Emerging Markets Monitor - March 27

China's Weak Rebound, India's LIC Caps Exposure After Adani Rout, S&P Sees Defaults in Lat-Am, China Stock Recovery 'Play' in Doubt, Saudi-China Energy Ties

The Top 5 Stories Shaping Emerging Markets from Global Media - March 27

China Economic Rebound Weaker Than Expected, Maersk Says

Financial Times

“China’s economic rebound is weaker than expected as consumers emerge ‘stunned’ from pandemic-led disruptions and a real estate meltdown last year, according to the head of AP Møller-Maersk.”

“Vincent Clerc, the new chief executive of the world’s second-largest container shipping group, said, however, that trading volumes associated with the Chinese economy remained resilient with little sign of negative impact from US-led efforts to ‘decouple’ from China.”

“‘When we started the year, there was this hope that as China reopens after Covid we would see a really strong rebound,’ Clerc said in an interview in Beijing. ‘I think we’ve not seen it yet . . . The Chinese consumer is a bit more stunned by what’s happened and is not in a splurging mood right now.’”

“China has set a growth target of 5 per cent this year — its lowest in decades — after the world’s second-largest economy undershot expectations in 2022 as a result of President Xi Jinping’s strict zero-Covid strategy. But many economists are hoping for a stronger performance after China abruptly abandoned its Covid-19 controls in December.”

“The IMF is predicting growth of 5.2 per cent in China this year. However, Clerc said some of Maersk’s customers were drawing parallels with the outbreak of severe acute respiratory syndrome, or Sars, in 2003, when consumers in the hardest-hit areas took time to recover their confidence.”

“‘This is not quite the ‘roaring ’20s’-type mood that one could have expected after this long interruption,’ said Clerc, who was among global chief executives gathered in Beijing at the weekend for the country’s annual China Development Forum investor conference. Joe Leahy reports.

India’s LIC Will Cap Exposure to Individual Firms in Post-Adani Rout

Reuters

“The Life Insurance Corp. of India (LIC) is planning to impose caps on its debt and equity exposure to companies, two sources said, in a bid to lower concentration of risk following criticism of its investment in Adani group companies.”

“After the Adani group lost over $100 billion in valuation post scathing allegations by U.S.-based Hindenburg Research, state-run LIC was criticized for having over $4 billion exposure to companies from the group.”

“LIC, the country's largest domestic institutional investor with assets under management of about $539 billion, is planning to cap its debt and equity exposure in individual firms, group companies and companies that are backed by same promoters, one of the sources, with knowledge of the matter, told Reuters.”

“…The caps, once approved by the LIC board, would further limit the insurer's exposure. Currently, the insurer cannot invest more than 10% of outstanding equity in a company and 10% of the outstanding debt.”

“The Insurance Regulatory and Development Authority of India (IRDAI) also bars insurers from having more than 15% of their investment funds in equity and debt of companies owned by one corporate or a promoter group.”

“The move is aimed at strengthening investment strategies, and fence LIC from public criticism of its investment decisions or exposure to entities like the Adani group, the second source said.” Reuters reports.

S&P Warns of Default Wave Ahead for Latin America as Rates Rise

Bloomberg

“Rapidly rising borrowing costs pose more of a threat to companies in Latin America than anywhere else in emerging markets, raising concern that defaults in the region are about to rise, according to S&P Global Ratings.”

“Credit conditions are tightening more quickly now in Latin America than they were at the height of the 2008 financial crisis, analysts led by Gregoire Rycx wrote in a report. That is expected to put companies under pressure through the end of next year.”

“‘Latin American countries are enduring the most severe tightening of financial conditions seen in recent history,’ the analysts wrote. Defaults may pick up quickly in Brazil as companies there rely on floating-rate debt, which becomes more expensive to service as interest rates rise.”

“Policy makers have raised the key Selic rate by 11.75 percentage points in the last two years. As a result, the average interest rate businesses are paying rose to 7.9% last year from 6.9% in 2021, and it’s already weighing on earnings and credit metrics, S&P said.”

“While there are only ‘faint signs’ of stress in the region’s largest economy so far, S&P is joining the chorus of investors and analysts predicting an incipient credit crunch in the country. The default of century-old retailer Americanas has sent shockwaves through domestic credit markets, with lenders growing more selective and new issuance freezing up.”

“Companies in Chile and Colombia — countries that long had stable and relatively low interest-rate environments — face the sharpest immediate risks, according to S&P. Central banks there have raised rates to 11.25% and 12.75%, respectively, making it more difficult for businesses to manage their debt loads. “

“‘The real concern is that credit stress could emerge if issuers are unable to roll over their debt,’ the analysts wrote. ‘In such cases, defaults become inevitable as capital structures adjust to the new elevated financing costs.’” Marina Elena Vizcaino reports.

China Stocks: Recovery Bets Doubted as Empty Shipping Containers Pile Up

South China Morning Post

“Investors putting their money on the mainland’s recovery theme may find their stock bets premature as one major part of the economy struggles. Empty shipping containers are piling up in major ports from Shanghai to Ningbo and Shenzhen as exports shrink.”

“Local media reports and posts on social media in the past month suggest idled containers are hitting multi-year highs, painting a bleak picture on the outlook for exports, challenging bullish calls from Wall Street banks on the economic upturn.”

“The Shanghai Yangshan port, once the world’s busiest, had to lease space from Taicang port in the neighbouring eastern Jiangsu province to park idle containers, according to a post on NetEase.com, while some port workers doubled their time-off duty. The volume of empty containers in Shenzhen’s Yantian port is as high as a seven-storey building, reaching the highest in three years, according to Sohu.com.”

