Emerging Markets Monitor - October 6

White House Blasts OPEC+, Investors Bearish on China, World Bank Cuts India Forecast, Lula and Brazil's Election, World Currency Reserves Shrink $1 Trillion

The Top 5 Stories Shaping Emerging Markets from Global Media - October 6

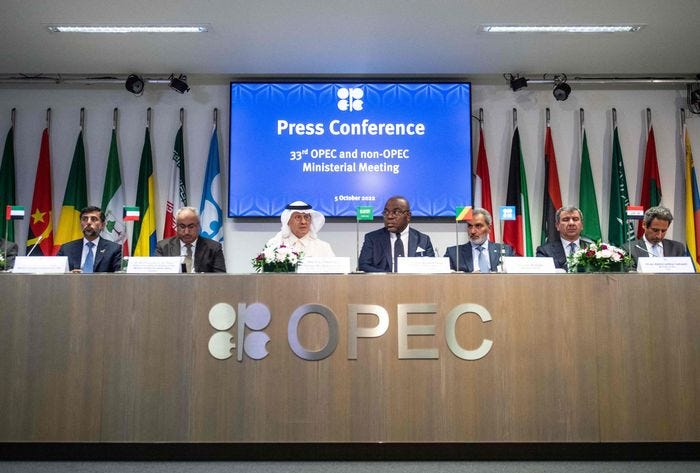

White House Accuses OPEC+ of ‘Aligning with Russia’

Financial Times

”The White House has accused Opec+ of aligning with Russia after Saudi Arabia led the group in agreeing deep oil production cuts, prompting a backlash from countries battling surging energy inflation triggered by Moscow’s invasion of Ukraine.”

“The Opec+ group said it would reduce production targets by 2mn barrels a day, equivalent to 2 per cent of global supply, following its first in-person meeting in two years in Vienna. The actual cut in output is likely to be closer to 1mn b/d as many weaker members have struggled to hit production targets in recent months.”

“The decision came despite extensive lobbying by the US government before the meeting and marked a significant breach with the Biden administration, which is seeking to drive down oil and petrol prices ahead of crucial midterm elections in November and to starve Russia of energy revenues.”

The Biden administration criticised the cuts, calling it a ‘shortsighted decision’ at a time when ‘maintaining a global supply of energy is of paramount importance’. White House spokesperson Karine Jean-Pierre told reporters on Air Force One it was ‘clear’ Opec+ was ‘aligning with Russia’.”

“Saudi Arabia’s energy minister Prince Abdulaziz bin Salman dismissed suggestions that the cartel’s cuts would hurt consumers, arguing that the group’s actions were intended to encourage long-term investment in oil production.”

“…Oil prices have risen more than 5 per cent since Friday in the run-up to the meeting, and international benchmark Brent edged higher to $93.95 a barrel after news of the cut. Analysts said Saudi Arabia’s move, which will damage western governments’ efforts to curb Russian oil income used to sustain its war in Ukraine, marked a significant moment in Riyadh’s 75-year energy alliance with the US.” The FT reports.

Bearish Views of China Stocks Takes Hold Among Investors: Survey

South China Morning Post

“Most global investors see Chinese equities as unattractive, deeming them partly uninvestable and likely to trail global peers over the next 12 to 18 months while bulls are a minority voice, according to a survey of clients conducted by BCA Research.”

“The survey showed sentiment among its clients remained fragile, with more than 60 per cent of respondents holding a bearish view on mainland China’s real estate market that has cracked under Beijing’s clampdown on excessive leverage, the Montreal-based research firm said in a report.”

“‘The majority of respondents do not expect conditions in China’s property market to improve over the coming six months,’ it said. China continues to ease policies in an attempt to shore up housing market activity but these measures ‘likely fall short of what is needed for an imminent turnaround’, it added.”

“Less than half of the respondents indicated that stocks are cheap and offer good upside potential over the next 12 to 18 months, while about 10 per cent said prices are near the bottom and worth buying.”

“Similarly, the majority of respondents were also concerned about the yuan, with 44 per cent expecting the local currency to weaken further by year-end versus 17 per cent predicting a recovery, BCA said. Like most Asian currencies, the yuan slumped past 7 per dollar last month as rate increases by the Federal Reserve fuelled a rally in the US dollar.” The South China Morning Post reports.

World Bank Cuts India Growth Forecast, Citing Global Risks

Bloomberg

“The World Bank cut India’s economic growth forecast by a full percentage point, the most for a non-crisis economy in South Asia, citing risks from a global slowdown and the hit to demand from rising interest rates.”

“India’s gross domestic product will grow 6.5% in the year to March, the Washington-based institution said in its South Asia Economic Focus report released Thursday. That revision, along with a 1.4 percentage point cut to crisis-ridden Sri Lanka’s growth outlook, pulled the region’s 2022 forecast down to 5.8% from 6.8% seen in June, even though the outlook for five other countries in the region were upgraded.”

“The view on India is sharply lower than the estimate of the Reserve Bank of India, which cut its forecast last month to 7% from 7.2%. While warning that the region faces an unprecedented combination of shocks on top of the lingering scars of the pandemic, the World Bank said some nations were coping better than others, citing the resilience of India’s exports and services sectors.”

“‘The spillovers from the Russia-Ukraine war and global monetary policy tightening will continue to weigh on India’s economic outlook,’ the World Bank said. Elevated inflation and rising borrowing costs will affect domestic demand, while slowing global growth will hurt the nation’s exports, it said.” Bloomberg reports.

Lula Shifts Strategy to Northeast Amid Campaign Worries

Buenos Aires Times

“Luiz Inácio Lula da Silva is huddling in São Paulo with his top advisers as the leftist former Brazilian president seeks to pivot his campaign to the northeast of the country and the key state of São Paulo after a narrower than expected first-round vote.”

“Lula, as he is widely known, took the most votes on Sunday. But at 48 percent to 43 percent for Bolsonaro he failed to get an outright win, and the margin was closer than most pollsters had forecast.”

“He is meeting with campaign advisers…to map out areas in need of improvement and give marching orders…Bolsonaro’s solid performance across Brazil, including his unexpected inroads in some northeastern states that have traditionally been Lula’s bastion, have brought a cold dose of reality to Lula’s campaign.”

“A sense of frustration pervaded his headquarters on Sunday night when it became clear the former president would finish the race with a lead of little more than five percentage points. The worst-case scenario, the people said, would have been an eight percentage-point gap.” BA Times reports.

World Currency Reserves Shrink by $1 Trillion in Record Drawdown

LiveMint India

“Global foreign-currency reserves are falling at the fastest pace on record as central banks from India to the Czech Republic intervene to support their currencies.”

“Reserves have declined by about $1 trillion, or 7.8%, this year to $12 trillion, the biggest drop since Bloomberg started to compile the data in 2003.”

“Part of the slump is simply due to valuation changes. As the dollar jumped to two-decade highs against other reserve currencies, like the euro and yen, it reduced the dollar value of the holdings of these currencies. But the dwindling reserves also reflect the stress in the currency market that is forcing a growing number of central banks to dip into their war chests to fend off the depreciation.”

“India’s stockpile, for example, has tumbled $96 billion this year to $538 billion. The country’s central bank said asset valuation changes account for 67% of the decline in reserves during the fiscal year from April, implying the rest came from intervention to prop up the currency. The rupee has lost about 9% against the dollar this year and hit a record low last month.” Mint India reports via Bloomberg.

“Don’t let yesterday take up too much of today.” — Will Rogers