Emerging World Week

Battle for India's Skies, Where is the Chinese Traveler? The Top 20 Lists: Airlines, Container Ports, Restaurants, and The Riddle of Russia's "Wagner Affair"

In this issue, we lay out what caught our eye over the past week at Emerging World.

Battle for India’s Skies

The battle for the Indian air traveler just got hotter.

Budget carrier IndiGo — India’s largest airline — announced last week a blockbuster deal to buy 500 narrow body jets from Europe’s Airbus. The multi-billion dollar deal — the largest on record — would outdo another blockbuster Indian aviation deal: Air India’s combined order of 470 jets from Boeing and Airbus.

If you’re doing the math, the latest deal would bring the number of aircraft on order by Indian carriers to roughly 1,615 new planes. In addition to the big buyers — Air India and IndiGo — other carriers have also put in orders for new planes, including SpiceJet, Akasa Air, and Vistara.

These airlines are betting that the world’s fastest growing aviation market still has plenty of room to grow. In 2022, India saw more than 123 million passengers take to the domestic skies and another 43 million fly internationally, according to the Ministry of Civil Aviation’s Annual Report. A graphic published on the Indian newsource Mint, using KPMG and Ficci data, displays the pre-Covid growth view.

Still, even though it has slowed, the Ministry has set an ambitious target for 2014: 1 billion air passengers.

With rising middle classes and a fast-growing economy, more Indians are taking to the skies for domestic and international travel. But to achieve the 1 billion mark, India will need more than just new airplanes. It will need substantial infrastructure investments in airport capacity.

According to reports, India has pledged to spend $12 billion over the next two years to ramp up airport capacity, aiming to boost the number of airports to 220 from the current 148.

Key airports in Delhi and Mumbai are running out of landing slots and foreign carriers are demanding more space. The government of Prime Minister Narendra Modi hopes to see more Indian carriers grow their international links. Of the 43 million international flights, less than half of the passengers flew on domestic carriers.

Emirates Airline — the largest foreign carrier operating flights to and from India — and other Gulf carriers as well as Turkish Airlines play a prominent role in India’s aviation market. While India’s new aviation strategy seeks to grow the market share of domestic carriers vis-a-vis foreign airlines, growth prospects suggest that there will be room for all in the fastest growing aviation market.

Oh, and about those airplanes on order? A slew of supply chain challenges will likely delay delivery, which means that those airlines with capacity today will still have a moat that could last a few more years. Expect more delays in major airports as travel accelerates.

Where is the Chinese Traveler?

