Emerging Markets Monitor - October 26

Wall Street Split on EM Equities, Hong Kong Stocks Rally After Slump, Saudi Fund Plans $24B MENA Investments, EU Gas Prices Tumble, Cocoa Industry Tensions

The Top 5 Stories Shaping Emerging Markets from Global Media - October 26

Wall Street Banks Split on EM Equities Outlook After $2 Trillion Rout

Financial Times

“Wall Street’s biggest banks are split on the outlook for emerging market equities, with Morgan Stanley and Goldman Sachs taking diametrically opposed views after a punishing $2tn sell-off this year.”

“An MSCI index of EM stocks has slumped about 30 per cent since early January, reflecting a punishing rout in markets ranging from China to South Korea. Those steep declines have fuelled debate among analysts about how much worse things can get, with Morgan Stanley identifying bargain opportunities just as Goldman casts doubt over a possible recovery.”

“The divergence comes at a critical point for emerging markets, particularly in Asia, which has been hard-hit by the global sell-off. The deteriorating sentiment is due in large part to an economic downturn in China, which has weighed on growth across the region, as well as a slump in semiconductor demand and a tech rout aggravated by rising interest rates in the US.”

“Investors have grown increasingly sceptical on China’s economic outlook in the wake of Xi Jinping’s consolidation of power at the party congress in Beijing, which helped spark a sell-off in Chinese equities earlier this week. Hong Kong’s Hang Seng tech index fell almost 10 per cent on Monday, its second largest one-day drop on record.”

“Elsewhere in the region, South Korea’s benchmark Kospi index is down 38 per cent this year after adjusting for currency depreciation against the dollar, while Taiwan’s Taiex has fallen almost 40 per cent by the same measure.”

“The EM wipeout has spurred more than $70bn of outflows from emerging market bond funds and wiped $2.1tn off the market capitalisation of stocks tracked by the benchmark MSCI Emerging Markets index, which is down 29.8 per cent this year.” The FT reports.

Hong Kong Stocks Halt Five Day Slump as Tencent and Meituan Rally

South China Morning Post

“Hong Kong stocks halted a five-day slump to climb from a 13-year low as valuations cheapened and authorities in the city and mainland China took steps to reassure investors about market stability. A flare-up in Covid-19 cases in Beijing tempered gains.”

“The Hang Seng Index rose 1 per cent to 15,317.67 at the close, giving up a gain of as much as 2.8 per cent. The benchmark arrested a 10 per cent slide over the preceding five trading sessions. The Tech Index gained 2.5 per cent, while the Shanghai Composite Index added 0.8 per cent.”

“Meituan rallied 5 per cent to HK$129.70 and Tencent added 2.5 per cent to HK$211.60, while WuXi Biologics jumped 3.4 per cent to HK$40. The city’s stock exchange operator Hong Kong Exchanges and Clearing rose 4.3 per cent to HK$233.60. HSBC added 0.8 per cent to HK$40.25.”

“Wednesday’s gains followed an overnight rebound in US-listed Chinese stocks in New York, recouping some of the record 14 per cent slump on Monday.” Zhang Shidong reports.

Saudi Wealth Fund Plans $24B Investments in MENA Region

Bloomberg

“Saudi Arabia’s sovereign wealth fund plans to invest $24 billion in Middle Eastern and North African countries as the oil-rich kingdom seeks to bolster regional economies.”

“The Public Investment Fund plans to set up companies to invest in Bahrain, Oman, Jordan, Iraq and Sudan, according to a statement. It will channel funds into several sectors including infrastructure, heath care, real estate and telecommunications. In August, the PIF started the Saudi Egyptian Investment Co. to invest in Egypt.”

“Saudi Arabia’s Crown Prince Mohammed bin Salman is sitting on his first budget surplus since coming to power, allowing him to channel billions of dollars into assets globally and to plan ambitious construction projects.”

“The wealth fund, also chaired by the crown prince, is a key lever for the kingdom’s efforts to revive growth after a recession caused by the coronavirus pandemic and lower oil prices. Since 2015, the PIF has grown assets under management to $620 billion from about $150 billion.” Dana Khraiche reports.

EU Gas Prices Tumble in Lull Before the Storm. Negative Prices On Horizon

Bne IntelliNews

“Gas prices have been falling fast in the last few weeks as the EU storage tanks are nearly full. Unlike equities, which are priced on a discount to future revenue flow, gas prices are set on the day depending on how much space is left in the tanks and how much gas is being consumed. Given at the moment the tanks are also completely full and thanks to one of the balmiest Octobers in years, the price for gas could well go negative in the next few weeks.”

“….The downward pressure on gas prices has mounted rapidly. A flotilla of LNG tankers is currently anchored off the EU coast, holding far more gas than the tanks can accommodate. On top of that, European countries have rallied to governments’ calls to decrease consumption, further reducing demand. A Brussels-based think-tank recently estimated the pan-Europe fall in consumption at 7% and in Germany consumption has dropped by an estimated 30%.”

