Emerging Markets Monitor - February 8

Major Hedge Fund Bets on EM Rout, US-China Trade Hits Record, EM Funds See Big Jan. Inflows, Indian Banks And Adani Group, Senegal Growth to Sizzle in '23

The Top 5 Stories Shaping Emerging Markets from Global Media - February 8

World’s Biggest Public Hedge Fund Bets on Emerging Markets Rout

Bloomberg

“The world’s largest publicly-traded hedge fund is bracing for a selloff in emerging markets, a view that pits it against bulls at some of Wall Street’s biggest investment banks.”

“This year’s spectacular rally in risk assets isn’t justified by improvements in economic fundamentals and is set to reverse, according to Man Group Plc, which manages $138 billion in assets, almost half of them within Europe, the Middle East and Africa.”

“‘We are expecting the selloff within the next two months,’ Guillermo Osses, the fund’s New York-based head of emerging-market debt strategies, told Bloomberg in an interview. ‘People have added exposure, probably a large part of the rally has already taken place, and now find themselves very long on risky assets with very tight valuations when the liquidity conditions are turning. This is why we think you will have a significant selloff.’”

“London-based Man Group shares are up 23% so far this year, compared with a 6% gain on the FTSE 100. Its bearish view on emerging markets contrasts with optimism at fund managers from Morgan Stanley Investment Management to Goldman Sachs, while even some bulls say the ferocity of the rally has them getting more selective.”

“Osses declined to comment on the group’s positioning or recommendations, citing company policy. The EM debt fund he manages outperformed 99% of peers last year, when it warned of default risk and eked out a 2.4% return, compared with an average 14% loss among peers, according to data and rankings compiled by Bloomberg.” Selcuk Gokoluk reports.

US-China Trade Hits Record Numbers in 2022

Nikkei Asia

“Trade between the U.S. and China set a record last year, official figures released Tuesday show, despite bilateral tensions running high.”

“Imports and exports of goods between the countries hit $690.6 billion, a U.S. Bureau of Economic Analysis report shows. The U.S. imported more toys and other consumer products, with China increasing imports of soybeans and other foods. The robust figures run counter to talk that the world's two largest economies are on track to decouple.”

“Exports to China increased by $2.4 billion, to $153.8 billion, while imports from China rose $31.8 billion to reach $536.8 billion, underpinned by strong U.S. consumer spending in the first half. The previous high for imports and exports between the two countries was $659 billion in 2018.”

"‘For U.S. importers, the benefit of buying cheap Chinese products was compelling, even with the sanction tariffs,’ said Kensuke Abe of trading company Marubeni's Washington office.”

“Tariffs imposed on Chinese goods such as toys and plastic products -- worth $370 billion -- during the Trump administration mostly remain. The Biden administration weighed cutting them as part of dealing with the acute inflation, but the momentum for the move faded after Sino-American tensions rose, partly due to then-House Speaker Nancy Pelosi's visit to Taiwan last summer.”

“…China's gross domestic product expanded a real 3% in 2022, among its weakest annual growth rates in decades, with the economy hamstrung by Beijing's zero-COVID policy.”

“…Whether U.S.-China trade will continue to grow remains uncertain. Diplomatic relations have been strained further by the suspected Chinese spy balloon that flew over American airspace and was shot down by the U.S. military the over the Atlantic Ocean. In a report released last month, Boston Consulting Group forecast that bilateral trade will decline about 10% through 2031.” Nikkei Asia reports.

EM Funds See Big Inflows in January on China Reopening

Reuters

“Emerging market bond and equity funds received heavy inflows in January after a dry patch last year, aided by China's reopening and softening inflation pressures worldwide.”

“According to Refinitiv Lipper data, which covers over 33,700 emerging market (EM) funds, EM equity funds received $13.2 billion, and EM bond funds obtained $11.36 billion in January. Both the inflows were the highest in over a year.”

