Emerging Markets Monitor - June 14

Chinese Companies Face US De-Listing, The Indian Equity Rout, Inflation Hits Asia Bonds, Shifting Global Economy (Visualization), Abu Dhabi Bourse Sees More Growth

The Top 5 Stories Shaping Emerging Markets from Global Media - June 14

Nearly 150 US-traded Chinese Companies at Risk of De-Listing by 2023

Nikkei Asia

“A total of 150 mostly China-based companies face possible delisting from the U.S. stock market over auditing rules, and American lawmakers want the deadline to come as soon as next year.”

“As of Friday, the list maintained by the U.S. Securities and Exchange Commission covered roughly 60% of all Chinese companies whose shares trade in the U.S., such as online search provider Baidu, and will likely continue to grow.”

“With the U.S. Congress pushing to accelerate their delisting to as early as 2023, pressure to decouple the American and Chinese markets is only building.”

“Publicly traded companies in the U.S. are required to have their auditors inspected by the SEC-appointed Public Company Accounting Oversight Board (PCAOB). Under the Holding Foreign Companies Accountable Act passed in 2020, those that fail to comply for three straight fiscal years beginning Dec. 18, 2020 will be delisted.”

“China for years has refused foreign audit inspections, citing national security concerns. But the SEC pressure may be working.”

“…Meanwhile, leading Chinese car-hailing service Didi Global voluntarily exited the NYSE on Friday, in line with an earlier vote by its shareholders. Chinese authorities are believed to be urging companies that handle sensitive information, like Didi, to stop trading in the U.S. It would be easier for China to accept audit inspections if they apply to only lower-risk companies.” Nikkei Asia reports.

Indian Equity Markets Wiped Out $127 Billion Investor Wealth in Two Days

Business Insider India

“The Indian benchmark indices — Sensex and Nifty — tumbled by over 1,400 and 400 points respectively Monday. However, last Friday too ended in the red as they both lost 1,000 and 270 points.”

“[On Monday] Sensex closed 2.68% lower than what it was after falling as much as 4% during the day as it was spooked by heightened inflation in the US markets that could result in aggressive interest rate hikes by the Fed.”

“Unfortunately, there are more events ahead that could lead to more selling pressure — like the domestic consumer inflation data due later in the day.”

”…Other Asian equity markets saw a huge sell off on tensions over rising borrowing costs. Hong Kong witnessed the steepest fall of 3.39%, followed by Tokyo which fell by 3.01% and Taiwan by 2.36%.”

”The value of the Indian currency, rupee, also kept depreciating on pressure of high inflation. Indian rupee spot touched a new record low of 78.28, [Monday].”

“‘Sharp sell-off in equity markets coupled with surging US treasury yields added to the weakness in Rupee. We might see more weakness ahead of the FOMC meeting on 15th June, where the Fed is expected to hike rates by 50 bps and showcase a more aggressive tone. However, runaway depreciation might not happen amid RBI intervention,’ said Jigar Trivedi, research analyst- commodities & currencies fundamental at Anand Rathi Shares & Stock Brokers.” Business Insider India reports.

Inflation Drives Investors from Asian Emerging Market Bonds

Bloomberg

“Bond investors are avoiding Asia’s emerging markets as the region’s resilience to the global inflation threat shows signs of cracking.”

“Abrdn plc has turned underweight on Asian debt and SEB AB has grown more cautious, while Goldman Sachs Group Inc. sees a nascent rate-hike cycle to tackle price pressures flattening its yield curves the most in the developing world. Asian sovereign bonds are among the worst performers in a gauge of local-currency debt, with some saying the pain is just starting.”

“‘We are becoming wary of Asian bonds on the deteriorating inflation backdrop,’ said Eugenia Victorino, head of Asia strategy at Skandinaviska Enskilda Banken AB in Singapore. ‘Even though domestic demand in the region is still recovering, the inflation backdrop will prompt even the most reluctant central banks to tighten.’”

