Emerging Markets Monitor - July 12

Temasek Still Bullish on China, Global Energy Squeeze Tightening, Debt Defaults Haunt EM, Argentina and the IMF, Polls Turn Bleaker for Erdogan

The Top 5 Stories Shaping Emerging Markets from Global Media - July 12

Singapore’s Temasek Crosses S$400 Billion for First Time. Still Bullish on China

Business Times (Singapore)

“TEMASEK’S net portfolio value has increased to S$403 billion as at end-March 2022, crossing the S$400 billion ($284 Billion US) threshold for the first time, according to its portfolio performance numbers released on Tuesday (Jul 12).)”

“…In terms of geographic exposure, the bulk of Temasek’s portfolio remains in Asia, with Singapore accounting for the largest segment of its portfolio at 27 per cent.”

“…China ranked second, with 22 per cent of Temasek’s portfolio based there. This was a decline from 27 per cent and 29 per cent in 2021 and 2020 respectively, when it accounted for the largest share of the portfolio. The movement in the portfolio was mostly due to market price movements and not rebalancing.”

“‘We were a net investor in China last year,’ Sipahimalani said, adding that the country continues to be an important market for them. ‘It’s actually - over the last decade – been…the best-performing market for us even including the last year,’ he said.”

“Martin Fichtner, deputy head of technology & consumer at Temasek, said: ‘There are very compelling opportunities in China – the rise of software, the rise of automation, rise of deep tech – that provide us with attractive investment opportunities now and in the year to come.’” Raphael Lim reports.

Global Squeeze on Energy Supply Could Get Worse

The National/Bloomberg

“A global squeeze on energy supply that’s triggered crippling shortages and sent power and fuel prices surging may get worse, according to the head of the International Energy Agency.”

“‘The world has never witnessed such a major energy crisis in terms of its depth and its complexity,’ IEA executive director Fatih Birol said on Tuesday at a global energy forum in Sydney. ‘We might not have seen the worst of it yet - this is affecting the entire world.’”

“The whole energy system is in turmoil following the February invasion of Ukraine by Russia, at the time the biggest oil and natural gas exporter and a major player in commodities, Mr Birol said. The soaring prices are lifting the cost of filling gas tanks, heating homes and powering industry across the globe, adding to inflationary pressures and leading to deadly protests from Africa to Sri Lanka.”

“Like the oil crises of the 1970s, which saw huge gains in fuel efficiency and a boom in nuclear power, the world may see a jump in energy policies that speed the transition to cleaner energy, Mr Birol said. In the meantime, security of oil and gas supplies will continue to pose a challenge for Europe, and also for other regions, he said.”

“‘This winter in Europe will be very, very difficult,’ Mr Birol said. ‘This is a major concern, and this may have serious implications for the global economy.’”

“The fallout for the global energy sector as the US and allies challenge President Vladimir Putin over the war in Ukraine and seek alternatives to Russian exports have highlighted the need to reduce dependence on fossil fuels, US energy secretary Jennifer Granholm told the same forum.” The National reports.

