Emerging World Week

Turkey's Elections and BRICS+?, Geopolitical Swing States, Commodities Crash and Inflation, Jamie Dimon in China, Chris Schroeder on China Tech, Dall-E Art, and more that caught our eye this week.

In this issue, we lay out what caught our eye this week over at Emerging World.

Let’s start with two geopolitical maps - one on Turkey, the other on BRICS+?

Geopolitical Map of the Week I - Turkey Elections - The ‘Somewheres’ vs ‘Anywheres’?

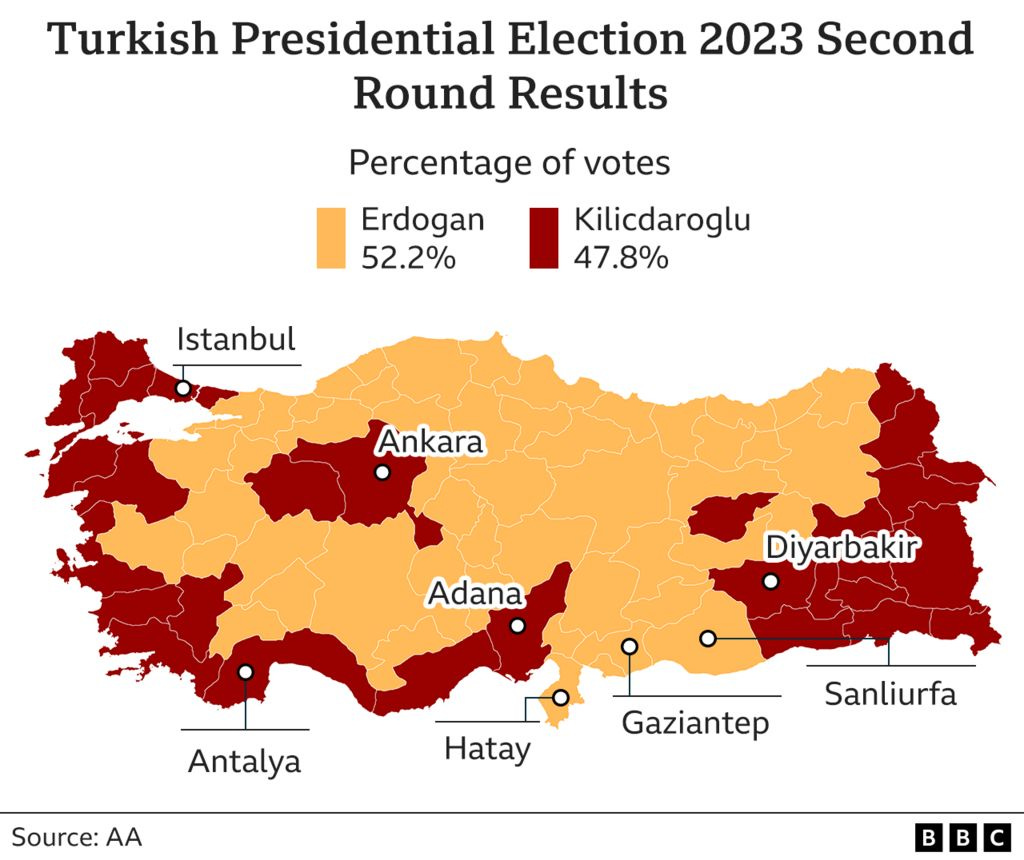

Take a look at the map of President Recep Tayyip Erdogan’s victory.

As you can see, major urban centers like Ankara and Istanbul voted for opposition candidate Kemal Kilicdaroglu — as did both coasts. There’s a lot of talk in political circles about rural-urban divides in voting or, in the US context, heartland voters vs coastal voters, and some of that looks at play in Turkey’s election.

But there may be another way to look at it. British political scientist David Goodhart coined the term “somewheres” and “anywheres” to describe the divide over Brexit in the United Kingdom. He describes the “somewheres” as people that are rooted close to home (their “somewhere) with more traditional values and few of the opportunities availed to the “anywheres,” who occupy the leading professions and could just as well be doing their job in Singapore or Dubai as in London or Manchester (hence, the moniker “anywhere”.)

