Emerging Markets Monitor - October 31

Lula's Economic Challenges, China Stocks Routed, World Food at Risk After Black Sea Deal Breaks, Wanted: More Energy (Including Oil) Investment, Eurozone Price Woes

The Top 5 Stories Shaping Emerging Markets from Global Media - October 31

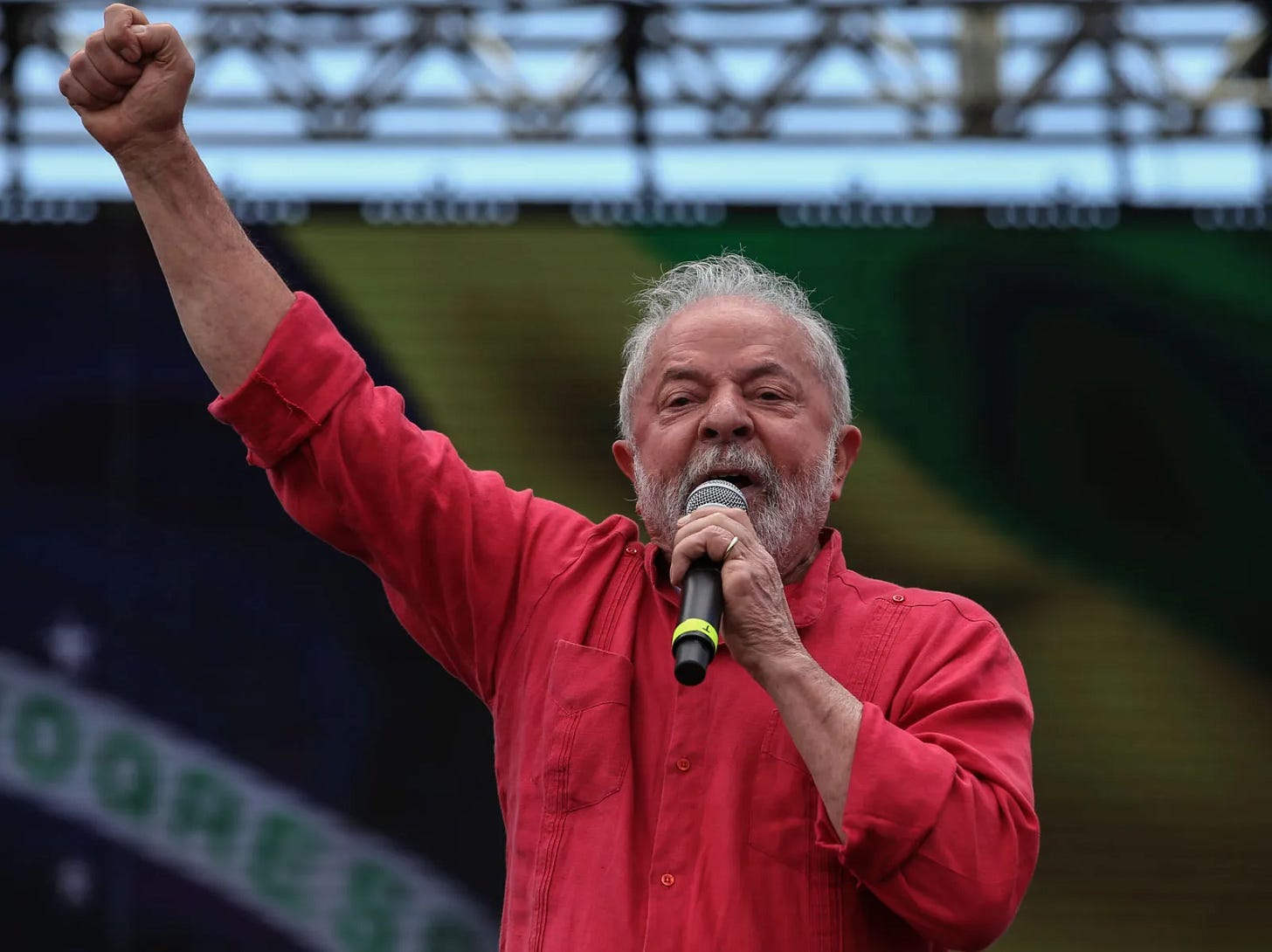

Lula Wins Brazil Election. Promises Prosperity, But Faces Economic Perils

Wall Street Journal

“Voters who swept Luiz Inácio Lula da Silva back into the presidency Sunday fondly recall his last heady two terms in office in the 2000s when commodity prices were soaring, poverty was plunging and Brazil was finally seen as the country of the future.”

“…But Brazil’s president-elect will struggle to deliver on those promises in the current economic climate when he takes office Jan. 1, economists said.”

“Mr. da Silva—who former President Barack Obama once called ‘the most popular politician on earth’—is now 77 and faces a different world. China, the biggest buyer of its exports, expects its worst slowdown in years, the U.S. is forecast to enter recession in the next 12 months, and countries worldwide, among them Brazil, are struggling to reduce poverty and jump-start moribund economies as they emerge from the Covid-19 pandemic.”

“When Mr. da Silva first took office in 2003, Brazil’s economy was revving up as a rapidly growing and voracious China consumed everything from Brazilian iron ore to beef, sugar to soybeans.”

“By 2010, Brazil was growing at 7.5%, its fastest rate in a quarter of century, and Mr. da Silva finished his two terms with an approval rating of more than 80%. With state coffers filling up, Brazil paid off its International Monetary Fund debt early and poured money into social welfare spending and infrastructure projects to jack up oil production and bring industrial jobs to forlorn corners of the country. More than 25 million people were lifted from poverty, the Getulio Vargas Foundation said.”

