Emerging World Week - August 2

An "African Spring?", Nigeria Protests Sink Bonds, India Rising in EM Index, Whither Copper?, China-US and South China Sea Tensions, Indonesia Nickel and China

Are we witnessing the “African Spring?”

That’s a question on the minds of many as young Africans take to the streets, fist pumping the air, chanting slogans against bad governance and demanding more opportunities and greater economic dignity - many of the themes echoed in the Arab uprisings more than a decade ago.

As the Wall Street Journal reports:

Young Africans, pummeled by the rising cost of living and dissatisfied with bad governance and a dire lack of opportunities, are driving a wave of protests that has now swept through at least three countries across the continent.

On Thursday, thousands of mostly young Nigerians took to the streets in the capital Abuja, in the economic hub of Lagos and in other cities across Africa’s most populous nation, despite warnings of a crackdown from the country’s authorities. Protesters in the West African country said they were inspired by weeks long demonstrations in Kenya, thousands of miles away in East Africa, which succeeded in stopping a raft of unpopular tax increases.

Last week, crowds of young Ugandans also marched through that country’s capital, Kampala, to denounce alleged government corruption, and earlier this week a court in the West African country of Ghana blocked a youth-led protest there.

As in the time of the “Arab Spring,” social media has played a prominent role in driving the protests and the core concerns seem familiar: young protesters desperate for more work, education and life opportunities, and angered by the corruption of the ruling elite.

In Nigeria, the hashtag #EndBadGovernanceInNigeria trended as crowds in Abuja and in other Nigerian cities faced a heavy deployment of police, 24-hour curfews, and tear gas.

Nigeria is battling high inflation, hitting 34% in June. Meanwhile, its currency, the naira, has plunged over the past year.

Ken Opalo lays out the challenge well for African governments. He notes the following over at his excellent Substack - An Africanist Perspective

A lot has changed since the 1980s when the region last faced protracted economic stagnation/decline. Population growth, ongoing rapid urbanization, the decline of agriculture, higher rates of education attainment, and fundamental shifts in individual-level aspirations, attitudes, and consumption habits mean that ever more Africans must work in non-agricultural sectors to live. Under these circumstances, it is hard to see how African countries will remain stable without adopting modern forms of economic management that enable job creation at scale. 10 million young Africans enter the job market each year to fight for 3 million positions. This cannot go on for much longer. Repression alone will not work.

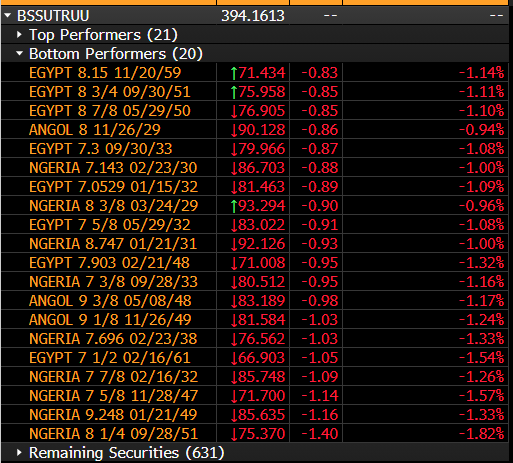

Nigeria Protests Sinking Its Dollar Bonds

Meanwhile, Bloomberg reports that Nigerias’s protests are sinking its dollar bonds

“Nigeria’s sovereign-risk premium surged to an eight-month high, and its dollar bonds were some of the worst-performing emerging-market assets on Friday, amid concerns that cost-of-living protests across the country could derail the government’s economic reform plan,” Bloomberg writes.

More from Bloomberg:

Political noise and “a challenging context for reform,” are weighing on Nigerian bond prices, according to Citigroup Inc. strategists Alexander Rozhetskin and Luis Costa.

“The sovereign bonds have been lagging over the last two months, particularly in the last weeks, as the noise around the cost-of-living protests is increasing,” they said in a note sent on Aug. 1.

Nigerian Eurobonds underperformed a Bloomberg index of frontier and emerging-market sovereign dollar debt. The biggest laggard was the 2051 bond, the price on which slid to 75.4 cents on the dollar as of 12:36 p.m. in London — down 1.4 cents on the day and the lowest in over a month.

We at Emerging World can only hope that these latest rounds of protests will not deter the growing optimism around investing in African startups. On July 16, Semafor wrote: “Investors in African startups are increasingly confident of a return to more dealmaking, as the causes of a near two-year pullback by global capital providers stabilize or fade away.”

The trouble is that the same population structure that attracts tech investors — young, urbanized, aspirational, wired Africans — also creates the tinder for protests. The more sophisticated investors will stay the course, but life just got much harder for African entrepreneurs in tech hubs like Lagos or Nairobi pitching their companies.

