Emerging Markets Monitor - May 16

Social Unrest 'Inevitable' in EMs, Goldman Sees High Risk of US Recession, China Economic Woes Deepen, EU Growth Outlook Dims, JP Morgan Bearish on Nigeria

The Top 5 Stories Shaping Emerging Markets from Global Media - May 14-16

Social Unrest Looms as ‘Inevitable’ in EM As Food, Fuel Prices Soar: Report

Reuters

“Rising fuel and food prices look set to stoke an ‘inevitable’ rise in civil unrest, with developing middle-income countries such as Brazil or Egypt particularly at risk, a report by a risk consultancy said.”

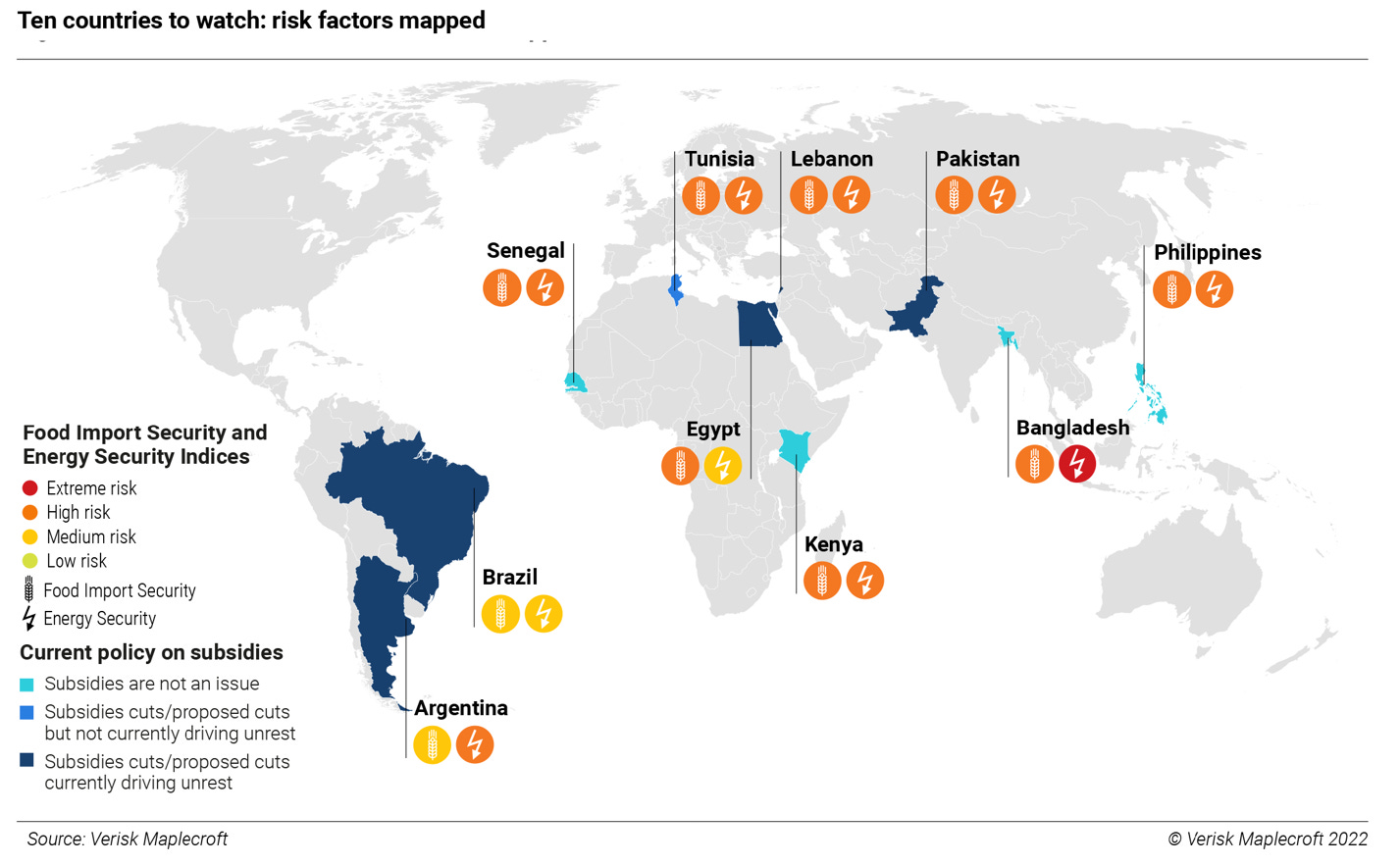

“Three quarters of nations expected to be at high-risk or extreme risk of civil unrest by the fourth quarter of 2022 were middle-income countries, as defined by the World Bank, Verisk Maplecroft said in an update to its political risk monitor.”

"‘Unlike low-income countries, they were rich enough to offer social protection during the pandemic, but now struggle to maintain high social spending that is vital to the living standards of large sections of their populations,’ the report found.”

“Argentina, Tunisia, Pakistan and Philippines were also among the countries to watch in the next six months, the authors said, pointing to their high dependency on food and energy imports. Russia's war in Ukraine has accelerated a rise in food prices, which hit an all-time record in February and again in March. Energy prices also rose sharply.”

"‘With no resolution of the conflict in sight, the global cost of living crisis will continue deep into 2023,’ the report said. Lebanon, Senegal, Kenya and Bangladesh face similar pressures.”

