…the possibility of working remotely has spurred a debate about leaving Brazil among a growing number of Brazilian executives and entrepreneurs.”

“Such cases make up only a fraction of the increasing number of Brazilians who go abroad in search of opportunities. The bulk of those leaving the country are less privileged, though emigration is out of reach for the poorest. In 2021, a staggering 17% of Brazilians who traveled abroad did not return, a record high.”

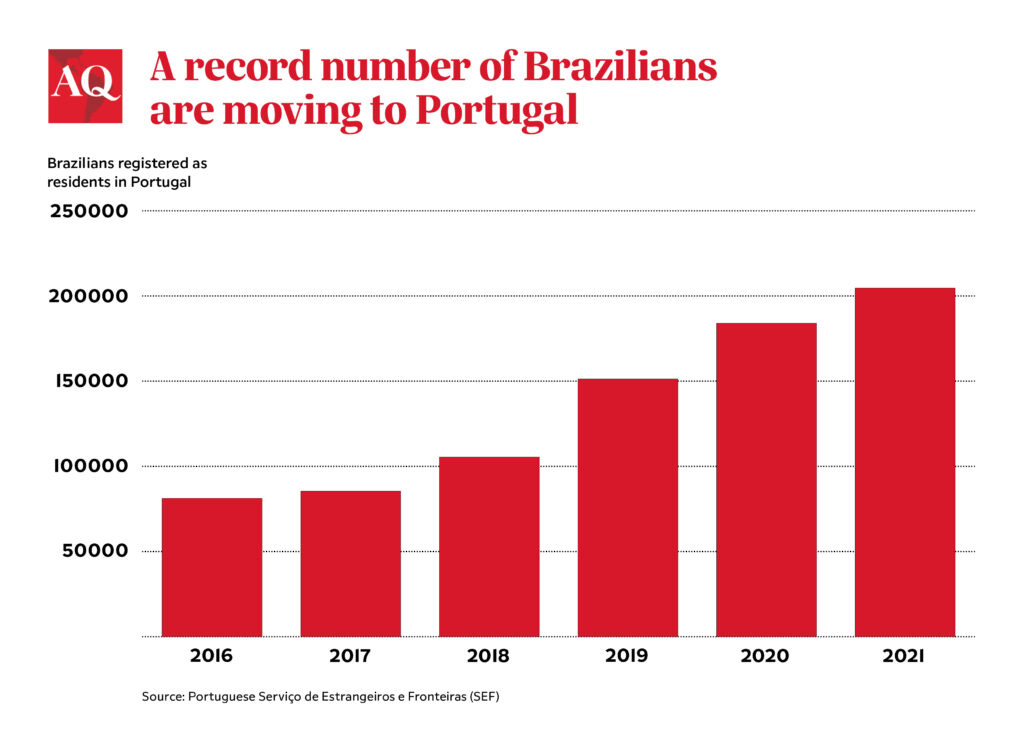

“The number of Brazilians legally residing in Portugal, for example, recently reached a new record of 252,000—a whopping 23% increase compared to last year. The actual number of Brazilians in Portugal is likely half a million, including those who live there illegally and the thousands of Brazilians who also hold European passports and thus do not register as Brazilians.”

“….This reveals deep-seated doubts about whether Brazil can overcome its most urgent challenges, such as profound inequality and a lack of public safety, over the years to come. Few of the Brazilians born in the 1970s and 1980s now reaching the top echelons of their organizations or heading their own companies have much faith that anything remotely resembling the commodity boom-fueled optimism of the late Lula years will return anytime soon.” Oliver Stuenkel writes.

Bearish Emerging Markets ETF Up Almost 50% This Year

ETF Trends

“The headwinds continue to blow for emerging markets amid a rising dollar and now a more hawkish Federal Reserve after its latest comments on more rate hikes to come. As such, the Direxion Daily MSCI Emerging Markets Bear 3X ETF (EDZ) is up almost 50% for the year.”

“The performances of emerging markets assets are tied to the strength of their currencies. As a monetary policy-tightening Fed continues its hawkish stance, it could put pressure on EM currencies, especially those in a fragile state.”

“‘Severe currency devaluations are common in emerging markets. We wanted to better understand these crashes: how fast they happen, how this relates to equity returns, and the nature of the recoveries,’ noted Igor Vasilachi with Martina Roman in a blog post by global asset management firm Verdad.”

“‘We studied the evolution of exchange rates and equity market returns before and after currency crashes since the mid-1990s, when EM equity return series first became widely available,’ the blog noted further. ‘We defined a currency crash as a 20%+ depreciation against the USD over a three-month period. We excluded markets with pegged currencies, such as Saudi Arabia, or common currencies, such as Greece, as their currencies do not reflect their underlying economy. In the remaining pool of countries, we found 16 instances of currency crashes across eight emerging markets. Of these, 12 happened during global crises, and 4 were idiosyncratic events. Below we show the average exchange rate curves before and after currency crashes (T=0).’”

Ben Hernandez reports.

“Let me not pray to be sheltered from dangers,

but to be fearless in facing them.

Let me not beg for the stilling of my pain, but

for the heart to conquer it.”

― Rabindranath Tagore