Emerging Markets Monitor - October 10

Israel Preps for Gaza Ground War, Global Recovery Sluggish: IMF, China Developer Warns of Default, Huawei Turns to the Middle East, Masdar in $8 Renewables Deal in Malaysia

The Top 5 Stories Shaping Emerging Markets from Global Media - October 10

Israel Readies for Ground War in Gaza

Wall Street Journal

“The Israeli military massed forces for a ground invasion of Gaza as Israeli officials warned of a lengthy and destructive war, amid fears in the Middle East of a broader regional conflict.”

“Israeli airstrikes reduced parts of an upmarket Gaza City neighborhood to rubble as the Israeli government stepped up its reaction to this weekend’s cross-border incursion by Hamas gunmen who killed more than 900 Israelis and took more than 100 hostage. Israeli strikes have killed at least 830 people in Gaza since, according to the Palestinian enclave’s health ministry.”

“The death toll could rise considerably on both sides as Israel and Hamas, a U.S.-designated terrorist group, head toward all-out war. The risk is growing that the conflict in Gaza could spill over into a wider regional war that draws in Lebanon’s Hezbollah movement, or even Iran, after Israeli forces traded fire with the Lebanese group’s fighters for a third straight day on Tuesday.”

“Hamas’s mass killing of Israelis and Israel’s planned assault on Gaza could be the start of another bloody and dangerous phase in one of the world’s longest-running and most intractable conflicts, as Israel tries to crush Hamas as a threat and the Islamist organization tries to light a spark for a broader uprising by Palestinians and their supporters across the Arab world.”

“…’The scope of this is going to be bigger than before and more severe. It’s not going to be clean…We are going to go very, very aggressively against Hamas,’ Israeli military spokesman Richard Hecht told reporters on Tuesday morning. ‘We should all change the paradigm.’” WSJ reports.

Global Recovery Remains Slow, With Growing Regional Divergences

IMF.org

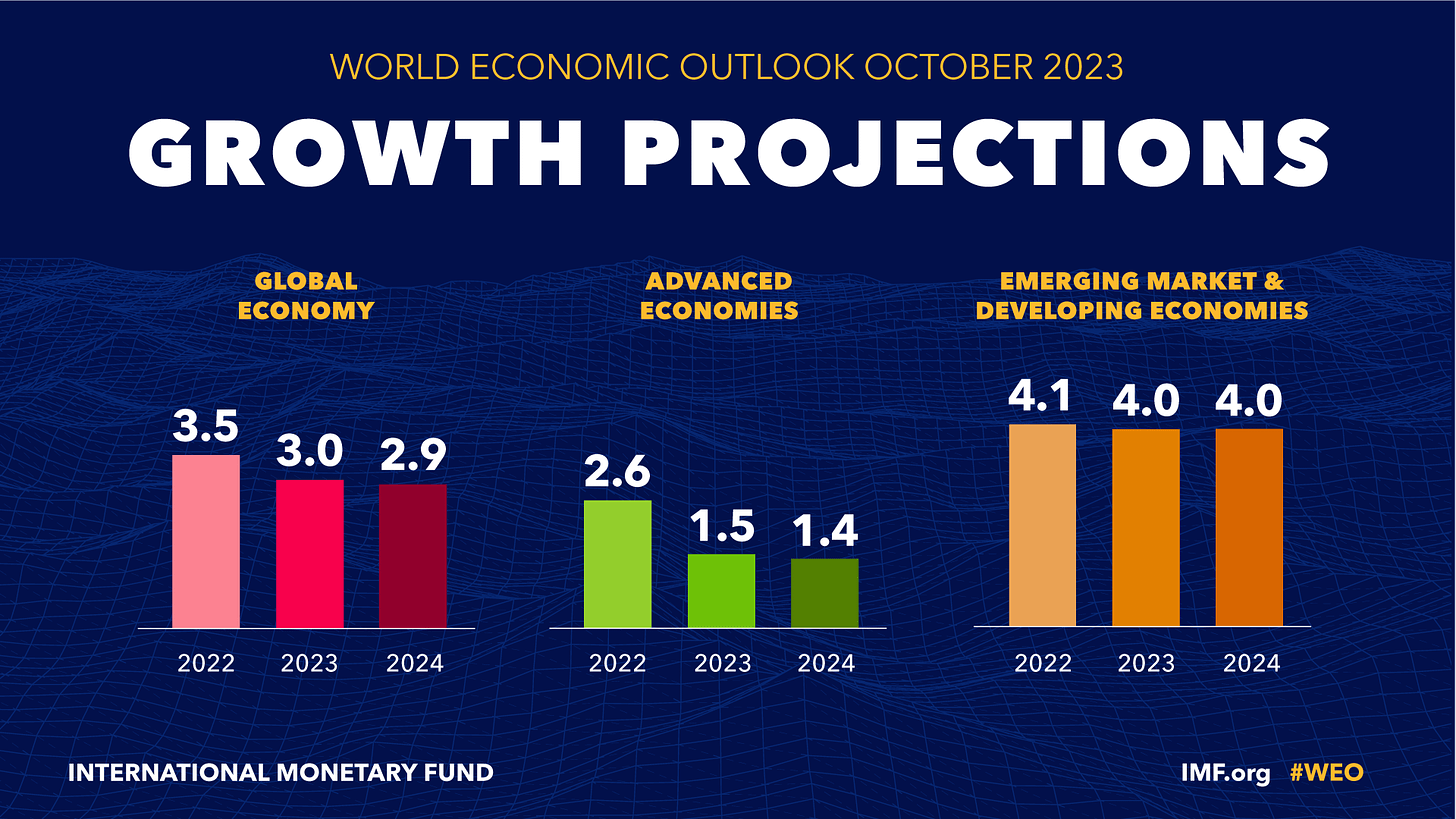

“The baseline forecast is for global growth to slow from 3.5 percent in 2022 to 3.0 percent in 2023 and 2.9 percent in 2024, well below the historical (2000–19) average of 3.8 percent.”

