Emerging Markets Monitor - June 8

Top Oil Trader Warns of Rocketing Prices, World Bank Slashes Growth Forecast, China Economy and Global Ambitions, RBI Rescues Rupee, Egypt Seeks Aid to Buy Wheat

The Top 5 Stories Shaping Emerging Markets from Global Media - June 7-8

Top Global Oil Trader Warns Prices Could Hit ‘Parabolic State’

Financial Times

“The head of Trafigura has warned that the oil market could reach a ‘parabolic state’ this year with prices surging to record highs and triggering a slowdown in economic growth.”

“Jeremy Weir, chief executive of the commodity trader, said that energy markets were in a ‘critical’ state as sanctions on Russia’s oil exports following its invasion of Ukraine had exacerbated already tight supplies created by years of under-investment.”

“‘I really think we have a problem for the next six months . . . once it gets to these parabolic states, markets can move and they can spike quite a lot.’ A parabolic move in markets is generally defined as when a price that has been rising suddenly surges to hitherto unseen levels, mimicking the right side of a parabolic curve.”

“Weir added it was highly probable that oil prices could rise to $150 a barrel or higher in the coming months, with supply chains strained as Russia tries to redirect its oil exports away from Europe.”

“Brent crude, the international oil benchmark, which is trading near $120 a barrel, hit an all-time peak of $147 on the eve of the financial crisis in 2008. The Trafigura executive was the latest to warn that the economy has not yet seen the worst of the energy crisis, with little way of lowering prices as already-squeezed global supplies are likely to get scarcer if Russian production falls further.” The FT reports.

Global Stagflation Risk Rises Amid Sharp Slowdown in Growth

World Bank News Release

“Compounding the damage from the COVID-19 pandemic, the Russian invasion of Ukraine has magnified the slowdown in the global economy, which is entering what could become a protracted period of feeble growth and elevated inflation…This raises the risk of stagflation, with potentially harmful consequences for middle- and low-income economies alike.”

“Global growth is expected to slump from 5.7 percent in 2021 to 2.9 percent in 2022— significantly lower than 4.1 percent that was anticipated in January. It is expected to hover around that pace over 2023-24, as the war in Ukraine disrupts activity, investment, and trade in the near term, pent-up demand fades, and fiscal and monetary policy accommodation is withdrawn. As a result of the damage from the pandemic and the war, the level of per capita income in developing economies this year will be nearly 5 percent below its pre-pandemic trend.”

“The June Global Economic Prospects report offers the first systematic assessment of how current global economic conditions compare with the stagflation of the 1970s—with a particular emphasis on how stagflation could affect emerging market and developing economies….”

“The current juncture resembles the 1970s in three key aspects: persistent supply-side disturbances fueling inflation, preceded by a protracted period of highly accommodative monetary policy in major advanced economies, prospects for weakening growth, and vulnerabilities that emerging market and developing economies face with respect to the monetary policy tightening that will be needed to rein in inflation.”

“However, the ongoing episode also differs from the 1970s in multiple dimensions: the dollar is strong, a sharp contrast with its severe weakness in the 1970s; the percentage increases in commodity prices are smaller; and the balance sheets of major financial institutions are generally strong…”

“Among emerging market and developing economies, growth is also projected to fall from 6.6 percent in 2021 to 3.4 percent in 2022—well below the annual average of 4.8 percent over 2011-2019.”

Download Global Economic Prospects here.

Regional Outlooks:

East Asia and Pacific: Growth is projected to decelerate to 4.4% in 2022 before increasing to 5.2% in 2023. For more, see regional overview.

Europe and Central Asia: The regional economy is expected to shrink by 2.9% in 2022 year before growing by 1.5% in 2023. For more, see regional overview.

Latin America and the Caribbean: Growth is projected to slow to 2.5% in 2022 and 1.9% in 2023. For more, see regional overview.

Middle East and North Africa: Growth is forecast to accelerate to 5.3% in 2022 before slowing to 3.6% in 2023. For more, see regional overview.

South Asia: Growth is projected to slow to 6.8% in 2022 and 5.8% in 2023. For more, see regional overview.

Sub-Saharan Africa: Growth is forecast to moderate to 3.7% in 2022 and rise to 3.8% in 2023. For more, see regional overview.

