Emerging Markets Monitor - July 11

Investors Flee EM Bond Funds, China Green Stocks Reviving, Biden and Saudi Oil, Rising Debts and EM Dangers, More than 800M Faced Acute Hunger in '21: UN

The Top 5 Stories Shaping Emerging Markets from Global Media - July 11

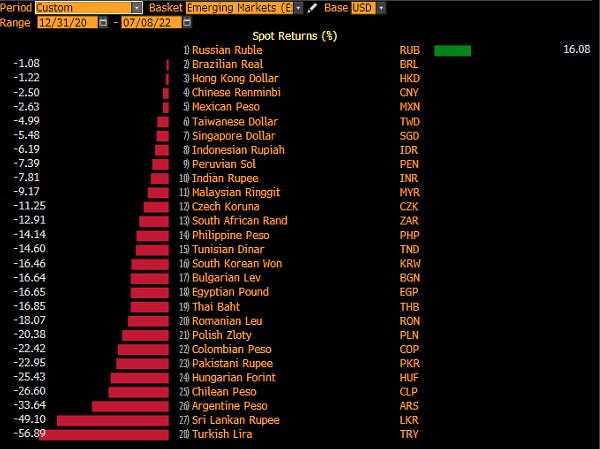

Investors Pull $50B From EM Bond Funds in 2022

Financial Times

“Investors have pulled $50bn from emerging market bond funds this year in the latest sign of how a sharp tightening of monetary policy in developed economies and the war in Ukraine has sparked a flight from the asset class.”

“The net outflows from EM fixed income funds are the most severe in at least 17 years, far worse than were recorded during a bout of acute concern about China’s economy in 2015, data collated by JPMorgan show.”

“‘It has been pretty dramatic,’ said Marco Ruijer, emerging markets portfolio manager at William Blair, adding that the combination of soaring global inflation, tightening central bank monetary policy and Russia’s invasion of Ukraine has culminated in ‘a perfect storm’ for emerging market debt.”

“The strong shift away from emerging market bonds, which are typically considered to be riskier than their developed market counterparts, has pulled prices sharply lower this year. The benchmark index of dollar-denominated emerging market sovereign bonds, the JPMorgan EMBI Global Diversified, has delivered total returns of minus 18.6 per cent in 2022, leaving it on track for its worst annual run on record.”

“‘These assets tend to be quite positively correlated with the economic cycle,’ said Cristian Maggio, head of emerging markets strategy at TD Securities. He added that investors have been ‘deterred from having large exposure to emerging markets by the fact that growth prospects are deteriorating by the day’.” Nikou Asgari reports.

China Green Energy Stocks Well-Positioned to Ride Equity Recovery

(CATL’s production base in Ningde, in China’s southeastern Fujian province. Photo: Xinhua)

South China Morning Post

“As Chinese equities approach bull-market territory, green energy stocks such as electric vehicle (EV) producers are enjoying a revival of sorts, with investors betting on shares with growth potential to ride the economic rebound in the second half.”

“This is evident from a 47 per cent surge in Contemporary Amperex Technology (CATL) – the world’s biggest maker of lithium-ion batteries for electric vehicles and a Tesla supplier – since the company suffered a rout in May. BYD reached 1 trillion yuan (US$149.2 billion) in market value for the first time last month, while peers such as Nio and XPeng have risen by at least 30 per cent over the past two months.”

“Longi Green Energy Technology and Ningbo Orient Wires and Cables, two leading players in the photovoltaic and windpower sectors, have almost recouped all their market losses from the two-month Shanghai lockdown.”

“The 20 per cent recovery in Chinese stocks since the low on April 26 is providing comfort to domestic and global money managers. Policy easing in China has created a haven for funds whipsawed by inflation and the most aggressive rate increases in decades in major economies elsewhere.”

“…Offshore funds have resumed buying of yuan-denominated stocks since the lifting of the Shanghai lockdown last month, with green-energy stocks such as Tianqi Lithium and Longi among their picks, according to Stock Connect data.”

“…The reopening of Shanghai has allowed EV makers such as Tesla and Nio to catch up on production and deliveries.” South China Morning Post reports.

Biden’s Quest for Saudi Oil Faces Reality of Slim Capacity

Bloomberg

“Even if Joe Biden secures a pledge for more oil when he visits Saudi Arabia this week, it may do little to drive down the high fuel prices roiling the global economy.”

“The US president’s visit to a country he once vowed to isolate represents a significant thawing of relations, but the Saudis and their OPEC partners have limited spare production capacity to offer in return for this political concession. Some market watchers also question whether tapping this supply buffer would calm energy markets, or just make matters worse.”

“‘A surge in Saudi production seems unlikely,’ said Ben Cahill, senior fellow at the Center for Strategic and International Studies. ‘Saudi Arabia and OPEC+ have very limited spare capacity, and they have to manage it carefully.’”

