Emerging Markets Monitor - July 26

India: The 'Dream Emerging Market'?, Global Economy Slows: IMF, Black Sea Shipping Threats, Qatar Fund Eyes Stake in Ambani Retail, China Stocks Set for Bounce

The Top 5 Stories Shaping Emerging Markets from Global Media - July 26

Why India is the ‘Dream Emerging Market’

ETF.com

“The perfect emerging market doesn’t exist—well actually, maybe it does.”

“In last week’s Exchange Traded Fridays podcast, Kevin Carter, founder and chief investment officer of EMQQ Global, said India is shaping up to be ‘the dream emerging market’ thanks to its massive population—the world’s largest—and several other supportive factors.”

“And according to Carter, India’s population lead is only going to widen further because most of the country’s inhabitants are so young. Of the country’s 1.4 billion people, 600 million are in Generation Z, he noted.”

“But a big population isn’t the only thing going for India. The country is seeing an accelerated digital shift that should power the economy for years to come.”

“India has ‘the fastest growing e-commerce market,’ even though it ‘still only has 50% smartphone penetration,’ Carter said, while adding that that number will quickly increase in the coming years.”

“In his eyes, India is doing what China has already done: becoming a digital-first economy. But this isn’t happening by accident. Carter mentioned India’s growth is the result of a strong foundation now in place.”

“It includes a giant population of talented tech workers and the ecosystem that surrounds them; a powerful prime minister that is ‘getting stuff done in a way India has never seen;’ and a cutting-edge digital public infrastructure that’s provided India with robust identity and payments capabilities.”

“These series of government initiatives ‘were put in place a long time ago’ and are now ‘starting to show incredible power,’ Carter explained.” Sumit Roy reports.

