Emerging Markets Monitor - May 4

China Shorts Rising on $71B Vanguard ETF, ECB Rate Rises, Nat Gas Markets Ease, Global Trade Slows as Maersk Sees Declines, India Services Index Sizzles

The Top 5 Stories Shaping Emerging Markets from Global Media - May 4

Shorts of China-Heavy Emerging Markets ETF Rises Above $1 Billion

Bloomberg

“Investors have added almost $600 million to bets that an emerging-market index dominated by Chinese stocks will lose money.”

“Short selling of the $71 billion Vanguard FTSE Emerging Markets ETF, which tracks an index heavy on Chinese A shares, surged in the past six weeks to $1.12 billion, or 1.6% of the fund, according to IHS Markit data. That leaves it the most shorted in 13 months, the data showed.”

“The surge in short interest on the Vanguard fund, the largest US index for emerging-market stocks, contrasts with other emerging-market ETFs that have a lower concentration in Chinese stocks, which have seen bearish wagers decrease.”

“The iShares MSCI Emerging Markets ETF has seen short-sold units drop to the lowest since September, according to Markit data. Short interest in the iShares Core MSCI EM ETF, which has the lowest allocations for Chinese stocks among its peers, is hovering near the lowest level since January.”

“Money managers who bet at the start of the year that China’s reopening will drive equity gains have been disappointed as stocks in the world’s second-biggest economy led a $500 billion selloff in emerging markets since January. The losses have come amid patchy economic data, rising geopolitical tensions and regulatory risks.”

“The Vanguard fund has tumbled 8% from a peak in January, underperforming its benchmark FTSE EM All Cap China A Inclusion Index on a one-month as well as three-month basis. As many as 2,495 of the gauge’s 4,552 stocks are Chinese.”

“Among the top 10 holdings of the Vanguard fund are Tencent Holdings Ltd., Alibaba Group Holding Ltd., Kweichow Moutai Co., Meituan and China Construction Bank Corp. The ETF offers a dividend yield of 2.6% compared with 3.2% on the MSCI Emerging Markets Index.” Srinivasan Sivabalan reports.

ECB Raises Rates by 0.25 Percentage Points

Financial Times

“The European Central Bank has raised interest rates by a quarter of a percentage point — less than previous increases — in a sign that eurozone borrowing costs may soon reach their peak.”

“The ECB’s decision on Thursday, which mirrors the US Federal Reserve’s quarter-point rate rise the previous day, takes the benchmark deposit rate to 3.25 per cent in the seventh consecutive increase since mid-2022.”

“Central banks on both sides of the Atlantic have dramatically raised rates since last year in response to a surge in inflation. But, with price pressures having fallen from their peak and a credit crunch looming, many economists think the rate-tightening cycle is nearing its end.”

“…Following a meeting of its governing council in Frankfurt, the ECB said ‘the inflation outlook remains too high for too long’ but confined itself to repeating that it would continue to take a ‘data-dependent approach’ to future policy decisions.”

“Christine Lagarde, ECB president, is likely to be asked at a press conference later on Thursday if she expects further rate rises. Investors are pricing in a couple more quarter-point moves by the ECB to lift its deposit rate to 3.75 per cent — matching its highest-ever level in 2001. This compares with benchmark rates of above 5 per cent in the US and 4.25 per cent in the UK. Eurozone inflation remains well above the ECB’s 2 per cent target after rising for the first time in six months to 7 per cent in April, up from 6.9 per cent in March.” The FT reports.

Global Natural Gas Markets Ease in 2023 Amid Price Decline and Higher Storage

The National

“A steep decline in natural gas prices and higher storage levels have eased the pressure on global gas markets this year, the International Energy Agency has said.”

“The prices of liquefied natural gas in the European and Asian spot markets fell below summer 2021 levels by the end of the first quarter of 2023, but were ‘well above’ historic averages, the agency said in its Gas Market Report on Thursday.”

“Dutch Title Transfer Facility gas futures, the benchmark European contract, is currently trading below €40 ($44.19) per megawatt hour after surging to a record high of about €343 in August last year.”

“…Supply is expected to be tight in 2023 amid uncertainties such as adverse weather, lower availability of liquefied natural gas and further curtailment of exports by Russia, the agency said. LNG exports surged last year as European countries scrambled to secure alternative sources of energy.”

“The agency said it expects global LNG supply this year to increase by only 4 per cent, which would not be enough to offset an expected drop in Russian gas supplies.”

“…The agency said it expects gas demand in China to increase by more than 6 per cent this year, supported by a recovery in economic activity.” John Benny reports.

