Emerging Markets Monitor - December 12

Cash Flows Back Into EM, China Markets: Expect Volatile 2023, Vietnam Leads Asia-Pacific Growth, Peru President Picks Moderate Cabinet, Pakistan Falls Into Arrears

The Top 5 Stories Shaping Emerging Markets from Global Media - December 12

EM Inflows Most Since June 2021 - Asia and Lat-Am Lead the Pack

Reuters

“Foreigners dumped the most cash into emerging market portfolios in November than any month since June 2021 even as Chinese debt continues to see outflows, the Institute of International Finance (IIF) said on Thursday.”

“Overall, foreign investors added $37.4 billion to emerging market portfolios last month, with fixed income attracting $14.4 billion in the strongest monthly inflows so far this year.”

“Flows to Chinese equities also posted their largest monthly increase this year at $8.5 billion, but Chinese debt continued to see outflows that now total almost $77 billion in 2022.”

“China this week eased COVID-19 quarantine rules in a major policy adjustment which could reverse the flow of cash back into portfolios in the world's second-largest economy.”

“Chinese stock indexes have had a rough year, and the low prices have enticed investors even before the new COVID rules. Shanghai stocks rose nearly 9% last month and are down 12% YTD while Hong Kong down 17% so far in 2022, added 27% last month alone. The China MSCI index, priced in dollars, rose almost 30% in November.”

“The yuan gained 3% last month against the dollar but remains down near 9% this year, still on track for the largest yearly losses in almost three decades.”

“Regional data showed an inflow of $25.6 billion to Asia, while Latin America took in some $8.2 billion, the most since March, and emerging Europe another $3.2 billion. Africa and the Middle East took in $0.4 billion in the first positive reading since March.” Reuters reports.

China Markets Poised for Extreme Volatility in 2023

Bloomberg

“Chinese stocks are now moving by 5% a day more frequently than anytime since the global market meltdown of 2008. Volatility in the offshore yuan is near a record. And the cost of insuring Chinese government debt against default has been at multi-year highs.”

“While market consensus is that Chinese assets will rise over the next 12 months, catalysts for extreme shifts in sentiment remain everywhere: from the risk of overwhelming infections as Covid Zero rolls back, to the lingering property crisis and a regulatory culture that never ceases to spring surprises. China’s relations with the US are still fraught, and the economic outlook at home and abroad is more uncertain than ever.”

“Traders who were burned after placing bets on a China rally this time last year are back. But they are far more cautious.”

“‘It’s not going to be a one-way smooth ride,’ said Keiko Kondo, head of multi-asset investments for Asia at Schroder Investment Management in Hong Kong. ‘Investor sentiment is still quite fragile — one thing people don’t want to have is too much volatility. That is why we haven’t gone all the way to overweight on Hong Kong and mainland shares.’”

“Traders are expressing their caution by piling into derivatives that will pay out if stocks and the yuan come crashing down, while building a hoard of those that should profit if these assets soar.” Bloomberg reports.

Vietnam Leads Asia-Pacific Major Economies with 8% Growth in 2022

VN Express Business

“Vietnam’s economy experienced a bumpy year with major stumbling blocks in the stock, property and corporate bond markets. However, it is expected to end 2022 on a high note thanks to surges in growth, the trade surplus and foreign investment.”

“Despite several economic challenges, Vietnam’s GDP growth is forecast to reach 8% this year, the highest among major countries in the Asia Pacific region. Vietnam’s economy expanded by 8.83% in the first nine months of the year, the largest increase for the 2011-2022 period, thanks to a 13.67% surge in the third quarter.”

“The services sector grew at nearly 10.57% during this period, accounting for over half the overall growth. Industry and construction grew by over 9.44% to account for most of the remaining growth. Agriculture, forestry and aquaculture expanded by 2.99%.”

“The government predicts growth will reach 8% for the whole year, while lender HSBC pegged the country’s growth at 7.6% and the World Bank at 7.2%.” VN Express reports.

New Peru Leader Picks Moderate Cabinet After Months of Chaos

Financial Times

“Peru’s new president, Dina Boluarte, on Saturday appointed a moderate cabinet that could calm investor nerves after the downfall of Pedro Castillo, who was impeached and arrested after attempting to shut down congress and rule by fiat.”