In an excerpt of the book published in the National Review, Goodhart writes:

“Anywheres dominate our culture and society. They tend to do well at school — Vernon Bogdanor calls them the ‘exam-passing classes’ — then usually move from home to a residential university in their late teens and on to a career in the professions that might take them to London or even abroad for a year or two. Such people have portable ‘achieved’ identities, based on educational and career success which makes them generally comfortable and confident with new places and people.”

As opposed to the “anywheres,” Goodhart describes the “somewheres” below:

“Somewheres are more rooted and usually have ‘ascribed’ identities — Scottish farmer, working-class Geordie, Cornish housewife — based on group belonging and particular places, which is why they often find rapid change more unsettling. One core group of Somewheres have been called the ‘left behind’ — mainly older white working-class men with little education.”

“They have lost economically with the decline of well-paid jobs for people without qualifications and culturally, too, with the disappearance of a distinct working-class culture and the marginalization of their views in the public conversation.”

Erdogan repeatedly appealed to wedge culture issues and nationalism - popular with the Turkish “somewhere” voters. As Gonul Tol writes incisively in Foreign Policy, Erdogan exploited the inevitable fears that accompany rapid change. In a separate conversation, Tol also told me that “Turkey is deeply divided and Erdogan uses pre-existing social, cultural, religious, and political cleavages to play on the anxieties of people.” In another comment that echoes the Brexit “somewhere” voter, Tol told me: “Culture and identity politics matter. It’s not just voting with your pocketbooks.”

I recall all of the economic arguments trotted out in favor of the Remain campaign, but people were not really voting with their pocketbooks on that one - nor in Turkey’s elections.

Even the “mild-mannered” Kilicdaroglu played the wedge populist-nationalist card in the second round, threatening to expel all Syrian refugees, but it was not enough, and Erdogan is all set for another five year term.

Consider this: When Erdogan’s next term ends, the wily politician will have served in Turkey’s top political post for a quarter of a century.

Geopolitical Map of the Week Part II - BRICS+?