“The report pointed to Sri Lanka and Kazakhstan as examples of middle income countries that have already suffered unrest this year. The former saw rising food and fuel prices contribute to escalating tensions, while an attempt to cut fuel subsidies sparked protests in Kazakhstan.” Reuters reports.

Goldman’s Blankfein Says US at ‘Very, Very High Risk of Recession’

Bloomberg

“Goldman Sachs Senior Chairman Lloyd Blankfein urged companies and consumers to gird for a US recession, saying it’s a ‘very, very high risk. If I were running a big company, I would be very prepared for it,’ Blankfein said on CBS’s ‘Face the Nation’ on Sunday. ‘If I was a consumer, I’d be prepared for it.’”

“A recession is ‘not baked in the cake’ and there’s a ‘narrow path’ to avoid it, he said. The Federal Reserve has ‘very powerful tools’ to tamp down inflation and has been ‘responding well,’ the former Goldman chief executive officer said.”

“With high fuel prices and a shortage of baby formula tangible measures of Americans’ unease, US consumer sentiment declined in early May to the lowest level since 2011. US consumer prices rose 8.3% in April from a year ago, slowing slightly from March but still among the fastest rate in decades.”

“Blankfein’s comments were broadcast the same day as the firm’s economists cut their U.S. growth forecasts for this year and next to reflect the recent shake-out in financial markets. Goldman’s economic team, led by Jan Hatzius, now expects U.S. gross domestic product to expand 2.4% this year, down from 2.6%. It reduced its 2023 estimate to 1.6% from 2.2%.” Bloomberg reports.

China Economic Woes Deepen Amid Covid Lockdowns

Wall Street Journal

“China’s economy descended deeper into a Covid-induced doldrums last month, raising questions about whether Beijing’s planned stimulus measures can prevent a prolonged downturn.”

“Consumer spending and factory output tumbled in April, while growth in infrastructure investment—which Beijing has been counting on to prop up growth this year—slowed sharply, China’s National Bureau of Statistics reported on Monday.”

“China’s headline jobless rate, meantime, surged to a two-year high of 6.1%, further evidence of the economic damage unleashed by the country’s strictest pandemic containment measures in more than two years.”

“While activity could snap back if lockdowns are ultimately lifted, the damage from China’s commitment to stamping out outbreaks of Covid is rippling through the economy and lingering. The question now is whether policy makers in the world’s second-largest economy will be able to soften the blow with fiscal and monetary policy tools.”

“China’s stimulus measures since the pandemic first exploded have focused on the supply side. Beijing’s reluctance to support households directly and its continuing Covid restrictions have sapped the power of consumer demand to boost the economy, economists say.” WSJ reports.

Outlook for EU Growth and Inflation Worsen as Energy Crisis Hits

Financial Times

”Brussels is set to cut its growth forecasts further and lift its inflation outlook as the energy crisis triggered by Russia’s invasion of Ukraine exacts its toll on the EU economy.”

“Both the EU and euro area are forecast to expand by 2.7 per cent this year, well shy of the previous expectation of 4 per cent, according to a draft of European Commission forecasts to be published on Monday.”

“Growth is tipped to be 2.3 per cent in 2023. Inflation is expected to surge above 6 per cent in both the EU and euro area this year, with some central and eastern European countries likely to see double-digit price rises in 2022.”

“Eurozone inflation is set to fall to 2.7 per cent in 2023. But the figure remains above the European Central Bank’s target of 2 per cent, underscoring the delicate balancing act policymakers face in an environment of tepid growth and soaring prices.”

“Last week, central bank president Christine Lagarde signalled that she would support raising the main interest rate in July, paving the way for the first increase for more than a decade.”

“The commission previously forecast that inflation would fall back below the ECB’s target next year. Energy costs have soared and confidence has faltered in the wake of the invasion of Ukraine.” The FT reports.

JP Morgan Removes Nigeria from ‘Overweight’ Listing on Bond Index

Business Insider Africa

“JPMorgan has removed Nigeria from its list of emerging market sovereign recommendations that investors should be 'overweight' in, saying the country had not taken advantage of high oil prices.”

“Analysts use overweight and underweight to broadcast recommendations on buying or avoiding stocks of certain sectors. Analysts attach an overweight recommendation to a stock that they believe will outperform its sector in the near future.”

“According to Reuters, the bank analysts said Nigeria's national oil company (NNPC) did not transfer any revenue to the government from January to March this year due to petrol subsidies and low oil production.”

“The bank further added that it moved Nigeria out of the 'overweight' category due to its fiscal woes amid a worsening global risk backdrop that has raised market concerns despite a positive oil environment.”

“On the other hand, JPMorgan replaced Nigeria in the list with Serbia and Uzbekistan in the 'overweight' category. According to Reuters, JPMorgan included Serbia in the category due to the country's high reserves and a fiscally cautious government. At the same time, Uzbekistan was added to the category due to the country's relatively low debt despite Russian exposure.” Victor Oluwole reports.

‘For Whom the Bell Tolls’

No man is an island,

Entire of itself.

Each is a piece of the continent,

A part of the main.

If a clod be washed away by the sea,

Europe is the less.

As well as if a promontory were.

As well as if a manor of thine own

Or of thine friend's were.

Each man's death diminishes me,

For I am involved in mankind.

Therefore, send not to know

For whom the bell tolls,

It tolls for thee.

John Donne (1572-1631)