Emerging Markets Monitor - October 12

IMF Cuts '23 Forecasts, OPEC Trims Demand Outlook, Argentines Leave in Waves, Shanghai Targets Industries of the Future, India's Byju's Eyes Profits in 2023

The Top 5 Stories Shaping Emerging Markets from Global Media - October 12

IMF Cuts 2023 Growth Forecast, and Warns “Worst is Yet to Come”

The National

“The International Monetary Fund has cut its growth forecast for 2023 and warned of a cost of living crisis as the global economy continues to be affected by the war in Ukraine, broadening inflation pressures and a slowdown in China.”

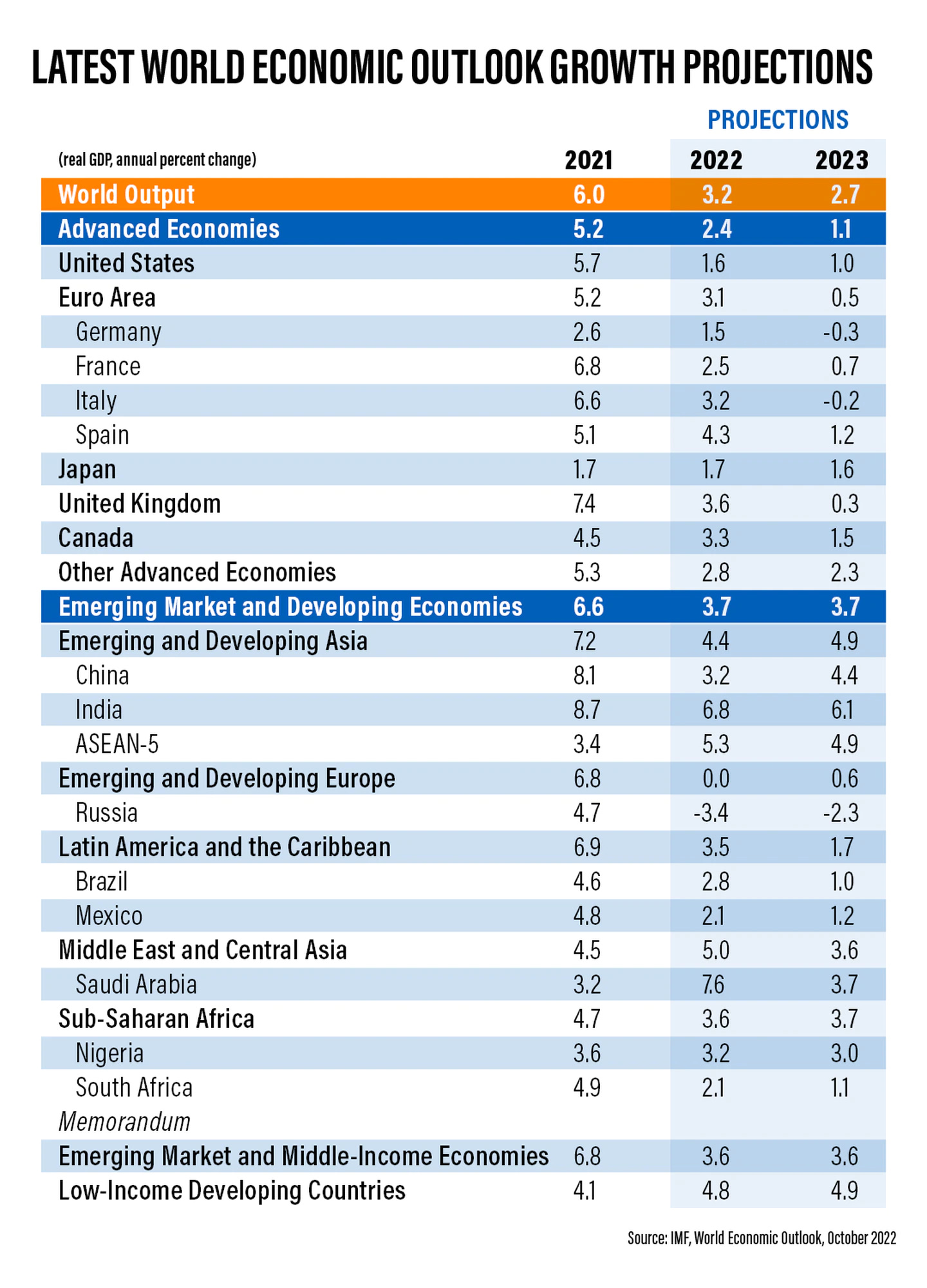

“The fund maintained its global economic estimate for this year at 3.2 per cent but downgraded next year's forecast to 2.7 per cent — 0.2 percentage points lower than the July forecast. There is a 25 per cent probability that growth could fall below 2 per cent next year, it said in its World Economic Outlook report released on Tuesday.”

“This is the weakest growth profile since 2001, except for the 2008 global financial crisis and the acute phase of the Covid-19 pandemic, and reflects significant slowdowns for the largest economies, the fund said.”

“Countries that account for about a third of the global economy are set to contract this year or next, and the world's largest economies — the US and China — along with the euro area will continue to stall.”

