Emerging Markets Monitor - June 24

EM Commodity Play Fizzles, US and Europe Slowdown, China Tech Giants Lose Swagger, Copper Prices Slump on Global Fears, Embraer Eyes Asia Market

The Top 5 Stories Shaping Emerging Markets from Global Media - June 24

The Bet on Commodity-Exporting EMs Is Losing Its Appeal

Bloomberg

“The most popular trade in emerging markets this year -- betting on commodity-exporting nations -- is losing its appeal.”

“The currencies and bonds of Brazil to Mexico and South Africa were the best performers among developing-nation peers in the first five months of 2022 as commodity prices skyrocketed following Russia’s invasion of Ukraine. They have turned laggards this month after growing fears of a global recession and China’s Covid lockdowns sent a Bloomberg gauge of raw-material prices tumbling 10% from an eight-year high.”

“The fizzling of the commodity-led rally comes at a crucial point for emerging-market investors as the Federal Reserve’s tightening saps liquidity and worsens the outlook for riskier assets. They have nowhere to hide as the other half of the developing world -- commodity importers mainly in Asia -- are also witnessing a selloff amid stubborn inflation and delayed rate-hike plans.”

“‘We are closer to the end of the emerging-market commodity boom than the beginning or even the middle,’ said Todd Schubert, head of fixed-income research at Bank of Singapore. ‘The rising risk of a severe economic downtown will further sap demand for a broad swath of commodities.’

“The Brazilian real, which rallied 18% in the year through May, has plunged about 10% in June. A similar reversal has happened in the Chilean and Colombian pesos and the South African rand. Their losses have sent the emerging-market currency benchmark toward the worst quarterly losses in more than two years.”

“‘I would be more defensive on commodity currencies right now, as it seems that slower global growth and the search for peak inflation globally continues to weigh on the commodity space,’ said Galvin Chia, EM FX strategist at Natwest Markets in Singapore.”

“Citigroup Inc. is urging investors to bet on further gains in the dollar against developing currencies, which ‘may see more broad-based weakness with commodity prices declining,’ strategists including Dirk Willer and Luis Costa wrote in a report Thursday.” Bloomberg reports

U.S, European Economies Slow Sharply as Recession Risks Grow

Wall Street Journal

“U.S. and European economies slowed sharply in June as surging prices of energy and food weakened demand for other goods and services, business surveys showed, increasing the risk of recessions around the world.”

“The new figures on manufacturing and services activity underline how dark the outlook has become in both Europe and the U.S. Russia’s war in Ukraine has hit global growth as high inflation spread across the globe. Economies also face continuing supply-chain disruptions and the prospect of rising interest rates that curb business investment. Europe faces additional pressure from a possible energy shortage this winter.”

“Germany on Thursday triggered the second stage of its three-step plan to deal with natural-gas shortages, moving closer to possible rationing this winter, which economists fear would deal a severe blow to manufacturers in Europe’s largest economy.”

“Economic growth in the U.S. and Europe slowed more sharply in June as higher prices chilled consumer demand. Readings above 50 indicate an increase in activity, and below that threshold, a decline. WSJ reports.

China Tech Giants Have Lost Their Swagger

Bloomberg

“On trading floors in New York and Hong Kong, the brightening mood toward Chinese technology companies is unmistakable: With stocks like Alibaba Group Holding Ltd. and Tencent Holdings Ltd. surging from multi-year lows, talk of a new bull market is growing louder.”

“Yet speak to executives, entrepreneurs and venture capital investors intimately involved in China’s tech sector and a more downbeat picture emerges. Interviews with more than a dozen industry players suggest the outlook is still far from rosy, despite signs that the Communist Party’s crackdown on big tech is softening at the edges.”

“These insiders describe an ongoing sense of paranoia and paralysis, along with an unsettling realization that the sky-high growth rates of the past two decades are likely never coming back.”

“Alibaba and Tencent are expected to deliver single-digit revenue growth in 2022, a letdown after years of rip-roaring expansion. One prominent startup founder said he’d pass on money from those companies because of the attention it would attract. Another said his company is proceeding on the assumption that it’s only a matter of time before officials double down again.”

“A third Beijing-based entrepreneur recently sold his stake in a tech unicorn and said he’s reluctant to start a new venture until there’s more clarity on what the government will allow.” Bloomberg reports.

