The Remarkable Story of a Small Kuwaiti Telecoms Firm that Became a Global Giant

From 2003-2009, a sleepy Kuwaiti telecoms firm surged to prominence on the back of visionary leadership and a string of acquisitions, most notably a big bet on Africa.

“History will be be kind to me,” the late Winston Churchill once famously said, “because I intend to write it.” And write he did, pouring out millions of words onto the page in a series of books, articles and memoirs. Today, partly as a result of his prolific writings, Winston Churchill quotes are ubiquitous (including, well, in the opening of this essay).

The Churchill quip about history, however, masks a more important reason to write history. History is, in many ways, the study of change, and to understand the sweeping changes of today, it helps to understand the sweeping changes of yesterday. Starting in the mid 1990s, the world experienced a massive acceleration of globalization, fueled by the internet and mobile connectivity and the rise of emerging markets.

There are several books and studies that chronicle this era, written by US or Europe-based academics and journalists, but there is a clear dearth of works written by CEOs or business leaders from Africa, the Middle East, Asia or Latin America - the entrepreneurs and leaders and dreamers in the eye of the storm who played a key role in shaping the world that emerged - and is still emerging.

For that reason alone, I am grateful to former Kuwaiti mobile telecoms executive, Saad Al Barrak, for telling his story in an illuminating book, A Passion for Adventure: Turning Zain into a Telecom Giant. It’s an extraordinary work tells the story of a sleepy, formerly government-owned Kuwait-based mobile telecommunications company, MTC, that grew rapidly starting in 2003 from a base of 500,000 subscribers in one country to 72 million subscribers across sub-Saharan Africa and the Middle East by 2009 — rebranded under the name Zain. It’s an important slice of emerging markets history and the book captures a fascinating moment in our world, when global businesses were first discovering the rise of the emerging markets consumer.

Al Barrak takes the reader behind the scenes of normally secretive business environments packed with tense moments of negotiations, the atmosphere imbued with the palpable promise of a new era dawning.

Reading it today, it felt like a “period piece”, one that evokes a particular era: that moment in the first decade of the 21st century when the great age of connectivity that we are living in today was only just beginning - as was the age of the emerging markets multinational spreading its wings. I remember back in that time period, I was often struck by the number of companies from the emerging world that seemingly came out of nowhere to bid - and win - major mobile telecoms contracts beyond their home countries, including Orascom (Egypt), Etisalat (UAE), Turkcell, America Movil (Mexico), Bharti (India), MTN (South Africa), and, of course, Zain (Kuwait, formerly known as MTC).

The book was a sort of rediscovery for me. It was first published in 2012, by Bloomsbury Qatar Foundation Publishing. You can still find the book on Amazon. I bought it back in 2016 (or so my Amazon history tells me). It turned out to be one of those books that got lost on my shelves. Amid a recent office move, I rediscovered it and am glad I did.

The book is also the personal business story of a visionary leader, Saad Al Barrak, who started his career as a salaried engineer with a small IT company in Kuwait in the 1980s and worked his way up the ladder, eventually becoming CEO of that company, and turning its fortunes around dramatically before being tapped to helm MTC in 2002 - a job he initially rebuffed.

“MTC had been my client for ten years and was the last company in the world that I wanted to join,” Al Barrak wrote in his characteristically frank manner. “I knew the company was politicized, clumsy and conservative, and I was a free soul used to an entirely private enterprise.” Still, he reluctantly agreed to meet with the principal shareholder of MTC, the prominent merchant family head Nasser Al-Kharafi, because of “the great respect” that he had for him. Though no longer majority government-owned, Al Barrak felt that MTC still had the whiff of a sclerotic government enterprise.

In that first meeting, Al Barrak listed a host of reasons why he would not like to lead the company, but Al-Kharafi remained insistent. “I want you to join. You are our first choice,” Al-Kharafi told him, even suggesting that “you should not consider any other opportunity.” Al Barrak made a series of demands, most notably around international expansion and freedom to act beyond the confines of the Board, and Al Kharafi agreed to each one. “I was trying to make it difficult for him,” Al Barrak wrote, “but he accepted everything I proposed.” Later, Al Barrak described Al Kharafi as “like a father” to him and the vital force in supporting every bold step he chose to make with the company.

Al Barrak eventually agreed and took the post on July 7, 2002. It turned out to be a good time to be in the mobile communications business. There was a new world forming but, as Al Barrak noted, “MTC was badly unprepared” for this new world. It was a company, he wrote, “stymied by government culture for sixteen years, that was an unprofessional, politicised monopoly. It had a big marketing department that knew nothing about marketing and little about PR. Many internal appointments were based on favouritism…The government appointees brought red tape and bureaucracy, and they were sometimes allied to some of the shareholders. Worse, the management had never heard of a business plan.”

