Emerging Markets Monitor - July 8

Asia Stocks Extend Global Rally, Defaults Looming Across EM, Former Japan PM Assassinated, Copper Slides on Recession Fears, Global Trade Robust in 1Q

The Top 5 Stories Shaping Emerging Markets from Global Media - July 8

Asia Stocks Extend Global Rally as Recession Fears Ease

Business Times (Singapore)

“ASIAN markets rose on Friday on easing recession fears, while there were growing hopes that Joe Biden will remove some Trump-era tariffs from Chinese goods.”

“Buying was also boosted by reports that Beijing was considering a huge stimulus shot to the struggling economy by allowing local governments to raise billions of dollars through bond issuance for infrastructure projects.”

“However, surging inflation, rising interest rates and a fresh flare-up of Covid infections in Shanghai continued to keep investor sentiment grounded.”

“Traders were handed a strong lead from Wall Street, where all three main indexes climbed for a fourth straight day, helped by two top Federal Reserve officials who said the economy could withstand sharper rate hikes and maintain growth.”

“There has been growing talk that the fast pace of monetary tightening by the bank will tip the world’s top economy into recession. But Christopher Waller, a member of the board of governors, said worries were overblown and that a strong jobs market would provide a buffer, adding that rates needed to go up sharply and quickly.” Business Times reports.

Historic Cascade of Defaults is Coming For Emerging Markets

Bloomberg

“A quarter-trillion dollar pile of distressed debt is threatening to drag the developing world into a historic cascade of defaults.”

“Sri Lanka was the first nation to stop paying its foreign bondholders this year, burdened by unwieldy food and fuel costs that stoked protests and political chaos. Russia followed in June after getting caught in a web of sanctions.”

“Now, focus is turning to El Salvador, Ghana, Egypt, Tunisia and Pakistan — nations that Bloomberg Economics sees as vulnerable to default. As the cost to insure emerging-market debt from non-payment surges to the highest since Russia invaded Ukraine, concern is also coming from the likes of World Bank Chief Economist Carmen Reinhart and long-term emerging market debt specialists such as former Elliott Management portfolio manager Jay Newman.”

“‘With the low-income countries, debt risks and debt crises are not hypothetical,’ Reinhart said on Bloomberg Television. ‘We’re pretty much already there.’”

“The number of emerging markets with sovereign debt that trades at distressed levels — yields that indicate investors believe default is a real possibility — has more than doubled in the past six months, according to data compiled from a Bloomberg index. Collectively, those 19 nations are home to more than 900 million people, and some — such as Sri Lanka and Lebanon — are already in default.” Sydney Maki reports.

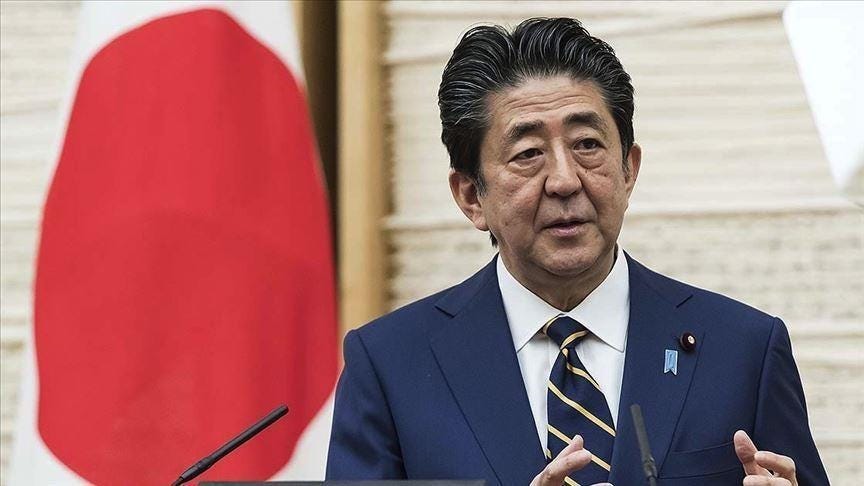

Former Japan PM Shinzo Abe Assassinated in Shock to Nation

Financial Times

”Shinzo Abe, Japan’s longest-serving former prime minister, has died after being shot during a campaign speech in one of the most significant acts of political violence to rock the country in the postwar era.”

“Abe, aged 67, was confirmed dead shortly after 5pm local time, according to the hospital where he was brought. The fire department said he was shot twice in the neck and left collarbone at around 11.30am on Friday in the western city of Nara.”

“The shooting of one of the most influential modern leaders in Japan, a society where violence is rare and only a handful of people own guns, has shocked the country’s public and leaders around the world. ‘I am at a loss of words. This heinous act of brutality is utterly unforgivable,’ a tearful Fumio Kishida, Japan’s current prime minister, said after Abe’s death was confirmed.”

“He added that the final day of campaigning for elections to Japan’s upper house on Sunday will be carried out as scheduled ‘to protect free and fair elections’.” The FT reports.

Copper Slide Signals Mounting Recession Concern

Wall Street Journal

“Copper prices have fallen to their lowest level in nearly two years, with investor concerns about an economic slowdown intensifying.”

