Emerging Markets Monitor - Sept. 26

Oil Drops on Dollar Strength, British Pound Sinks to Record Low, India FDI Sizzles, Brazil Election and the Economy, Iran Protests Ramp Up + Where is Xi Jinping?

The Top 5 Stories Shaping Emerging Markets from Global Media - Sept. 26

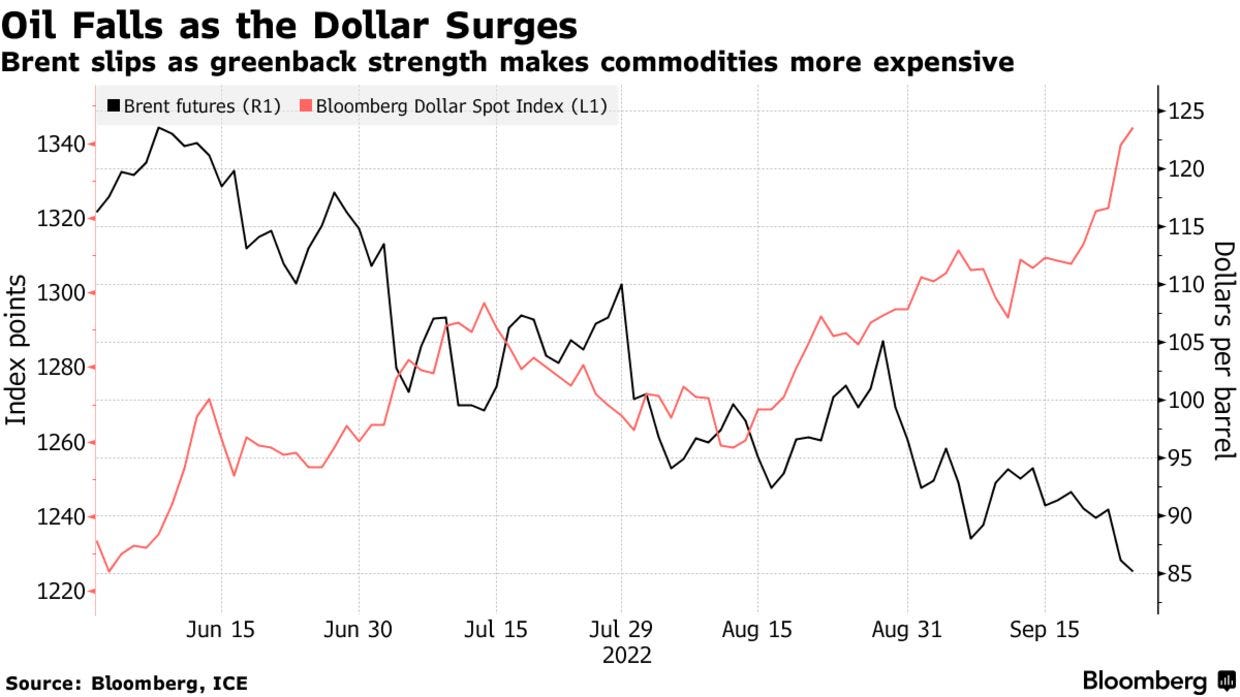

Oil Drops As ‘Wrecking Ball’ Dollar Piles on Commodity Losses

Bloomberg

“Oil dropped again, with Brent sliding below $85 a barrel at one point, as the dollar’s surge and mounting recessionary concerns threatened global demand.”

“The global oil benchmark hit the lowest intraday level since January as a Bloomberg gauge of the US currency rallied to an all-time high. Most other commodity markets from copper to wheat were also lower as risk assets began the week softly. Crude fell almost 6% last week for a fourth straight weekly drop, the longest losing run this year.”

“Crude is on track for a substantial quarterly slump as leading central banks including the Federal Reserve raise interest rates aggressively to fight inflation, hurting the outlook for energy demand and sapping investors’ appetite for risk. The Fed’s tightening has helped to drive the US dollar to a record, making commodities priced in the currency more expensive for overseas buyers.”