A McKinsey report he commissioned laid out a stark picture of a company in decline, unprepared for the new world of mobile awaiting them. Over the next few years, Al Barrak streamlined staff, created incentives to attract and retain the best talent, emphasized a values-based approach to business, focused heavily on branding, developed innovations to attract new customers, made strategic acquisitions, and rode the wave of rising mobile connectivity. The broad contours of the story would be familiar to all who understand business transformations.

But those broad contours - familiar to business turn-arounds in the West - don’t do justice to the particular aspects of this story, of a Kuwaiti telecoms firm striking out in the world far beyond its borders. By 2005, MTC had grown beyond its home of Kuwait to operations in Jordan, Bahrain, and Iraq. This was a company on the move, but still a regional player.

Then, there was Africa.

Saad Al Barrak made a big bet on the continent, and it paid off. He saw Africa as the next great frontier of mobile connectivity back in 2005. Where others saw risk, he saw opportunity. More than anything else, it was MTC’s Africa play that put it on the global map, and generated alpha returns for its shareholders.

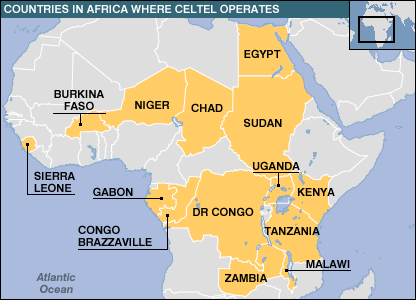

Saad Al Barrak’s push into Africa began with a 2004 meeting with one of the continent’s most visionary entrepreneurs, Mo Ibrahim. The son of a Sudanese clerk and born in Egypt in 1946, Ibrahim was an early pioneer in mobile networks in the 1970s and 80s. By the time Al Barrak entered the scene, Ibrahim was a well-established player in the industry and the founder of Celtel, a growing mobile provider across Africa.

In 2003, Celtel was Africa’s third largest mobile provider, and Mo Ibrahim was highly regarded in business and development circles. So, when Celtel decided to sell their business, Saad Al Barrak jumped at the opportunity. MTC’s main competitor was MTN, the South African telecoms company that had slightly deeper pockets than the Kuwaiti firm and deeper reach in the continent.

After a competitive bidding process, it looked as if MTN had the deal in hand, until Al Barrak called Ibrahim directly. Here is where the behind-the-scenes story got riveting. On the phone, Ibrahim told Al Barrak that they cannot solicit new offers and that he would need to speak to the shareholder’s committee. Undeterred, Al Barrak said the following to Ibrahim:

“True, you cannot [solicit new offers], but if you receive an unsolicited offer from us, you are obliged to look into it, as it may bring better returns for the shareholders. That’s your fiduciary responsibility.”

Al Barrak later wrote: “here I was improvising. I had received no advice from UBS over this, but I was interested in the slightest chance of making a move.” His instincts turned out right, and they could legally make an unsolicited offer.

MTN had what they thought was a deal, though they delayed in finalizing it through the Easter weekend in 2005. With that slim opening, Al Barrak marshalled his board, his principal shareholder, Nasser Al-Kharafi, and his team of advisors to make a rival bid that changed the game, and blindsided MTN. The two sides signed the deal on Easter Monday in 2005, and Mo Ibrahim turned to Al Barrak and said: “Listen, my brother, I’m very proud of you.”

(Pictured: Saad Al Barrak and Mo Ibrahim)

Two years after the purchase, the business was growing and MTC re-branded its company (another interesting chapter of twists and turns) under the name Zain. Al Barrak wrote of this era as a time when many African leaders “proved themselves eager to transform their countries through making them open to attract investments.” He wrote: “these leaders wanted to make history, and this coincided with the time that we were eager to make history in business, so two forces met.”