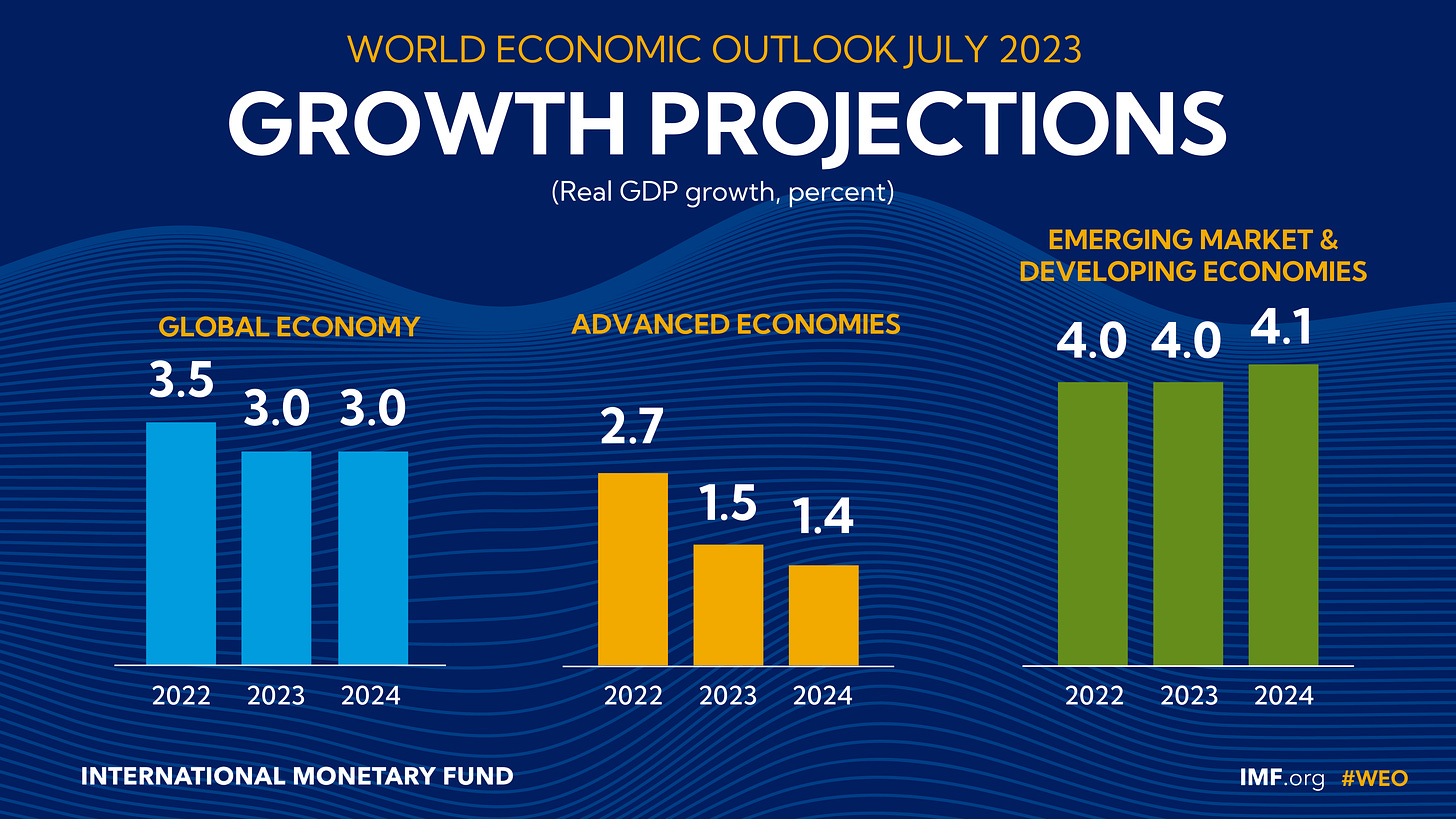

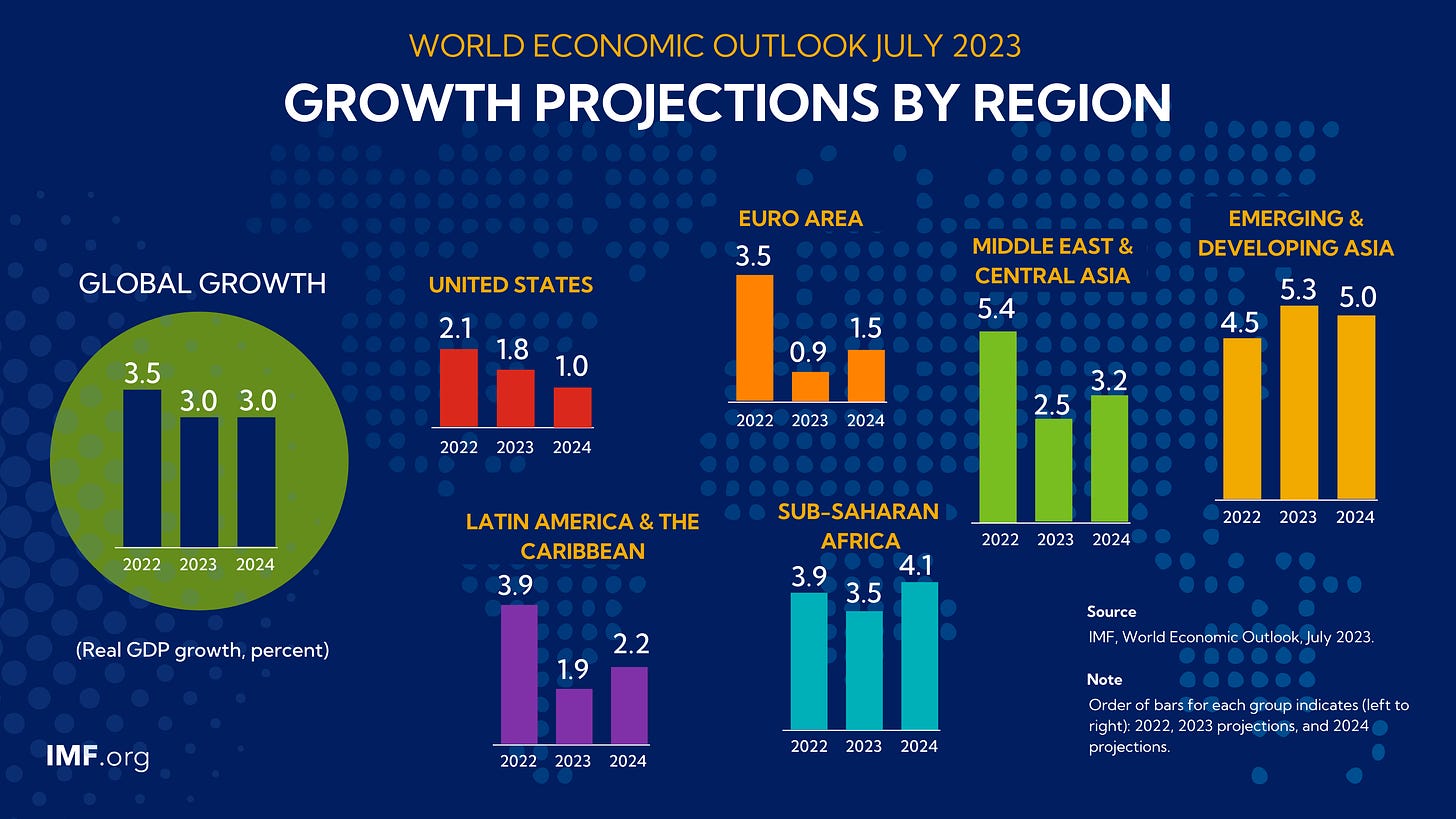

Global Economy Slows Amid Widening Divergences in Sectors and Regions

IMF World Economic Outlook

“Global growth is projected to fall from an estimated 3.5 percent in 2022 to 3.0 percent in both 2023 and 2024. While the forecast for 2023 is modestly higher than predicted in the April 2023 World Economic Outlook (WEO), it remains weak by historical standards. The rise in central bank policy rates to fight inflation continues to weigh on economic activity. Global headline inflation is expected to fall from 8.7 percent in 2022 to 6.8 percent in 2023 and 5.2 percent in 2024. Underlying (core) inflation is projected to decline more gradually, and forecasts for inflation in 2024 have been revised upward.”

“The recent resolution of the US debt ceiling standoff and, earlier this year, strong action by authorities to contain turbulence in US and Swiss banking reduced the immediate risks of financial sector turmoil. This moderated adverse risks to the outlook.”

“However, the balance of risks to global growth remains tilted to the downside. Inflation could remain high and even rise if further shocks occur, including those from an intensification of the war in Ukraine and extreme weather-related events, triggering more restrictive monetary policy.”

“Financial sector turbulence could resume as markets adjust to further policy tightening by central banks. China’s recovery could slow, in part as a result of unresolved real estate problems, with negative cross-border spillovers. Sovereign debt distress could spread to a wider group of economies.”

