Emerging Markets Monitor - December 6

EM Currencies Rise as Dollar Dips, India Robust Growth, Morgan Stanley Bullish On China Stocks, Surprise S. Africa Growth, Airlines Look to 2023 Profits

The Top 5 Stories Shaping Emerging Markets from Global Media - December 6

As Dollar Tumbles, Investors Bet on EM Currencies

Reuters

“As the U.S. dollar tumbles from multi-decade highs, some investors are betting emerging market currencies will be big winners from a sustained reversal in the greenback.”

“The MSCI International Emerging Market Currency Index is up nearly 5% from its lows and notched its best monthly gain in about seven years in November, as expectations that the Federal Reserve will soon slow the pace of its interest rate hikes bolstered the case for investors betting on emerging market currencies.”

“Signs of a broader turn in dollar sentiment are visible in the buck’s 8% decline against a basket of developed market currencies from its September highs. In futures markets in November, speculative traders swung to a net short position on the U.S. dollar for the first time in 16 months, calculations by Reuters based on U.S. Commodity Futures Trading Commission data showed.”

“…Investors have cheered the prospect of a shift in China’s COVID-19 policy, after rare street protests increased pressure on officials to ease some rules. China - the world’s second-largest economy and a key consumer of the commodities produced by many emerging market countries - is set to announce a further easing of its COVID curbs as early as Wednesday, sources said.”

“The Chinese yuan is up about 5% against the dollar since late October and posted its best weekly performance against the U.S. currency in at least two decades on Friday, while the Hang Seng Index rose 27% in November, its best month since October 1998.”

"‘I think the cat is out of the bag. They can't go back to their pure restrictive zero COVID policy,’ said Jack McIntyre, a portfolio manager at Brandywine Global. McIntyre has been increasing exposure to some Asian currencies, including the Thai baht and the Malaysian ringgit . Thailand's currency rose 8% in November, while the ringgit has appreciated 6%.” Reuters reports.

India Economy to Grow 6.9% This Year, World Bank Says

LiveMint India

“The Indian economy has demonstrated resilience despite a challenging external environment and is set to grow at 6.9% in 2022-23, the World Bank said on Tuesday, raising its forecast of 6.5% growth made in October.”

“The multilateral agency, however, lowered its India growth forecast for next fiscal to 6.6% from 7% made earlier. While the deteriorating external environment will weigh on India’s growth prospects, the economy is relatively well positioned to weather global spillovers compared to most other emerging markets, the World Bank said in its latest India development update titled ‘Navigating the Storm.”

“The impact of a tightening global monetary policy cycle, slowing global growth and elevated commodity prices will mean that the Indian economy will experience lower growth in 2022-23 compared to 2021-22, World Bank said in a statement.” LiveMint reports.

Morgan Stanley Upgrades China Stocks On Covid Re-opening Bullishness

CNN Business

“Global traders are increasingly feeling more bullish on China, as they bet the country will gradually unwind Covid restrictions following widespread protests.”

“Multiple cities across China loosened Covid-19 restrictions over the weekend. Starting Monday, Shanghai residents will no longer require a negative Covid test result to enter outdoor venues including parks and scenic attractions.”

“Investment bank Morgan Stanley has upgraded its view of the future performance of Chinese equities for the first time in nearly two years. ‘Multiple positive developments alongside a clear path set towards reopening warrant an upgrade and index target increases for China,’ its analysts said in a research note on Monday. They raised China equities to ‘overweight’ from ‘equal-weight,’ a position they had held since January 2021. ‘We are at the beginning of a multi-quarter recovery in earnings revisions and valuations,’ they said.”

“The bank recommended that investors increase their investment allocations to offshore Chinese equities. MSCI China, an index tracking major Chinese stocks available to global investors, will hit the 70 level by the end of 2023, according to Morgan Stanley. That would be a 14% increase from its current level.”

“It also raised its target for Hong Kong’s benchmark Hang Seng Index to 21,200 by the end of next year. That’s up 10% from its current level.”

“The offshore yuan, a key gauge of how international investors think about China, strengthened sharply against the US dollar on Monday. It rose more than 1% to trade at 6.947 per dollar, breaking through the important level of 7 per dollar for the first time in more than two months.” CNN Business reports.