“Investor skepticism on Asia is deepening this week as worse-than-expected US inflation, hovering at a 40-year high, roils global assets. As markets opened Monday, bonds of nations that have failed to prepare for Federal Reserve tightening with their own rate hikes -- such as Indonesia and Thailand -- saw some of the worst losses. With the Fed expected to raise borrowing costs even faster than expected earlier, these Asian nations are exposed to the risk of a capital flight and a sharper slowdown in growth than peers such as Brazil who’ve been pro-active.” Bloomberg reports.

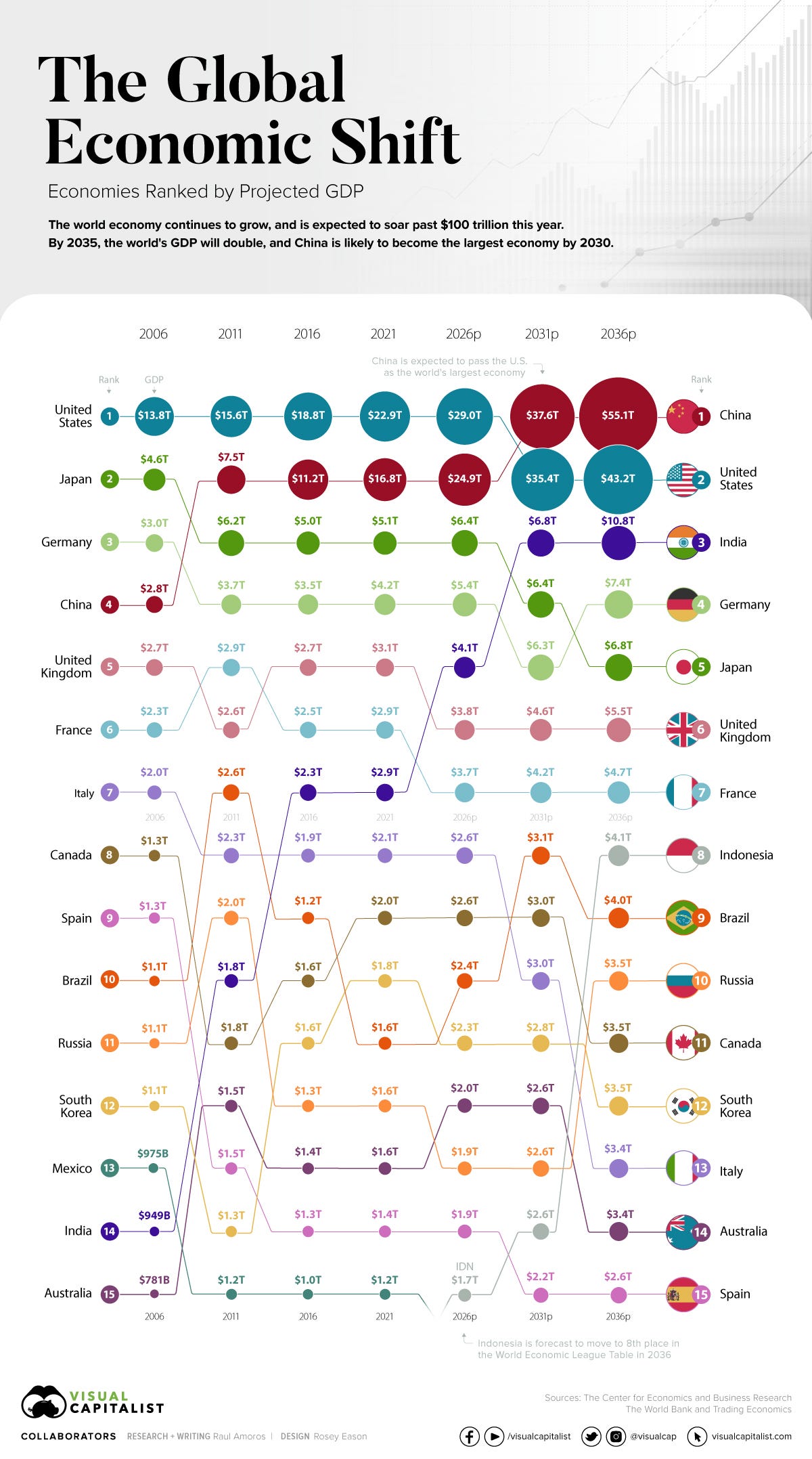

China Expected to Top U.S As World’s Largest Economy by 2030

Visual Capitalist

“As the post-pandemic recovery chugs along, the global economy is set to see major changes in the coming decades. Most significantly, China is forecast to pass the United States to become the largest economy globally.”

