Emerging Markets Monitor - August 6

EM Stocks Rising, Reliance to List Financial Unit, Saudi Entity Buys 10% of Vale, Pakistan Election Delay, Maersk Sees Slowing Economy + Mobius' Latest EM Bets

The Top 5 Stories Shaping Emerging Markets from Global Media - August 6

EM Stocks Having a Moment As Growth Bets Return

Bloomberg

“Investors in emerging markets are shifting to stocks from bonds as they prepare for the world after monetary tightening.”

“There are early signs of a rotation under way, with equity benchmarks beating local-currency bonds since the beginning of July. And traders are already starting to chase the rally, with Bank of America Corp. reporting that emerging-market equities have absorbed $4.1 billion in the week to Aug. 2, adding to inflows in the previous three weeks.”

“It all points to evidence that local-currency bonds, which have been the standout trade in emerging markets this year, are now facing tougher competition from stocks. While investors including Bank Julius Baer & Co. and Brazil’s Legacy Capital argue that there’s still money to be made in debt markets, bigger gains will come from stocks.”

“The macro backdrop is also tilting in favor of developing nations. Emerging economies are expected to expand almost three percentage points quicker than advanced nations over the next three years, led by China, albeit at a slower pace, and India. Analysts have raised their forecasts for earnings in July at the fastest clip in 18 months, according to data compiled by Bloomberg.”

“‘The main drivers for equity performance will be a benign macro environment, especially in countries like India, Indonesia and Brazil, along with strong earnings growth driven by strength in consumption and investment,’ said Ashish Chugh, a money manager at Loomis Sayles & Co. in Boston.”

“…Emerging-market assets broadly saw a 5.5% spike in capital inflows in July, the biggest since November. Investors in US exchange-traded funds have poured a net $2.61 billion into emerging-market stock ETFs in the past four weeks, while allocating just $269 million to bond equivalents.” Srinivasan Sivabalan reports.

Reliance Industries to List Financial Services Unit Soon

LiveMint India

“Reliance Industries Ltd. said it expects shares of its financial services business to be listed soon as the conglomerate seeks to propel its recently carved out unit into India’s largest non-banking lender, leveraging the prowess of the digital and retail businesses. Meanwhile, Reliance Industries seeks the appointment of Mukesh Ambani as chief executive for another 5 years at nil salary according to a company shareholder resolution.”

“Last month, Reliance demerged JFS, which was valued at around $20 billion after its stock price was set at a much higher than expected 261.85 rupees ($3.19). Jio Financial Services Limited (JFS) through its operating subsidiaries and joint ventures will offer a broad range of financial services solutions addressing the needs of both consumers and merchants. JFS will use technology as a key enabler to reach customers directly.”

“According to Bloomberg, this year, analysts are keen to know more about the billionaire’s strategy for his new unit Jio Financial Services Ltd., clean energy and digital businesses. Reliance Strategic Industries Ltd., which will be later renamed as Jio Financial, has been valued at about $20 billion after its shares were spun off last month through a special session conducted by exchanges to discover its trading value.”

“The newly formed firm, which little revenue as of now but owns 6.1% stake in Reliance Industries, has already announced partnership with BlackRock to set up an Indian asset management venture… Jio Financial and Blackrock are targeting an initial investment of $150 million each in the joint venture, Jio Financial said on Wednesday.”

“Reliance is also seeking to make Jio Financial Services one of India’s top non-banking finance companies to bolster its presence and creating an empire that’s similar to Alibaba Group Holding Ltd. and Tencent Holdings Ltd.” Mint India reports.

Saudi Entities Buy 10% Stake in Brazil’s Vale in Major Mining Deal

The National

“Manara Minerals Investment Company, a joint venture between Saudi Arabian Mining Company (Ma’aden) and the Public Investment Fund has signed a binding agreement to acquire a 10 per cent stake in Brazil's base metals company Vale as the company continues to pursue global mining investments.”

“The company is buying the stake in Vale, which has projects in Canada, Brazil and Indonesia, based on an enterprise value of $26 billion, Ma’aden said on Sunday in a statement to Saudi Arabia’s Tadawul stock exchange, where its shares are traded.”

“…The deal, which is subject to regulatory approvals and other conditions, is expected to be completed in the first quarter of 2024.”

“Ma’aden, which operates several extraction sites and mines in Saudi Arabia to produce gold, copper, iron ore and strategic minerals, has a 51 per cent stake in Manara, while the PIF holds a 49 per cent interest.”

