Emerging Markets Monitor - June 27

Frontier Market Bonds: Buy Now?, Iran and EU Back to Nuke Talks, Aircraft Demand Roaring Back, India Economy 'Animal Spirits' Up, New Colombia Prez Faces Reality

The Top 5 Stories Shaping Emerging Markets from Global Media - June 27

Frontier Market Debt Distress Flashing Red. Is Now the Time to Buy?

Bloomberg

“Signs of distress flashing in bond markets suggest the world’s poorest nations are set to see a wave of debt restructurings. But a growing cohort of investors say that’s a buying opportunity.”

“Panic selling in the aftermath of Sri Lanka’s economic collapse has sent the average yield in junk-rated emerging economies to almost 900 basis points above US Treasuries, the highest risk premium in 13 years except for the Covid-related rout in 2020, according to JPMorgan Chase & Co. data. Yet, initial fears about a widespread default Armageddon across emerging markets is easing, and money managers are looking beyond the handful of countries that may reschedule their debt.”

“This shift in perception means at least some smaller developing nations, called frontier markets, have been unduly punished in the recent selloff and now offer highly attractive yields. Even in the event of debt restructuring, their bonds will offer greater recovery values than current bond prices, investors including Barclays Plc and Bluebay Asset Management say.”

“‘The beating in the frontier space has been much more severe than the broader emerging-market space,” said Lars Jakob Krabbe, a money manager for frontier-market fixed income at Coeli Frontier Markets AB. ‘We are getting closer to where we see a bottom.’”

“The selloff in frontier-market debt started last year, well before the Sri Lankan crisis grabbed the world’s attention, as investors trimmed the riskiest portions of their portfolios in preparation for the Federal Reserve’s monetary tightening. The Asian island nation’s default this year sparked further losses, especially among countries seen as having similar problems to Sri Lanka -- high debt, a food-and-fuel price crisis, low foreign-exchange reserves and political discontent.”

“‘The risk premium embedded in the market is quite substantial,’ said Anupam Damani, the head of international and emerging-market debt at Nuveen. ‘In some cases, these credits have been pricing in way below recovery levels. I’m not saying all of these credits will survive but some surely will. Being selective in that space clearly offers value.’” Bloomberg reports.

Iran and EU Herald Fresh Talks to Revive Nuclear Accord in ‘Coming Days’

Financial Times

”Iran and the EU said talks to revive the 2015 nuclear accord between the Islamic republic and leading global powers would restart ‘in the coming days’, beginning with indirect talks between Tehran and the US. ‘We are ready to resume the talks,’ Hossein Amirabdollahian, Iran’s foreign minister, said on Saturday at a joint press conference with Josep Borrell, Europe’s top diplomat, who is visiting the country.”

“‘What matters to the Islamic republic is to thoroughly enjoy the economic benefits of the agreement we reached in 2015 . . . [or else] it will not be acceptable’ to Iran. Borrell said that ‘the coming days [literally] means the coming days. I mean quickly, immediately.’”

“…US president Joe Biden is willing to resurrect the agreement but Trump’s designation of Iran’s Revolutionary Guards as a terrorist organisation is seen as a major obstacle. As well as being Iran’s most powerful security and military organisation the elite force also runs a business empire.”

“Iran is concerned that the terrorist designation will deprive the country of economic benefits under the accord and insists that it be removed. Analysts warn Biden may not be able to do this as it could further complicate domestic politics.” Najmeh Bozorgmehr reports.

Aircraft Demand to be Back to Pre-Pandemic Levels by 2024, Boeing Says

Arab News

“Boeing anticipates global demand to see about 4 percent annual growth year over year for the next two decades, expecting to be back to pre-pandemic levels by 2024, said Omar Arekat, the company’s Middle East and Africa VP of commercial sales and marketing. He added that the growth for the Middle East would be slightly above that at 4.2 percent year over year.”

“During the Annual General Meeting of the International Air Transport Association, Arekat told Arab News that the market is growing, and there is a demand for roughly 3,000 cargo and freighters in the Gulf Cooperation Council region.”