“Negative gas prices would be a repeat of oil prices that fell to less than zero for the first time ever in April 2020 due to similar bizarre market conditions cause by the coronavirus (COVID-19) and likewise turned the market on its head thanks to a massive slump in demand.” Ben Aris reports.

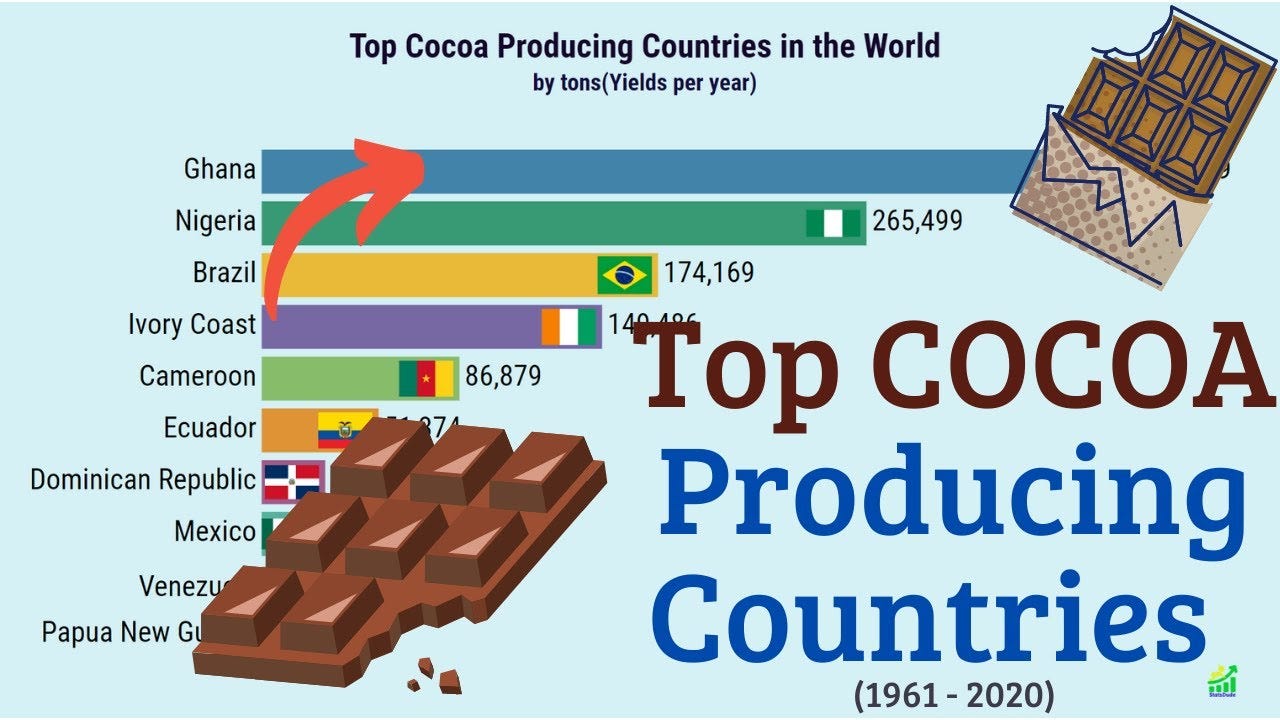

Ghana and Ivory Coast Civil Society Orgs Denounce Global Chocolate Industry, Praise Governments’ Cocoa Summit Boycott

Ghana Business News

“The Ghana Civil-Society Cocoa Platform and the Plateforme Ivoirienne pour le cacao durable of Côte d’Ivoire have commended governments of Ghana and Cote d’ Ivoire for boycotting the World Cocoa Foundation partners’ meeting scheduled for Brussels.”

“The two organisations comprising of farmers, farmer-based organisations, cocoa cooperatives, small-scale processors, media, and civil society organisations said they endorsed the action and the justifications for boycotting the event, which would take place on October 26 and October 27, 2022.”

“‘We believe it is about time the world recognised the double standards of multinational cocoa and chocolate industries, especially on cocoa pricing and the deteriorating living conditions of cocoa farmers due to their self-seeking interests and quest to maximise profits without any willingness to distribute profits along the value chain,’ the organisations said in statement.”

“They said the refusal of multinational cocoa and chocolate industries to pay the right prices for cocoa beans under the pretext of sustainability programmes, which prevented the payment of a living income had affected farmers negatively.”

“…Côte d’Ivoire and Ghana account for 65 per cent of global cocoa production, but farmers in these two countries earn less than six per cent of the chocolate industry’s total revenue valued at about US$130 billion per annum.”

“New studies have shown that the share of cocoa growers in the overall chocolate industry has drastically reduced over the years as traders, brands and retailers have accumulated super profits.” Ghana Business News reports.

“The best time to plant a tree was 20 years ago. The second best time is now.” ―Chinese Proverb