Emerging Markets Monitor - February 3

Goldman Raises EM Forecast, Powell Remarks Bullish for EM, Adani Losses Top $100B, Lat-Am Faces Growing Troubles: IMF, Indonesia Nickel and EV's

The Top 5 Stories Shaping Emerging Markets from Global Media - February 3

Goldman Sachs Raises EM Equities Forecast

Reuters

“Goldman Sachs on Thursday revised its forecast for emerging market equities upwards as it sees the developing world benefiting from the reopening of China's borders, improving European growth prospects and softening U.S. inflation.”

“The investment bank sees MSCI's index of emerging market shares hitting 1,150 over the next 12 months, representing a near-10% jump from current levels, and up from the bank's previous target of 1,075.”

"‘These forecasts do suggest further EM outperformance, though this view is driven by returns in North Asia and Middle East and North Africa (MENA) primarily – which are in turn based on a constructive outlook of Chinese growth and oil prices,’ Goldman said in a note dated Thursday.” Reuters reports.

Risk-Hungry Investors See Powell Nod as Green Light for EM Rally

Bloomberg

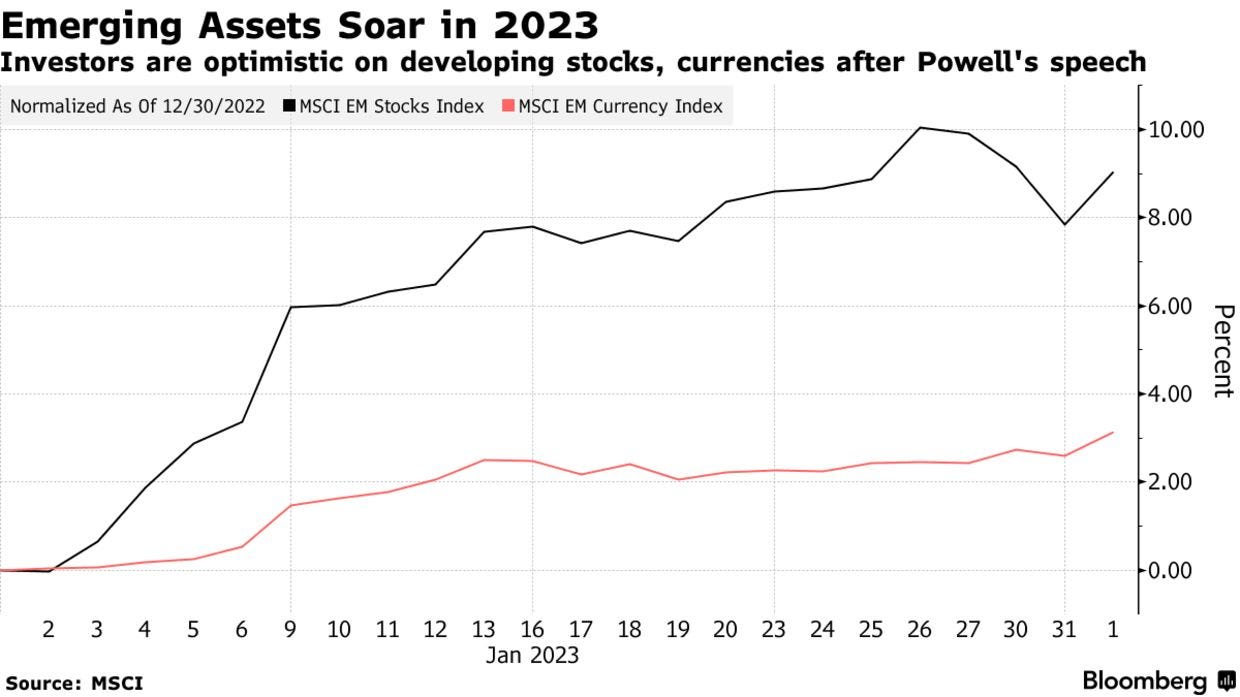

“Emerging markets lit up green as Federal Reserve Chair Jerome Powell nodded at the progress made against US inflation, adding fuel to Wall Street’s bullish outlook on developing assets.”

“MSCI Inc.’s emerging-market currency benchmark soared to the highest since April on Thursday, extending gains after Powell hinted that the Fed may have only a few more interest-rate hikes to go. A similar gauge of developing-economy equities also jumped, bringing its year-to-date gain to 10%. The won led the advance among Asian currencies with a rise of as much as 1.2%.”

