Emerging Markets Monitor - July 21

ECB Raises Rates, Russia Resumes Nordstream Gas, ADB Lowers China Growth Forecast, Moody's Bullish on Saudi Arabia, Turkey Clings to Low Real Rates

The Top 5 Stories Shaping Emerging Markets from Global Media - July 21

ECB Raises Rates for First Time in More than a Decade

Financial Times

“The European Central Bank has raised interest rates by half a percentage point — its first increase for more than a decade — while pledging to prevent rising borrowing costs from sparking a eurozone debt crisis amid political turmoil in Italy.”

“The central bank increased interest rates by twice as much as it said it would only last month, ending eight years of negative rates by raising its deposit rate to zero. Christine Lagarde, ECB president, said on Thursday afternoon it was ‘time to deliver’ after eurozone inflation hit a fresh record high of 8.6 per cent in the year to June, more than four times the central bank’s target of 2 per cent.”

“Policymakers simultaneously agreed a new bond-buying programme aimed at countering a disorderly surge in the cost of borrowing for the region’s more vulnerable governments. ‘The ECB is capable of going big,’ Lagarde said, later adding: ‘We would rather not use [the new programme], but if we have to use it, we will not hesitate.’”

“…The ECB decision came hours after Mario Draghi resigned as Italy’s prime minister. His planned exit is expected to trigger early elections this year. Krishna Guha, head of policy and central bank strategy at US investment bank Evercore, said before Thursday’s decision: ‘The combination of a brewing giant stagflationary shock from weaponised Russian natural gas and a political crisis in Italy is about as close to a perfect storm as can be imagined for the ECB.’” The FT reports.

Russia Resumes Nordstream Natural Gas Supply to Europe

Wall Street Journal

“Russian natural gas began flowing again at a reduced volume through a critical pipeline into Europe on Thursday, buying time for governments to decouple from the Kremlin’s exports amid what they expect will be an increasingly unreliable supply of energy from Moscow heading into the winter.”

“The Nord Stream pipeline connecting Russia with Germany under the Baltic Sea resumed operation after its annual maintenance, ending 10 days of tense speculation about whether President Vladimir Putin’s regime would cut off the gas flow to Europe in retaliation for Western sanctions after his invasion of Ukraine.”

“Gas-flow data showed the pipeline was operating at its premaintenance level of around 40% of total capacity. The pipeline has been operating below capacity since Russia began throttling supplies in June, invoking technical issues related to Western sanctions against Russia.”

“Annalena Baerbock, Germany’s foreign minister, said Mr. Putin was using Germany’s dependence on Russian energy as a weapon in his hybrid warfare.” Wall Street Journal reports.

ADB Lowers China Growth Forecast by a Full Percentage Point

CNBC

“The Asian Development Bank has cut its growth forecast for China due to concerns over the country’s zero-Covid approach and strict lockdowns, which put even more pressure on the real estate sector.”

“Gross domestic product growth for the world’s second largest economy is expected to be at 4% in 2022, down from an earlier estimate of 5%, ADB said in a report published Thursday.”

“China’s continued ‘adherence to a zero-covid strategy in response to renewed outbreaks early in 2022 has triggered the reimposition of strict lockdowns,’ the bank said in its report.”

“..In addition to lockdown-induced weakness in household consumption, a further burden on China’s economy ‘is that the housing market has not stabilized,’ ADB said in the report. Household demand has been hit by recent Covid-19 outbreaks, which has placed further stress on the property market, it noted.” Sumathi Bala reports.

Saudi Economy To See 3.9% Growth for Next Four Years: Moody’s

Arab News

“Saudi Arabia’s economy is forecast to grow at an average rate of 3.9 percent between 2022 to 2026, according to credit rating agency Moody’s Investors Service.”

“In its annual credit analysis, Moody’s affirmed Saudi Arabia’s rating at ‘A1’ with a stable outlook, primarily driven by its robust government balance sheet, underpinned by moderate debt levels and substantial fiscal reserve buffers.”

“The report noted the large stock of proven hydrocarbon reserves with low extraction costs combined with a regulated financial system is also supporting the Kingdom’s sovereign credit profile.”

“Some of the challenges faced by Saudi Arabia include its high economic and fiscal exposure to declines in global oil demand and prices, longer-term risks stemming from the global carbon transition and challenges posed by elevated unemployment, the report further added.”

