Emerging Markets Monitor - January 4

Top '23 Calls: Buy EM and China, Turkish Exports Hit Record High, China's Great Re-Opening and the World, India Stocks See Foreign Exodus, Iraq Oil Sales Top $222B

The Top 5 Stories Shaping Emerging Markets from Global Media - January 4

Buy China and EM Stocks in 2023, Top Fund Managers Say

Reuters

“Investors see Chinese equities as a comeback story after a torrid few years, helped by an easing of COVID-19 restrictions, renewed focus on economic growth and shoring up the battered property market.”

“With COVID deaths rising again uncertainty remains, but the enthusiasm is undoubtedly there for a reopening that also eventually lifts Asian capital markets and deal-making.”

“MSCI's China index gained nearly 40% from November to mid December but more is possible. BNP Paribas reckons travel, domestic consumption and tech shares can rise further and has upgraded China to ‘overweight’ in its 2023 model portfolio, which includes stocks such as Tencent and Trip.com.”

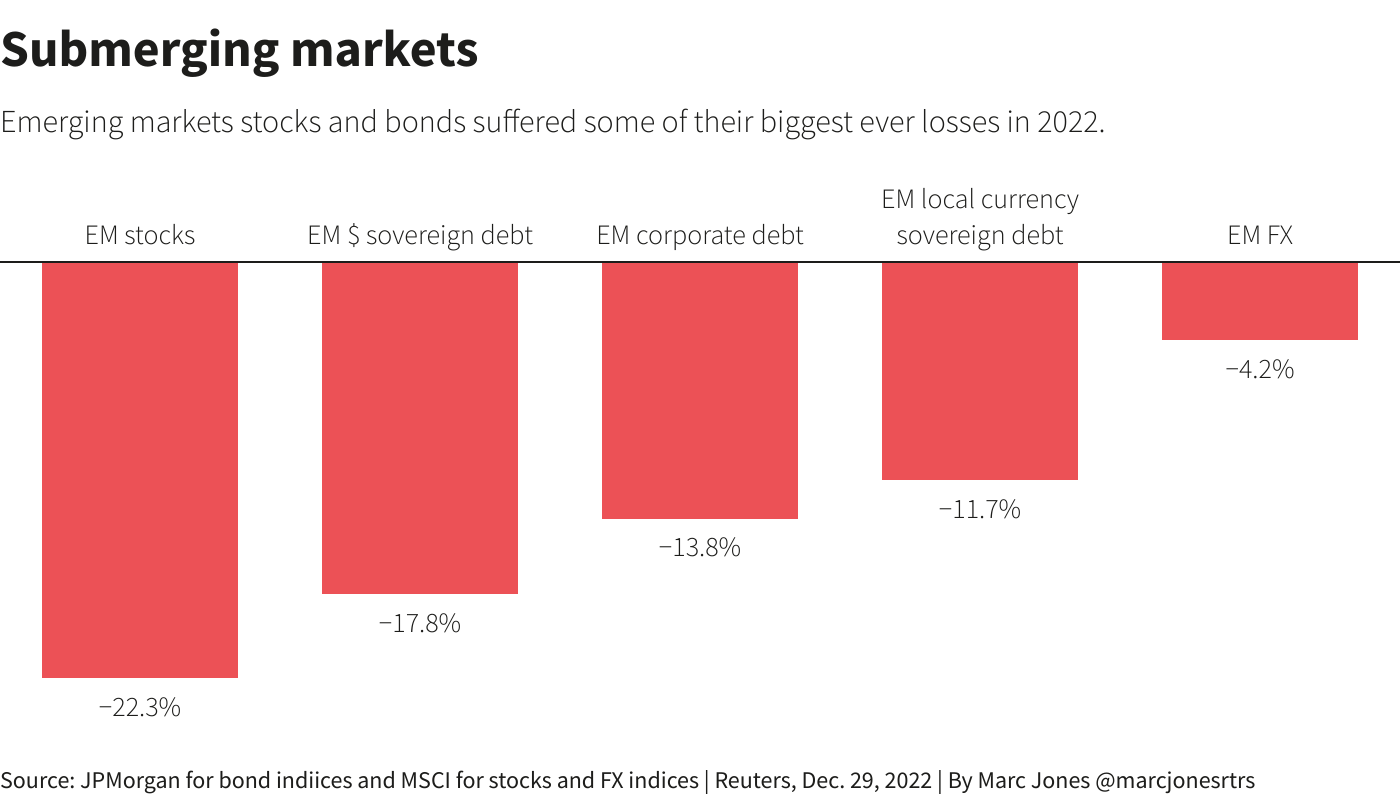

“Whisper it, but the emerging markets (EM) bulls are back after 2022 delivered some of the biggest losses on record.”

“With the caveat that global interest rates stabilise, China relaxes COVID restrictions and nuclear war is averted, UBS reckons EM stocks and fixed income indexes could earn between 8-15% in 2023 on a total returns basis.”

“A ‘bullish’ Morgan Stanley expects a near 17% return on EM local currency debt. Credit Suisse particularly likes hard currency debt and DoubleLine's Jeffrey Gundlach, AKA the ‘bond king’, has EM stocks as his top pick.”

“Performance following past routs underscores this wave of optimism. MSCI's EM equity index soared 64% in 1999, following the Asian financial crisis, and 75% in 2009. EM hard currency debt saw a whopping 30% rebound too after its 12% global financial crisis drop.”