“‘The market is highly concerned that central banks will drive economies into recession,’ said Bjarne Schieldrop, chief commodities analyst at SEB AB. That puts heightened focus on the next OPEC+ meeting on October 5, he added.”

“The upward pressure on the dollar ‘is a wrecking ball for commodities,’ Gary Ross, the chief executive officer of Black Gold Investors LLC, told a conference in Singapore, flagging scope for OPEC cuts. ‘The supply-demand balance has caught up and, as we’re entering the fourth quarter, we’re building stocks.’”Bloomberg reports.

British Pound Hits Record Low. Traders Bet on Emergency Interest Rate Rise.

Financial Times

“The pound tumbled to a record low on Monday while government bonds extended heavy losses, stirring expectations of a Bank of England statement or an emergency rise in UK interest rates after chancellor Kwasi Kwarteng’s package of tax cuts last week.”

“The currency lost as much as 4.7 per cent to trade as low as $1.035 early in the morning before stabilising just below $1.08, after Kwarteng vowed at the weekend to stick with his tax-cutting drive, prompting warnings that the UK is entering a currency crisis.”

“Neither the BoE nor the Treasury denied rumours there would be a BoE statement later on Monday in the wake of the currency’s slide. The early fall had taken the pound to its lowest level ever recorded.”

“It sharpened criticism of Friday’s fiscal statement, when the chancellor announced a massive new wave of borrowing to fund £45bn of tax cuts and a package to curb rising energy bills. ‘The UK is now in the midst of a currency crisis,’ said Vasileios Gkionakis, Citigroup’s Emea head of foreign exchange strategy.”

“Traders ramped up bets on an emergency interest rate rise to stabilise sterling before the Bank of England’s next meeting in November. Derivatives markets are pricing in a rise of 0.75 percentage points in a week’s time and an increase of more than 1.5 percentage points by the November meeting.” The FT reports.

India On Track to Attract $100 Billion in FDI This Fiscal Year

The Hindu

“India is on track to attract $100 billion in foreign direct investment (FDI) in the current fiscal on account of economic reforms and ease of doing business, the government said on September 24, 2022.”

“'In 2021-22, the country received the ‘highest ever’ foreign inflows of $83.6 billion. This FDI has come from 101 countries, and invested across 31 union territories and states and 57 sectors in the country. On the back of economic reforms and Ease of Doing Business in recent years, India is on track to attract $100 billion FDI in the current FY (financial year, the commerce and industry ministry said in a statement.”

“It said that to attract foreign investments, the government has put in place a liberal and transparent policy wherein most sectors are open to FDI under the automatic route.”

“The reform measures include liberalization of guidelines and regulations, in order to reduce unnecessary compliance burden, bring down cost and enhance the ease of doing business in India, it added.” The Hindu reports.

Brazil Election Hinges on the Economy

Financial Times

"Brazil’s ascendancy in the early years of the 21st century as an emerging market darling — the B in the Brics — ended with a thud in 2014.”

“The nation had been riding a global commodities boom with increased exports of raw materials and foodstuffs, especially to a resource-hungry China. It then collapsed into a brutal recession from which the country has still not recovered.”

“Since then, the economy has barely budged. Gross domestic product expanded just 0.15 per cent, on average, annually in the decade up to the end of 2021. Living standards have fallen in a country where the middle class had been expanding. And despite being one of the world’s foremost agricultural producers, food insecurity has risen.”

“‘Brazil’s growth underperformance since the end of the previous commodity supercycles in 2014 has surprised even those who were pessimistic,’ says Marcos Casarin, chief economist for Latin America at Oxford Economics.”

“‘Per capita income is still 10 per cent below its 2013 peak and will take at least another four years to return to that level.’ Political coverage in the build up to next week’s presidential election has been dominated by the controversies around the two leading candidates — whether incumbent Jair Bolsonaro will respect the result if he loses and the potential return to power of former leader Luiz Inácio Lula da Silva who spent time in jail on corruption charges.”