“Even though the Kingdom’s growth trend and growth volatility both stand below the top tier As-A rated median, it still managed to rank higher than neighboring countries like Qatar and Kuwait.”

“The country’s national income, measured by Gross Domestic Product per capita in purchasing power terms, totaled $49,387 in 2021 according to International Monetary Fund estimates.” Arab News reports.

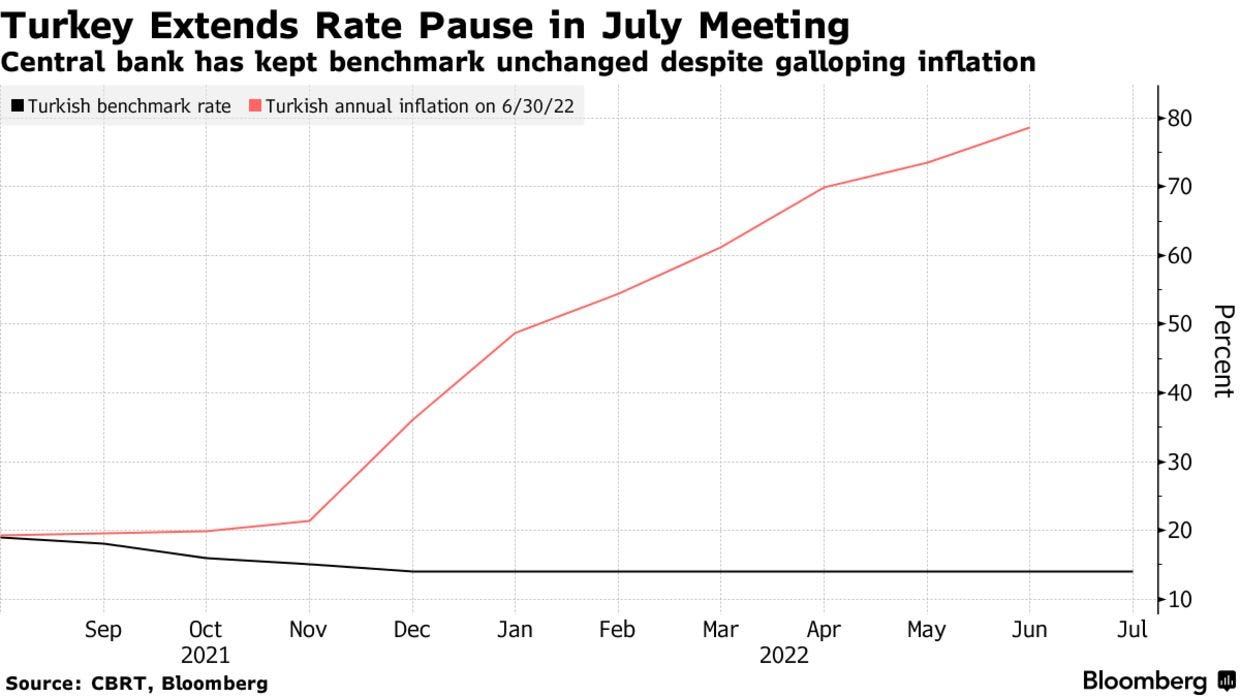

Turkey Clings to World’s Most Negative Real Interest Rates

Bloomberg

“Turkey’s central bank left interest rates unchanged for a seventh month in anticipation that its fringe measures will be enough to reverse a steep decline in the lira and hold back spiraling prices.”

“The Monetary Policy Committee led by Governor Sahap Kavcioglu kept its benchmark at 14% on Thursday, as forecast by all but one analyst surveyed by Bloomberg. Turkey’s borrowing costs are the world’s most negative when adjusted for prices.”

“In a statement, the central bank said its macroprudential policies will be strengthened if needed, citing an already visible decline in credit growth. ‘The Committee expects disinflation process to start on the back of measures taken,’ it said.”

“Turkey is defying a global trend toward more aggressive monetary tightening to get a grip on inflation. Instead, it’s counting on macroprudential and collateral measures such as increases in risk weights and a doubling of reserve requirements at banks for lira-denominated loans to subdue credit.”

“Rate hikes aren’t on the agenda in large part because of President Recep Tayyip Erdogan. A staunch advocate of the unconventional belief that lower rates will curb inflation, he’s fired three governors in the past four years for not toeing the line.” Bloomberg reports.

"Most people are not really free. They are confined by the niche in the world that they carve out for themselves. They limit themselves to fewer possibilities by the narrowness of their vision."

— V.S. Naipaul