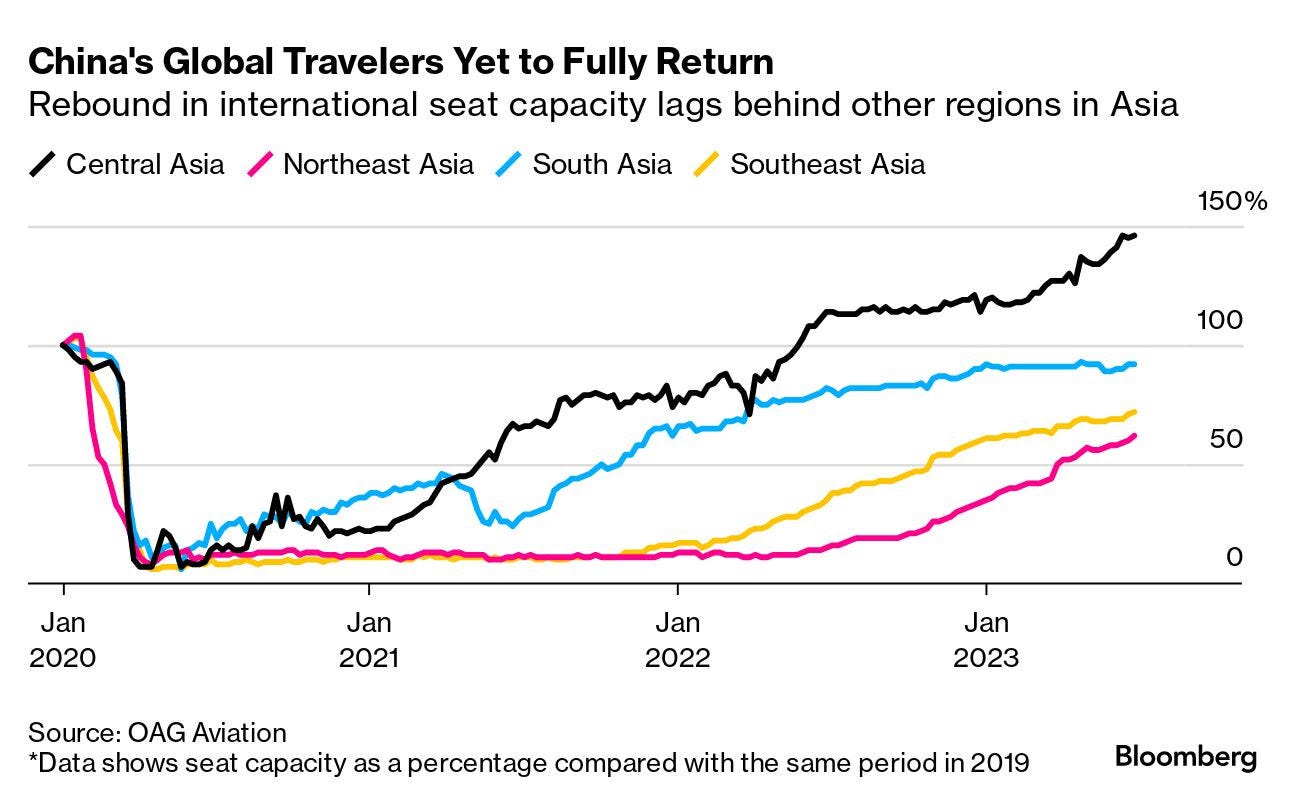

The big travel story of the decade pre-Covid was the rise of the Chinese traveler. I wrote about the stunning rise of the Chinese traveler in Foreign Policy back in 2017. Around that time, we were hitting Peak China Traveler. Today, the industry is still waiting for Chinese travelers to return to their pre-Covid days of spending. See chart below.

The Top 20 Airlines

Speaking of air travel, the World Airline Awards are out and the winner this year is….Singapore Airlines. The Singapore-based carrier edged out last year’s winner, Qatar Airways, though the Doha-based carrier won a slew of other awards for best business class cabin.

SkyTraxx has been doing the awards since 1999 based on passenger surveys. Interestingly, Asian and Middle East-based carriers have tended to dominate in these awards over the past two decades or so. If you’ve traveled Emirates or ANA or Singapore Airlines, it’s easy to see why. The level of service is a cut above most European or American carriers.

In 2023, only one European carrier cracks the top ten - Air France - and one American carrier barely ekes in at number 20: Delta Airlines.

Of course winning awards does not spell greater profitability. The U.S carriers still dominate in that category.

Here are the Top 20 for 2023 below.

These are the top 20 airlines for 2023:

1. Singapore Airlines

2. Qatar Airways

3. All Nippon Airways (ANA)

4. Emirates

5. Japan Airlines

6. Turkish Airlines

7. Air France

8. Cathay Pacific Airways

9. Eva Air

10. Korean Air

11. Hainan Airlines

12. Swiss International Air Lines

13. Etihad Airways

14. Iberia

15. Fiji Airways

16. Vistara

17. Qantas Airways

18. British Airways

19. Air New Zealand

20. Delta Air Lines

The Top 20 Most Efficient Container Ports

While we’re talking transport and doing lists, the World Bank and S&P Global have just launched their latest Container Port Performance Index (CPPI). The rankings are based on the total number of hours spent in port by visiting ships as well as examining the workload achieved in port. For more on the index and the methodology, you can go here.

We’re interested in which ports made the Top 20 this year. It’s usually a good sign of which ports are rising in importance on global shipping lanes. It’s not a sign of the busiest ports or those with the largest volume - with a few exceptions. Often, they have a harder time on an index like this given their congestion. Below are the Top 20

Yangshan (China)

Salalah (Oman)

Khalifa Port (Abu Dhabi, UAE)

Tanger-Mediterranean (Morocco)

Cartagena (Colombia)

Tanjung Pelepas (Malaysia)

Ningbo (China)

Hamad Port (Qatar)

Guangzhou (China)

Port Said (Egypt)

Hong Kong

Cai Mep (Vietnam)

Shekou (China)

Mawan (China)

Yokohama (Japan)

Algeciras (Spain)

King Abdullah Port (Saudi Arabia)

Singapore

Posorja (Ecuador)

Tianjin (China)