“Mining is a key component of Saudi Arabia’s Vision 2030 plan, which aims to reduce the country's dependence on oil and gas revenue. The kingdom, Opec’s top oil exporter, aims to more than triple the mining sector’s contribution to the nation’s economic output by 2030.” Fareed Rahman reports.

For more on Saudi mining, see Afshin Molavi’s report for Al-Monitor Pro on Saudi copper mining

Pakistan Election Set for Delay as Boundaries Redrawn

Financial Times

”Pakistani officials have approved a plan to redraw the country’s electoral boundaries, probably delaying this year’s election by several months and further fuelling tensions in the wake of the jailing of popular opposition leader Imran Khan.”

“A council chaired by prime minister Shehbaz Sharif on Saturday approved a new census that showed Pakistan’s population had risen to 241mn, a decision that will require authorities to redraw constituency maps before elections can be held.”

“While elections were constitutionally supposed to happen by November this year, Pakistan’s law minister Azam Nazeer Tarar told the country’s Geo TV that the new census means that polls are now only likely early next year.”

“The decision was announced on the same day as police took Khan into custody following an Islamabad high court’s decision to sentence him to three years in jail on corruption charges. Many analysts saw him as the election frontrunner.”

“Khan’s Pakistan Tehreek-e-Insaf party has decried the conviction as a politically motivated attempt to stop him returning to power. Khan has denied the allegations that he illegally sold gifts he received while in office from 2018 to 2022.”

“…Khan has appealed against the court’s decision, which disqualifies him from holding office for five years and removes him from the electoral race. His jailing threatens to escalate the country’s already fraught political tensions.” Benjamin Parkin reports.