“Airlines returned to almost 100 percent of their operational capacity for regional and domestic travel, Arekat said. Internationally, it is growing, but it isn’t completely there yet, he added.”

“Based on peak season base, Boeing is 70 to 75 percent behind 2019, Arekat said. He believed that the GCC is doing better than the rest of the world in terms of recovery. There has been strong growth in intra-regional travel, and international travel is increasing quickly, he said. ‘So we anticipate that we would see a recovery to 2019 levels by the year 2024,’ Arekat added. Arab News reports.

India Economy ‘Animal Spirits’ Up, Recovery Gathers Momentum

Business Standard (India)

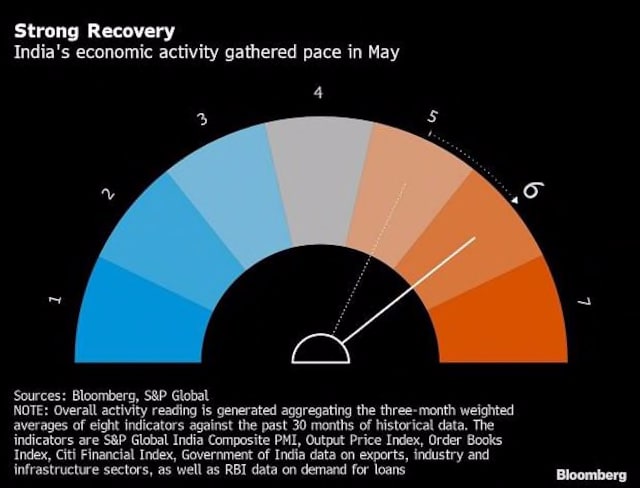

“India’s economy gathered momentum in May driven by pent up demand for services and higher output from industries as reopening continued from pandemic restrictions.”

“Five of the eight high-frequency indicators compiled by Bloomberg News showed improvement, pushing the needle on a dial measuring so-called ‘Animal Spirits’ to 6, from 5, for the first time since July and the first upward move in more than a year. The gauge is based on the three-month weighted average scores to smoothen out volatility in the single-month readings.”

“The upturn was fueled by an expansion in services activity and a robust growth in core infrastructure industries. However, an unprecedented rise in input prices, due in part to Russia’s invasion of Ukraine and persistent demand-supply imbalances, may spoil sentiment going forward.”

“Higher food, fuel, labor and transportation costs are forcing central banks globally to prioritize price stability over growth. The Reserve Bank of India has raised borrowing costs by 90 basis points so far this year and vows to do more to bring price gains below its target ceiling of 6 per cent.” Business Standard reports.

Colombia President-Elect With Bagful of Promises Faces Cost Reality

Wall Street Journal

“As a presidential candidate, former leftist guerrilla Gustavo Petro promised to modernize Colombia’s poverty-stricken countryside, end the U.S.-backed war on drugs and replace oil production with solar and wind farms.”

“But with inflation and the budget deficit around their highest levels in two decades, and the U.S., Colombia’s top trade partner, facing the risk of recession, the question is how President-elect Petro expects to pay for his proposals.”

“He says he will curtail the output of oil and coal, the country’s two largest exports. He aims to build a railroad to neighboring Venezuela, offer free university education, extend public pensions to those who didn’t pay into the system and have the state create jobs for millions of unemployed citizens.”

“Mr. Petro’s coalition of left-wing political parties lacks a majority in Congress, putting into question the support for his plans of steering the economy toward a more state-led model.”

“Mr. Petro’s proposals would mean a radical shift for this country of 50 million people and Latin America’s fourth-largest economy. Since the 1920s, Colombia has embraced policies based on a consensus of conservative fiscal management and respect for property rights, as it grappled with decades of guerrilla- and drug-fueled conflict.” Kejal Vyas reports.

My candle burns at both ends;

It will not last the night;

But ah, my foes, and oh, my friends—

It gives a lovely light!

Edna St. Vincent Mallay