Emerging Markets Monitor - October 9

Iran Concerns Grip EM As Israel Heads to War, Oil Prices Jump, India's Booming Stocks, U.S-China Jockey Ahead of Biden-Xi Meet, Debt Defaults Loom in EM

The Top 5 Stories Shaping Emerging Markets from Global Media - October 9

Iran Concern Grips Emerging Markets as Israel Heads to War

Bloomberg

“The possibility of conflict with Iran surged to the top of emerging-market investors’ concerns as they returned from the weekend to assess the fallout of another conflict between Israel and Hamas.”

“The outbreak of war in the Middle East has momentarily replaced Federal Reserve policy and China’s growth as the most immediate concern, after surprise attacks by the militant group on Saturday killed at least 700 people inside Israel. The risk-off move on Monday morning was largely confined to Middle Eastern stocks and crowded currency trades in Mexico and eastern Europe, though, with losses across wider emerging markets more muted.”

“One fear is that the US could take a more active role in the conflict after it sent an aircraft-carrier strike group to the eastern Mediterranean and a Wall Street Journal article said Iran was actively involved in planning the attack. A brief surge of over 5% in oil prices also raised concerns of spill-over effects on global inflation.”

“‘The general consensus is that the effects of this conflict are going to be localized,’ said Simon Harvey, head of foreign-exchange analysis at Monex Europe Ltd. ‘But, there is a risk that this broadens out into a larger conflict threatening to destabilize the region as a whole, and that is why close attention is being paid to the actions of the US and Iran in the coming days.’”

“…The grim newsflow from Israel had already sunk those Middle Eastern stock markets that were open on Sunday, but the losses continued across the region for a second day as concerns of a prolonged war deepened. Benchmark indexes in Dubai, Abu Dhabi and Istanbul, which opened for the first time since the attacks, caught up on their peers with outsized losses.” Srinivasan Sivabalan reports.

Oil Price Jumps to $89 a Barrel Following Hamas Attack on Israel

Financial Times

“Crude prices surged to as high as $89 a barrel on Monday over concerns that Hamas’s attack on Israel will increase tension across the Middle East and affect output from leading oil producers. Brent, the international oil benchmark, jumped as much as 5.2 per cent in early trading in Asia, before steadying to trade 3.8 per cent higher at $87.83. WTI, its US counterpart, rose 4 per cent to $86.07.”

“The jumps have revived fears of another prolonged period of high prices that would fuel inflation in many parts of the world. Supply cuts by major producers Saudi Arabia and Russia had pushed Brent above $97 a barrel at the end of September, before prices dropped 11 per cent last week amid concerns about slowing global growth.”

“…Israel is not an oil producer, but there are concerns the conflict could trigger wider uncertainty in the region and lead to tougher enforcement of sanctions on oil from Iran, whose foreign ministry backed Hamas’s actions as an act of self-defence. Adding to the uncertainty, Israel suspended production at its offshore Tamar gasfield, sending European gas futures prices about 13 per cent higher.”

“…Pierre Andurand, a hedge fund manager who specialises in energy trading, said that while there was little immediate threat to supplies, the market could tighten. ‘Over the past six months we have seen a very large increase in Iranian supply due to weak enforcement of sanctions,’ he wrote on social media site X, formerly Twitter. ‘There is a good probability that the US administration will start enforcing those sanctions on Iranian oil exports more tightly.’”

“The gains followed a report in The Wall Street Journal citing claims from senior members of Hamas that officers of Iran’s Islamic Revolutionary Guard had helped plan the militant group’s surprise attack on Israel. US officials have yet to confirm any such connection, and on Sunday US secretary of state Antony Blinken told CNN that ‘we have not yet seen evidence that Iran directed or was behind this particular attack’.” The FT reports.

India’s Booming Stock Market is Leaving China in the Dust

Wall Street Journal

“India’s stock market is booming, helped by billions of dollars of inflows from international funds and a fast-growing army of small investors.”

“The MSCI India index has gained more than 7% this year, pulled higher by a rally in the shares of banks and automakers. The MSCI China index has lost almost 11% of its value, while a wider emerging-market index is down 2%.”