More Debt Defaults Haunt Emerging Markets

Bloomberg

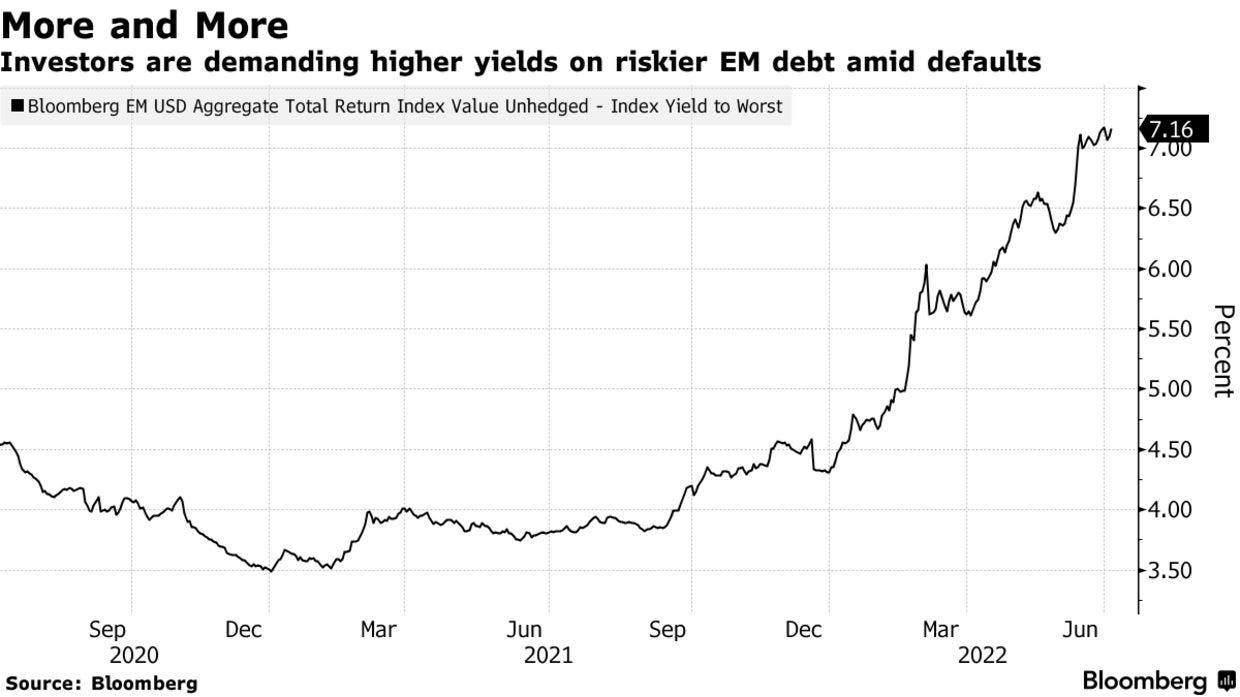

“More debt defaults are going to roll across emerging markets because countries can’t cope with the sudden increase in borrowing costs, according to Man Group, which runs one of the best-performing funds in the industry.”

“About 10% of dollar-denominated sovereign debt is at a high risk of default, said portfolio manager Lisa Chua in an interview with Bloomberg. Russia and Sri Lanka have already defaulted this year, and there’s now a record 19 developing countries with sovereign debt trading at distressed levels.”

“The number of nations with debt yields that indicate investors believe default is a real possibility has more than doubled in the past six months, according to data compiled from a Bloomberg index. At stake is $237 billion due to foreign bondholders, with the market’s focus on countries such as El Salvador, Ghana and Pakistan.”

“…Such concerns have already led investors to pull $48 billion from global emerging-market debt funds in the first half of 2022, according to Bank of America Corp. citing EPFR Global data. For the coming months, Chua is cautious, but sees opportunities to add higher-quality assets if default fears cause a broad selloff.” Selcuk Gogoluk reports.

Argentina New Finance Minister Pledges ‘Order and Balance’

Financial Times

“Silvina Batakis has spent her first week as Argentina’s finance minister pledging to stick to IMF commitments and restore ‘order and balance’, but those reassurances have failed to calm investors who fear another sovereign debt default amid galloping inflation and poor public finances.”

“Batakis was selected July 4 to replace Martin Guzmán, the country’s more pragmatic minister…The appointment of 53-year old Batakis, a relatively unknown career civil servant, triggered a week of market turmoil as investors braced for possible policy changes that would undermine efforts to stabilise the Argentine economy and keep the already fragile $44bn IMF deal on track.”

“Batakis used her first official press conference in Buenos Aires on Monday to provide a reassuring message, saying that Argentina is ‘not going to spend more than we have,’ and that as minister she was committed to the IMF programme agreed earlier this year.”

“…Kristalina Georgieva, the IMF’s managing director, said Batakis understood ‘the purpose of fiscal discipline,’ and described having had a ‘very good’ first call with the minister last week. Georgieva also stressed the ‘very complex’ economic outlook the country faces.”

“But with Argentina’s economy in distress, the task will be a formidable one. Inflation is forecast to exceed 75 per cent this year, according to a central bank survey. Poverty is high and climbing higher. Savers have rushed to convert their holdings into more stable currencies fearing the economy could get a lot worse before it gets better.”

“Purchases of cryptocurrencies have also shot up in signs that these digital assets are increasingly seen as a store of value amid the economic turmoil…The country’s sovereign bonds, already in distressed territory, have fallen to record lows. Two of the six dollar bonds that were restructured in 2020 fell below 20 cents on the dollar last week — levels that indicated a high probability of default.” Lucinda Elliott reports.

Polling Data Gets More Bleak for Erdogan

bne IntelliNews

“The opinion polling data continues to look bleak for Turkey’s President Recep Tayyip Erdogan, who must face the electorate by next June at the latest.”

“Some 80% of Turkey’s Generation Z—those born after 2000—say they will not vote for Erdogan’s ruling Justice and Development Party (AKP), according to a study by Gezici Research. By next June, Gen Z will represent 11.8% of Turkey’s voting adult population.”

“‘They do not approve of dictating, imperious or harsh language from politicians,’ Gezici Research chairman and international security expert Murat Gezici told Turkish daily Cumhuriyet on July 10.”

“Gezici also noted that an ‘overwhelming majority’ of young people said they would vote for the opposition’s Nation Alliance candidate if the presidential election went to a second round run-off. ‘Because they see the government as more oppressive and controlling,’ he added.”

“The main constituency that will determine the outcome of the elections—in which the parliamentary and presidential contests will be held in parallel—is Gen Y. The demographic is made up of people born between 1980 and 1999 and represents 32.6% of the Turkish electorate. Gezici said it has a higher percentage of undecided voters.”

“‘Those who remember the old Turkey, who are close centrist, but remain undecided will determine the fate of this election,’ Gezici said. Seventy percent of undecided voters were part of Gen Y, with most of them women, he added.” bne IntelliNews reports.

“Oh threats of Hell and Hopes of Paradise!

One thing at least is certain - This Life flies;

One thing is certain and the rest is Lies -

The Flower that once has blown forever dies.”

― Omar Khayyam, Rubáiyát of Omar Khayyám