Emerging Markets Monitor - June 30

Marcos Jr. Takes Reins in Philippines, Bleak Outlook for EM's, Inside Didi's Meltdown, Egypt $500M World Bank Loan, Ukraine Says Deal Not Near on Russia Grain Blockade

The Top 5 Stories Shaping Emerging Markets from Global Media - June 30

New Marcos is Back in Power in the Philippines Amid Mounting Economic Trouble

Singapore Straits Times

“Mr Ferdinand Marcos Jr was sworn in as the 17th president of the Philippines on Thursday (June 30), completing an epic return of his family to power 36 years after they fled the country in shame and giving himself six years to remake the legacy of his father.”

“‘This is a historic moment for us all. I feel it deep within me. You, the people, have spoken, and it is resounding,’ Mr Marcos Jr said during his inauguration.”

“Riding on a promise to continue what Mr Duterte started and on the key backing of Mr Duterte’s hugely popular daughter, Ms Sara Duterte-Carpio, Mr Marcos Jr won the May 9 elections with 31.6 million votes – more than double the 15.03 million received by his closest rival, former vice-president Leni Robredo.”

“‘The incoming Marcos government is likely to represent a continuation of Duterte’s style of managing the government and economy, rather than a disruption, with a focus on post-pandemic recovery at the onset,’ said Mr Dereck Aw, a senior analyst at the think-tank Control Risks.”

“That continuity also means inheriting the baggage Mr Duterte is leaving behind. The Duterte government is leaving a massive debt: over 12 trillion pesos (S$320 billion). Most was money his government borrowed to fund his pandemic response.”

“Prices have soared, as the ripple effects of the war in Ukraine reach the Philippines. A sharp spike in petrol prices has spawned a transport crisis. Food prices are forecast to rise even further in the latter half of the year, even as salaries are expected to remain stagnant and taxes likely to head north.”

“Mr Marcos Jr is taking office as the Philippine peso falls to 55 against the US dollar, making it Asia’s worst-performing currency.” Raul Dancel reports.

Bleak Outlook for EMs After Stormy Start to the Year

Reuters

“It's been a torrid first half for emerging market assets and with the Federal Reserve kicking off its tightening cycle amid soaring inflation shock waves might be on the horizon.”

“Adding to that are supply chain problems out of China, a war in Europe's bread basket, stalling global growth and fears that the world's largest economy could tip into recession - all casting a pall over riskier assets.”

“Data from the Institute of International Finance (IIF) showed that small inflows into emerging market debt for the year until end-May were almost all offset by outflows from equities. The IIF predicted that year-on-year foreign portfolio flows to emerging markets could shrink by 42% to less than a trillion dollars in 2022.”

“…Latin American currencies posted sharp gains in the first quarter thanks to rising commodity prices and central banks frontrunning the Fed, and remained in the black despite massive de-risking in the second quarter.”

“…Emerging equities are set for their largest first-half drop since the 1998 Asian financial crisis with the MSCI benchmark down 17% year-to-date while China, the index's single biggest component, is down 12%.”

“The single biggest emerging - or global - markets story of the first half of 2022 was Russia's war in Ukraine. An investment grade emerging market in January, Russia tipped into default after being severed from global financial markets amid sweeping sanctions.” Reuters reports.

Inside Didi’s Meltdown After Beijing’s Crackdown

Bloomberg

“…Didi’s ordeal since it debuted in New York despite regulators’ objections has become one of the clearest object lessons in the dangers of doing business in China. Through interviews with more than a dozen insiders, staff and Didi investors, a picture emerges of how an $80 billion company was brought to its knees in a matter of months by a series of unprecedented government decrees.”

