Emerging Markets Monitor - October 10

IMF Warns of Global Recession, Russia Bombards Ukraine with New Strikes, World Container Index Down, Indonesia to list Pertamina Unit, MENA Start-Ups Rising

The Top 5 Stories Shaping Emerging Markets from Global Media - October 10

IMF, World Bank Warn of Increasing Risk of Global Recession

Bloomberg

“The International Monetary Fund and World Bank warned of the rising risk of a global recession as faster inflation forces central banks to raise interest rates, crimping growth.”

“Higher borrowing costs are ‘really starting to bite,’ IMF Managing Director Kristalina Georgieva said alongside World Bank President David Malpass at a virtual event on Monday kicking off the annual meetings of their institutions.”

“The IMF calculates that about one-third of the world economy will have at least two consecutive quarters of contraction this year and next, and that the lost output through 2026 will be $4 trillion.”

“At the same time, policymakers can’t let inflation be a ‘runaway train,’ Georgieva said. Malpass warned that there’s a ‘real danger’ of a worldwide contraction next year, and that dollar strength is weakening the currencies of developing nations, increasing their debt to ‘burdensome’ levels.” Eric Martin reports.

Bloomberg summary:

World Economic Outlook: the IMF releases this on Tuesday. Georgieva said last week that the 2023 global growth forecast of 2.9% will be lowered.

Ukraine: the country Vladimir Putin’s forces invaded in February will stay in focus, from the impact of a depleted grain harvest to Russia’s gas squeeze on Europe. The IMF board on Friday approved a $1.3 billion loan for Ukraine, its first lending to the nation since early March.

Food Prices: the IMF board last month approved a new emergency finance “food shock window” to help nations hurt by rising agricultural costs.

The UK: the country remains vulnerable after market turmoil forced a partial U-turn on a tax-cut package from new Prime Minister Liz Truss’s government that was panned by the IMF.

The Fed: US tightening is hurting other economies. IMF calculations show 60% of low-income countries and a quarter of emerging markets at or near debt distress.

Climate: the crisis is only getting worse, as shown recently by disasters from flooding in Pakistan to a hurricane that slammed Puerto Rico and Florida.

Bloomberg reports.

Russia Unleashes Biggest Barrage of Strikes on Ukraine Since Invasion

Wall Street Journal

“Waves of Russian missiles slammed into Kyiv and other Ukrainian cities on Monday in one of the broadest and most intense barrages of the war, in response to a weekend attack Moscow blamed on Ukraine that seriously damaged a bridge connecting Russia to occupied Crimea.”

“Ukrainian President Volodymyr Zelensky said Russia had carried out dozens of strikes using missiles as well as Iranian-made drones to target the country’s electrical grid and other civilian infrastructure. ‘They want panic and chaos,’ he said in a video address filmed near his office. ‘They want to destroy our energy system.’”

“…Russia fired at least 83 missiles at Ukrainian cities, of which 43 were intercepted, according to Ukraine’s Defense Ministry. Nine drones were also shot down, said Ukrainian Prime Minister Denys Shmyhal, calling for more modern weapons systems to protect Ukraine’s skies.” WSJ reports.

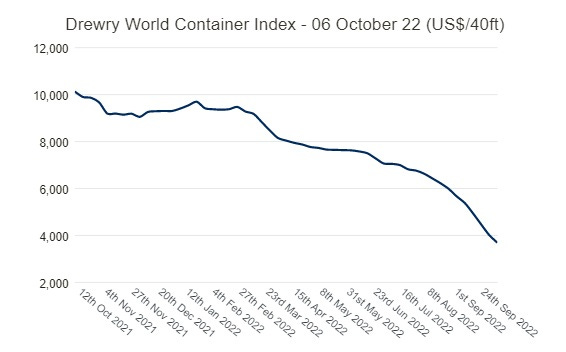

World Container Index Down 8% This Week

Hellenic Shipping News

“Drewry’s composite World Container Index decreased by 8% to $3,688.75 per 40ft container this week. The composite index decreased by 8% this week, the 32nd consecutive weekly decrease, and has dropped by 64% when compared with the same week last year.”

Source: Drewry

Source: Drewry

“The latest Drewry WCI composite index of $3,689 per 40-foot container is now 64% below the peak of $10,377 reached in September 2021. It is 1% lower than the 5-year average of $3,723, indicating a return to more normal prices, but remains 160% higher than average 2019 (pre-pandemic) rates of $1,420.”

“Spot rates on Shanghai – Los Angeles fell 9% or $288 to $2,995 per 40ft box. Likewise, Rates on Shanghai – Genoa and Shanghai – New York dipped 6% and 5% to $4,912 and $6,887 per 40ft container, respectively. Rates on Rotterdam – Shanghai and Los Angeles – Shanghai slid 4% each to $967 and $1,226 per feu, respectively. However, rates from Rotterdam – New York gained 3% or $214 to $7,252 per 40ft box. Rates on New York – Rotterdam grew 4% to $1,305 per 40ft container. Drewry expects the index to decrease in the next few weeks.”

Source: Drewry as reported by Hellenic Shipping News.

Indonesia Plans Listing of Flagship Oil Group Pertamina This Year

Financial Times

“Indonesia plans to list a unit of its government-run oil group Pertamina this year, stepping up a partial privatisation push as part of reforms to its $606bn state-owned enterprise sector.”

“The initial public offering of Pertamina Geothermal Energy, which uses seismic heat to generate electricity in the volcano-studded archipelago, could value the company at up to $2bn depending on market conditions, people familiar with the matter said.”

“State-owned enterprises minister Erick Thohir said the offering would spearhead other capital raisings and strategic partnerships planned for government-controlled companies, including Pertamina’s exploration and production arm Pertamina Hulu Energi.”

“‘This is the first time one of the sub-holdings [subsidiaries] of Pertamina will go public,’ said Thohir in an interview with the Financial Times at his ministerial residence in Jakarta, adding that the IPO was slated for November or December.”

“Indonesia’s state-owned enterprises have assets equivalent to about half of the country’s $1.2tn gross domestic product in sectors ranging from telecoms and oil to cement and hotels. They generated total revenue of about $155bn and net profit of $8bn last year.” The FT reports.

Venture Capital Funding for MENA Startups Hits $2.3 Billion

The National

“Venture capital funding for start-ups in the Middle East and North Africa rose 20 per cent annually to more than $2.3 billion in the first three quarters of 2022, putting it on track to potentially surpass the total investments attracted in 2021, a study carried out by Magnitt has found.”

“Funding reached $512 million in the third quarter, which was the lowest since the first quarter of 2021, the data intelligence company said in its quarterly update, citing global economic and geopolitical factors.”

“That, however, put total funding in 2022 at more than 80 per cent of the 2021 level, leaving the industry with a full quarter to match or even surpass last year's total of about $2.8bn.”

“The start-up sector has grown exponentially over the past few years as entrepreneurs use innovation to address consumer needs. They are also increasingly seeking funding from global investors to accelerate their development.”

The sector's growth has risen in tandem with the increase in digitalisation in key sectors such as retail, services, e-commerce and government. Alvin R. Cabral reports.

“You can't cross the sea merely by standing and staring at the water.” - Rabindranath Tagore