“Advanced economies are expected to slow from 2.6 percent in 2022 to 1.5 percent in 2023 and 1.4 percent in 2024 as policy tightening starts to bite.”

“Emerging market and developing economies are projected to have a modest decline in growth from 4.1 percent in 2022 to 4.0 percent in both 2023 and 2024.”

“Global inflation is forecast to decline steadily, from 8.7 percent in 2022 to 6.9 percent in 2023 and 5.8 percent in 2024, due to tighter monetary policy aided by lower international commodity prices. Core inflation is generally projected to decline more gradually, and inflation is not expected to return to target until 2025 in most cases.” IMF World Economic Outlook - October

China’s Largest Property Developer Warns of Default

Financial Times

“Country Garden, China’s largest private developer, has warned of a potential default on its international debts in a significant blow to the country’s embattled property sector.”

“The company, which has about $200bn in liabilities and close to $10bn in dollar-denominated debt, said in a statement to the Hong Kong stock exchange that it had missed a due payment of HK$470mn ($60mn) on some of its debts and also expected it ‘will not be able to meet all of its offshore payment obligations’ when they are due.”

“‘Such non-payment may lead to relevant creditors of the group demanding acceleration of payment of the relevant indebtedness owed to them or pursuing enforcement action,’ the company said on Tuesday.”

“The statement underscores a sudden deterioration in the financial health of Country Garden, which had so far this year withstood a sector-wide property cash crunch following the 2021 default of its peer Evergrande. The potential default also adds to concerns over China’s property sector, which typically drives more than a quarter of the country’s economic activity but has for two years been plagued by construction delays after a wave of developer bond defaults, as well as by falling demand.”

“…Country Garden missed international bond payments in August, triggering a 30-day grace period, within which it narrowly avoided default last month. It said on Tuesday that it expected not to make payments ‘within relevant grace periods’, one of which expires next week.” The FT reports.

Huawei Turns to the Middle East Amid Increasing Headwinds in Europe

South China Morning Post

“Chinese telecommunications gear giant Huawei Technologies is turning to the Middle East to promote its advanced 5G technology as the US-sanctioned company faces increasing pressure in Europe.”

“At Huawei’s Global Mobile Broadband Forum in Dubai on Tuesday, the company’s rotating chairman Ken Hu Houkun said the firm is working on 5.5G technology with operators to meet demand for equipment that can deal with growing amounts of data.”

“The 5.5G technology, also known as “5G-Advanced”, has been hailed by the company as the next level of telecommunications technology with a tenfold increase in speed over existing networks.”

“‘We need to keep innovating because technology is changing so fast, with large language models, ChatGPT and driverless cars,’ Hu said in his keynote speech via a live video chat. ‘The demands are evolving every day, so our networks also need to evolve. And we, as an industry as a whole, need to get ready for the future.’”

“It is the second time that Huawei has held its annual Global Mobile Broadband Forum in Dubai of the United Arab Emirates since the inaugural event in 2010. The move comes as the Chinese telecoms giant faces increased regulatory scrutiny in Europe on national security grounds.” South China Morning Post reports.

South-South - UAE’s Masdar Commits $8 Billion To Malaysia Renewable Energy

Arab News

“Malaysia’s energy transition is set to gain momentum with an $8 billion investment from UAE’s Masdar to develop up to 10 gigawatts of renewable projects in the Southeast Asian nation.”

“In a strategic partnership, the Malaysian Investment Development Authority inked a memorandum of understanding with the Emirati clean energy firm to develop these projects.”

“This will include ground-mounted, rooftop, and floating solar power plants, onshore wind farms, and battery energy storage systems, with a goal to complete them by 2035. According to a statement by Masdar, the collaboration marks an important milestone in pursuing a sustainable and greener future for Malaysia.”

“The MoU was formally signed by Mohamed Jameel Al-Ramahi, CEO of Masdar, and Datuk Wira Arham Abdul Rahman, CEO of MIDA. The event was attended by Malaysian Prime Minister Anwar Ibrahim and the UAE Minister of Industry and Advanced Technology, Sultan Al-Jaber, who also serves as the chairman of Masdar and holds the position of COP28 president-designate, as well as other senior dignitaries.”

“Al-Jaber underscored the significance of this agreement, emphasizing that it will strengthen the partnership between the UAE and Malaysia in the area of renewable energy, aligning with the objectives outlined in Malaysia’s National Energy Transition Roadmap.” Arab News reports.

The most authentic thing about us is our capacity to create, to overcome, to endure, to transform, to love and to be greater than our suffering. - Ben Okri

china CCP seems quite skilled at steering 1-at-a-time slow-motion property developer insolvency .