Emerging Markets Monitor - January 25

Emerging Markets Decade Looms: Morgan Stanley, Shipping Costs Drop, US Tanks to Ukraine, China Reopening Eases Inventory Woes, Argentina Gas and Mining Boom

The Top 5 Stories Shaping Emerging Markets from Global Media - January 25

The Emerging Markets Decade Has Begun, Morgan Stanley Says

Bloomberg

“Stocks in emerging markets are set to be this decade’s winners, Morgan Stanley Investment Management said, adding to a chorus of investors who are souring on the US in favor of other regions.”

“The fund manager is taking money out of US equities to add to its developing markets exposure, according to Jitania Kandhari, deputy chief investment officer and head of macroeconomic research for emerging markets at Morgan Stanley IM. Developing equities have attractive valuations, and economies like India are set for better growth than the US, she said.”

“‘Every decade, there is a new leader in the market. In the 2010s, it was US stocks and mega-cap tech,’ Kandhari said in a phone interview. ‘Leaders of this decade can clearly be emerging-market and international stocks.’ Morgan Stanley IM has $1.3 trillion in assets under management.”

“The asset class has had a strong start to the year, with the MSCI emerging-markets index soaring 8.6% compared with a 4.7% advance for the US benchmark. The gains come as China’s pullback from its strict Covid Zero policy brightens the economic outlook, while investors position for the end of aggressive central bank interest-rate hikes. Many also still see US stocks as expensive, with those in emerging-markets trading at a nearly 30% discount.”

“There’s a growing disconnect between US’s shrinking share of the global economy and the size of its stock market capitalization, Kandhari said. Along with fund allocations to emerging-markets that are well below historical averages and inexpensive currencies, that gives them a lot of room to outperform, she said.” Bloomberg reports.

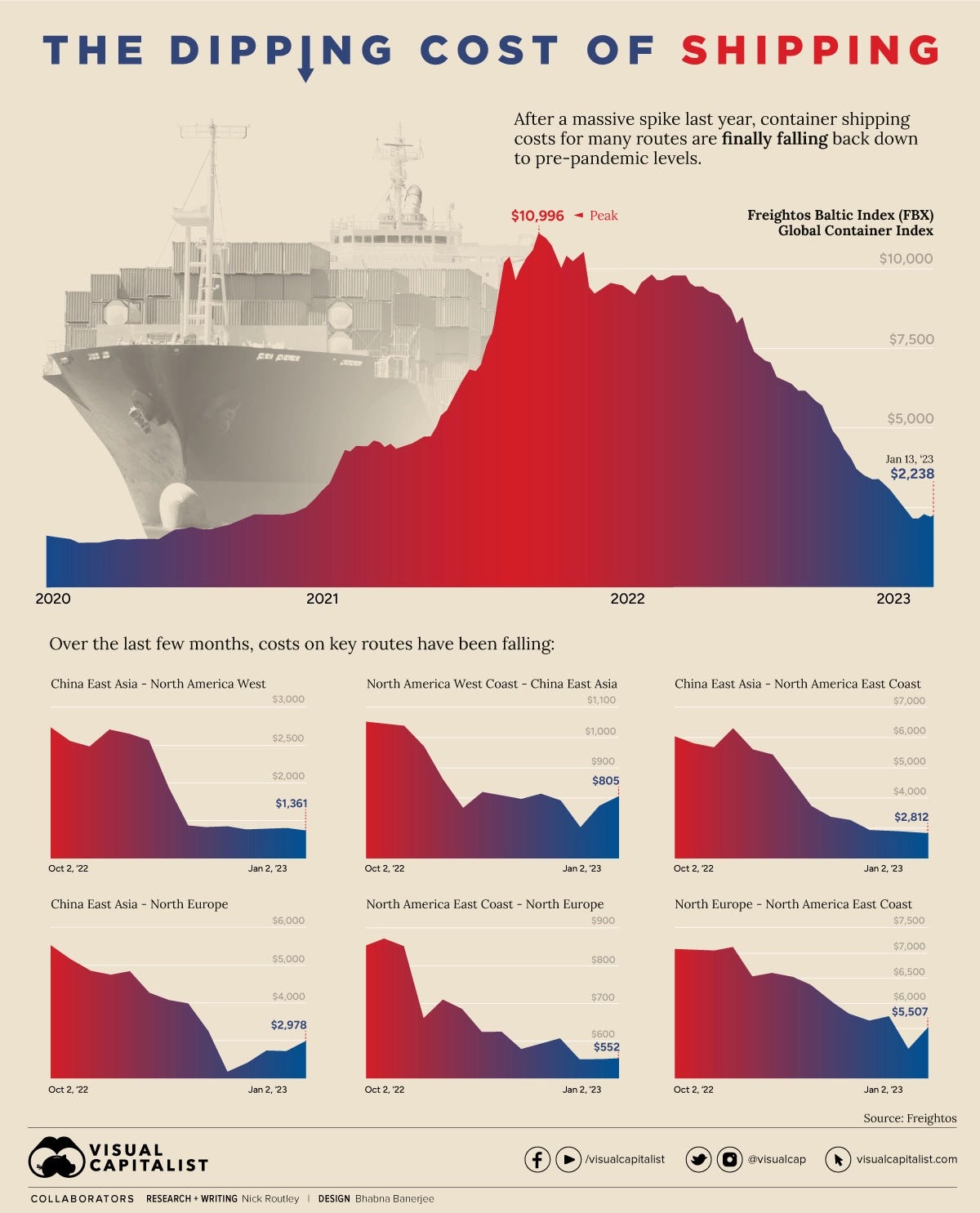

The Dipping Cost of Shipping

Visual Capitalist

“A little over one year ago, congestion at America’s West Coast ports were making headlines, and the global cost of shipping containers had reached record highs.”