Global Trade Slows in Blow to Maersk as Further Hit Expected

Bloomberg

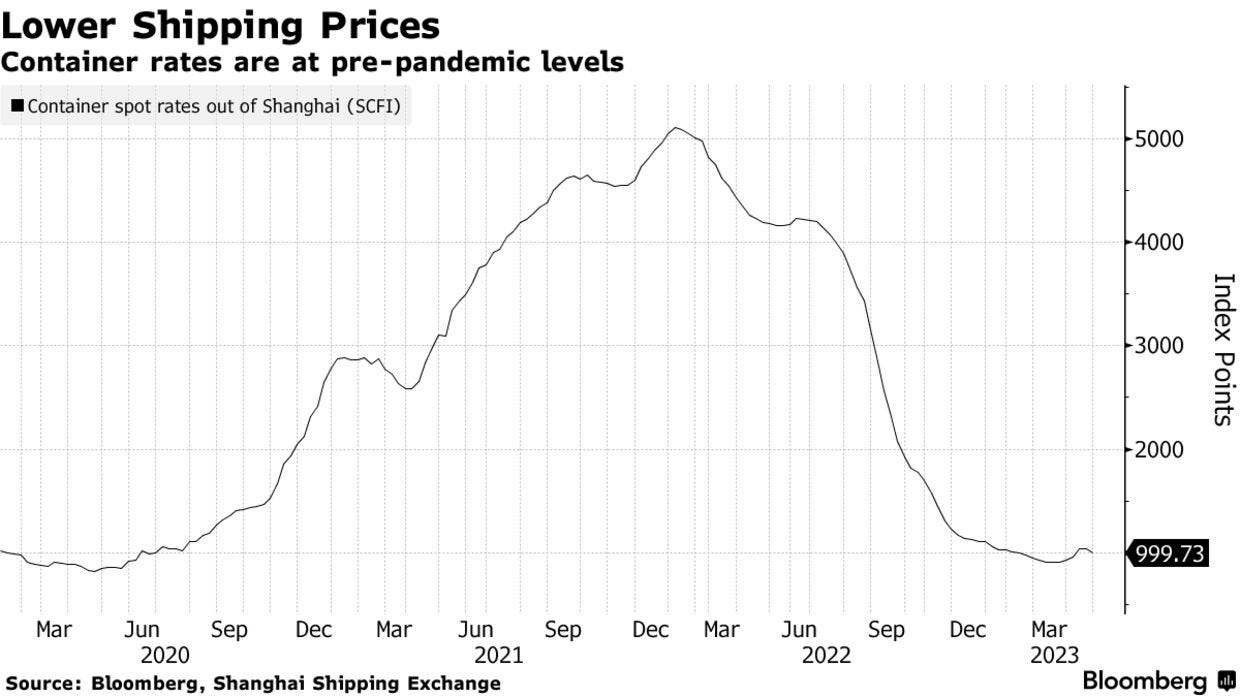

“A.P. Moller-Maersk A/S, a bellwether for global trade, signaled weaker results for the rest of 2023 after reporting first-quarter operating profit that tumbled by more than half with transport volumes slowing and freight rates plunging.”

“Maersk, which transports close to one-fifth of the world’s containers, warned that the first three months of 2023 ‘will be best quarter of the financial year,’ the Copenhagen-based company said in a statement on Thursday. It expects global economic growth to remain ‘weak’ at around 2% this year.”

“There’s ‘still a lot of clouds that we need to handle,’ Chief Executive Officer Vincent Clerc said in an interview with Bloomberg TV. As business activity slows, companies are seeking to reduce inventories at warehouses rather than moving new goods from Asia to Europe and the US. That’s a sharp turnaround from 2021 and 2022, when a spike in demand for consumer goods during the Covid-19 pandemic, coupled with supply-chain issues limiting vessel supply, lead to record profits in the freight industry.”

“In the first quarter, Maersk reported a 56% drop in earnings before interest, tax, depreciation and amortization to $3.97 billion. That compares with a median estimate of $3.55 billion in a survey of analysts. Volumes declined 9.4% in the quarter, and freight rates fell 37% and are close to the break-even level, according to the CEO.”

“The shipping company repeated its forecast that the world’s container transport volumes may shrink as much as 2.5% this year.” Christian Weinberg reports.

India’s Services Sector Index Hits 13 Year High

Economic Times (India)

“The demand strength in India's services sector promoted the fastest increases in new business and output in close to 13 years, a private survey showed on Wednesday.

The S&P Global India Services PMI Business Activity Index rose to 62 in April from 57.8 in March, signalling the fastest expansion in output since mid-2010.”

"‘India's service sector posted a remarkable performance in April, with demand strength backing the strongest increases in new business and output in just under 13 years. Finance & Insurance was the brightest spot, topping the sectoral growth rankings for both measures,’ said Pollyanna De Lima, Economics Associate Director at S&P Global Market Intelligence.”

”Along with robust domestic demand, international demand was strong as the sub-index rose to a four-month peak and business optimism hit its highest since December. However, employment generation in the services industry only saw a marginal uptick as most firms reported sufficient labour capacities to meet rising demand.”

"Rising price pressures, alongside an improving economic outlook, mean the Reserve Bank of India will likely lean towards keeping its key interest rate on hold rather than easing it anytime soon. The overall S&P Global India Composite PMI Output Index rose to 61.6 in April, the highest since July 2010, as activity in both manufacturing and services remained strong.” Economic Times reports

"Let me not pray to be sheltered from dangers,

but to be fearless in facing them.

Let me not beg for the stilling of my pain, but

for the heart to conquer it."

— Rabindranath Tagore