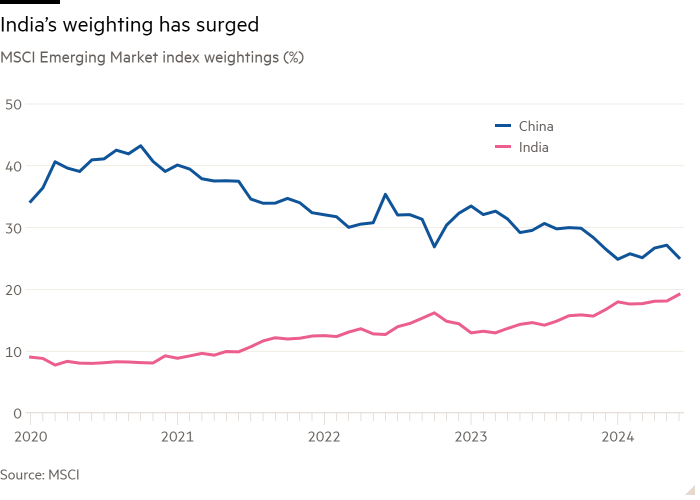

India Stocks Continue to Rise, Its Weighting on the MSCI EM Index Follows

This from the Financial Times:

“India is catching up on China’s spot as the largest country in a benchmark emerging-market index, underlining a quandary for global investors who are becoming increasingly exposed to its ebullient but expensive stock market. Soaring share prices, stock sales and earnings growth by Indian companies have pushed India to just under a fifth of the MSCI emerging markets index while China has fallen to a quarter, from more than 40 per cent in 2020,” the FT writes.

Check out this chart below that illustrates the closing gap between China and India on the EM Index:

The FT reports that “an MSCI index review scheduled for next month could elevate India to above 20 per cent, eclipsing Taiwan and putting India’s weighting directly behind China’s, investors say.”

This has posed a dilemma for investors, as the FT notes:

The narrowing gap has become one of the biggest issues for investors in emerging markets this year, as they debate whether to put capital into an already red-hot Indian market, or into Chinese stocks that are relatively cheap, but are being hit by an economic slowdown. “The two consensus trades in emerging markets today are ‘long India, short China’,” said Varun Laijawalla, emerging markets portfolio manager at NinetyOne, the asset manager. “The valuation spread between these two markets is as wide as it’s ever been,” he added. Indian stocks are trading at 24 times their expected earnings next year, while China is at just 10 times. The shift has also underlined the power of indices in emerging markets, whether by directing billions of dollars in index-tracking passive flows or leading active managers to calibrate their exposure relative to established benchmarks.

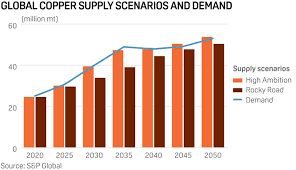

Copper Prices are Tumbling. Long Live Copper?

The FT reports this week that copper prices are tumbling.

“The sell-off has been driven by traders unwinding their sizeable bets on prices rising as the outlook for growth in China — the biggest consumer of many commodities — has dimmed and the country’s authorities have failed to deliver the stimulus that investors had been hoping for,” the FT wrote.

The FT also quoted Tracey Allen, commodities strategist at JPMorgan, as saying: “Investor selling pressure has been immense across copper and base metals as weak Chinese demand sentiment has been re-enforced by a lack of significant policy support in July.”

Ole Hansen, head of commodity strategy at Saxo Bank, summed it up when he said: “The short-term outlook is not looking good.”

Ok, maybe, but the long-term outlook on copper remains strong. Consider this:

According to S&P Global: "Copper prices are anticipated to ascend in the long term as a result of the clean energy transition, notwithstanding prevailing short-term apprehensions." S&P Global forecasts that copper demand will double, reaching 50 million metric tons by 2035. Where will the most significant new demand come from? The US, China, Europe, and India.

Copper is vital to our everyday lives and becomes even more important as the world moves toward greater renewable energy use.

Look at this copper demand forecast chart through 2050 by S&P Global - below.

They note that the copper market in 2035 could see a deficit of up to about 1.5 million mt in the best case “high-ambition” supply scenario and up to a 9.9 million mt deficit in the rocky-road supply scenario.

Either scenario could lead to a historic copper deficit, S&P Global reports.

Copper miners see the writing on the wall, and are looking to acquire existing mines or build new ones.

As Mining.com reports, Rio Tinto said “it would contemplate a significant copper acquisition if it added exceptional value, but noted that buying quality assets in the current ‘hot market’ would be ‘seriously’ expensive.”

Take a look at this chart below of the world’s largest copper miners (2022 production)

The New Copper Players in Riyadh and Abu Dhabi

There are also new players entering the copper and mining arena in big ways. Watch the Gulf Arab states, in particular - holders of the kind of long-term, patient capital required for mining projects. Last year, I wrote about Saudi Arabia ramping up its copper mining for Al-Monitor Pro.

Some excerpts of what I wrote:

Investment needs for future copper production are immense. According to global research and consulting firm Wood Mackenzie, some $23 billion will need to be invested annually for the next three decades. This would amount to a copper investment boom only seen for a few years from 2012-16 during the China-driven commodities super-cycle.

Robert Friedland, founder of Vancouver-based Ivanhoe Mines and a key figure in the mining world, points to the Arabian Shield geological formation of western Saudi Arabia as well as the broader African continent as the next sources of growth for copper production.