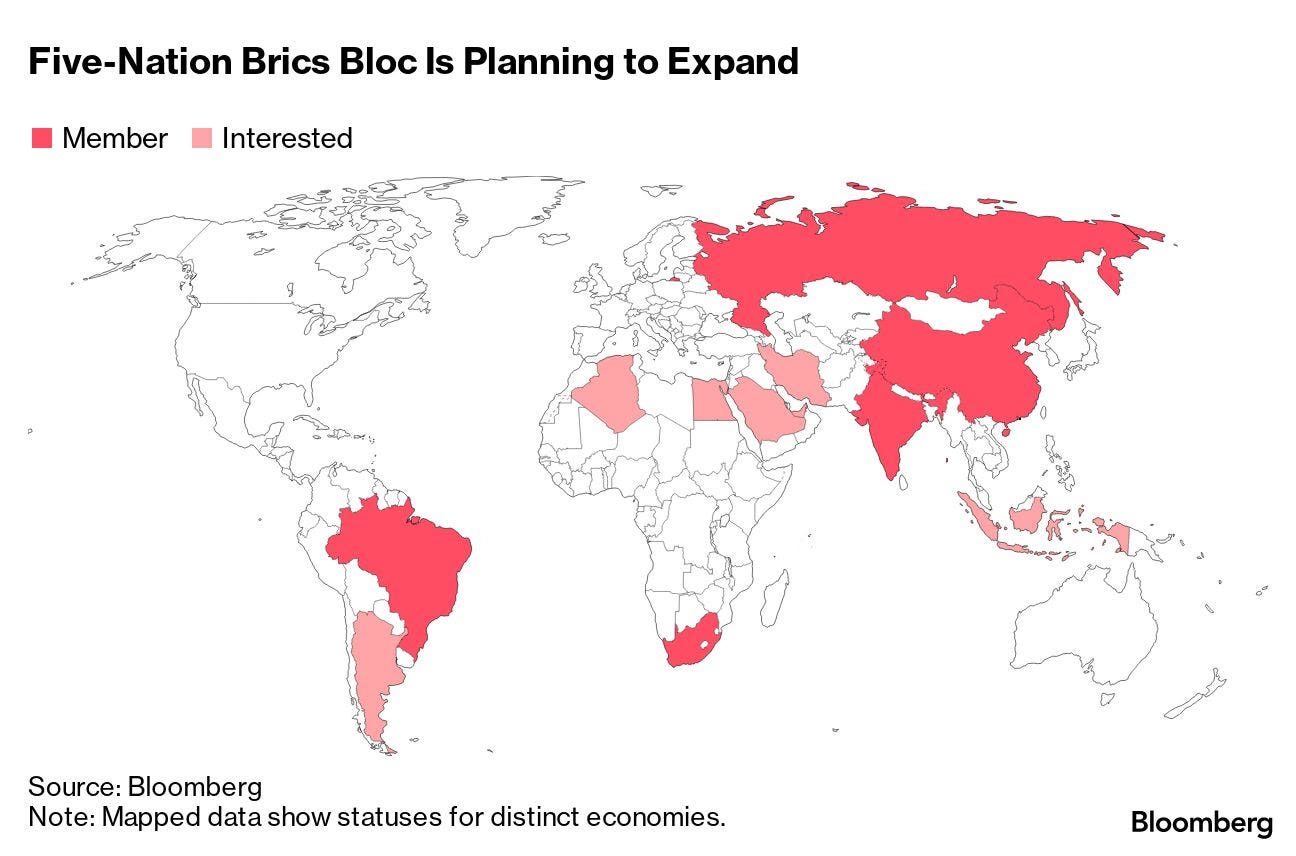

First, there was OPEC+, now BRICS+? Check out this map from Bloomberg laying out the countries reportedly interested in joining the BRICS grouping: Argentina, Algeria, Egypt, Saudi Arabia, UAE, Iran, and Indonesia.

If I had to put odds on which one would join first, I’d say Indonesia. They are a large and growing economy, the largest producers of nickel and palm oil in the world, and a target of Chinese investment largesse and diplomatic attention. In the great power competition for influence in Asia between China and the United States, Indonesia looms large, and China seems to be winning friends across the nation of 240 million people. Adding Indonesia to the BRICS would be seen as a win for Beijing.

What’s more, you would only need to add one more “I” - The BRIICS.

Paper of the Week - Geopolitical Swing States

Speaking of Indonesia, I just came across a very smart paper by Jared Cohen, President of Global Affairs at Goldman Sachs, who gives us a useful framework for how to think about Indonesia and other middle powers amid great power competition.

“As the U.S. and China coexist, compete, and confront each other to determine who will set the geopolitical rules, they will either court or thwart an emerging group of countries to gain an edge,” Cohen writes. “This new class of influential nations are the geopolitical swing states of the 21st century.”

He describes these swing states as falling into “four overlapping categories”

1. Countries with a competitive advantage in a critical aspect of global supply chains

2. Countries uniquely suited for nearshoring, offshoring, or friendshoring

3. Countries with a disproportionate amount of capital and willingness to deploy it around the world

4. Countries with developed economies and leaders with global visions that they pursue within certain constraints

Indonesia fits the bill, and so does India, Taiwan, the Netherlands, Saudi Arabia the UAE, Brazil, Australia, Germany, Canada, Japan and several other states.

“Geopolitical swing states are critical to the world economy and balance of power, but they don’t have the capacity by themselves to drive the global agenda, at least for now,” Cohen writes.

For all of you that are tired of terms like the new non-aligned states or the somewhat better multi-aligned states, Cohen’s swing states framework will be very helpful in understanding the new geopolitical order.

Maybe we should have a geopolitical swing states summit? Now, that would be interesting. Far-fetched, maybe, but interesting, and there is precedent here: the BRICS grouping was launched after another Goldman paper was published - the famous 2003 Jim O’Neil paper - Global Economics Paper 99: Dreaming with BRICs: The Path To 2050.