“‘In short, the worst is yet to come, and for many people 2023 will feel like a recession,’ said Pierre-Olivier Gourinchas, IMF chief economist.”

“Emerging market and developing economies are now projected to grow 3.7 per cent this year, down from 6.6 per cent in 2021, with China's output slowing to 3.2 per cent this year and 4.4 per cent in 2023, after an 8.1 per cent expansion last year.”

“‘As the global economy is headed for stormy waters, now is the time for emerging market policymakers to batten down the hatches,’ Mr Gourinchas said.”

“…Saudi Arabia, the Arab world’s largest economy, is forecast to grow 7.6 per cent, after expanding 3.2 per cent last year. The kingdom, the world's largest exporter of oil, has benefitted from the rally of crude prices this year after Brent, the global benchmark for two thirds of the world's oil, rose about 67 per cent in 2021 and gained about 20 per cent since the start of this year.” Massoud A. Derhally reports.

OPEC Trims Oil Demand Outlook, Making Case for Its Supply Cut

Bloomberg

“OPEC slashed projections for the amount of crude it will need to pump this quarter, making the case for the contentious supply cut announced last week.”

“The Organization of Petroleum Exporting Countries reduced forecasts for its required production in the fourth quarter by 440,000 barrels a day, and slashed estimates for global demand growth in the period by more than twice as much, according to its monthly report.”

“The downgrade to consumption gives further insight into the motivations for the substantial 2 million barrel-a-day supply cut agreed by Saudi Arabia and its allies on Oct. 5, a move that provoked fierce criticism from President Joe Biden and other US officials.”

“‘Risks are skewed to the downside, with slowing growth in the global economy,’ OPEC’s Vienna-based research department said in the report. Combined with ‘a possible resurgence of Covid restrictions in China and elsewhere,’ the oil market may miss out on the typical seasonal uptick in consumption, it said.”

“Saudi Energy Minister Prince Abdulaziz bin Salman cited a ‘variety of convoluted uncertainties’ last week for the OPEC production cutback, as several institutions have downgraded their forecasts for economic growth.”

“The International Monetary Fund warned on Tuesday that the worst of the current turmoil ‘is yet to come.’ Oil prices slumped 23% in the third quarter, their worst rout in more than two years, putting OPEC nations’ revenue at risk.” Grant Smith reports.

Argentines Leaving the Country in Waves Amid Deteriorating Economy

Financial Times

“Argentines are leaving the country in waves as its deepening economic crisis spurs thousands to emigrate for the first time in a generation.”

“The Latin American country has historically drawn in migrants from elsewhere. In the late 19th century, people arrived from Europe, followed by Jewish migrants in the pre-war period and later Bolivia, Paraguay and more recently those fleeing economic turmoil in Venezuela.”

“But poor job prospects, rocketing inflation and a government that is struggling to restore public confidence appear to be slowly reversing this trend, as more Argentines opt to escape the nation’s troubled finances.”

“‘Five years ago, no one I knew lived abroad, Belén Ferrari, 30, told the Financial Times. Fifteen of her friends from the capital, Buenos Aires, live in Europe, more than half of them in Spain. Some call Barcelona ‘BA on the Med’, in a reference to the latest influx from the capital.”

“…The leftwing Peronist government is struggling to fund itself with an ever-increasing pile of domestic debt and precariously low-net international reserves. Political infighting ahead of an election next year has dashed any hopes about the government’s ability to shepherd reforms to bring down inflation.” Lucinda Elliott reports.

Shanghai Aims to be Future Industries Hub As US-China Tensions Deepen

South China Morning Post

“Shanghai, China’s financial and semiconductor production centre, has declared its ambition to become a base for ‘industries of the future’ amid an intensifying US-China tech war and stringent Covid-19 controls.”

“Under a guideline published by the Shanghai government on Tuesday, the city aims to groom innovative enterprises and talent in areas including health, smart technology, energy and materials. By 2030, the city wants to be home to 1,000 hi-tech enterprises with a combined production output of 500 billion yuan (US$70 billion).”

“Shanghai, the country’s financial and business capital, has unexpectedly emerged as a high-end manufacturing base in recent years thanks to generous policy support. The city is currently China’s largest chip producer, contributing a quarter of the national semiconductor value output, as well as 40 per cent of chip talent last year.”

“Several major Chinese chip companies, including national champion Semiconductor Manufacturing International Corporation, are already headquartered in Shanghai, while start-ups such as Biren Technology and Iluvatar CoreX have also set up shop in the city.” Tracy Qu reports.

Byju’s To Hire 10,000 Teachers, Designs Mega Plan to be Profitable by 2023

Mint India

“Byju's will turn profitable by March 2023, the Tiger Global-backed edtech company has claimed. Byju's announced on October 12 that it had plans to turn profitable by March 2023.”

“Byju's has developed a plan to reduce its marketing and operating costs in order to turn a profit by March 2023. As a result, 5% of its workforce, or roughly 2,500 workers, will be let go during the following six months.”

“According to Divya Gokulnath, co-founder of Byju, the company will start concentrating on establishing brand awareness abroad through new collaborations and hire 10,000 teachers for both its Indian and international operations.” Mint reports.

“Be yourself; everyone else is already taken.” ― Oscar Wilde