“Foreign investors put $8.3 billion into Indian equity funds between January and August, the highest amount on record for the period, according to data provider EPFR. They started selling their India holdings in September, but the country’s stock market still attracted more foreign investment in the third quarter than anywhere else in Asia, according to Goldman Sachs.”

“‘Investors have cut their exposure to Chinese equities to build a large underweight position, and instead rotated into India. Foreign investors’ interest in India has been pretty dominant in driving the market,’ said Prerna Garg, an equity strategist at HSBC.”

“India’s stock market has outperformed China’s for the past three years, partly the result of China’s strict effort to combat Covid-19, which caused economic pain that the country hasn’t fully recovered from. But until this year, foreign investment in Indian stocks has been patchy. Foreign institutional investors reduced their exposure to the market by around $17 billion last year, according to data compiled by Goldman Sachs. By the end of September this year, they were net buyers of more than $15 billion of shares.”

“Some investors think stock prices in India have risen too quickly this year. Stocks in the MSCI India index were trading at a forward price/earnings ratio of around 20 at the end of August, compared with a ratio below 10 for the stocks in the MSCI China index and around 12 for the wider emerging-markets index. That suggests Indian stocks are expensive.” Frances Yoon reports.

U.S, China Jockey For Position Ahead of Biden-Xi Summit

Wall Street Journal

“Even as the U.S. and China are trying to repair ties ahead of an expected summit between President Biden and Chinese leader Xi Jinping, Washington and Beijing are jockeying for the upper hand.”

“Each government is taking actions aimed at setting the tone in the relationship and coming into the summit in a position of strength, said people familiar with recent discussions on both sides.”

“As soon as the coming days, the Biden administration is expected to roll out long-awaited updates to export-control measures that would further restrict China’s access to advanced semiconductors and chip-making tools, according to people briefed on a draft of the updates. Timing of the release hasn’t been finalized. Beijing has objected to what it calls persistent ‘technology bullying’ by Washington.”

“Meanwhile, ahead of Xi’s expected trip to the U.S. in November to attend a summit of Asia-Pacific leaders and meet with Biden, the Chinese leader is planning to travel to Vietnam, said people close to Beijing. The aim is to showcase the two neighbors’ close relations after Biden courted Vietnamese leaders in Hanoi last month, they said.”

“The efforts by both sides underscore the intensifying competition between the two world powers even as they try to improve the relationship. ‘The U.S. and China are in the process of negotiating the boundaries of their increasingly global competition,’ said Evan Medeiros, a former senior national-security official in the Obama administration and now a professor at Georgetown University. ‘They’re trying to figure out where and how they can compete most effectively.’” WSJ reports.

Argentina, Pakistan, and Kenya Face Sovereign Debt Default: JP Morgan

Reuters

“Argentina, Pakistan and Kenya top the list of nations that might face a sovereign debt default, according to JPMorgan's September investor survey.”