Surprise S. Africa Growth Lifts Economy, Eclipsing Pre-Pandemic Output

Bloomberg

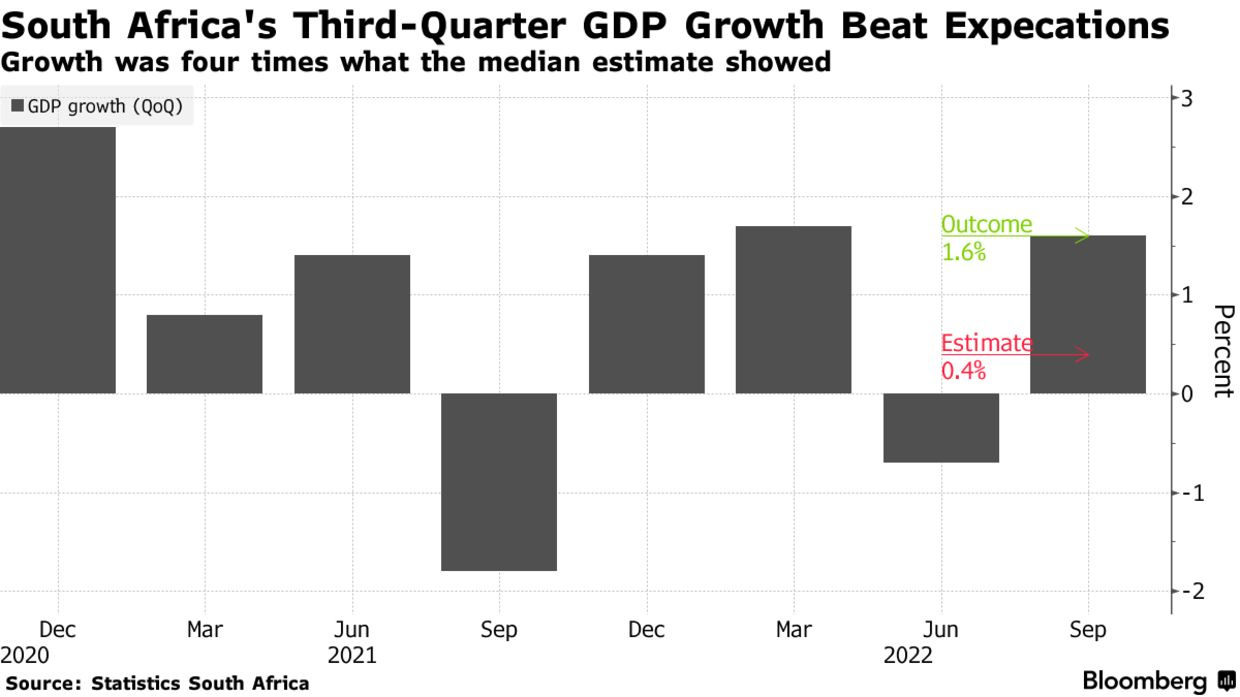

“South Africa’s economy is bigger than before the coronavirus pandemic struck, after growing faster-than-expected in the third quarter on increased farm output.”

“Gross domestic product expanded 1.6% in the three months through September, compared with a contraction of 0.7% in the previous quarter, Statistics South Africa said Tuesday in a report released in the capital, Pretoria. The median of 12 economists’ estimates in a Bloomberg survey was for growth of 0.4%. The economy grew 4.1% from a year earlier.”

“Full-year growth may also surprise on the upside. The central bank forecasts an expansion of 1.8% and the National Treasury 1.9%. For the nine months through September, an early indicator of where full-year growth may land, GDP grew by 2.3% from last year.” Bloomberg reports.

Global Airlines On Track to Return to Profits in 2023, a First Since the Pandemic

The National

“Airlines around the world are on track to return to profit next year after narrowing losses this year as passenger demand continues to improve and Covid-19 restrictions ease, despite economic headwinds, the International Air Transport Association (Iata) has said.”

“The global industry is forecast to collectively earn a net income of $4.7 billion in 2023 — the first time it will return to the black since 2019, when it recorded a profit of $26.4 billion — while revenue is projected to reach $779 billion, Iata said in Geneva on Tuesday.”

“The net profit margin for 2023 stands at 0.6 per cent, compared with 3.1 per cent in 2019. The expected financial recovery is a ‘great achievement’, given the scale of the financial and economic damage caused by government-imposed pandemic restrictions, said Iata director general Willie Walsh.”

“‘Despite the economic uncertainties, there are plenty of reasons to be optimistic about 2023. Lower oil price inflation and continuing pent-up demand should help to keep costs in check as the strong growth trend continues,’ he said.”

“‘At the same time, with such thin margins, even an insignificant shift in any one of these variables has the potential to shift the balance into negative territory. Vigilance and flexibility will be key.’”

“….The expected return to profit next year comes at a time when the industry's prospects for the year have improved, with strong passenger demand and a rebound from the coronavirus-induced slowdown that ravaged air travel for about three years.” Deena Kamel reports.

Video of the Day - Morgan Stanley’s Jonathan Garner on Squawk Box

Morgan Stanley has been bullish on EM for the past couple of months. In this interview with Squawk Box, Jonathan Garner makes the case that “EM Equities Are Outstandingly Cheap”

“And once the storm is over, you won’t remember how you made it through, how you managed to survive. You won’t even be sure, whether the storm is really over. But one thing is certain. When you come out of the storm, you won’t be the same person who walked in. That’s what this storm’s all about.”

― Haruki Murakami, Kafka on the Shore

China to overtake Russia in misallocation of resources !

who needs a 5 yr plan?