“Investors and analysts have been broadly bullish on emerging markets this year, partially due to the odds that major central banks — including the Fed — will back off their aggressive tightening paths.”

“The market is hopeful that the Fed isn’t going to overdo it,’ said Aaron Gifford, an emerging-market sovereign-debt strategist at T. Rowe Price in Baltimore. ‘With the end of the US tightening cycle getting closer, China reopening and a softer slowdown in Europe, it’s hard not to be optimistic on risk markets — including EM.’” Bloomberg reports.

Losses from Adani Stock Rout Top $100 Billion

Wall Street Journal and The Guardian

“Shares of companies linked to Indian billionaire Gautam Adani continued to slide on Thursday, after his namesake conglomerate canceled a planned share sale that was meant to raise more than $2 billion.”

“Adani Enterprises Ltd., the group’s flagship business that scrapped its follow-on public offering after a plunge in its shares the previous day, fell another 26% on Thursday. The shares have lost more than half their value since Hindenburg Research, a U.S. short seller, released a scathing report last week alleging fraud and stock-price manipulation at Mr. Adani’s conglomerate.”

“The six other companies bearing the Adani name also declined further, with some hitting the maximum daily loss of 10% allowed by India’s stock exchanges for their shares,” WSJ reports.

“Traders sent shares in the listed flagship Adani Enterprises down more than 25% shortly after markets opened in Mumbai on Friday, despite attempts by the company to restore investor confidence. Other listed entities, such as Adani Green Energy and Adani Ports, were also down sharply.”

“The relentless selling has now wiped more than US$115bn from the value of Adani companies in the two weeks since US-based Hindenburg Research accused the conglomerate of stock manipulation and accounting fraud,” The Guardian reports.

Latin America Faces Slowing Growth, High Inflation Amid Social Tensions

IMF Blog

“Latin America’s economies held up well last year despite the shocks from Russia’s invasion of Ukraine and global interest rate hikes. In 2022, the region’s economy expanded by nearly 4 percent, employment recovered strongly, and the service sector rebounded from the damage caused by the pandemic.”

