The US-China Showdown in the Trump 2.0 Era

The US and China are headed for an accelerated showdown on trade and beyond, but much has changed in China and the world since Trump 1.0. Where are we headed?

When Hall of Fame basketball player Shaquile O’Neal was asked to comment on legendary superstar Michael Jordan’s return to the sport at age 39, his response was pithy and profound:

“39 ain’t 29, bro.”

It was not only one of the great sports quotes of all times, but one of the great life quotes. All of us who are aging - and well past 39 - can understand how much difference a decade makes in our body’s ability to withstand the kind of intense pressure required of a sport like basketball.

But it goes beyond our own changes. The world also changes profoundly in a decade, so even if you return to the arena, you will be faced with an entirely new set of challenges and opportunities. Or as the ancient Greek philosopher Heraclitus put it: “No man steps in the same river twice, for he is not the same man and it is not the same river.”

As foreign policy analysts grapple with what a Trump 2.0 foreign policy might look like, it’s worth paraphrasing Shaquille O’Neal: “2025 ain’t 2017, bro.”

Macro strategists must be wary of the charge leveled at some military strategists who are “always fighting the last war,” adopting tactics and strategies that may have worked in the past, but are not future-fit.

Over the next few weeks, I’ll be looking at several key over-the-horizon trends that all business leaders, strategists and policymakers should be watching today and over the next decade. While some will be obvious (AI and the China-US Cold War), others might not be top of mind, but they should be.

In this post, I’ll start with the obvious: The China-US “Cold War.”

