Emerging Markets Monitor - July 28

Investors Flock to Non-China EM Stocks, Top EM Fund Bets Big on AI, Turkey CB Goes Mainstream, Geopolitics: Top WH Officials in Saudi, Oil Prices in 5th Week of Gains

The Top 5 Stories Shaping Emerging Markets from Global Media - July 28

Investors Dumping China Load Up on Other Emerging Markets

Reuters

“Global investors are increasingly choosing to bypass China's markets in favour of other emerging countries that are either gaining from the geopolitical and growth risks stalking the world's second-biggest economy or are far removed from them.”

“Reuters analysis shows a massive jump in the assets of emerging market (EM) mutual funds and exchange traded funds (ETFs) that exclude China as U.S. and European investors turn more wary of being exposed to the Asian giant.”

“Investor aversion to China has intensified this year following a faltering post-COVID economic rebound, disappointment over the absence of robust policy response and renewed Sino-U.S. tensions over trade, tech and geopolitics.”

“Some of the money is being diverted into markets directly benefiting from China's economic pain, such as Mexico, India, Vietnam and other locations that are replacing it across global manufacturing supply chains. Other investors are simply moving to markets with better growth prospects, such as Brazil.”

"‘China’s export dominance is ebbing, creating opportunities for other emerging market countries to fill the gap, including Mexico, India, and Southeast Asian nations,’ said Malcolm Dorson, a New York-based senior portfolio manager at ETF manager Global X.”

“‘The scale of change needed in global supply chains could drive such capital flows for the next decade,’ he said. Refinitiv data shows China-focused mutual funds suffered a net outflow of $674 million in the second quarter of this year, while, in contrast, nearly $1 billion went into EM ex-China mutual funds.” Reuters reports.

Top EM Fund Beating 96% of Peers is Betting on AI Stocks

Bloomberg

“A top-performing fund focused on developing economies is betting on artificial intelligence-related stocks while steering clear of Chinese equities in a bid to maintain its double-digit returns.”

“Northcape Capital Global Emerging Markets Fund has loaded up on shares of telecommunications and IT servicing firms which are seen as prime beneficiaries of the global shift to AI technology. Tata Consultancy Services Ltd., America Movil SAB de C.V. and PT Telkom Indonesia Persero Tbk are among stocks that are set to gain, according to the fund’s founding portfolio manager Patrick Russel.”

“Businesses are ‘going to need IT outsourcing companies to assist with the integration of AI applications,’ Melbourne-based Russel said in an interview. Greater demand for faster connectivity and bandwidth will increase demand for data storage, which would boost telecoms, cloud services and other related services, he added.”

“A bullish consensus has formed around AI stocks, with the likes of BlackRock Inc. and Morgan Stanley touting their merits as industries ranging from healthcare to auto and banking embrace the technology. But caution is also creeping in as some analysts question if stock valuations have become unsustainable. The Federal Reserve’s plan to increase interest rates again this week may also add to that worry.”

“The A$5.5 billion ($3.7 billion) Northcape fund has gained 14% so far this year to beat 96% of its peers, according to data compiled by Bloomberg. Indian and Mexican stocks account for almost half of its portfolio and the vehicle also holds shares of Samsung Electronics Co. and Taiwan Semiconductor Manufacturing Co., according to Russel.” Georgina McKay reports.

Turkey Shakes Up Central Bank in Shift to Mainstream Approach

Financial Times

”Turkish president Recep Tayyip Erdoğan has shaken up the central bank’s policy-setting board with the appointment of three new deputy governors, including a former New York Federal Reserve official, as part of a shift to a more mainstream economic approach.”

“The move comes a day after central bank governor Hafize Gaye Erkan, a former Wall Street banker who was appointed in June, acknowledged that Turkey’s economy was overheating and that inflation would probably reach almost 60 per cent by year-end, from 38 per cent last month.”

“Erdoğan has overhauled the country’s economic management following his re-election in May after years of unorthodox policies. These included a huge pre-election spending spree that is blamed for stoking runaway inflation, depleting the country’s foreign policy war chest and threatening to set off a balance of payments crisis.”