“‘They were really exceptional circumstances…a one-off boom,’ said William Jackson, chief emerging markets economist at London-based research firm Capital Economics. ‘It’s going to be a very challenging environment over the course of this presidential term.’ Mr. Jackson added that Mr. da Silva could follow the path of Chilean President Gabriel Boric, whose approval ratings sunk after he took office in March as the reality of the tough global economic context set in.”

“Economists expect Brazil’s economy to grow just 0.6% next year, after 2.8% growth this year, according to a survey Monday by the Central Bank.” WSJ reports.

China Stocks Extend Post-Congress Rout Amid Lockdowns

Bloomberg

“Chinese shares extended losses following last week’s selloff as a ramp-up of Covid restrictions and poor economic data worsened the outlook for the market.”

“The Hang Seng China Enterprises Index ended Monday’s volatile session with a 1.8% loss, closing at its lowest since November 2005. Property shares plunged, while tech shares bucked the downtrend following BYD Co.’s record earnings. The CSI 300 Index, a benchmark of onshore shares, fell 0.9% to its lowest close since February 2019.”

“Chinese stocks have faced relentless selling pressure through most of the year, hammered by Covid curbs and tensions with the US. Sentiment suffered a fresh blow after President Xi Jinping’s power grab and his recommitment to the Covid Zero strategy at the Communist Party congress, which spurred the worst ever five-day rout for the Hang Seng China gauge following any leadership meet since its 1994 inception.”

“Down 40% this year, the Hang Seng China Enterprises Index is the worst performer among more than 90 global equity measures tracked by Bloomberg.”

“‘Investors appear to be increasingly concerned about three issues in particular,’ namely that China’s reopening might take longer than expected, China’s social priorities may take precedence over the economy and Beijing’s emphasis on security means a higher risk premium, strategists at Nomura Holdings Inc. including Chetan Seth wrote in a note.” Bloomberg reports.

World Food Supplies at Risk as Russia Withdraws from Black Sea Grains Deal

Reuters

“Russia's weekend backtrack from a U.N.-brokered deal to export Black Sea grains is likely to hit shipments to import-dependent countries, deepening a global food crisis and sparking gains in prices.”