Turkish Exports Hit Record High in 2022

Financial Times

“Sales of Turkish exports hit a record high last year as the slump in the value of the lira made businesses’ products more competitive overseas, with the country also benefiting from closer economic ties to Russia.”

“Turkey recorded a 13 per cent rise in exports by value, with sales hitting $254bn in 2022, said Recep Tayyip Erdoğan, the country’s president, in a televised speech on Monday.”

“…Turkey stepped into a void created by western sanctions and traded more with Russia over the past year. In December alone, exports to Russia more than doubled to $1.31bn, the trade ministry said.”

“The surge in exports is good economic news for the president, who faces re-election in June. A cost of living crisis has eaten into his party’s popularity. Inflation has been above 80 per cent for months, in large part because of his unorthodox monetary policies.”

“Under orders from Erdoğan, the central bank has reduced the benchmark interest rate to 9 per cent, shaving off almost 30 per cent of the value of the lira against the dollar over the past year. The weak lira has swelled Turkey’s trade deficit to $110.2bn in 2022, as the cost of imports jumped 34 per cent to $364.4bn, according to trade ministry figures.”

“Turkey is a major importer of crude oil and other energy products. Brent, the main international oil benchmark, rose more than 10 per cent in dollar terms in 2022 to end the year around $85 a barrel. Erdoğan’s growth-at-all-costs policies centre on the devalued lira boosting manufacturing and on cheap loans encouraging spending.” The FT reports.

What the Great Re-Opening Means for China - and the World

The Economist

“When its borders open on January 8th, China will have spent 1,016 days closed to the outside world. The country’s ‘zero-covid’ policy has been a social and economic experiment without precedent: a vast public-health campaign that mostly kept the disease at bay; Xi Jinping’s pride and joy; and, by the end, a waking nightmare for many of China’s 1.4bn people.”

“Zero-covid lasted longer than anyone initially expected, then collapsed faster than anyone could have imagined. In a matter of weeks China has gone from some of the world’s strictest restrictions to almost none. For the population at large, fear of lockdowns and quarantine has vanished. After a period of turbulence, economic activity is likely to rebound sharply. Increased demand for energy and commodities will be felt around the world. Investors and multinational executives can hope to visit colleagues and factories, after a painfully long pause. The great reconnecting of China with the outside world marks the end of an era: that of the global pandemic.”

“The economic implications of reopening extend farther afield. Zero-covid kept a lid on China’s demand for global goods, services and commodities. During the lockdown of Shanghai in the first half of last year, for instance, the country’s oil demand fell by 2m barrels per day…”

“…China’s most direct channel of influence is via commodities. It consumes almost one-fifth of the world’s oil, over half of refined copper, nickel and zinc, and more than three-fifths of iron ore. On November 4th the mere rumour of a reopening caused a 7% increase in the price of copper by the end of the day. As the rumours are realised, China’s demand for metals, crops and energy will help exporters of commodities, hurt importers and give the world’s central banks another headache in their fight against inflation.” The Economist reports.

India Market Sees Worst Foreign Investor Sell-Off to Tune of $16.5B, but Analysts Say: They’ll be Back

Quartz India

“Amid wobbly economic conditions around the world, Indian equities have seen the worst sell-off ever from foreign institutional investors (FIIs) in 2022.”

“FIIs have sold Indian stocks worth $16.5 billion (1.2 lakh crore rupees) this year, translating to a daily average outflow of about $68 million, according to data from National Securities Depository Limited (NSDL). This rout was worse than the one during the 2008 global financial crisis, when FIIs pulled out roughly $12 billion from Indian stocks.”

“Still, the Indian benchmark indices—Nifty50 and Sensex—are ending the year up 3%, which has been possible only because of domestic institutional investors, who bought $32.9 billion worth of equities in 2022.”

“Analysts expect foreign investors to return sporadically in the beginning of 2023 and more steadily in the second half of the year, as China’s economy reopens and the global macroeconomic environment improves.”

“‘Overall, Indian stocks are likely to continue performing better in comparison to other major economies and expected to give 10%-15% return in 2023,’ Mohit Ralhan, the CEO of TIW Capital, a Singapore-based asset management firm, wrote in a note.” Quartz India reports.

Iraq Oil Revenues Top $115 Billion in 2022

Asharq Al-Awsat

“Iraq's oil revenues in 2022 exceeded $115 billion, according to preliminary figures announced by the oil ministry on Tuesday -- a four-year high following a collapse in prices during the coronavirus pandemic.”

“Oil production accounts for some 90 percent of Baghdad's income, and the country is the second largest producer within the Organization of the Petroleum Exporting Countries (OPEC).”

“The country exported more than 1.2 billion barrels in 2022, averaging 3.3 million barrels per day, according to the statement. With a near total reliance on oil revenue to fund state spending, Iraq was hit by a collapse in prices at the beginning of the coronavirus pandemic. “

“From $78.5 billion in 2019, oil revenues fell to $42 billion in 2020, according to official statistics. By 2021 they had risen back up to $75.6 billion.”

“Following decades of conflict Iraq, faces chronic economic challenges and requires significant investment in infrastructure projects, making oil revenues and prices per barrel crucial data for Baghdad's preparation of annual budgets.”

“Despite its oil riches Iraq, home to 42 million inhabitants, faces an energy crisis that sees regular power cuts and damaging electrical surges, known as load shedding.” Asharq Al-Awsat reports.

“Life is like riding a bicycle. To keep your balance, you must keep moving.” ~ Albert Einstein

awesome work, thanks!