“The most actively traded copper futures contract finished Wednesday at $3.408 a pound, its lowest settlement since November 2020. That has copper, used in everything from construction to electronics, on pace to decline for five consecutive weeks.”

“Behind the fall is concern about slowing demand as the Federal Reserve raises interest rates and as China, a leading user of the metal, has a sluggish recovery from Covid-19 lockdowns. Copper, which is particularly sensitive to expectations for the world-wide industrial outlook, is sometimes called Dr. Copper because of its use as a gauge of economic health.”

“Many investors have unwound bets on copper. Hedge funds and speculators have turned net-bearish, with more wagers on falling copper prices than on gains. That has pushed net positioning to its lowest levels in more than two years, according to Commodity Futures Trading Commission data tracking futures and options through the week ended June 28.”

“Copper hit record highs earlier this year partly because of supply concern related to the war in Ukraine and sanctions on Russia, a metals producer. Rising recession fears have lately weighed on stocks, bonds and commodities. ‘We don’t anticipate base metals’—copper’s included—outlook to improve until we see a change in Chinese demand,’ said Darwei Kung, head of commodities and portfolio manager at DWS Group, an asset-management firm.”

“…While Zhiwei Ren, portfolio manager at Penn Mutual Asset Management, forecasts a recession in the next six to nine months, he said he thinks the transition to an economy less dependent on fossil fuels will lead to commodity gains in the future. He plans to buy the stock of mining companies. ‘Longer term, I’m very bullish on commodities,’ Mr. Ren said.” Hardika Singh reports.

Global Trade Hits Record $7.7 Trillion in 1Q: UNCTAD

The National

“The value of global trade rose by almost 15 per cent to a record $7.7 trillion in the first quarter of 2022, an increase of about $1tn compared with the same period last year, according to the UN Conference on Trade and Development (Unctad).”

“The trade value was about $250 million more than the fourth quarter of 2021, the UN body said in its 'Global Trade Update' report on Thursday.”

‘Trade in both goods and services surged in the January to March period. Trade in goods reached nearly $6.1tn, an annual rise of about 25 per cent, while trade in services soared about 22 per cent yearly to $1.6tn. Trade growth is expected ‘to remain positive but continues to slow during the second quarter’, Unctad said.”

“In the first quarter, trade in goods was significantly above the 2021 levels in both developing and developed countries. Exports from developing and developed countries were about 25 per cent and 14 per cent higher year-on-year, respectively, in the three-month period.”

“Trade between developing countries was about 23 per cent higher in the first quarter compared with the same period in 2021, and about 42 higher than the pre-Covid-19 pandemic levels.”

“‘The war in Ukraine is starting to influence international trade, largely through increases in prices,’ the report said. Economic growth forecasts for 2022 are being revised downwards due to rising interest rates, inflationary pressures in several economies and negative global economic spillovers from the conflict in Ukraine. It is likely that global trade will reflect these macroeconomic trends, with a decrease in trade growth, according to Unctad.”

“…In April, the International Monetary Fund lowered its 2022 global growth forecast to 3.6 per cent, down from its previous estimate of 4.4 per cent in January.”

“Last month, the World Bank slashed its growth forecast for the global economy for the second time this year as the Ukraine war, now in its fifth month, exacerbates the slowdown from the pandemic.”

“The Washington-based lender lowered its growth estimate for 2022 to 2.9 per cent, from the 3.2 per cent projection it issued in April.”

“In the first quarter, the value of global trade was about 30 per cent higher than the pre-pandemic levels of 2019. However, trade volumes increased to a much lower extent (about 6 per cent). The divergence between values and volumes is due to rising commodity prices, especially for energy products and general inflation, Unctad said.” Alkesh Sharma reports.

"Be yourself; everyone else is already taken." — Oscar Wilde

This story also caught our eye: LNG shortages in emerging markets.

The downstream effects of Russia’s war on Ukraine has included everything from supply chain disruptions to grain shortages to rising food prices and more. A Wall Street Journal piece also pointed out another casualty: LNG shortages for developing countries.

As Europe scrambles to diversify away from Russian sources of natural gas, they are buying up vast amounts of the available liquid natural gas (LNG) on the market. In some cases, LNG tankers headed for Asia are diverted mid-route to Europe, where they can command a higher price.

Europe Scoops Up LNG, Choking Power Supplies in Poorer Nations

From the WSJ:

A tender from Pakistan for around $1 billion of liquefied natural gas attracted no offers Thursday , Pakistani officials said. Each day, businesses and homes are suffering hours of government-imposed electricity shutdowns because the country can’t import enough natural gas to fuel power plants.

The price of LNG, which can be moved by ship around the world, has rocketed 1900% from the bottom hit two years ago amid suppressed demand during the Covid-19 pandemic. Current prices are the equivalent of buying oil at $230 a barrel, more than double the current price of oil. LNG normally trades at a discount to oil.

And here’s the money quote that encapsulates the crisis in the developing world

“Because of the Ukraine war, every single molecule that was available in our region has been purchased by Europe, because they’re trying to reduce their dependence on Russia,” said Pakistan’s Petroleum Minister, Musadik Malik.

You can read the whole story here.