“Erkan has more than doubled interest rates during her two months in charge of the central bank. New finance minster Mehmet Şimşek, a former Merrill Lynch bond strategist, has also allowed the lira to depreciate sharply against the dollar by easing up on a costly defence of the currency. He has also boosted taxes to cool consumer spending and refill government coffers.”

“…The changes mark a change in direction from previous years, when Erdoğan had insisted on sharp rate cuts despite scorching inflation. Investors have generally reacted positively to the economic changes since Erdoğan extended his grip on Turkey to a third decade.”

“The price to protect against a default on Turkish debt using five-year credit default swaps, a key barometer of perceived market risks, is at its lowest level since late 2021, according to Refinitiv data. At the same time, foreign investors have pumped $1.6bn into Turkey’s equity market since June 9, central bank data shows.” Adam Samson reports.

Geopolitics: Top White House Officials in Saudi Arabia Amid ‘Grand Bargain’ Talk

Al-Monitor

“US President Joe Biden’s National Security Adviser Jake Sullivan, his top deputy on Middle East policy Brett McGurk, and senior adviser for energy and infrastructure Amos Hochstein met Saudi Crown Prince Mohammed bin Salman in Riyadh on Thursday to advance efforts aimed at establishing formal ties between the kingdom and Israel.”

“The visit was first reported by the New York Times and later confirmed by the White House and the Saudi government. Riyadh said the meeting was also attended by Energy Minister Prince Salman bin Abd al-Aziz, Defense Minister Khalid bin Salman, the governor of the Public Investment Fund, Yasir al-Rumayyan, and Saudi National Security Adviser Musaid al-Aiban. Saudi Ambassador to the United States Princess Reema bint Bandar and US Ambassador to Saudi Arabia Michael Ratney also attended.”

“A National Security Council spokesperson said in a statement that normalization with Israel was discussed — alongside other issues. ‘We continue to support normalization with Israel, including with Saudi Arabia, and obviously continue to talk to our regional partners about how more progress can be made. It’s one effort we are pursuing toward advancing US foreign policy goals for a more peaceful, secure, prosperous and stable Middle East region,’ the spokesperson said.”

“In exchange for what would be a historic decision to normalize relations with Israel, the Saudis are reportedly asking Washington to provide a NATO-style mutual defense agreement with the the kingdom, along with help developing a civilian nuclear program, in addition to advanced weapons systems such as THAAD (Terminal High Altitude Area Defense) ballistic missile defense batteries.”

“The demands aim to fulfill the crown prince’s goals for energy diversification while bolstering the kingdom’s defenses against regional rival Iran. Biden has not yet decided whether to approve the requests, the president told the New York Times — but it’s not certain he has the power to grant them.”

“Any mutual defense pact akin to what US maintains with its closest Western allies would require approval by Congress, and despite bipartisan support for an Israeli-Saudi normalization deal, intense skepticism remains among powerful senators on both sides of the aisle over any entangling alliances with the Gulf kingdom.” Al-Monitor reports.

Oil on Track for Fifth Week of Gains

Hellenic Shipping News

“Oil prices were steady on Friday, but on track for a fifth straight week of gains with investors optimistic healthy demand and supply cuts will keep prices buoyant. Risk appetite in wider financial markets has been fuelled by growing expectations that central banks such as the Fed and European Central Bank are nearing the end of policy tightening campaigns, boosting the outlook for global growth and energy demand.”

“Bolstered by supply cuts from the OPEC+ alliance announced earlier this month, both oil benchmarks are on track for a 3.6% weekly increase – a fifth straight week of gains…Bullish demand expectations were boosted on Thursday after U.S. second quarter gross domestic product grew at a forecast-beating 2.4%, supporting Federal Reserve Chairman Jerome Powell’s view that the economy can achieve a so-called ‘soft landing.’”

“Investors are warming up to the idea of peak rates getting ever closer, while it is looking increasingly probable that the United States will avoid recession, said PVM analyst Tamas Varga.”

“…In a broadcast interview on Friday, Exxon Mobil (NYSE:XOM) chief Darren Woods said he expected record oil demand this year and next.”

