Emerging Markets Monitor - May 23

After $5 Trillion Sell-Off, Is EM a Buy?, IMF Chief Bleak Outlook, India CB: Rate Hikes a 'No Brainer," US Committed to Taiwan Defense: Biden, Borouge's Big Abu Dhabi IPO

The Top 5 Stories Shaping Emerging Markets from Global Media - May 23

After $5 Trillion Selloff, Buying Opportunity in Emerging Markets?

Bloomberg

“The wreckage of a $5 trillion rout in emerging markets is starting to look like a buying opportunity to some intrepid investors.”

“The pain points are all too obvious: Stocks have fallen below their average valuations of the past 17 years. Local-currency bond yields have soared through a range that’s held since the 2008 crisis. Spreads on dollar bonds are close to thresholds seen only during times of distress.”

“After 15 months of capital outflows, emerging markets are at an advanced stage of pricing in the risks. For some money managers, that means it’s time to start buying again -- not in a bullish outburst, but in gradual, cautious steps. Still, the risk of deeper losses remains, especially if China’s economy slows further or the Federal Reserve turns more hawkish.”

“‘We have reduced our bearishness on the emerging-market asset class,’ said Paul Greer, a money manager at Fidelity International in London. “While fundamentals remain very challenged, the valuations on offer, coupled with a more favorable technical picture, have meaningfully altered the near-term risk-reward asymmetry.’”

“The combined equity values of the 24 nations classified as emerging markets by MSCI Inc. has fallen $4 trillion since a peak in early 2021, while Bloomberg gauges of dollar bonds and local-currency debt have lost $500 billion each from their highs. Fed rate hikes and quantitative tightening are the top concern for investors, but surging inflation, fresh pandemic outbreaks in China and the war in Ukraine also play a role.” Bloomberg reports.

IMF Chief Says World Faces ‘Biggest Test’ Since World War II

Financial Times

“The head of the IMF has warned at the start of the World Economic Forum in Davos that the global economy faces perhaps its ‘biggest test since the second world war’. Kristalina Georgieva, IMF managing director, said Russia’s invasion was ‘devastating lives, dragging down growth and pushing up inflation’, and urged countries not to ‘surrender to the forces of geo-economic fragmentation that will make our world poorer and more dangerous.’”

“Georgieva’s warning came as Ukraine stepped up its bid to give its citizens hope of a brighter future, if the war can be won, with a $1tn package of reconstruction support, financed from confiscating frozen Russian assets.”

“Speaking to the Financial Times from the Ukraine House, which has taken over the centre of Davos, Switzerland, Natalie Jaresko, a former finance minister, said the world should support Ukraine’s ideas for reconstruction because ‘Putin has attacked us all’.”

“Delivering the message of Ukraine in Davos, the US-born Jaresko, who ran the finance ministry in Kyiv in 2014-16, warned that everyone in the world would soon feel the economic effects of Russia’s invasion. ‘From the poorest nations with a food crisis, to the US and EU through oil and gas prices, and to all those wanting to stop climate change, we need Ukraine to prevail,’ she said.” The FT reports.