“But as Brazilians prepare to vote on October 2, it is the widespread decline in quality of life that is at the forefront of their minds.” The FT reports.

Iran Protests Gathering Steam, Posing Major Challenge to Hard-Line Government

Wall Street Journal

“Antigovernment protests in Iran gathered strength Sunday with new demonstrations in scores of cities and indications that unrest was growing, posing one of the biggest challenges the country’s conservative Islamic rulers have faced in years.”

“A movement initially led by young people that focused on the country’s strict Islamic dress code for women appeared to be broadening into a mass outpouring of pent-up dissatisfaction among middle-class workers and even religious Iranians at the regime’s treatment of its own citizens.”

“The nightly street clashes between security forces and protesters that have erupted in dozens of cities since the death of 22-year-old Mahsa Amini in police custody on Sept. 16 for allegedly not wearing her headscarf, or hijab, properly have shown no signs of abating, despite an intensifying crackdown and a mounting death toll.”

“As the unrest grew, Iranian security forces cracked down on the demonstrators, using tear gas and live rounds to disperse the crowds. Some protesters have violently clashed with the security forces. Authorities have disrupted access to the internet in an attempt to block the social-media networks on which the protesters have relied to express dissent and rally support.”

“At least 41 people have been killed so far, most of them protesters, as police escalated the use of live ammunition. In Tehran neighborhoods, shouts of ‘death to the dictator,’ referring to Iran’s Supreme Leader Ali Khamenei, could be heard Sunday night even from residents not actively participating in the demonstrations.” WSJ reports.

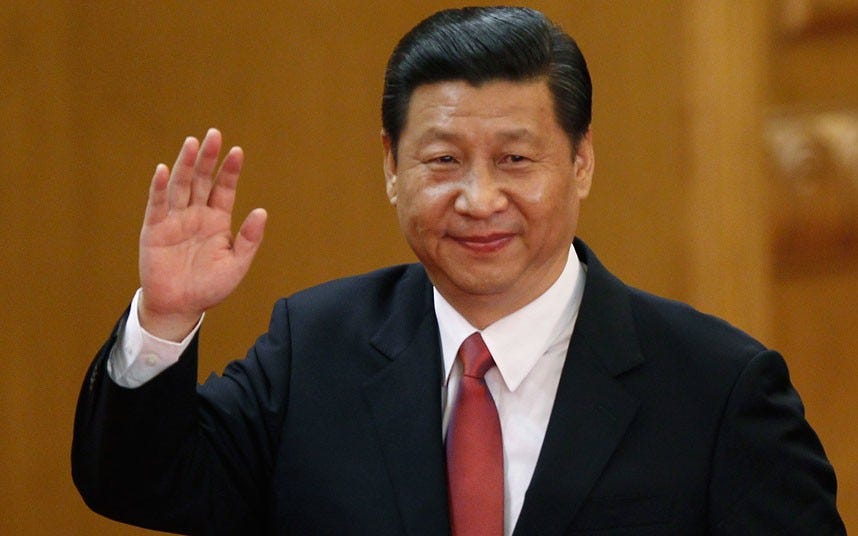

Bye Bye Xi?

The Rumor Mill….is heating up about Xi Jinping in China. Has there been a coup? Is he under house arrest? So far, it has mostly been Indian media, social media buzz and a few other outlets. This story in the Hindustan Times sums it up

Hindustan Times

“Social media has been abuzz with rumours of a coup in China claiming that the country's president Xi Jinping has been deposed. Speculations began on the internet after Jinping was said to be missing from the public eye following his return from the Shanghai Cooperation Organisation (SCO) meeting in Uzbekistan – his first official foreign visit since the start of the Covid-19 pandemic.” Hindustan Times reports.

Obviously, at Emerging World, we’ll keep watching this space…

“And those who were seen dancing were thought to be insane by those who could not hear the music.”― Friedrich Nietzsche