Chart of the Week I - Commodities Crash

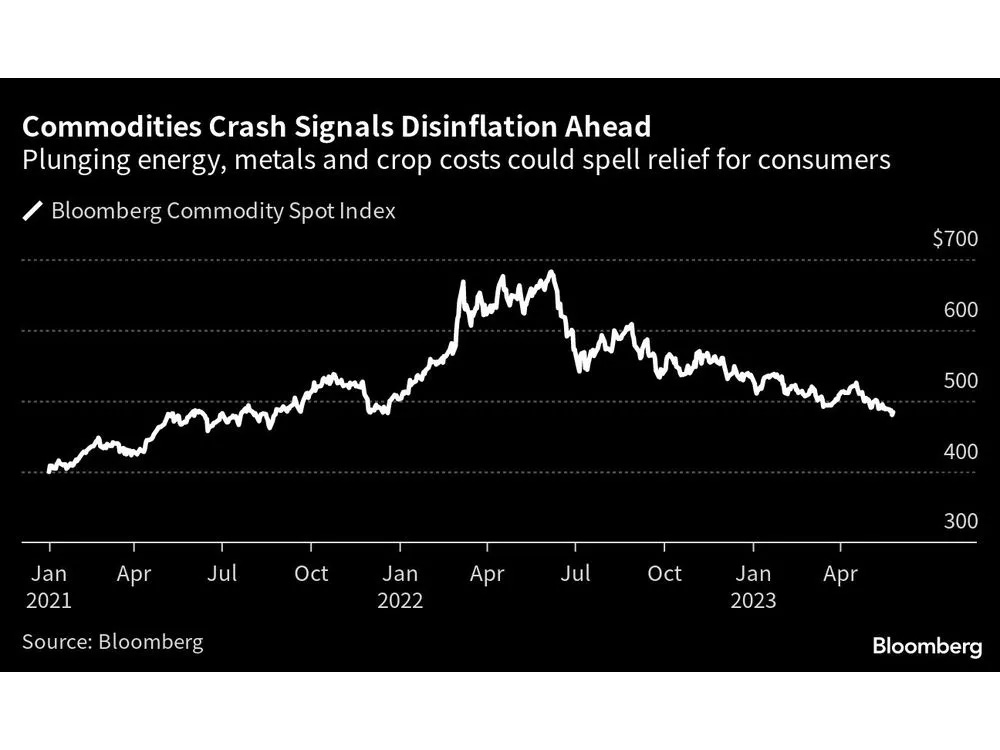

In a world where everyone is concerned about inflation - and its relative stickiness – this chart from Bloomberg above should soothe some anxieties. After breaking records and breaking wallets in much of 2022, commodities prices from energy to metals to agricultural goods are easing.

The Bloomberg report describes “the commodity crunch unleashed by Russia’s invasion,” but the reality is that commodities prices had been rising even before Vladimir Putin’s ill-fated gambit. Yes, the February 24, 2022 invasion accelerated the rise, but make no mistake: we were in a commodities bull market even before that.

And it may still have legs…some of the smartest commodities analysts say we are still headed for a commodities supercycle - which should exert upward pressure on prices.