“Investors will hope that stability is restored to the executive branch after the chaotic 16-month tenure of the leftist former schoolteacher Castillo. Over 80 ministers passed through his cabinet, including five prime ministers and three finance ministers.”

“Lawyer Pedro Miguel Angulo was announced in the role of prime minister, while Ana Cecilia Gervasi is the new foreign minister. Former police general César Cervantes will serve as interior minister, overseeing the country’s police. Alex Contreras, who served as deputy finance minister in the previous government and previously worked at Peru’s central bank, will serve as finance minister continuing with Castillo’s preference for career economists in the crucial cabinet post.”

“Castillo remains in custody in a police base on the outskirts of Lima. He was apprehended on Wednesday shortly after announcing the dissolution of the country’s congress and the formation of an emergency government. Lawmakers had been preparing to vote on his impeachment. That vote was then brought forward and Castillo was impeached by a margin of 101-6.” Joe Parkin Daniels reports.

Pakistan Falling Deeply into Arrears

Dawn

“Technically, Pakistan has not defaulted on its debt because it hasn’t missed — or even delayed — any payment to its creditors. Yet it certainly has fallen into ‘arrears’.”

“For example, last week, the global International Air Transport Association complained that Pakistan was second among the top five markets that have restricted or stopped foreign airlines from repatriating their ticket sales revenues of nearly $225 million to their home countries.”

“This is just one of the many examples of how the country’s central bank is struggling to protect its liquid foreign currency reserves, which were reported to have sunk to the four-year low of $6.7 billion on December 2 following the payment of $1bn Sukuk bonds.”

“Ask a foreign company executive, and they will tell you how difficult it has become for their shareholders to repatriate their dividends or profits.”

“This is happening on top of the administrative actions by the State Bank of Pakistan to restrict imports to prevent the existing foreign exchange stocks from disappearing. So you cannot blame the markets if they don’t respond to the attempts of finance minister Ishaq Dar and central bank governor Jameel Ahmed to reassure them that Pakistan can meet all its future external debt payments.”

“Indeed, the reports of Pakistan ‘facing the risk of (actual) default’ are exaggerated. So are the government’s claims of a hunky-dory situation. In last week’s episode of the State Bank of Pakistan podcast series, the governor admitted that overall the situation is challenging as he blamed the war in Ukraine, a historic increase in international commodity prices and monetary tightening pursued by central banks as major global challenges to the national economy.” Nasir Jamal writes.

“To live is the rarest thing in the world. Most people exist, that is all.” ― Oscar Wilde

Last week, we launched our flagship newsletter under the Emerging World banner - the Emerging World Investor, written and curated by Afshin Molavi. Check it out below:

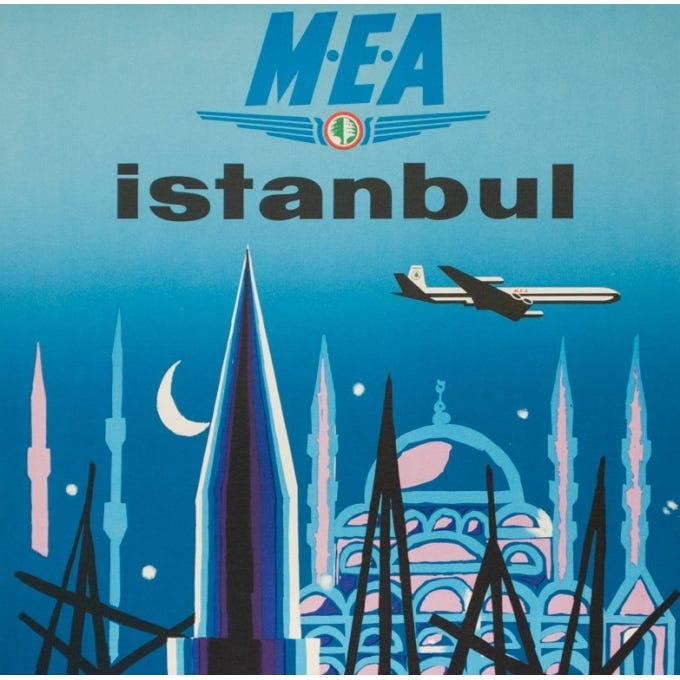

Vintage Photo of the Day: - Middle East Airlines - Istanbul