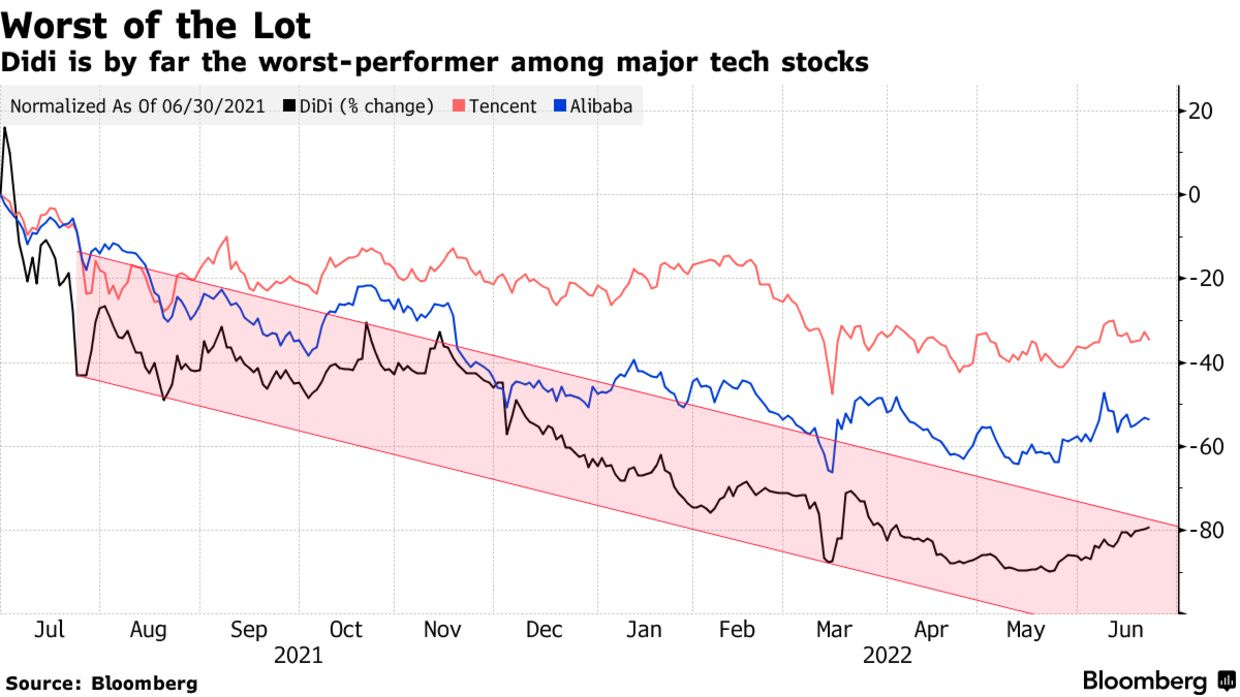

“Didi shed about 80% or more than $60 billion of market cap in a year -- the single biggest destruction of shareholder value ever witnessed over the first 12 months of an Asian IPO that raised over $1 billion.”

“To investors and executives who’ve struggled for decades to come to grips with the world’s No. 2 economy, the Didi saga is a jarring tale of competing government factions, billionaires’ miscalculations -- and the systemic failure of even the savviest tech industry leaders from Alibaba Group Holding Ltd. to Tencent Holdings Ltd. to gauge a rapidly changing climate under Xi Jinping’s watch.”

“‘There cannot be business as usual again, not after looking at this saga,’ says Fraser Howie, co-author of Red Capitalism: The Fragile Financial Foundation of China’s Extraordinary Rise. ‘Didi is part of a very worrying picture of how domestic private companies are treated, let alone how foreigners are treated in China, and I don’t think that can ever be forgotten.’”

“Didi’s future now hinges on resolving the investigation to Beijing’s satisfaction. Insiders and investors close to the company are divided on what happens next -- some are convinced Beijing is in no rush to rule on Didi’s fate, others say that its track record of complete compliance has finally mollified Beijing, which may soon restore its apps and allow the company to again sign up new users. Once that’s done, it may be allowed to list in Hong Kong.” Bloomberg reports.

Egypt to Receive $500 Million Loan to Support Food Security

Asharq Al-Awsat

“The World Bank’s Board of Executive Directors approved on Wednesday a $500 million loan to bolster Egypt’s efforts to ensure that poor and vulnerable households have uninterrupted access to bread, strengthen Egypt’s resilience to food crises and support reforms in food security policies, including to improve nutritional outcomes.”

“In a statement, it noted that the Emergency Food Security and Resilience Support Project will help cushion the impact of the war in Ukraine on food and nutrition security in Egypt.”

“Russia and Ukraine are the world’s largest wheat exporters, and the war has driven up prices and created nutritional shortfalls, particularly for people who rely on bread for their daily nutritional needs.”

“The new project links wheat imports to direct assistance to the poor and vulnerable population through Egypt’s Bread Subsidy Program. It will finance the public procurement of imported wheat, equivalent to one month of supply for the Bread Subsidy Program, which supports around 70 million low-income Egyptians, including approximately 31 million people under the national poverty line.”

“The loan will also support national efforts to reduce waste and loss in the wheat supply chain through the upgrade and expansion of climate-resilient wheat silos, sustainably improve domestic cereal production, and strengthen Cairo’s preparedness and resilience to future shocks.”

“It further supports Egypt by mobilizing immediate short-term relief to address supply and price shocks while simultaneously bolstering its longer term food security strategy and improved nutrition for the poor and vulnerable.” Hiba al Qudsi reports.

Ukraine Plays Down Prospects of Deal to End Russia Grain Blockade

Financial Times

“A deal to end Russia’s blockade of Ukrainian seaports and grain exports remains distant because Moscow is using talks to push its war aims and ambition to dominate the Black Sea, Kyiv’s top negotiator said.”

“Turkey and the UN are trying to broker an end to Russia’s naval blockade in the Black Sea, which has crippled Ukrainian commodity exports and triggered fears of global food shortages.”

“But Taras Kachka, Ukraine’s deputy minister for the economy and lead trade negotiator, said Russia’s efforts to conquer the country’s south were preventing a deal and rumours of a breakthrough were ‘more optimistic than reality’.”

“‘If there are talks, we will participate. But that doesn’t mean we will agree to any option that is on the table,’ Kachka said. ‘Any attempts to base a food security solution on the goodwill or grace of Russia will not work or be trusted.’”

“Kachka’s comments came days after G7 leaders implored Vladimir Putin to lift the Black Sea blockade ahead of Ukraine’s imminent summer harvest, with fears that the country’s grain storage capacity could be quickly exhausted unless space is cleared. Ukraine accounts for about 13 per cent of global grain exports.” The FT reports.

“Even if you are on the right track, you’ll get run over if you just sit there.” - Will Rodgers