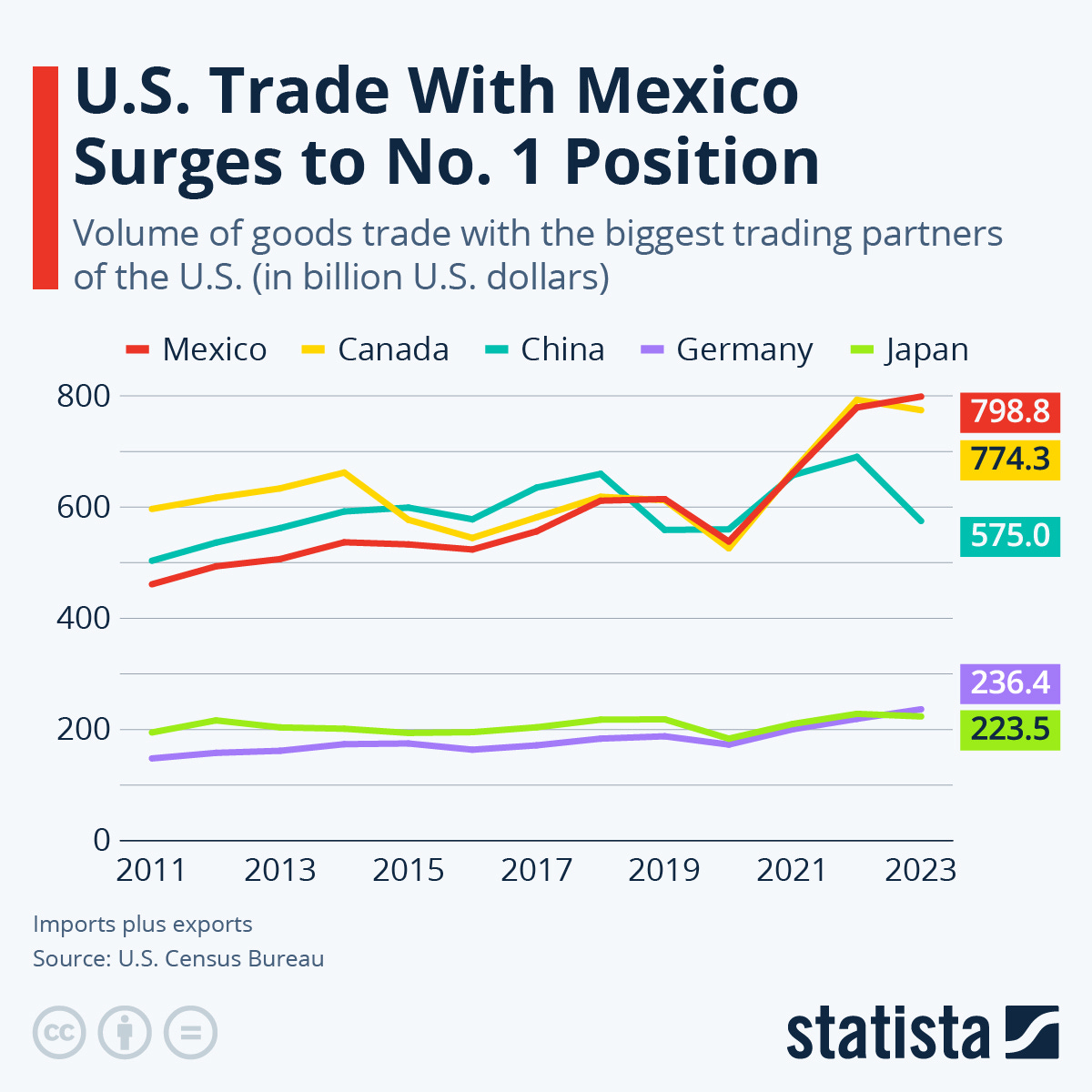

First, let me take aim at the “Cold War” moniker because it does just what I warned of above: it fights the last war. The US-China relationship is vastly different than the United States and the Soviet Union. For one thing, the Soviet Union and the United States had only a modest trade and investment relationship. The US-China commercial relationship is anything but “modest.” For all of the talk of showdowns and trade wars, China clocks in as America’s third largest trade partner, after Mexico and Canada, and second largest international holder of U.S Treasuries.

From the chart below, you can see that China held the top spot from 2015-18. It is also worth noting that China has been pouring investment into Mexico, partly as a back-door to trade with the United States.

Yes, the China-US trade relationship is on the decline, but it is falling from elevated heights. A crash would not only hit both sides hard, but also the broader global economy.

Early commentary after President-elect Donald Trump’s announcement of Senator Marco Rubio as his Secretary of State nominee and Congressman and former Army Special Forces operator Michael Waltz as National Security Advisor has focused on their China “hawk” credentials, suggesting a harder line on Beijing. The President-elect’s own stated threats of a possible 60% tariff on all goods coming from China has added to the heightened sense that a significant trade showdown is looming.

But 2025 is not 2017, and China will be better prepared for targeted retaliation in the event of Trade War 2.0 with the United States. Trade War 1.0 began in 2018 with the Trump administration tariffs and continued into the Biden Administration. Make no mistake: the Biden team was not soft on China. In fact, they continued most of the Trump-era tariffs and added a round of new export controls. In 2022, National Security Advisor Jake Sullivan said that US policy was no longer to keep “a relative lead” over China on tech, but “as large of a lead as possible.”