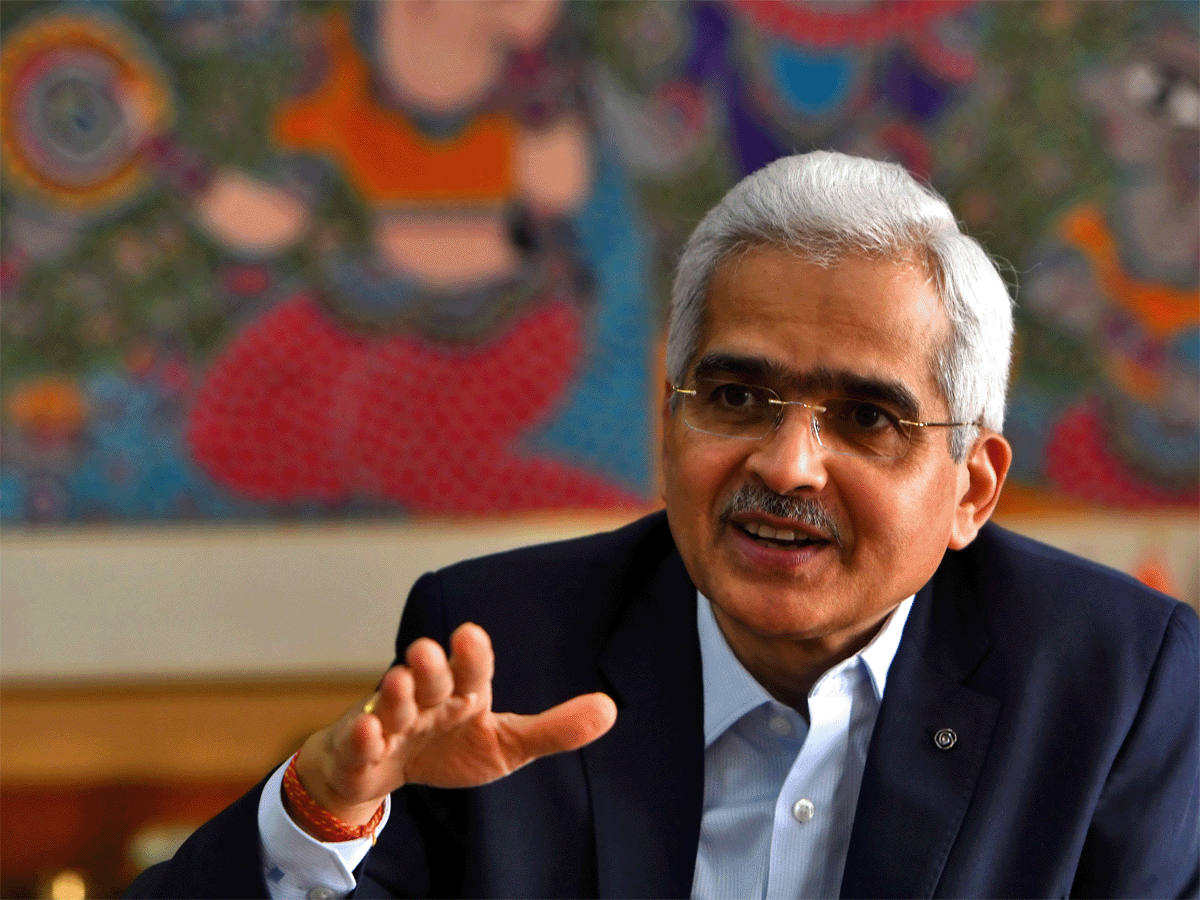

India Central Bank Chief Says Rate Hikes Coming, a ‘No Brainer’

Live Mint India

“The Reserve Bank of India (RBI) is looking at more rate hikes in the next few meetings, said Governor Shaktikanta Das in an interview with CNBC TV18 on Monday, adding that the the central bank will also release a new inflation forecast at its June meeting.”

“‘Expectations for higher rates are a no brainer and policymakers are aiming to remove a liquidity overhang,’ he said adding that the RBI will not allow a runaway depreciation of the rupee.”

“Inflation above the 6% upper range for four straight months prompted the central bank to raise rates in a surprise meet earlier this month. In a surprise move, RBI hiked the repo rate by 40 basis points (bps) to 4.4%, and is expected to increase the key lending rates again in the June meeting of the MPC which is scheduled for June 6-8.”

“‘We have entered another phase of coordinated action between fiscal and monetary authorities to check inflation,’ Das said in the interview, adding that the measures would have a sobering impact on consumer prices.”

“The Governor added that fiscal and monetary authorities were working in co-ordination to control inflation which has stayed well above the central bank's mandated target band of 2-6%.

Geopolitics: Biden Says U.S Would Intervene Militarily if China Invades Taiwan

Wall Street Journal

“President Biden said the U.S. would get involved militarily to defend Taiwan if China tries to take it by force, issuing a stark warning to Beijing and appearing to break with the longstanding American policy of strategic ambiguity.”

“‘Yes. That’s the commitment we made,’ Mr. Biden said Monday at a news conference in Tokyo during his first trip to Asia as commander-in-chief. He was responding to a question about whether the U.S. would get involved militarily in response to a Chinese invasion of Taiwan after declining to send American troops to Ukraine to fight Russia’s invasion.”

“Mr. Biden stressed that the U.S. remains committed to the bedrock ‘One China policy,’ which recognizes the People’s Republic of China as the only legitimate government of China and acknowledges—but doesn’t endorse—Beijing’s claim that Taiwan is a part of China. But the president said that policy doesn’t give China the right to forcefully take over the democratically self-ruled island.”

“‘We agree with the One China policy and all the attendant agreements we made. But the idea that it can be taken by force, just taken by force, would just not be appropriate,’ Mr. Biden said. ‘It would dislocate the entire region and be another action similar to what happened in Ukraine. So, it’s a burden that is even stronger.’”

“The American president played down the possibility that China will try to take Taiwan. ‘My expectation is that it will not happen, it will not be attempted,’ Mr. Biden said, adding that it is important for world leaders to send a strong message that there will be consequences if Beijing takes such action.”

Borouge to Raise $2 Billion in Abu Dhabi’s Largest IPO

The National

“Borouge, the joint venture between Adnoc and Austrian chemicals producer Borealis, will raise $2 billion from its initial public offering, set to be the biggest listing yet on the Abu Dhabi Securities Exchange.”

“Borouge has set the price per share for its 10 per cent float at Dh2.45, implying an equity value of about $20bn for the company, which is selling about three billion shares to the public, it said on Monday.”

“The IPO subscription period starts on Monday and runs until Saturday for UAE retail investors. It will end next Monday for qualified institutional investors. Borouge shares are expected to start trading on the Abu Dhabi Securities Exchange on June 3.”

“Borouge is the fourth Adnoc subsidiary that has sought a listing on the second-biggest Arab stock market. Adnoc will own 54 per cent of the company after the listing while Borealis will control 36 per cent.”

“The company has secured a total commitment of about $570 million from seven strategic investors to anchor the public offering, Borouge said.” Sarmad Khan reports.

"Don’t quit. Suffer now and live the rest of your life a champion." - Muhammad Ali.