“On the upside, inflation could fall faster than expected, reducing the need for tight monetary policy, and domestic demand could again prove more resilient.”

“In most economies, the priority remains achieving sustained disinflation while ensuring financial stability…Improvements to the supply side of the economy would facilitate fiscal consolidation and a smoother decline of inflation toward target levels.” IMF WEO writes. For a transcript and video of the press conference, see here.

Russia’s Threats to Shipping Bring War to Black Sea, Imperiling Food Security

Wall Street Journal

“Moscow’s withdrawal from an international grain export agreement this week has pushed Russia and Ukraine to the brink of a new phase in their war, threatening Black Sea shipping lanes that supply much of the world’s food.”

“Russia backed out of the grain agreement Monday, reimposing a de facto blockade of Ukraine’s largest ports. Russian forces also launched waves of missile and drone strikes on Ukraine’s ports and grain export infrastructure this week, destroying more than 60,000 tons of grain.”

“Russia threatened on Wednesday to attack any civilian ships heading to Ukraine, saying it would regard any such ships as potentially carrying military supplies. The warning also banned cargo ships from entering certain areas in international waters in the Black Sea.”

“Ukraine responded with its own warning, saying that all ships heading to Russia and areas of Russian-occupied Ukraine would be considered to be carrying military cargo ‘with all the associated risks.’”