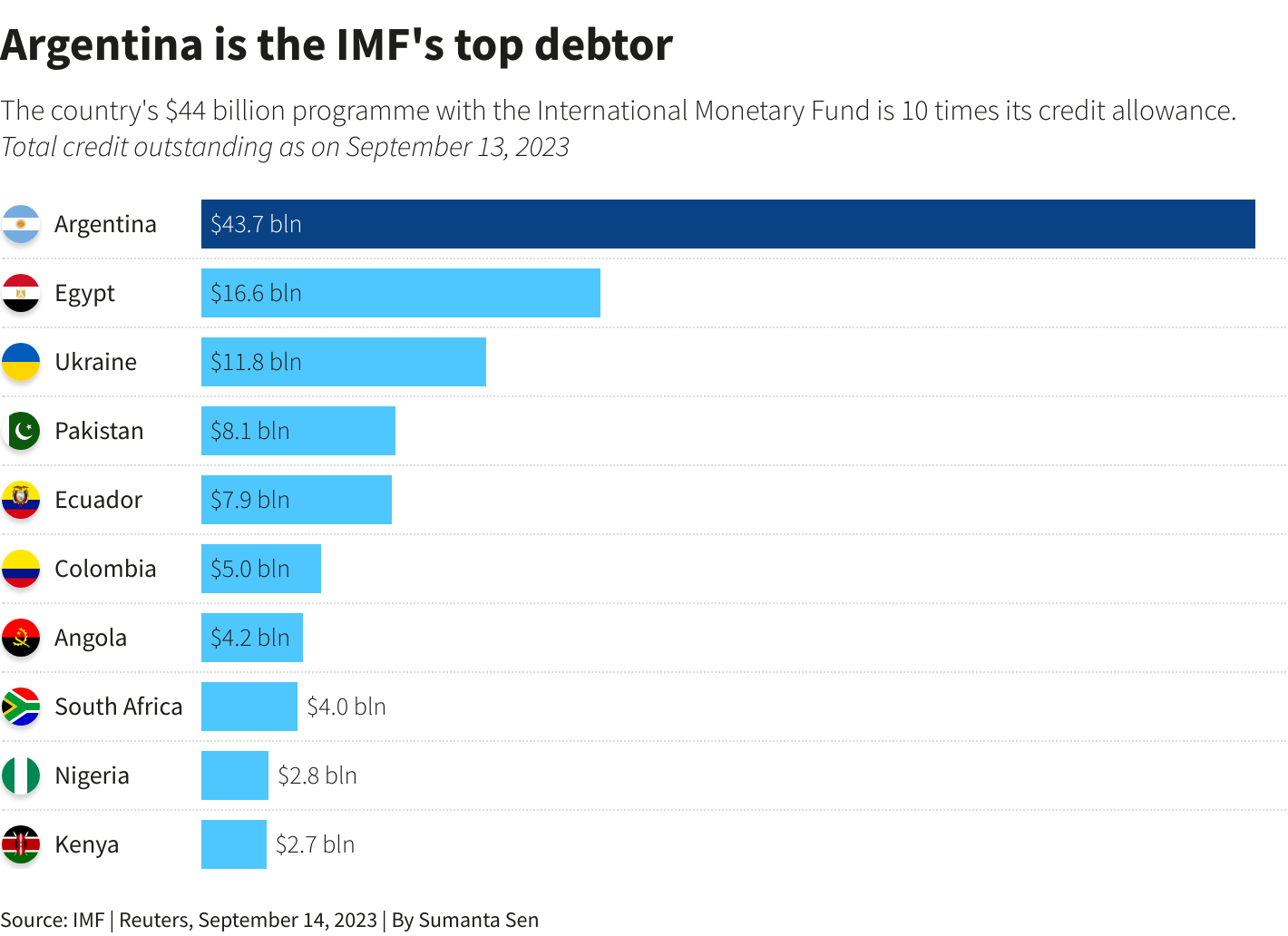

“The South American economy's reserves are negative and it has to pay back a record $44 billion IMF loan that is off track, with a presidential vote looming on Oct. 22.

“The Fund has provided Pakistan a bridge loan that should help tide the country over until the January general election. Overseas debt repayments on high-yield emerging economies will total $30 billion in 2024. Much focus is on Kenya's $2 billion bond maturing in June.”

“At the same time, higher interest rates mean it has been ‘prohibitively expensive’ for single-B sovereigns to tap international bond markets since early 2022, said Gregory Smith, fund manager at London-based M&G Investments.”

“Egypt might be the most likely country to swerve default, according to the JPMorgan survey. ‘Can the Egypt IMF programme get larger financially is the big question for the meetings,’ Smith said referring to Cairo's $3 billion loan.”

“Egypt's sovereign dollar bonds tumbled on Friday, though, after ratings agency Moody's downgraded its credit rating deeper into junk territory and IMF Managing Director Kristalina Georgieva told Bloomberg the country would continue to ‘bleed’ reserves unless it devalues its currency again.”

“Egypt, Pakistan and Nigeria - whose president is struggling to implement long-sought reforms - will spend 40% or more of revenues on debt interest payments next year, according to Fitch.” Reuters reports.

“It is well that war is so terrible, otherwise we should grow too fond of it.” - Robert E. Lee