Saudi Arabia’s Vision 2030 initiative highlighted mining as a key strategy toward its economic diversification goals. The kingdom has announced plans to quadruple mining’s contribution to GDP, making it “the third pillar of the kingdom’s economy,” according to Bandar Alkhorayef, Minister of Industry and Mineral Resources, a newly formed ministry that became operational in 2020.

Meanwhile the UAE’s International Resources Holding has pledged to invest $1.1 billion in Zambia’s Mopani Copper Mines as part of a deal that gave the company 51% ownership as the strategic equity partner.

Keep that name in mind: IRH will likely make more headlines as it seeks to do more mining deals in Africa and beyond.

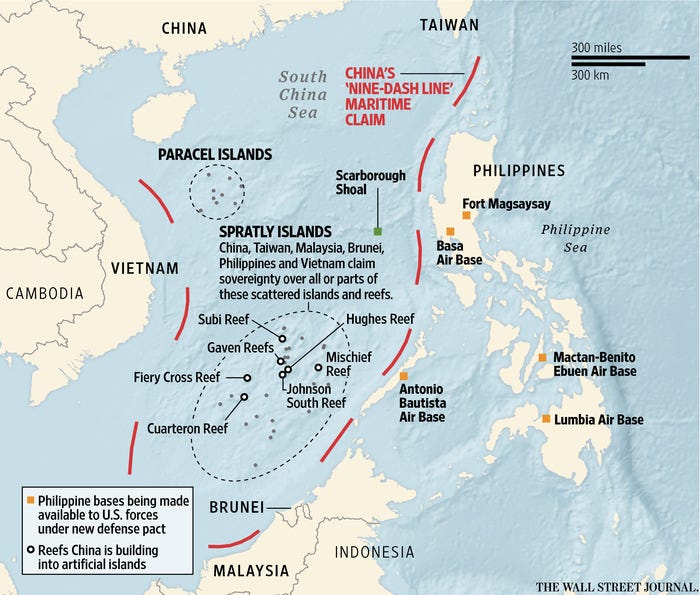

U.S, China Seek Stability Despite Tensions in Disputed Sea; Philippines Resupplies Ship Without Interference from Beijing

Bloomberg and Reuters

“US Secretary of State Antony Blinken and China’s Foreign Minister Wang Yi emphasized the need for stability between the two countries during a meeting [this week] in which they discussed security issues ranging from Taiwan to tensions in the South China Sea.”

“…the two envoys pledged to make progress on military communications, according to a senior US State Department official. They also discussed a recent Chinese agreement with the Philippines on vessel movements in the South China Sea.” Bloomberg reports.

Meanwhile, Reuters reports that “the Philippines on Saturday completed unimpeded a resupply trip to its troops at a disputed South China Sea shoal, its foreign ministry said, the first such mission under a new arrangement with China aimed at cooling tensions.”

The Philippines and China last week announced a ‘provisional agreement’ on Manila's resupply missions to its contingent of troops on a naval ship grounded on the Second Thomas Shoal, after repeated clashes between vessels that have caused regional concerns about an escalation of hostilities.

So, for now, at least, tensions have cooled in the South China Sea.

Indonesia Moves to Reduce Chinese Ownership of Nickel Projects

The Indonesia nickel story is a fascinating one, particularly its effort to avoid falling into the one-trick pony trap of just exporting raw nickel ore. They are investing - and attracting investment - in the nickel value chain from smelting and refining to electrical vehicle battery production. Of course, China plays a prominent role in all of this, and that’s why this FT piece below caught my eye.

Financial Times

Indonesia is trying to reduce Chinese investment in new nickel mining and processing projects to help its industry qualify for tax breaks in the US, as the Biden administration seeks to curb Beijing’s influence in the electric vehicle supply chain.

Generous tax breaks are available from 2025 under President Joe Biden’s Inflation Reduction Act, but they will not apply to EVs containing batteries and critical minerals such as nickel sourced from ‘foreign entities of concern’, including some companies with more than 25 per cent Chinese ownership.”

That would hurt Indonesia’s industry, which has become the world’s biggest supplier of nickel on the back of a huge influx of Chinese capital over the past four years into mining and smelting projects. Indonesia’s government and industry are now working to structure new nickel investment deals with Chinese companies as minority shareholders, according to three people familiar with the matter.”

This is yet another example of how countries are navigating the biggest geopolitical issue of our era: the US-China Cold War.

Mine reports the following top ten largest suppliers of nickel by country:

The Nickel Top Ten

- top ten largest suppliers of nickel by country in 2023:

Indonesia: 1.7 million tonnes.

Philippines: 365,000 tonnes.

Russia: 219,000 tonnes, slightly decreased from the previous year.

New Caledonia: 194,000 tonnes.

Australia: 158,000 tonnes.

Canada: 132,000 tonnes.

China: 110,000 tonnes.

Brazil: 85,000 tonnes.

Cuba: 45,000 tonnes

Source: Mine

Reports of Note: BP World Energy Outlook 2024