“Russia and Ukraine now risk a widening of the war that could have major consequences for global food security. Russia and Ukraine together accounted for 28% of the world’s exported wheat before the war, with much of it shipped via the Black Sea. The shutdown of Ukraine’s Black Sea exports this week has raised fears of a repeat of a global surge in food prices that resulted from the Russian invasion of Ukraine last year.”

“Russia’s blockade of Ukraine and threats to civilian ships have also thrust the Black Sea into the heart of a broader contest for power in the region, intensifying Moscow’s efforts to impose its dominance over the waterway, military analysts say. The Kremlin’s freezing of the grain deal poses a challenge for neighboring Turkey and its president, Recep Tayyip Erdogan, who helped broker the agreement in the first place, and put pressure on Washington and the North Atlantic Treaty Organization to respond. Jared Malsin reports.

Qatar Sovereign Fund Seeks Stake in Ambani Retail Arm

Financial Times

“Qatar’s sovereign wealth fund is in talks to buy a stake in billionaire Mukesh Ambani’s retail unit, as oil-rich Gulf funds increase their bets on the fast-growing Indian market.”

“The Qatar Investment Authority (QIA) is considering a minority stake in Reliance Retail Ventures, according to three people with knowledge of the discussions. One of them said the fund is considering a $1bn investment giving it a stake of about 1 per cent and valuing the business at around $100bn.”

“The people, who asked not to be named as the deal is private, said the agreement has yet to be finalised and is subject to change. One person said the $450bn Qatari sovereign wealth fund had not yet approved it.”

“The talks come as Reliance Retail is spending heavily to expand its consumer businesses. India’s biggest shopping group by revenues, spanning luxury fashion to groceries, is a subsidiary of Ambani’s oil-to-data conglomerate Reliance Industries, India’s biggest company with a market capitalisation of $205bn.”

“Ambani’s daughter Isha leads the retail business as the tycoon grooms his three children to succeed him. She has overseen a blitz of brand acquisitions — recently a chocolate company — as Reliance builds out its retail offerings.”

“Saudi Arabia’s Public Investment Fund invested $1.3bn for a 2.04 per cent stake in Reliance Retail Ventures in 2020, in a deal that valued the company then at about $62.4bn. Other shareholders include New York-based private equity firm KKR and two Abu Dhabi sovereign investment funds.”

“Analysts at AllianceBernstein estimated in May that Reliance Retail was worth as much as $131bn, a valuation that would give QIA a 0.7 per cent stake for a $1bn investment. But other analysts say the retail unit’s value is much lower: Ambit Capital recently estimated it at $57bn, and JM Financial at $100bn.”

“The QIA is mirroring other Gulf sovereign wealth funds in looking to increase its investments in Asia, including in India. Last year, it pledged to invest up to $1.5bn in James Murdoch’s new media and education venture in India, Bodhi Tree. It has also invested in Indian start-ups Rebel Foods and Swiggy, an online food delivery platform.” The FT reports.

China Stocks Set to Bounce Back, UBS and China Asset Management Say

South China Morning Post

“China’s stocks are likely to bounce back in the second half of the year as supportive government measures boost earnings growth and as valuations dented by economic pessimism bottom out, according to UBS Group and China Asset Management.”

“A recovery in corporate earnings may drive an average 10 per cent gain in Chinese stocks by the end of the year, UBS said. Battered valuations, an easing of geopolitical tensions and a predicted end to US interest-rate rises provide fertile ground for an uptick in equities, according to the Hong Kong unit of China Asset Management that oversees 1.23 trillion yuan (US$171.9 billion) of assets.”

“‘The market is probably overly pessimistic and most of the slowdown in growth has now been priced into stocks,’ said Meng Lei, a Shanghai-based strategist at UBS, during an online briefing on Tuesday. ‘Actually, excessive pessimism offers investors a very good opportunity for positioning.’”

“Both China and Hong Kong stocks are off to a good start in the second half, with the CSI 300 rising 1.7 per cent and the Hang Seng gaining 2.4 per cent since the end of June.” Zhang Shidong reports.

“Only those who will risk going too far can possibly find out how far one can go.” - T.S Eliot