Emerging Markets Monitor - May 19

China Explores More Russia Oil Purchases, Sri Lanka in Default, The Next Emerging Markets Crisis?, Indonesia Palm Oil Exports to Resume, Kenya Rising in eSports

The Top 5 Stories Shaping Emerging Markets from Global Media - May 19

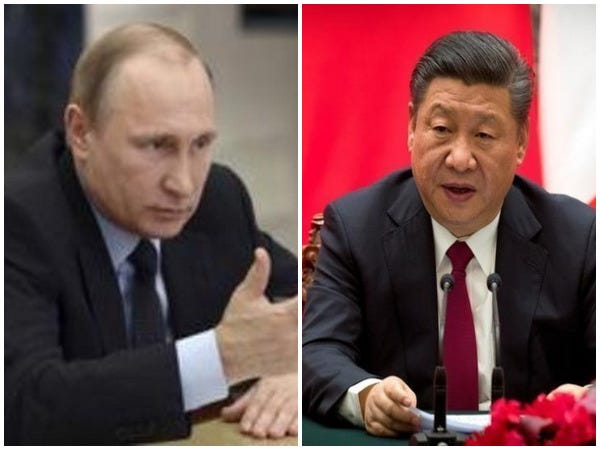

China in Talks with Russia to Buy Oil for Strategic Reserves

Bloomberg

“China is seeking to replenish its strategic crude stockpiles with cheap Russian oil, a sign Beijing is strengthening its energy ties with Moscow just as Europe works toward banning imports due to the war in Ukraine.”

“Beijing is in discussions with Moscow to buy additional supplies, according to people with knowledge of the plan who asked not to be named as the matter is private. Crude would be used to fill China’s strategic petroleum reserves, and talks are being conducted at a government level with little direct involvement from oil companies, said one person.”

“Oil has rallied this year following Russia’s invasion of its smaller neighbor, but the price of its own crude has tumbled as buyers step away to avoid damaging their reputation or being swept up in financial sanctions. That’s provided an opportunity for China to cheaply replenish its vast strategic reserves, which are typically tapped during times of emergencies or sudden disruptions.”

“The foreign ministries for both China and Russia didn’t immediately respond to requests for comment. Details on volumes or terms of a potential deal haven’t been decided yet, and there’s no guarantee an agreement will be concluded, said one person.” Bloomberg reports.

Sri Lanka Missed Debt Payment, First Asia-Pacific Sovereign Default this Century

Financial Times

“Sri Lanka’s central bank has confirmed the country has missed a deadline for foreign debt repayments, the first sovereign default in the Asia-Pacific region this century, according to Moody’s.”

“A 30-day grace period for missed interest payments on two international sovereign bonds expired on Wednesday, forcing Sri Lanka into what some analysts called a ‘hard’ default as the country confronts an economic and political crisis.”

“The last Moody’s-rated sovereign borrower to default in Asia was Pakistan in 1999. President Gotabaya Rajapaksa’s government said last month that Sri Lanka would stop repaying its international debt to conserve foreign currency reserves for imports such as fuel, medicine and food.”

“Sri Lanka, which has never defaulted before, owes about $51bn in overseas debt to international bondholders as well as bilateral creditors including China, Japan and India. At a briefing on Thursday, Nandalal Weerasinghe, the central bank governor, confirmed that Sri Lanka’s creditors could now consider the country technically in default.”

“…Analysts said that rising global interest rates, high energy prices and a surge in inflation were piling pressure on import-dependent developing economies such as Sri Lanka.” The Financial Times reports.

The Next Emerging Markets Crisis?

Wall Street Journal (Editorial)

“The Federal Reserve’s new campaign against inflation is catching many investors in its crosshairs, as Wall Street showed again Wednesday. But spare a thought as well for emerging economies, which often suffer crises as a result of policy mistakes elsewhere and are at risk of another.”

“The underlying problem is the vast financial flows the Fed and other central banks unleashed with ultraloose monetary policies during the pandemic. The central banks wanted investors to chase returns by taking on greater risks, and some of the best-rewarded risks were in developing economies. Capital flooded into South and Southeast Asia, South America and Africa.”

“Foreign capital chasing yield drove down borrowing costs, allowing emerging-market governments to increase borrowing to 67% of GDP on average from 52% before the pandemic. The private sector in developing economies also expanded its debt, to the tune of an additional $5.8 trillion in borrowing by households and nonfinancial companies over the past year, according to a report Wednesday by the Institute of International Finance (IIF).”

“The danger is that these bills will now come due, big time. Rising interest rates are an immediate issue, especially for governments. Interest expenses as a percentage of government revenue, at some 10%, are the highest since before the 2007-2008 panic and set to rise.” WSJ Opinion writes.

Indonesia Palm Oil Export Ban to be Lifted May 23

Channel News Asia

“Indonesia's palm oil export ban will be lifted on May 23, as the average price of cooking oil domestically has begun to decrease, said President Joko Widodo on Thursday (May 19).”

“In a televised statement, Jokowi, as the president is popularly known, said that Indonesia needs about 194,000 tonnes of bulk cooking oil every month. In March, prior to the export ban, the national supply was only 64,500 tonnes, he said. However, after the export ban was put in place in April, the national supply reached 211,000 tonnes.”

“The president said that the price of bulk cooking oil was around 19,800 rupiah (US$1.35) per litre before the export ban. The price is currently down to between 17,200 rupiah and 17,600 rupiah per litre, he said.”

“‘Therefore, based on the current supply and price of cooking oil and considering that there are 17 million workers in the palm oil industry … I have decided that cooking oil exports will be allowed again on Monday, 23 May 2022.’ He added that despite the lifting of the ban, the government would continue to monitor the situation to ensure that prices are affordable for the people.” Channel News Asia reports.

How Kenya is Pushing for Esports Dominance

Quartz Africa

“Kenya has a global reputation for athletics success. It has the biggest medal haul of any African country in the history of the Olympics—thanks mostly to the exploits of its famed middle and long-distance runners. But the country is keen on making a mark in many more disciplines.”

“There’s less than 100 days left until the 2022 Commonwealth Games in Birmingham where esports will make its debut. Dota 2, eFootball Series by Konami, and Rocket League will be the gaming titles featured at the inaugural Commonwealth Esports Championships.”

“Esports Kenya Federation CEO Bavon Ojwang’ tells Quartz that Kenya is aiming to compete for all three titles on offer at the Commonwealth esports championships. The country has secured direct qualification for Dota 2, but still has to take part in regional qualifiers before the championships for the other titles, against African countries including Malawi and Mauritius.”

“While there is a world of difference between athletics and esports, Kenya is hoping to channel the same energy that has put it on the athletics global map into esports. The wins of Africa’s 100m record holder Ferdinand Omanyala, coupled with highlights such as Africa’s top-ranked junior Angela Okutoyi at the Australian Open, have served to fuel Kenyans’ ambitions to dominate the larger sports landscape.”

“French President Emmanuel Macron is among those who want esports to make its Olympics debut in Paris 2024. Kenya is among African countries birthing a new generation of gaming talent. The video games market in Kenya, worth $63 million in 2017, is projected to hit $118 million in 2022.” Quartz Africa reports.

"I don't know any other way to live but to wake up every day armed with my convictions, not yielding them to the threat of danger and to the power and force of people who might despise me." - Wole Soyinka