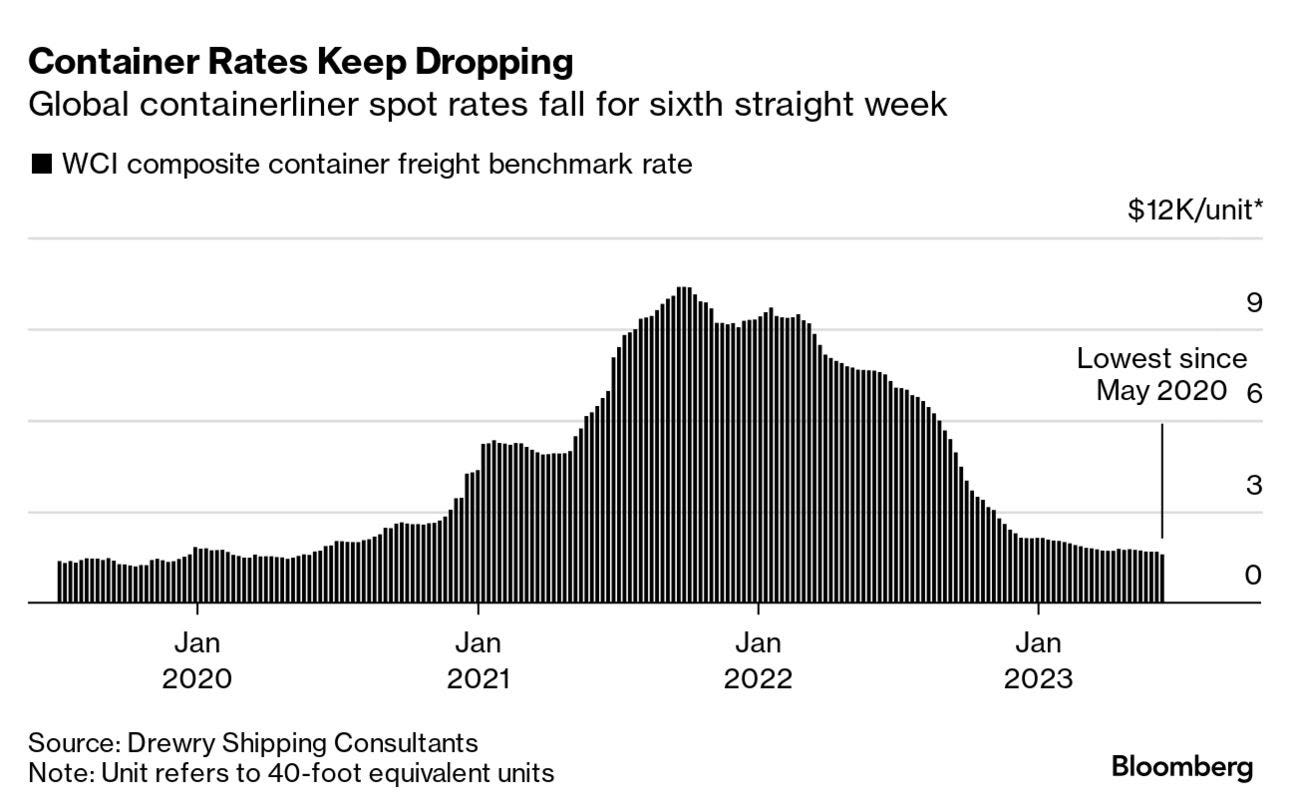

And while we’re talking ports and shipping, it’s worth checking in on shipping rates. They continue to trend downward across the board.

And another chart from Bloomberg showing that shipping container rates are trending down…

The Top 20 Restaurants in the World

Ok, I didn’t plan it this way, but this is becoming a Top 20 issue…Here’s a list of the Top 20 restaurants in the world picked by a panel of more than a thousand culinary experts. For the full Top 100 list, you can go here. Peru is the big winner, with two restaurants in the top ten, including #1 Central in Lima.

I’ve bolded those from the emerging world that made the list.

1. Central, Lima, Peru

2. Disfrutar, Barcelona, Spain

3. Diverxo, Madrid, Spain

4. Asador Etxebarri, Axpe, Spain

5. Alchemist, Copenhagen, Denmark

6. Maido, Lima, Peru

7. Lido 84, Gardone Riviera, Italy

8. Atomix, New York, US

9. Quintonil, Mexico City, Mexico

10. Table by Bruno Verjus, Paris, France

11. Trèsind Studio , Dubai, UAE

12. A Casa do Porco, São Paulo, Brazil

13. Pujol, Mexico City, Mexico

14. Odette, Singapore

15. Le Du, Bangkok , Thailand

16. Reale, Castel di Sangro, Italy

17. Gaggan Anand, Bangkok , Thailand (*)

18. Steirereck, Vienna, Austria

19. Don Julio, Buenos Aires, Argentina

20. Quique Dacosta, Denia, Spain

Chekhov’s Pistol and the Next Act in Russia

John Authers of Bloomberg reminded us this week of the great line from celebrated Russian dramatist Anton Chekhov: “If in the first act you have hung a pistol on the wall, then in the following one it should be fired. Otherwise, don’t put it there.”

Was the Prigozhin mutiny and the Wagner march to 200 km south of Moscow the first act? If so, what comes next? When will the pistol be fired?

Obviously, fluid events like war humble the most confident prognosticators. While I never liked the Winston Churchill line about Russia that it was “a riddle wrapped in a mystery inside an enigma” because it suggested an almost otherworldly quality to Russia, but, I’m willing to rephrase the Churchill line by saying that “the Wagner affair is a riddle wrapped in a mystery inside an enigma.” Stay tuned. The layers will gradually unpeel themselves.

That’s it for this week….Thank you for reading Emerging World. We are always interested in hearing from you on story ideas, tips, charts that explain the world, or Top 20 lists of any kind… You can reach us on eworldairmail@gmail.com