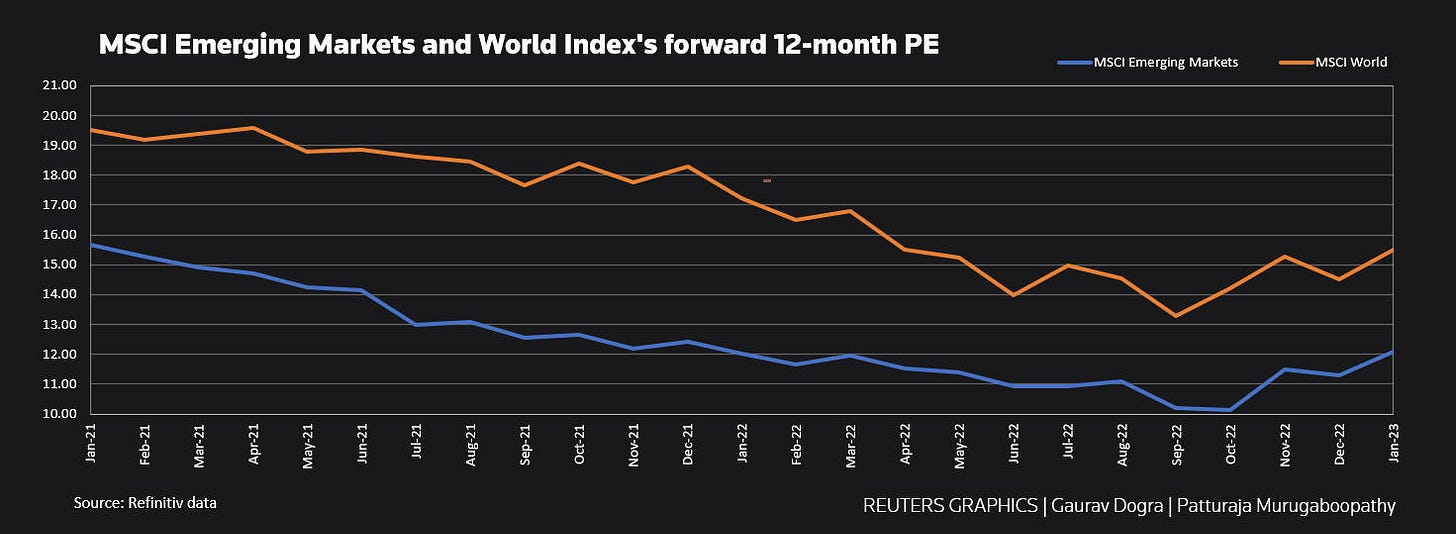

“Analysts expect cheaper valuations, a weakening dollar, peaking Fed rates pricing, and lower U.S. Treasury yields to bolster EM assets this year.”

"‘Even as global growth slows, we believe EM equity valuations have room to improve in 2023, driven by lower inflation, a peaking U.S. dollar, greater clarity around key political events, and structural shifts within the region,’ Josh Rubin, portfolio manager at Thornburg Investment Management.” Reuters reports.

Indian Banks Face ‘Limited Risk’ from Adani Group Turmoil, Fitch Says

The National

“Indian banks' exposure to the embattled conglomerate Adani Group is ‘insufficient in itself’ to present substantial risk to lenders, according to Fitch Ratings. Indian banks’ issuer default ratings ‘remain driven by expectations that the banks would receive extraordinary sovereign support, if needed’, the rating agency said on Tuesday.”

“The Adani Group has been in turmoil since US-based short-seller Hindenburg Research accused the conglomerate of ‘brazen’ market manipulation, unsustainable debt and use of tax havens in a report last month.”

“The group has repeatedly denied the allegations. Since the report's release, Adani shares have been in free fall, with the group's cumulative market value slumping by more than $110 billion.”

“However, Adani group shares stemmed the decline and surged on Tuesday on news that its founder, Indian billionaire Gautam Adani, and his family prepaid $1.11 billion worth of debt. Shares of the group's flagship company Adani Enterprises were up more than 15 per cent on the Bombay Stock Exchange at the close of trading on Tuesday.”

“…Even under a hypothetical scenario where the wider Adani group enters distress, exposure for Indian banks should, in itself, be manageable without adverse consequences on the banks' viability ratings,” the rating agency said. Aarti Nagraj reports.

Senegal On Track for World-Beating Growth in 2023

African Business

“The World Bank predicts that Senegal will grow by 8% in 2023, the most out of any sub-Saharan African country.”

“The growth is largely attributed to huge oil and gas finds in the Atlantic Ocean, with one of the projects due to come online later this year, according to Aissatou Sophie Gladima, minister of petroleum and energies of Senegal. The eventual production of oil and gas – after its discovery in 2014 – will turbocharge Senegal’s economy for the next few years.”

“‘After slowing to 4.8% in 2022, growth in Senegal is projected to jump to 8.0% in 2023 and then to 10.5% in 2024,’ the World Bank states.”

“This puts Senegal at the top of sub-Saharan African growth rates for the next two years, as the region is predicted to grow by an average of 3.6% in 2023 and 3.9% in 2024. Other strong performers this year are Benin (6.2%), Republic of Congo (6.4%), Côte d’Ivoire (6.8%) and Niger (7.1%).”

“…In 2014, more than 1bn barrels of oil and 120trn cubic feet of natural gas were discovered in the Atlantic Ocean.”

“The huge hydrocarbon finds led to a flurry of investment by oil and gas companies including British oil major BP and US operator Kosmos Energy, which pumped $4.8bn into the development of the Greater Tortue Ahmeyim (GTA) LNG project – boasting 15trn cubic feet of recoverable gas reserves – set to come online in 2024.”

“Australian petroleum company Woodside Energy is also developing the Sangomar Field, 100km south of the capital city of Dakar, which has the capacity to produce 100,000 barrels of oil a day and is set to come online later this year.” Tom Collins reports.

“Confucius had a great saying that every man has two lives, and the second starts when he realizes he has just one.” - Naval Ravikant