Copper Prices Slump as Slowdown Fears Hit Industrial Metals Markets

Financial Times

”Copper prices fell to a near 16-month low on Thursday in the latest sign of recession fears gripping the wider industrial metals market. Often seen as a gauge of economic activity because of its usage in everything from household appliances to electric vehicles, copper fell as much as 2 per cent to $8,564 a tonne in morning trading.”

“It is now down 11 per cent for the year. Having climbed sharply after Russia’s invasion of Ukraine, copper has fallen this month over concerns that demand will be crimped by central banks rapidly raising interest rates to curb inflation and China’s tough Covid-19 lockdown policies.”

“‘The [US Federal Reserve] is tightening aggressively. Holding copper’s getting expensive. The commodity world’s flagship is under fire,’ said Tom Price, an analyst at Liberum, referring to copper.”

“Speaking to a Senate banking committee on Wednesday, Fed chair Jay Powell conceded that plans to raise borrowing costs this year could tip the world’s largest economy into recession. That message also weighed on other metal prices. Aluminium fell almost 2 per cent, nickel lost 1 per cent and tin slid 10 per cent on Thursday morning.” Neil Hume reports.

Brazil’s Embraer Eyes Aviation Growth in Asia

Nikkei Asia

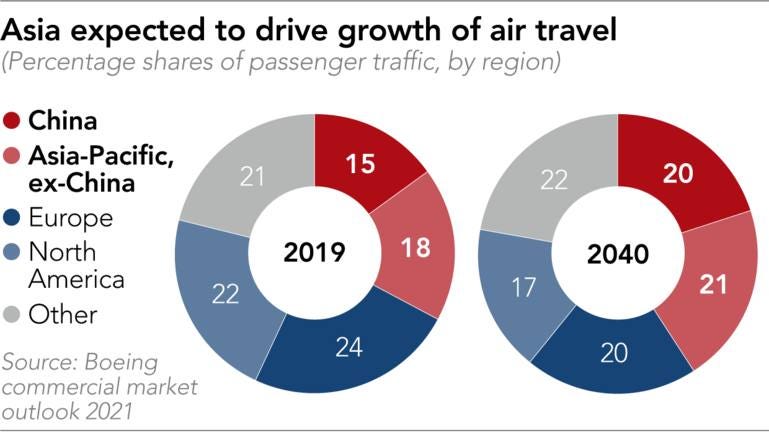

“…Embraer predicts its passenger jet production will increase to 60-70 aircraft this year, and eventually back to its prior level of 100-110, after two years dented by the pandemic. But achieving the goal may not be so simple. The company now faces competition from Airbus for larger jets and state-owned Commercial Aircraft Corp. of China (COMAC) for smaller ones -- while Japan's Mitsubishi Heavy Industries, which acquired the regional jet business of Canada's Bombardier in 2020, is pushing its customers to use their existing fleets for as long as possible instead of buying from Embraer.”

“Small passenger jets are a niche, distinct from the market for large jets that has long been dominated by Boeing and Airbus…In India, Embraer is in talks to sell regional jets to low cost carrier IndiGo. IndiGo's appointment of Pieter Elbers as CEO in May has prompted speculation that the Indian airline will become more open to using Embraer jets. Elbers was the former CEO of Dutch national carrier KLM, a big customer of Embraer.”

"‘Of course I know Pieter very well. Of course we have good relationships with Pieter because he was our customer,’ said Arjan Meijer, Embraer's commercial aviation chief, during a recent media event. ‘But we will have to talk to IndiGo, not just to Pieter, for their fleet development.’”

“Another Indian airline, Star Air, has been a user of Embraer's 50-seater ERJ-145 and is seen in need of an upgrade… In April, Embraer conducted a demonstration of its E190-E2 aircraft for Vietnam's airlines, including Bamboo Airways, an up-and-running low cost carrier offering access to resorts and sightseeing spots within the long and narrow country. Bamboo currently has five Embraer aircraft of the previous generation.”

“Embraer, however, has had more difficulty expanding in China, where the government in Beijing wants to nurture a domestic aerospace industry as part of its ‘Made in China 2025’ industrial policy, and is seen pushing Chinese airlines to buy from COMAC, not from foreign suppliers.” Nikkei Asia reports.

“We cannot solve problems with the kind of thinking we employed when we came up with them.” — Albert Einstein