“Hundreds of thousands of tonnes of wheat booked for delivery to Africa and the Middle East are at risk following Russia's withdrawal, while Ukrainian corn exports to Europe will get knocked lower, two Singapore-based traders said.”

“Russia on Saturday suspended participation in the U.N. grain deal for an ‘indefinite term’, after what it said was a major Ukrainian drone attack on its Black Sea fleet in Crimea.”

"‘If I have to replace a vessel which was due to come from Ukraine, what are the options? Not much really,’ said one Singapore-based grains trader who supplies wheat to buyers in Asia and the Middle East. Chicago wheat futures on Monday jumped more than 5% and corn rose over 2% from the fears over supplies.”

“Earlier this year global wheat prices jumped to an all-time high and corn hit a 10-year top as Russia's invasion of Ukraine added fuel to a rally set off by adverse weather and COVID-19 supply disruptions.”

“Australia, a key wheat supplier to Asia, is unlikely to be able to fill any supply gap, with shipping slots booked right up to February, traders said.” Reuters reports.

More Investment in Oil Needed to Avoid Major Shocks, ADNOC Says

The world needs to produce 30% more energy by 2050

The National

“The world will lose 5 million barrels per day of oil each year from current supplies if spending comes to a halt, Dr Sultan Al Jaber, managing director and group chief executive of Adnoc, has said.”

“‘This would make the shocks we have experienced this year feel like a minor tremor,’ he said. ‘If this year has taught us anything, it taught us that energy security is the foundation of all progress — economic, social and climate progress.’”

“Dr Al Jaber, who is also Minister of Industry and Advanced Technology, was speaking at the Abu Dhabi International Petroleum Exhibition and Conference (Adipec) on Monday, where he called for ‘maximum’ energy with ‘minimum’ emissions to ensure global energy security.”

“‘Our world is on its way to being home to 9.7 billion people by 2050. To meet their needs, the world will have to produce 30 per cent more energy than today,’ he said. ‘And as we meet that need, we will be helping to bring electricity to almost 800 million people who don’t have it today.’”

“The world needs all the solutions it can get. It is not oil and gas or solar, not wind or nuclear, or hydrogen. It is oil and gas and solar, and wind and nuclear, and hydrogen. It is all of the above, plus the clean energies yet to be discovered, commercialised and deployed.” The National reports.

Eurozone Inflation Hits Record High of 10.7% in October

Financial Times

”Eurozone inflation surged to a record high of 10.7 per cent in October, keeping the pressure on the European Central Bank to continue raising interest rates despite a sharp slowdown in growth in the third quarter.”

“The increase in eurozone consumer prices accelerated from 9.9 per cent in September, which was already the highest in the 23-year history of the euro. The latest high, reported on Monday by the European Commission’s statistics arm Eurostat, also outstripped the 10.2 per cent expected by economists polled by Reuters.”

“It was the 12th consecutive month that inflation has set a record high in the eurozone, taking it to more than five times the ECB’s 2 per cent target. Claus Vistesen, an economist at Pantheon Macroeconomics, said the latest inflation figures were ‘a proper Halloween nightmare for the ECB’.”

“Real interest rates in the region remain deep in negative territory. The central bank raised its nominal policy rate by 0.75 percentage points last week to 1.5 per cent to tackle ‘far too high’ inflation and said more increases were likely, despite signs that the euro area is on the verge of a recession.”

“Gross domestic product figures published on Monday by Eurostat confirmed eurozone growth slowed in the third quarter, rising 0.2 per cent from the previous quarter. The figure was in line with expectations, but marked a slowdown from growth of 0.8 per cent in the previous quarter. Growth accelerated slightly in Germany, but France, Italy and Spain reported sharp slowdowns.” The FT reports.

“It's never too late to be what you might have been.” ―George Eliot.

it will hardly get recognized as such, but the rejection of bolsanaro is almost as globally consequential as the rejection of trump. there is a yet unfulfilled option to regain dignity for both countries.