Emerging Markets Monitor - Sept. 23

Citi Eyes India for Growth, EM Shares Fall Hard, HK Stocks Hit 11 Year Low, Dubai Toll Operator in $1B+ Listing, UN to Pakistan: Suspend Debt Payments

The Top 5 Stories Shaping Emerging Markets from Global Media - Sept. 23

Citigroup Targets India as High Priority Market Amid China Risks

Bloomberg

“Citigroup Inc. is targeting India as one of its top markets to expand in globally as risks mount in China and other regions, the bank’s global co-head of investment banking said.”

“India presents ‘very clear’ opportunities, said Manolo Falco, the global co-head of Banking, Capital markets and Advisory, in an interview in Mumbai. The New York-based lender expects initial public offerings in India to pick up next year as well as inbound deals in renewable energy and infrastructure, he said.”

“The world’s second-most populous country is gaining traction among Wall Street dealmakers in part as growing political tension casts a pall over major plans to expand in China and as tensions mount in Europe and the US. India’s main stock gauge has gained this year, in contrast to mostly steep declines seen in major global markets. The nation saw a record $82 billion in merger and acquisition deals in the second quarter, defying a slump elsewhere.”

“‘India looks very steady and it has a government that seems to know exactly what they have to do,’ Falco said. ‘The political situation in other parts of the world, and that includes Europe and probably the US and China, is a bit different I would say.’”

“After two years of expansion in China, global banks are now facing stronger headwinds as economic growth slows and political tension with the US has dented dealmaking. Banks including Goldman Sachs Group Inc., HSBC Holdings Plc, Credit Suisse Group AG and UBS Group AG have all cut investment banking jobs linked to China amid a drought in deals.” Bloomberg reports.

EM Shares Down 25% This Year, On Pace for Worst Year Since 2008

Reuters

“Emerging market currencies and stocks declined on Thursday as the dollar surged after an aggressive view for U.S. interest rates from the Federal Reserve, with investors focusing on a slew of other interest rate decisions due in the day.”

“The Fed on Wednesday lifted its policy rate by 75 basis points (bps) for the third time and projected raising rates further and faster than investors had expected. China's onshore yuan ended at a 27-month low of 7.08 per dollar, while broader EM currencies fell for a second straight day, down 0.4%.”

"‘The message was more hawkish than expected, so the market is taking in the information and you may see volatile sessions till end of the week,’ said Cristian Maggio, head of portfolio and ESG strategy at TD Securities.”

“EM shares are now down more than 25% so far this year and are on pace for their worst year since the 2008 financial crisis, as markets digest a deteriorating global growth outlook on the back of surging inflation, aggressive tightening cycles and rising geopolitical risks.” Reuters reports.

Hong Kong Stocks Hit Lowest Levels in Almost Eleven Years

South China Morning Post

“Hong Kong stocks weakened for a third day as the benchmark index hit the lowest level in almost 11 years. Property developers extended losses with higher interest rates seen rattling consumers.”

“Alibaba, Tencent, property developers drop as stocks head for 3.5 per cent weekly loss following prime-rate hike”

“Property developers lead the retreat as rising mortgage costs bring local homebuyers’ purchasing power to the lowest point this yearThe Hang Seng Index has dropped over 9 per cent this month and nearly 30 per cent this year, wiping away more than US$1.27 trillion in value”

“The Hang Seng Index lost 0.1 per cent to 18,143.06 at 10.10am local time, the lowest since December 2011. The Tech Index lost 0.2 per cent, while the Shanghai Composite Index gained 0.3 per cent.”

“Property developers led the retreat. Wharf Real Estate Investment Company tumbled 1.6 per cent to HK$37.35, New World Development dropped 0.6 per cent to HK$25.10 and Sun Hung Kai Properties lost over 0.5 per cent to HK$93.15.” Jiaxing Li reports.

Dubai Toll Operator Raises $1 Billion+ In Oversubscribed Listing

The National

“Dubai toll operator Salik raised Dh3.735 billion ($1.017bn) from its initial public offering on the Dubai Financial Market, as part of a series of IPOs of state enterprises aimed at boosting the size of the emirate's capital market.”

“The IPO was more than 49 times oversubscribed across all tranches, with total gross demand at Dh184.2bn ($50.2bn). The company had set its offering price at Dh2 a share, giving it a valuation of Dh15bn.”

“…The UAE Strategic Investment Fund, Dubai Holding, Shamal Holding and the Abu Dhabi Pension Fund are cornerstone investors in the IPO, with a total commitment of Dh606 million, representing 16.2 per cent of the offering. Cornerstone Investors’ shares are subject to a 180-day lock-up arrangement, following listing.”

“…Salik's offering is part of Dubai's plans to list 10 state-owned companies to increase the size of its financial market to about Dh3 trillion. The emirate also plans to set up a Dh2bn market maker fund to encourage the listing of more private companies from sectors such as energy, logistics and retail.”