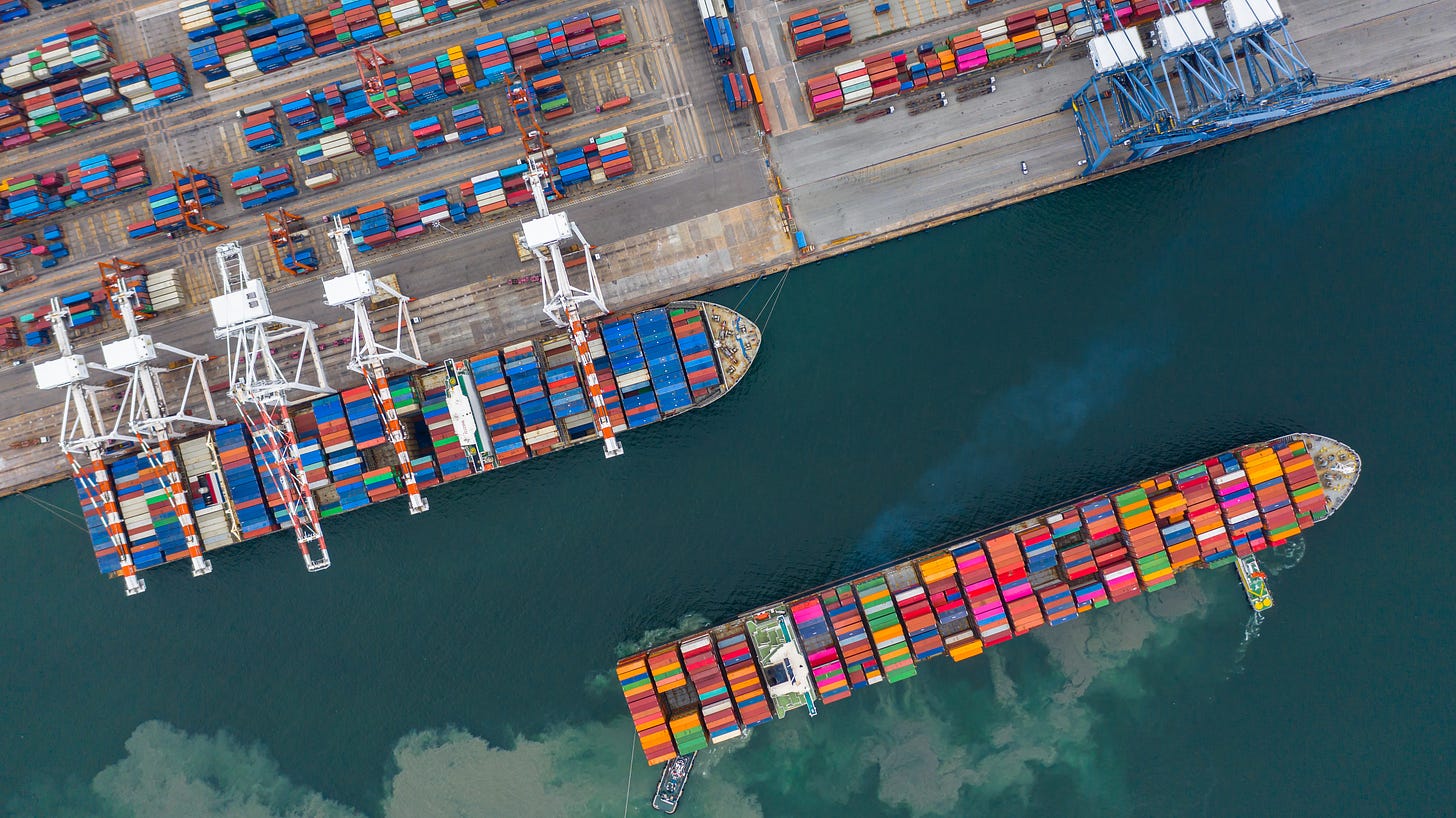

World Trade Forecast Cut as Maersk Flags Fears for Global Economy

Bloomberg

“Shipping giant A.P. Moller-Maersk A/S, a bellwether for the world economy, lowered its estimate for global container trade, indicating that weak demand continues to hamper economic activity after years of supply shocks.”

“Global container trade will probably contract as much as 4% this year, down from Maersk’s previous prediction of as much as 2.5%, the Copenhagen-based company said in a statement on Friday, as there are no substantial signs that volumes will recover this year.”

“‘Our case is not for a recession, but it is for a really subdued environment that will continue for the rest of this year,’ Chief Executive Officer Vincent Clerc said in an interview with Bloomberg TV’s Dani Burger and Mark Cudmore. The expectation is ‘to see some recovery in the market in 2024 and getting back to positive growth territory,’ he said.”

“…Maersk, along with the rest of the shipping industry, is facing an abrupt readjustment after generating record profits in 2021 and 2022 thanks to a spike in demand for consumer goods during the pandemic, coupled with limited vessel supply. Now, global economic growth is losing pace and companies are working through existing inventories instead of transporting new goods from Asia to Europe and the US — a process known as destocking.”

“Maersk had expected to see the inventory correction to be winding down already, but said it ‘appears to be prolonged and is now expected to last through year end,’ adding that ‘there is no sign of a substantial rebound in volumes in the second half of the year.’” Christian Wienberg reports.

"For the great doesn't happen through impulse alone, and is a succession of little things that are brought together." - Vincent Van Gogh

And, in the ICYMI category this week…..

Mark Mobius So Bullish on EM That He Has No US Investments

Markets Insider

“Billionaire investor Mark Mobius confirmed he has no US investments, saying he is bullish on emerging markets in Asia. ‘I'm all international and emerging markets in particular,’ the Mobius Capital Partners founder said in an interview with CNBC on Thursday.”

“Mobius said he is focusing his investments in Taiwan, South Korea, and India. But he sounded more cautious on China, saying he is looking at Hong Kong-listed companies because they have attractive valuations.”

“He added that the world's second-largest economy is still going through a ‘tremendous adjustment’ that will make it ‘very difficult for many companies.’ Companies in countries like Korea are also exposed to China as they export to customers there, and are looking to diversify to reduce their dependence on China, Mobius said.”

“…And while some observers have expressed concern over potential conflict between China and Taiwan, Mobius believed tensions were unlikely to boil over anytime soon. Any attack delivered on Taiwan would likely face resistance from the US, and China's economy is dependent on US markets, he said.”

“Mobius has also turned more bullish on India, as companies like Apple are shifting towards India in order to diversify their business away from China. …In Korea, Mobius was enticed by the nation's impressive technological developments, pointing to one company he invested in that's developing machines to smooth over wrinkles.”

“Other Wall Street commentators have turned optimistic on emerging market investments as financial conditions tighten in the US. Emerging markets could top the US in the global stock market starting in 2030, Goldman Sachs estimated. Meanwhile, the MSCI Emerging Markets exchange traded fund has risen 10% this year.” Markets Insider reports.

For more on Mark Mobius, see the Emerging World interview conducted last year:

The Michael Jordan of Emerging Markets Investing: A Conversation with Mark Mobius

By Afshin Molavi Emerging World Interview If emerging markets investing had a hall of fame, Mark Mobius would be a first ballot, unanimous entry. The trouble is that most sports hall of fames only induct you after retirement, but the legendary investor is still going strong, at age 85, after a highlight-filled career. Imagine Michael Jordan still at the t…