Chart of the Week II - Inflation Dipping

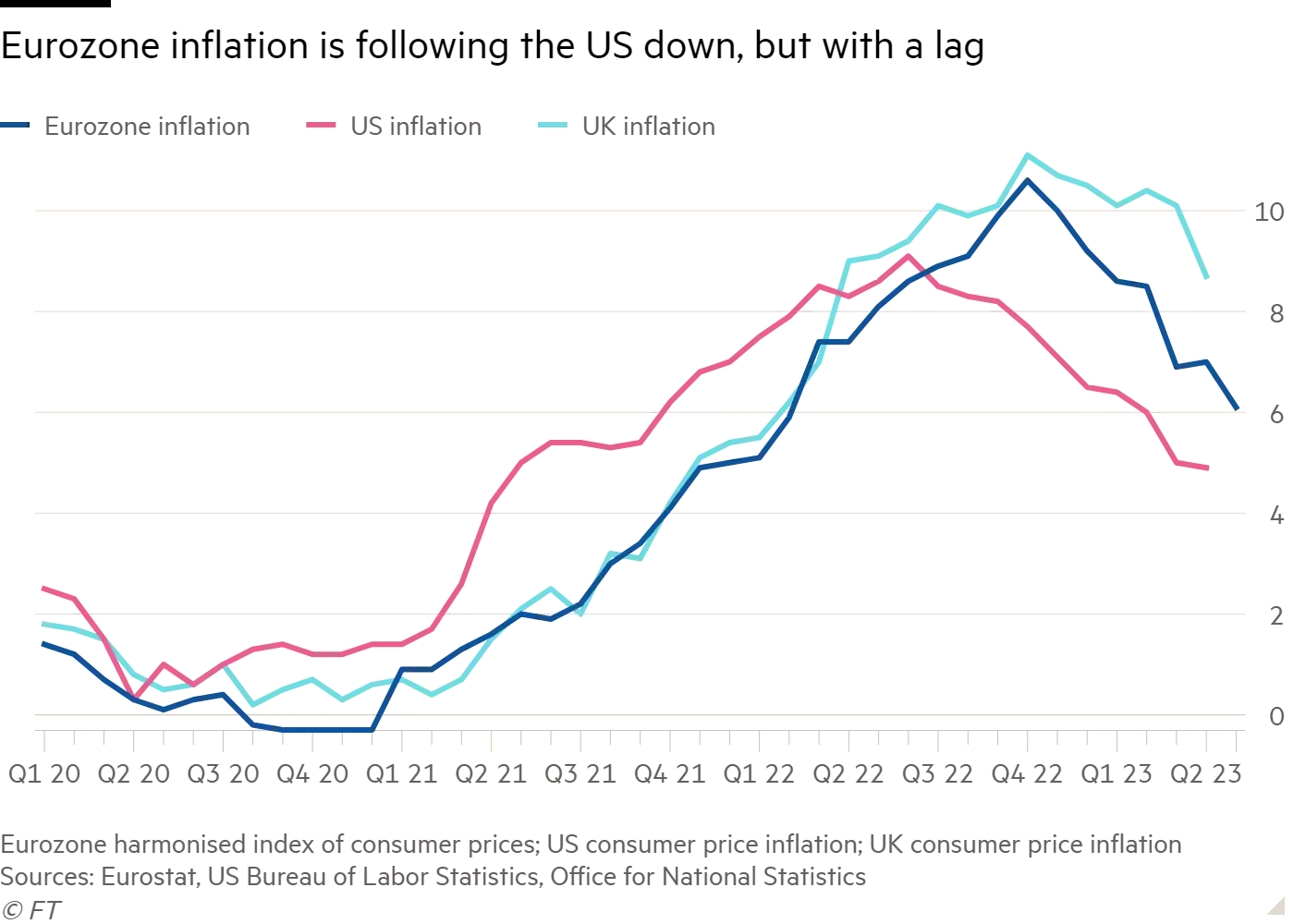

While we’re talking inflation, take a look at this chart from the FT. It shows inflation ticking downward in the US, the Eurozone, and the UK. Welcome news going into the summer.

Top American CEO Visit to China of the Week: Jamie Dimon or Elon Musk?

This one is a close call, but the winner is….Jamie Dimon. I’d say the Dimon visit was more consequential for U.S-China ties. Dimon presided over J.P Morgan’s Global China Summit - its first since 2019 - and he publicly declared the bank’s willingness to stick with China through good times and bad. With more than 2500 guests from 37 countries, The JP Morgan 2023 China Summit was a loud signal to the world that American business is back in China and willing to face down some of the myriad geopolitical risks in the US-China relationship.

Also worth noting, this chart from Bloomberg, laying out JP Morgan’s considerable exposure in China, second only to Citigroup.