“The world’s economic center has long been drifting from Europe and North America over to Asia. This global shift was kickstarted by lowered trade barriers and greater economic freedom, which attracted foreign direct investment (FDI). Another major driving factor was the improvements in infrastructure and communications, and a general increase in economic complexity in the region.”

“Our visualization uses data from the 13th edition of World Economic League Table 2022, a forecast published by the Center for Economics and Business Research (CEBR).”

“China is expected to surpass the U.S. by the year 2030. A faster than expected recovery in the U.S. in 2021, and China’s struggles under the ‘Zero-COVID’ policies have delayed the country taking the top spot by about two years.”

“China has maintained its positive GDP growth due to the stability provided by domestic demand. This has proven crucial in sustaining the country’s economic growth. China’s fiscal and economic policy had focused on this prior to the pandemic over fears of growing Western trade restrictions.”

“India is expected to become the third largest country in terms of GDP with $10.8 trillion projected in 2031. Looking back, India had a GDP of just $949 billion in 2006. Fast forward to today and India’s GDP has more than tripled, reaching $3.1 trillion in 2022. Over the next 15 years, it’s expected to triple yet again.” Visual Capitalist reports.

Abu Dhabi Bourse Aims to Top 2021 Record Listings

The National

“The Abu Dhabi Securities Exchange expects to match or exceed the record number of listings it achieved in 2021 as it continues to add new products and expand its investor base, its managing director and chief executive said.”

“The bourse's benchmark FTSE ADX General Index was among the best-performing exchanges worldwide last year, having rallied more than 62 per cent in 2021. It is the best-performing bourse in the GCC this year, having climbed about 14 per cent since January.”

“Its market value was up about 25 per cent so far this year at more than Dh2.015 trillion ($549 billion) as of Monday 12.53pm UAE time, making it the Middle East and Arab world’s second-largest exchange.

“‘We are confident that the listing this year will not be less than what we have seen last year,’ Saeed Al Dhaheri, who is also managing director of the exchange, told The National.”

“…The ADX has a ‘good pipeline’ of initial public offerings, with healthcare and FinTech companies among others expressing an interest in listing on the exchange this year, Mr Al Dhaheri said.”

“There were nine listings on the exchange last year, including the initial public offerings of Adnoc Drilling, which raised $1.1bn in October, and Fertiglobe, the world’s largest seaborne exporter of urea and ammonia combined, which reaped about $795 million.”

“The ADX has carried the IPO momentum into 2022. Abu Dhabi Ports Group, the operator of industrial cities and free zones in the emirate, began trading on the ADX in February.”

“Borouge, the joint venture between Adnoc and Austrian chemicals producer Borealis, successfully closed its $2bn IPO, the biggest share sale on the ADX, in a deal that was about 42 times oversubscribed.”

“The ADX could host 13 more listings before the end of this year as it seeks to reach a market value of Dh3tn, Mohammed Al Shorafa, chairman of the Abu Dhabi Economic Development Department, told Sky News Arabia in March.” Sarmad Khan reports.

“Ah Love! could thou and I with Fate conspire

To grasp this sorry Scheme of Things entire,

Would not we shatter it to bits -- and then

Re-mould it nearer to the Heart's Desire!” - Rubaiyat of Omar Khayyam

Podcast Alert: Check out Bloomberg’s conversation with Mark Mobius on Emerging Markets Investing.

Also, check out our own interview with Mobius below. In that interview, the legendary investor talks investment philosophy, how he got started, advice to students and aspiring pros, favorite airlines, and why he's bullish on EM but bearish on crypto 'religion' (we spoke in December/January).

As always, we welcome your outreach on LinkedIN - Afshin Molavi - or on email at emergingworld85@gmail.com