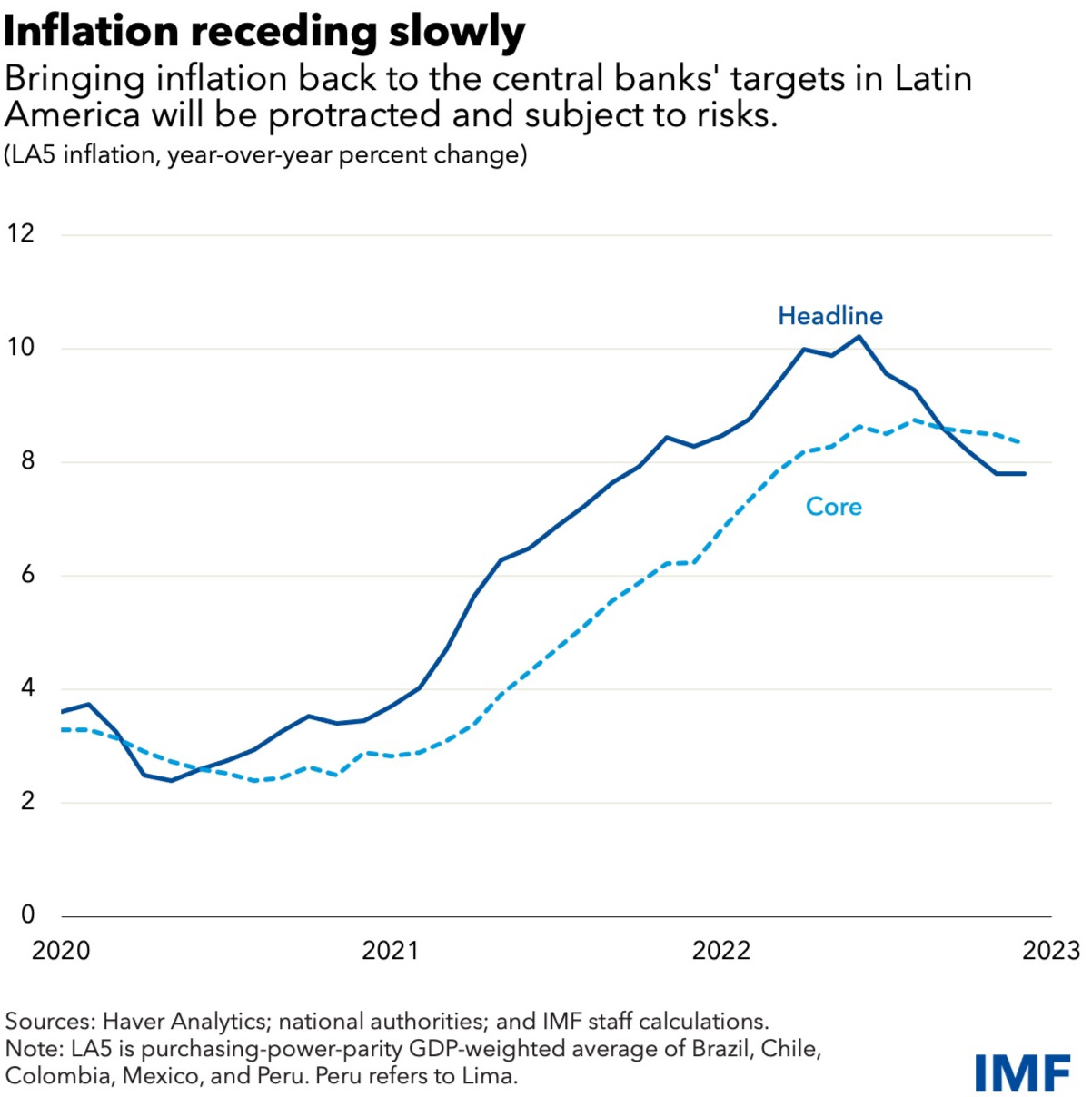

“Inflationary pressures are receding in many countries due to the early and determined efforts of central banks as well as lower global prices of food and energy. However, core inflation (that is, excluding food and energy), remains high at around 8 percent in Brazil, Mexico, and Chile (and somewhat higher in Colombia but lower in Peru).”

“Despite this encouraging news on growth and inflation, 2023 is likely to be a challenging year for the region. Growth this year is poised to slow to just 2 percent, amid higher interest rates and falling commodity prices. Job creation and consumer spending on goods and services are both slowing, and consumer and business confidence are weakening. Growth will also be held back by a slowdown in trading partners, particularly the United States and the euro area. Moreover, downside risks—including from tighter-than-anticipated financial conditions and Russia’s war in Ukraine—continue to dominate.?

“Furthermore, bringing inflation back down to central banks’ targets is likely to be a protracted process that is subject to risks, including from increases in wage pressures.”

“Slowing growth, high inflation, and global uncertainty mean that many people in the region will see their living standards decline this year and will likely face increased anxiety about their future.”

“Growing social discontent and diminished trust in public institutions has been an important trend in the region for some time. Social tensions were certainly exacerbated during the pandemic. Poorer people—particularly those employed in in-person services—bore the brunt of the economic fallout….Increased food insecurity is also a key symptom of the lasting socioeconomic effects of the pandemic.”

“The region’s middle class also faces a more unstable economic situation. Many small businesses struggled during the lockdowns and the wages of middle-income workers were eroded by the subsequent surge in prices”. Gustavo Adler, Nigel Chalk, Anna Ivanova write.

Indonesia Nickel Riches Spur Foreign Interest and Local Competition

Nikkei Asia

“From coal miners to conglomerates, Indonesia's burgeoning electric vehicle and battery scene is attracting broad local corporate interest buoyed by the country's rich nickel resources and government promises of incentives.”

“The involvement comes as global EV makers including China's BYD and Tesla of the U.S. have either signed or are ‘finalizing’ deals to invest in Indonesia, Luhut Pandjaitan, coordinating minister for maritime affairs and investment, told a briefing of Indonesian regional leaders last month.”

“Companies hope to ride on the government's push to utilize the nickel reserves to develop a battery industry, enter the global EV supply chain and develop a manufacturing base. With a population of more than 270 million, Indonesia also offers a potentially huge market.”

“But formidable challenges to individual, public and business adoption include consumer affordability, lack of public charging infrastructure and corporate governance questions over potential conflicts of interest arising from close relations among government officials, politicians and companies.” Nikkei Asia reports.

"Sometimes even to live is an act of courage." - Seneca

“You miss 100% of the shots you don’t take.” - Wayne Gretzky