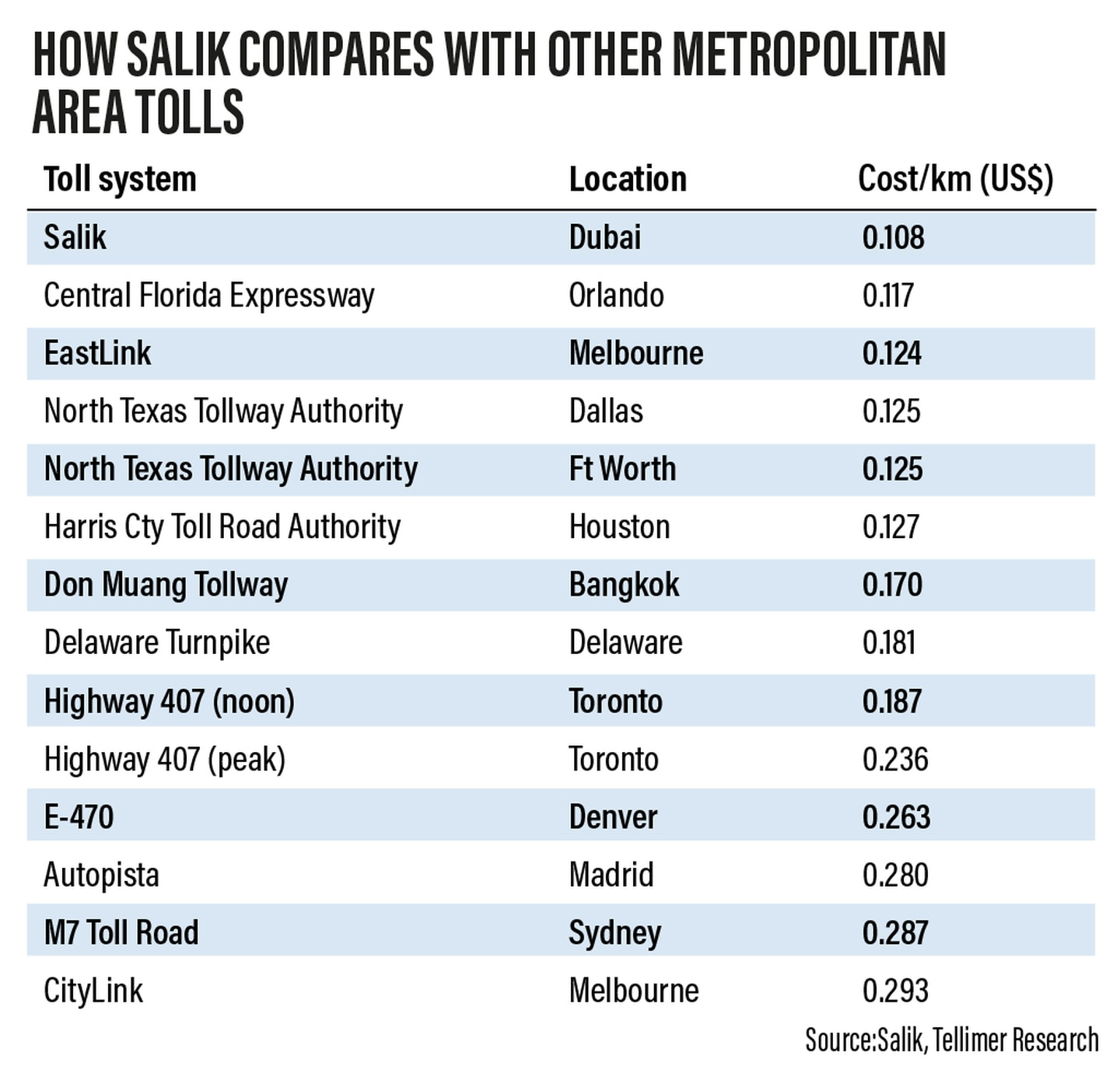

“…Salik is Dubai’s sole toll operator and currently operates eight toll gates that use radio frequency identification technology throughout the emirate, where more than 60 per cent of commuters use privately owned vehicles. Salik’s net toll traffic from 2013 through to 2019 grew at a compound annual rate of 5.5 per cent, driven by Dubai’s expanding economy and population.”. Massoud A Derhally reports.

UN Policy Paper to Pakistan: Suspend Debt Repayments and Deal with Floods

Financial Times

"Pakistan should seek to suspend international debt repayments and restructure loans after devastating floods triggered a humanitarian emergency and imperilled the country’s finances, a UN policy memorandum has argued.”

“The draft paper from the UN Development Programme, seen by the Financial Times, proposes that Pakistan negotiate debt relief with creditors to ‘stem the climate-change-fuelled crisis’. Pakistan’s largest creditors include Chinese lenders, to whom Islamabad owes more than $30bn accumulated through Beijing’s Belt and Road Initiative, along with countries such as Japan and France, the World Bank and commercial bondholders.”

“The memorandum, which the UNDP will share with Pakistan’s government this week, argues that creditors should consider debt relief so Islamabad can prioritise financing its disaster response over repaying loans.”

“Pakistan, whose external debts total about $100bn, was struggling with a balance-of-payments crisis that strained its ability to repay loans even before unprecedented flooding recently.”

“The country, which has been particularly hard hit by the global surge in commodity prices, received a $1.1bn bailout from the IMF last month. The disaster has amplified the challenges, affecting more than 30mn people and causing an estimated $30bn in damage. The UNDP memo argues Islamabad and its creditors should find a longer-term solution that ‘would involve lowering Pakistan’s debts down to a sustainable level to enable the government to put people’s needs first.’” Benjamin Parkin reports.

“The most difficult thing is the decision to act, the rest is merely tenacity.” —Amelia Earhart