“Today, shipping costs have come back down to Earth, with some routes approaching pre-pandemic levels. The graphic (below), using data from Freightos, shows just how dramatically costs have fallen in a short amount of time.”

“The Freightos Baltic Index (FBX)—a widely recognized benchmark for global freight rates—has fallen 80% since its peak in late 2021.”

“The vast majority of trade is conducted over the world’s oceans, so skyrocketing shipping costs can wreak havoc on the global economy.”

“A recent study from the IMF, which included 143 countries over the past 30 years, found that shipping costs are an important driver of inflation around the world. In fact, when freight rates double, inflation increases by 0.7 of a percentage point.”

“Of course, some nations feel the effects of higher shipping costs more acutely than others. Countries that import more of what they consume and that are more integrated into the global supply chain are more likely to see inflation rise as shipping costs elevate.” Visual Capitalist reports.

Geopolitics: US Poised to Provide Abrams Tanks to Ukraine in Major Breakthrough

Wall Street Journal

“The Biden administration is poised to send a significant number of Abrams M1 tanks to Ukraine, settling a rift that threatened the unity of the alliance supporting Ukraine at a pivotal moment in the war, U.S. officials said.”

“The move, which could be announced as soon as Wednesday, would be part of a broader diplomatic understanding with Germany in which Berlin would agree to send a smaller number of its own Leopard 2 tanks and would approve the delivery of more of the German-made tanks by Poland and other countries.”

“The U.S. is expected to send about 30 tanks, according to U.S. officials. The shift in the U.S. position follows a Jan. 17 call between President Biden and German Chancellor Olaf Scholz in which Mr. Biden agreed to look into providing the Abrams tanks against the judgment of the Pentagon, which thought the tanks would be too difficult for Ukraine to field and maintain.”

“A senior German politician said Berlin would pledge on Wednesday to provide around 14 Leopard 2 tanks to Kyiv from its stocks and approve third-party requests from other European countries to donate German-made tanks to Ukraine. The politician said that a request by Poland would be approved and that countries such as the Netherlands also have expressed interest in sending Leopard tanks to Ukraine.” WSJ reports.

China Reopening Will Help Ease Inventory Woes

Korea Times

“Even as the worst point of the COVID-19 disruptions has eased a bit, recently, its real impact continues to ripple throughout the world's leading economies including the United States and China.”

”The so-called ‘second-order effect’ is still being felt all over, and addressing pending challenges could be considered as tricky as maneuvering through the initial shocks. One strong example could be found in inventories. Inventory levels have a direct effect on the cash flow of a company.”

”During the pandemic, high demand for tech, retail and home products worsened supply chain issues, draining the inventories of manufacturers and retailers. But higher inflation and shifts in consumer behavior have caused a lot of uncertainties for manufacturers as demand is now softening for end-products that saw substantial growth during the pandemic.”

”Sources inside Samsung Electronics, for example, told The Korea Times that the company didn't expect the size of the switch in consumer buying patterns, leaving it with a huge amount of unwanted inventory. As of the third quarter of last year, Samsung's inventory assets swelled to 57.3 trillion won, up 51.6 percent year-on-year, according to company data.”

”South Korea's export leaders including Samsung, LG, SK Groups' tech affiliates, steel manufacturer POSCO and Hyundai Motor are set to report bearish fourth-quarter earnings results mostly due to higher inventories, the level of which hasn't been seen in a decade, as well as weak product demand.”

”Still, the long lead times for end-products remains a key issue. The country's leading manufacturers, the core engine of South Korea's economy, will remain in a fragile position of worrying about the amount of "unwanted and unsold goods" both above and below manageable levels.” Kim Yoo-chul reports.

Gas and Mining Boom to Transform Argentina’s Economy, Minister Says

Financial Times

“Exports of gas, lithium and other minerals offer Argentina a ‘phenomenal growth opportunity’ and will significantly boost the heavily indebted South American nation’s ability to repay creditors from 2025, the country’s economy minister has said.”

“‘We are going to start gas exports to Chile in the next few days and we could start exporting gas to Brazil from September,’ Sergio Massa said. Even without additional investments, Argentina’s trade balance on energy would swing from a deficit of more than $5bn last year to a surplus of about $12bn in 2025, he said, adding: ‘This will give Argentina a very strong ability to pay [debt] in 2025, 2026 and 2027.’”

“Massa, who took on one of the world’s toughest economic challenges last August, is under no illusions about the severity of Argentina’s crisis. Central bank money-printing has helped push annual inflation to almost 100 per cent, exchange controls have hurt industry and fed a black market in the US dollar, while the country remains cut off from international markets in the wake of its ninth debt default in 2020.”

“‘When we took over, we understood that we were dealing with a patient who was in a coma,’ the minister told the Financial Times in an interview. ‘Today he is in intensive care and we have to get him down on to a ward and then walking out of hospital. That’s my job.’

“To get the Argentine economy back on track, Massa said he would reduce inflation to 60 per cent by keeping spending under control. The Peronist coalition, which is facing an election battle in 2023, had last year met all their IMF objectives on reducing the government deficit and building reserves, he said. According to the economy ministry, the country owes the fund $44bn from a 2018 bailout.” The FT reports.

"If you correct your mind, the rest of your life will fall into place." - Lao Tzu