Economic Slowdown and Zero-Covid Threaten China’s Global Ambitions

South China Morning Post

“China’s Premier Li Keqiang’s recent warning that the economy is facing serious challenges as a result of its Covid-19 controls has raised fears the country may be facing its biggest economic slowdown – or even recession – in decades.”

“Chinese and international observers have suggested that Beijing may need to rethink its approach towards the West and scale down its global ambitions as it grapples with an increasingly hostile external environment.”

“They warned that economic headwinds may compromise China’s ability to compete with the United States and put further strains on the Belt and Road Initiative, its transcontinental investment strategy.”

“Senior Chinese officials, however, have put on a brave face over the past week, trying to play down such concerns while repeating their promises to developing nations.”

“Although some of the toughest anti-Covid restrictions – including a two-month-long lockdown of Shanghai, China’s financial and commercial hub – have been lifted this week, it has ravaged the economy and dealt a heavy blow to international confidence in the Chinese leadership ahead of a major reshuffle later this year.” Shi Jiangtao reports.

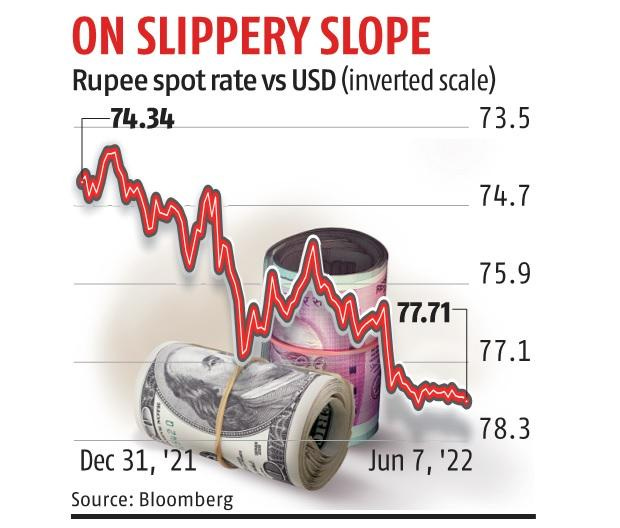

India Central Bank Steps in to Rescue Rupee From Hitting All-Time Low

Business Standard of India

“The Reserve Bank of India (RBI) stepped up its intervention in the foreign exchange market on Tuesday as the rupee headed for a new all-time low after a weak opening, though the currency traded in a narrow range ahead of the monetary policy review by the central bank.”

“The rupee opened at 77.68 to a US dollar compared to the previous close of 77.63, and went on to hit the day’s low of 77.74. According to currency dealers, state-run banks sold dollars on behalf of the RBI at around 77.70 levels. The rupee ended the day at 77.71, down 8 paise from its previous close.”

“…Crude oil prices scaling back to the $120 per barrel level also impacted the currency, with India importing 80 per cent of its requirements.”

“…The rupee hit an all-time closing low on May 19, when it ended at 77.73/$, while intra-day record low was 77.80 on May 17.”

“…The central bank has beefed up its intervention in the foreign exchange market since the Indian unit came under pressure after the Russia-Ukraine war broke out in late February. There has been intervention in all three segments of the market – spot, futures and the offshore.” Manojit Saha reports.

Egypt Asks World Bank for $500 Million to Buy Wheat

Al-Monitor

“The Egyptian government asked the World Bank in late May to obtain $500 million to finance the Emergency Food Security and Resilience Support Program, which is aimed at managing Egypt’s needs for imported wheat in light of the ongoing repercussions of the Russian war in Ukraine on global markets.”

“According to a document issued by the World Bank in May regarding the program, ‘The immediate food security impacts of the Ukraine war are particularly pronounced on countries heavily dependent on Ukrainian and Russian grain imports. As the largest importer of wheat in the world, the Ukraine war has delivered a major shock to Egypt.’”

“Egypt's wheat imports cover nearly 62% of the country's total wheat needs; about 85% of these imports come from Russia and Ukraine, the document states. It further noted that ‘the effect of the Ukraine war on global wheat prices has increased Egypt’s food import bill.’”

“World Bank executive director and dean of the board of executive directors Merza Hasan told Akhbar el-Yom on June 3, ‘Egypt will soon obtain approval for the loan that is being negotiated with the World Bank,’ without specifying a date for the expected approval.” Al-Monitor reports.

“No one behind, no one ahead.

The path the ancients cleared has closed.

And the other path, everyone's path,

easy and wide, goes nowhere.

I am alone and find my way.”

― Octavio Paz