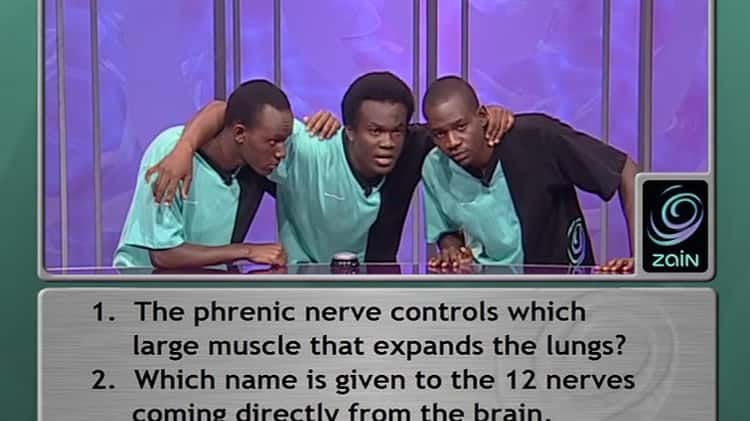

During this period, Zain invested widely across mobile networks in Africa, while contributing broadly to societies through philanthropy and sponsorship of academic events like the Zain Africa Challenge - a televised quiz show for university students.

Shortly after the 2008-9 global financial crisis, Zain’s principal shareholders, the Al Kharafi family, decided to sell Zain’s Africa assets. Many Gulf Arab investors felt the pinch of the crisis, and Zain’s Africa networks were by this time a prized possession.

Al Barrak understood their motive, but he could not endorse the direction. “If selling was the shareholder’s only option, where did this leave me? I could hardly preside over a complete change of course,” he wrote. “Without Africa, Zain would be retreating from being a global to barely a regional company. Zain would be the company that sold Africa, and this would take a significant toll on the brand.” He tabled his resignation in February 2010, and thus ended a remarkable run of a business leader who transformed a small telecoms firm in Kuwait to a global player.

The Financial Times had this to say about Saad Al Barrak of his eight year tenure at Zain: “In eight years at the top he changed Kuwait’s Zain from a provincial mobile operator into a global telecoms giant.”

A few months after his departure, Zain’s Africa assets were sold to Bharti Airtel for $10.7 billion, including $1.7 billion in debts. Al Barrak does not hide his disappointment, describing the decision as “exasperating.”

His big bet on Africa proved to be a lucrative one for his investors. The sale brought a net value of $4 billion to Zain on top of the loans and its original purchase price of $3.36 billion. While he disagreed with the decision, he maintained his respect for Nasser Al-Kharafi, who emerged throughout the narrative as an ideal Board Chairman willing to back his CEO’s big bets.

“You cannot change history, and Zain certainly made history,” he wrote. “To go in six years from one country to twenty-three, and to create such immense value, was an achievement that could not be denied.”

Postscript: Where Are They Now?

Today, Saad Al Barrak holds senior positions in Kuwait’s government. In 2023, he was appointed Minister of Oil and a deputy prime minister. He also serves as Minister of State for Economic and Investment Affairs and Chairman of the Board of the Kuwait Investment Authority.

Zain remains a profitable company, though mainly regional. According to its website, They have more than 50.6 million active individual and business customers and operate in Kuwait, Bahrain, Iraq, Jordan, Saudi Arabia, Sudan and South Sudan, and in Morocco through a 15% stake in a joint venture.

As for Nasser Al-Kharafi, he unfortunately passed away suddenly of cardiac arrest in 2011 on a visit to Cairo. He was such a prominent business leader in the country that the Kuwait stock market fell 1% on news of his death. The family business, M.A Kharafi and Sons, remains active in a wide range of fields, including construction, food services and telecoms (via Zain.)

As for Bharti Airtel, its African assets have grown rapidly. Airtel Africa, the susbidiary of Bharti Airtel, recently reported a 9.1 percent increase in its total customer base, reaching 151.2 million.

Bharti Airtel is one of the largest mobile providers in the world, with some 400 million customers. Its founder, Sunil Bharti Mittal, has an estimated net worth of $14.8 billion.

Wanted: More Books About Business in the Emerging World

I started this essay noting the importance of business leaders from the emerging world writing their story. I have never met Saad Al Barrak, but I’m glad he wrote his story. In the Middle East alone, I can rattle off a long list of names of business leaders that I’d love to see put pen to paper and tell their stories, including (but not limited to) Naguib Sawiris of Orascom, Mohamed Al Abbar of Emaar, Fadi Ghandour, the founder of Aramex, Lubna Olayan of Saudi Arabia, Mo Ibrahim of Sudan and Egypt, and much more.

Over the next few months, I’ll review and reflect on other books by business leaders from the emerging world, and would love to hear more from you. Any book recommendations written by or about businesses that transformed the emerging world? Please send them directly my way to eworldairmail@gmail.com and I’d love to share with all of our fellow travelers.

Until next time, let’s close with a “period piece” photo from 1973 - the first mobile phone, a Motorola model weighing in at 2 and 1/2 pounds.

“We shape our tools and afterwards our tools shape us.” Marshall McLuhan