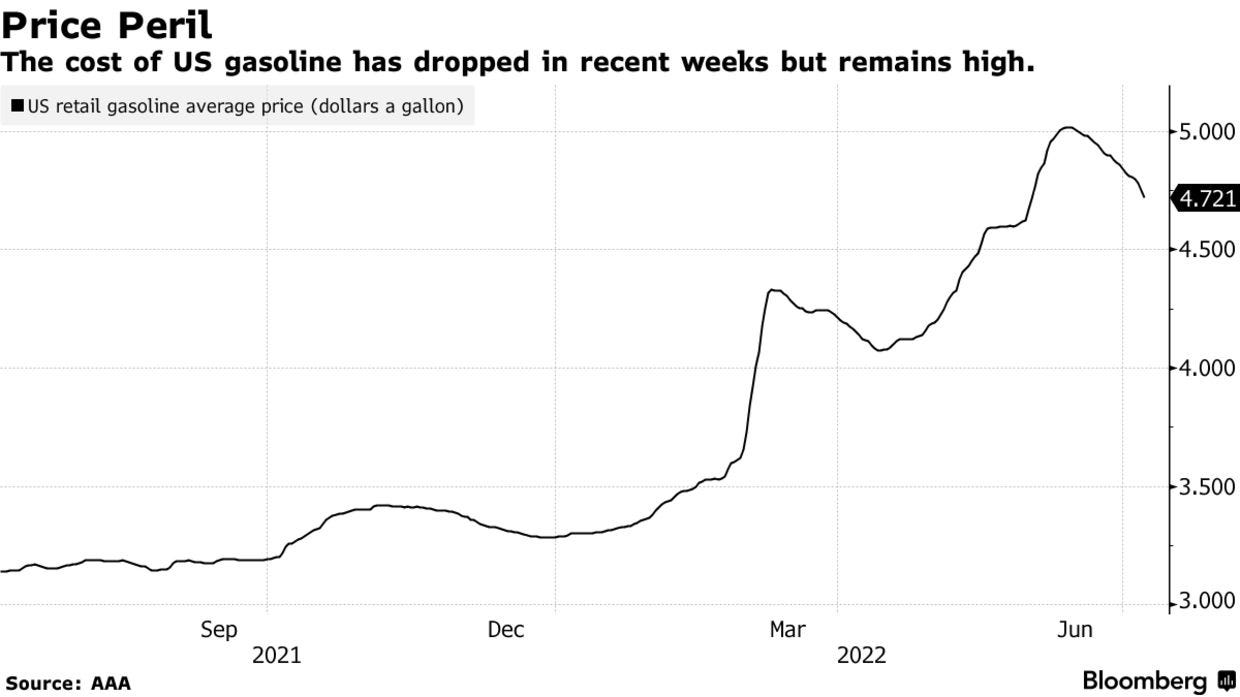

“Oil prices retreated last week, but remain above $100 a barrel. World crude production and refining output are still struggling to keep pace with the post-pandemic rebound in demand and the supply disruption resulting from sanctions on Russia over the invasion of Ukraine. The price of gasoline remains a source of political peril for a president heading to mid-term elections with approval ratings near 40%.” Grant Smith reports.

Sri Lanka Crisis Flashes Warning for Other Indebted Economies

Wall Street Journal

“Uncertainty over Sri Lanka’s leadership set in on Sunday as protesters continued to occupy the president’s residence a day after they stormed it, and President Gotabaya Rajapaksa’s whereabouts remained unknown.”

“The president hasn’t yet directly addressed an announcement by the speaker of the parliament that Mr. Rajapaksa would resign on Wednesday. His only communication since massive protests overran his official residence was a statement from his office ordering officials to expedite the distribution of a shipment of natural gas due to arrive Sunday.”

“Sri Lanka’s financial and political crisis, driven by the country’s mix of high indebtedness, soaring inflation and poor economic management, now stands as a cautionary tale for a number of other debt-laden countries who are now increasingly vulnerable to the recent confluence of food shortages, inflation and rising U.S. interest rates.”

“Countries such as Zambia and Lebanon are already in the grip of crises and are seeking international help to provide loans or restructure their debts, while Pakistan’s new government, which came to power in April, says that it narrowly averted a debt default in recent weeks, driven by a soaring fuel-import bill.”

“…Islamabad is seeking a bailout from the International Monetary Fund. The country removed a $600 million-a-month gasoline subsidy in June, to stabilize government finances and enable ongoing talks with the IMF. It has raised the price of gasoline and electricity repeatedly in the past few weeks, to keep pace with the international price of oil.”

“…The World Bank recently cut its forecast for growth in developing economies to 3.4% this year from 4.6% previously, citing the effects of spiraling prices for food and energy and rapidly rising borrowing costs following interest-rate increases in the U.S.” Philip Wen reports.

Tweet of the Day from our fellow traveler and the always insightful Ziad Daoud

More than 800 Million Faced Acute Hunger in 2021

The Nation (Nigeria)

“The number of people affected by hunger globally rose to as many as 828 million in 2021, according to the latest State of Food Security and Nutrition report.”

“This is an increase of about 46 million since 2020 and 150 million since the outbreak of the COVID-19 pandemic according to a United Nations report that provides fresh evidence that the world is moving further away from its goal of ending hunger, food insecurity and malnutrition in all its forms by 2030.”

“…The report was jointly published today by the Food and Agriculture Organization of the United Nations (FAO), the International Fund for Agricultural Development (IFAD), the United Nations Children’s Fund (UNICEF), the UN World Food Programme (WFP) and the World Health Organization (WHO).”

“After remaining relatively unchanged since 2015, the proportion of people affected by hunger jumped in 2020 and continued to rise in 2021, to 9.8 percent of the world population. This compares with 8 percent in 2019 and 9.3 percent in 2020.”

“Around 2.3 billion people in the world (29.3 percent) were moderately or severely food insecure in 2021 – 350 million more compared to before the outbreak of the COVID 19 pandemic. Nearly 924 million people (11.7 percent of the global population) faced food insecurity at severe levels, an increase of 207 million in two years.” The Nation reports.

“It is never too late to be what you might have been.” — George Eliot