“On the supply side, evidence of tightening is mounting, given declining US inventories and Saudi Arabia’s voluntary cut of 1 million barrels per day, Commerzbank analysts said, highlighting this month could have seen OPEC oil production plunge to its lowest level since the autumn of 2021.”

“The soul which has no fixed purpose in life is lost; to be everywhere, is to be nowhere.” - Michel de Montaigne

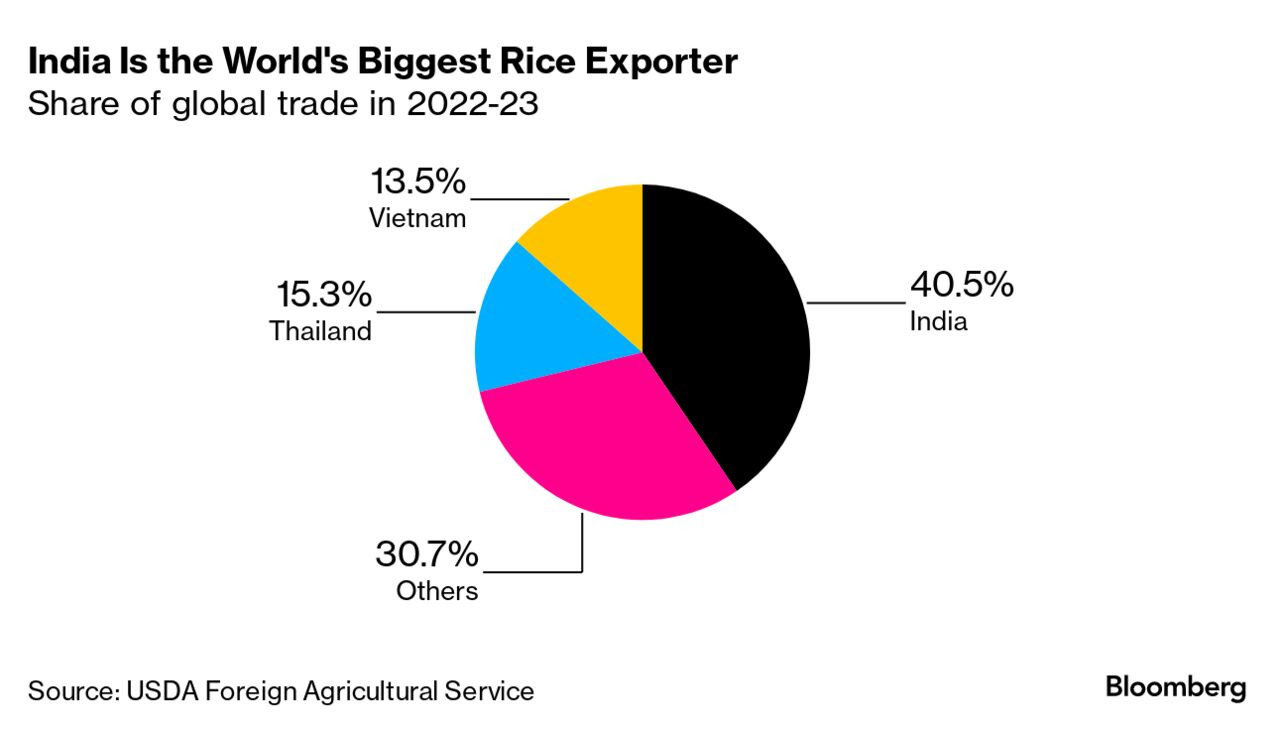

Infographic: Rice Supplies Growing Scarce (via Bloomberg)

“Concerns are growing over supplies of rice, the food staple that almost half of the global population relies on. Top exporter India banned a hefty chunk of its exports last week, sending prices in Asia to the highest level in more than three years. It’s expected that costs are set to surge even further.”

“India’s latest move, plus an earlier curb on broken rice, affects 30% to 40% of the nation’s total shipments, and restrictions could widen to other categories in the event of uneven rainfall and rising domestic inflation.”

Great read - thanks for sharing!