De-Risking, not De-Coupling

It’s striking to see the change in tone from Washington over the past few weeks. The Biden Administration has seemingly gotten the memo that U.S-China ties are in a “de-risking” phase rather than a “de-coupling” one. That’s new language borrowed from European Commission Chief Ursula von der Leyen who first coined the term. In late April, Treasury Secretary Janet Yellen gave a speech at my academic home, Johns Hopkins SAIS, in which she described a possible “de-coupling” of the U.S and China economies as “disastrous.”

None of this is to suggest that the U.S and China are about to enter a phase of amicable cooperation, but like the hot inflation numbers that have eased, so have the hot tensions between China and the U.S - for now, at least.

Christopher Schroeder on China Tech and more

My friend and colleague Christopher Schroeder is a great seeker of insights - with a lot of insights of his own to impart. In his latest Substack post, he tackles the China narrative in the U.S, noting that “as we and China pull away from each other geopolitically, a similar distancing has happened among my sisters and brothers in Silicon Valley.” He writes:

The appetite of investment in Chinese tech companies and funds from the West has dried up significantly, physical interaction and travel has all but disappeared unless people are visiting families and friends. The great juggernauts like Apple, Microsoft and the hardware makers, of course, have long and historic connection but many are famously exploring manufacturing partnerships as widely spread as India, Vietnam and Mexico.

He dives underneath the noise to find some signals. He finds:

Chinese startups are as fixated on Generative AI as in the States.

The next generation of entrepreneurs are hyper focused on the “big problems” and the way to think about the hand of government is to understand the importance of social and political priorities over economic.

The talent is better than ever.

The companies rising and leveraging newest technologies like AI are better than ever.

It’s a good read and I recommend checking out Christopher’s newsletter.

Numbers of the Week

-30% - The fall in nickel prices this year

+166.25% - The rise in stock price for Nvidia this year

+27.52% - The rise in Greek stocks this year as tracked by the Global X MSCI Greece ETF

AI Image Art of the Week

I asked Dall-E, ChatGPT’s AI image-creator to come up with an original work with the following guidelines:

“A high-speed, urban landscape in East Asia with neon signs and many people walking in a crowded commercial center”

Within seconds, this is what it came up with:

The best description I could come up with for the result: an AI-generated impressionist-esque Asian street scape?

Like many of you, I’ve delved into ChatGPT. I find it to be a very useful resource for quick-hit historical research on deadline, like if you ask it: please list the three most important innovations of the Industrial Revolution.

It still can’t do real-time or recent research well, and it still has a bad habit of making things up that require you to go to Google and fact check - and then fact check that elsewhere. And, yes you are still better off reading old fashioned hard copy books, raher than asking ChatGPT for a summary. But, hey, I still read print newspapers - and lament their demise.

ChatGPT also writes average and moderately humorous poetry on command (more on that in later issues,). I am sure it will get better. I’m still toying around with Dall-E and find it fascinating. If you have cool Dall-E images, please send them our way at eworldairmail@gmail.com

Self-Promotional Item of the Week - My latest article in Forbes on Turkey

As part of my Forbes column covering macro trends and geopolitics, I wrote this past week on Turkey’s elections. I spoke to a lot of smart people who know Turkey well like Gonul Tol of the Middle East Institute, Ugras Ulku at the Institute for International Finance, Sergey Dergachev of Union Investment Privatfonds GmbH, Malcolm Dorson of Global X ETFs, and Metodi Tzanov of EmergingMarketWatch.

An excerpt:

"Turkey’s economy is heading in the wrong direction. Several years of questionable policy decisions by President Recep Tayyip Erdogan have financially battered the country, which currently faces mounting debt loads, rising current account deficits, muted international investor interest, a weakening lira, high inflation and sluggish growth.”

You can read the piece here

That’s it for this week. Have a great weekend and week ahead and if you have any suggestions, tips, Dall-E images, white papers, or vintage photos to share (or if you just want to say hello), you can always reach me at - eworldairmail@gmail.com

Have a great weekend and week ahead!

“Be yourself; everyone else is already taken.”

― Oscar Wilde