“‘We are generally cautious on export-linked stocks such as shipping lines and port operators this year,’ said Wang Chen, a partner at Xufunds Investment Management in Shanghai. ‘External demand is supposed to be sluggish, given all the happenings overseas. These stocks won’t be the focus of our allocation this year.’

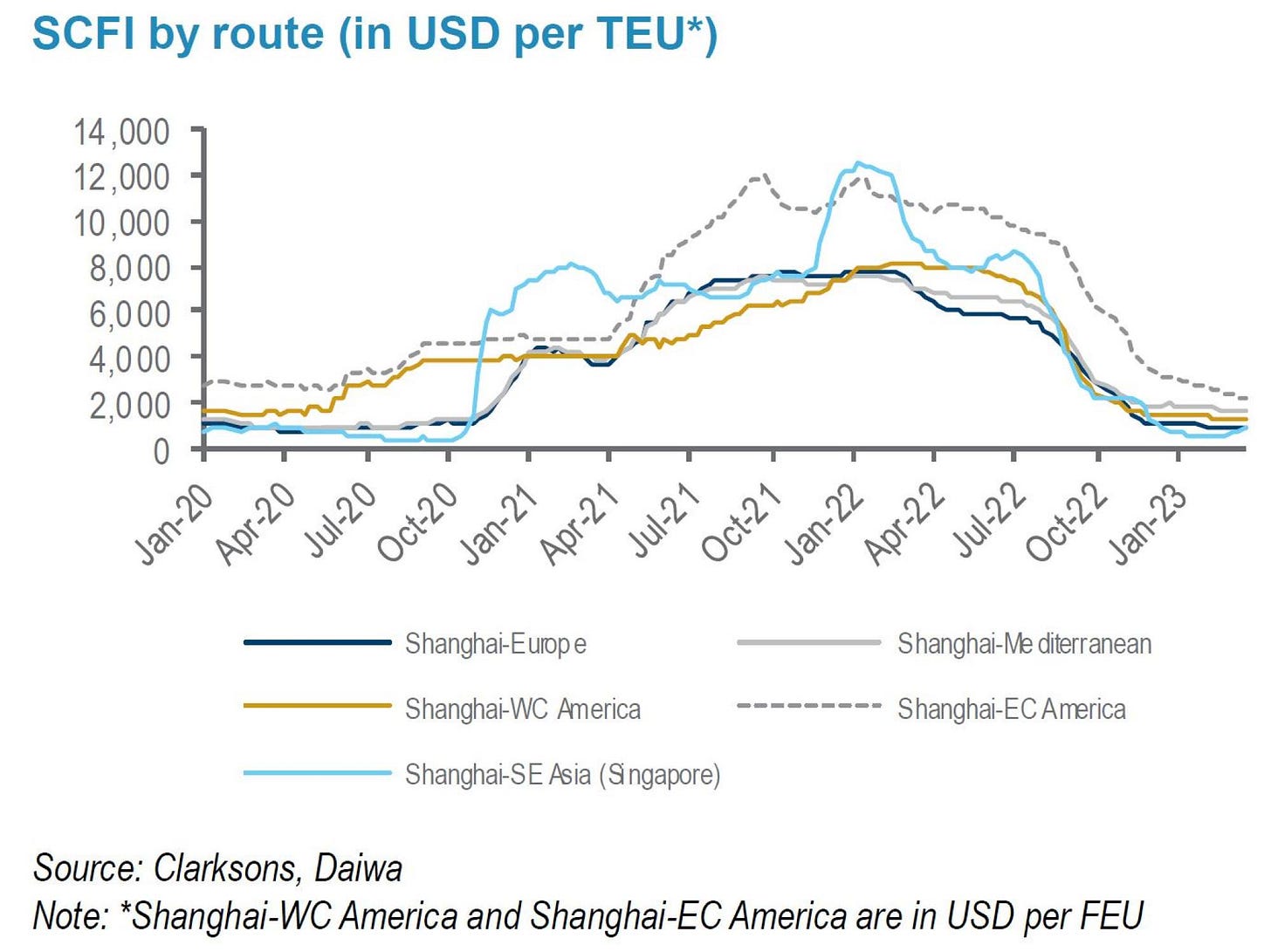

“An index of freight rates for 15 shipping routes has dropped 18 per cent this year, according to Shanghai Shipping Exchange, bringing the slump to 82 per cent since January 2022. That is a red flag for investors holding the share of shipping stocks and port operators, some analysts cautioned.” Zhang Shidong reports.

Saudi Aramco is “Doubling Down” on China Energy Supply, Chief Executive Says

The National

“Saudi Aramco, the world’s largest oil exporting company, is ‘doubling down’ on China’s energy supply, according to its chief executive.”

“‘We want to be an all-inclusive source of energy and chemicals for China’s long-term energy security and … high-quality development,’ Amin Nasser said at the China Development Forum on Sunday. ‘That’s why we are doubling down on China’s energy supply, including new lower carbon products, chemicals, and advanced materials, all supported by emissions reduction technologies,’ he said.”

“Despite a surge in China’s imports of Russian crude last year, Saudi Arabia remains the country’s top crude supplier. Saudi Arabia exported 87.49 million tonnes of crude oil to China in 2022, which is equal to 1.75 million barrels per day, according to Chinese customs data.”

“China is expected to import record volumes of crude this year as it gradually reopens its economy, ending nearly three years of strict Covid regulations. There are ‘green shoots’ appearing, especially in China, that are positive for the world economy, the International Monetary Fund's managing director, said at the same event.” John Benny reports.

“If we did all the things we are capable of, we would literally astound ourselves.” - Thomas Edison