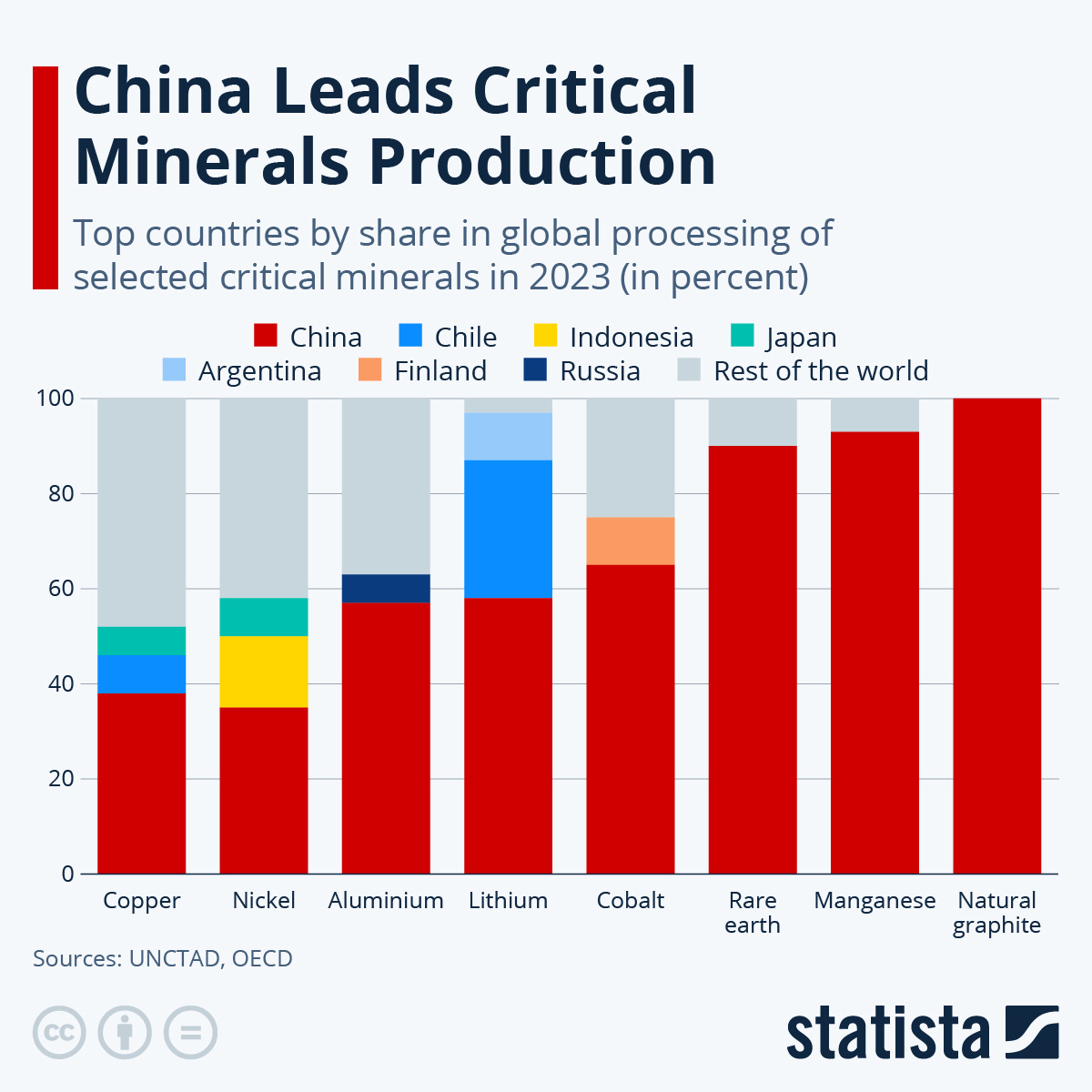

If Trump turns up the heat ( and “if” is the operative word because forecasting what the incoming President will actually do versus what he says he will do is a perilous exercise), China will have more tools at its disposal to respond this time around. Beijing has created laws that allow it to target and blacklist foreign companies, impose its own sanctions and cut American access to critical supply chains. China, in particular, can cut off the supply of dozens of resources such as rare earths and lithium crucial to modern technologies.

Look at China’s dominant position in critical minerals processing below.

The Soviet Union had nukes, but it never had this kind of immense power over global critical minerals.

The incoming President will likely take aim at China’s technology development by further restricting US exports of advanced tech to China beyond AI chips. Think quantum computing, robotics and biotechnology. This will slow - but not halt - China’s stated goals of leadership in several of these industries.

While China may have more tools to respond, it faces this threat in a worse position economically than the Trump 1.0 era. It’s hard to depict China these days as the “the ten foot tall economic behemoth” about to eat everyone’s lunch. With a slowing economy, an over leveraged property sector, high youth unemployment, significant local government debt challenges, and a private tech sector still reeling from the government’s heavy-handed crackdowns, today’s China does not feel like a dynamic economy on the move.

China suffers from the 3 D’s, as The Economist magazine put it recently, “debt, deflation, and poor demography,” and it now faces a fourth D in Donald Trump, but the Middle Kingdom remains the world’s manufacturing powerhouse. As Richard Baldwin writes: “China is now the world’s sole manufacturing superpower. Its production exceeds that of the nine next largest manufacturers combined.”

Look at this chart below to see China’s manufacturing might.

On the negative side for China, it also faces a mounting debt load. While still lower than the United States, it is rising. See graphic below.

Clearly, China will take some hits if the U.S begins ratcheting up tariffs. The U.S will take a few lumps too as China retaliates.

There have been talk of “winners” in the China-US trade war such as Mexico, Cambodia, Vietnam, Malaysia and others who might benefit from near-shoring and friend-shoring supply chain trends. But, in some ways, that’s an “old” story - very 2023. The Biden Administration has already begun targeting allies and sectors in Asia that serve as backdoors for China trade with the U.S. Southeast Asia’s solar industry, for example, has come under fire from the United States due to its extensive China ties.

With Robert E. Lighthizer, the uber China hawk, back in action likely in a senior position in the Trump administration, the countries that seek to “capitalize” on US-China tensions will not likely be given much reprieve. Expect other China backdoors to be challenged and possibly shut down. Chinese companies that continue a strategy of “Singapore-washing” will also likely face tougher restrictions, as will those who facilitate the growing practice of domiciling an essentially Chinese-owned business in the Southeast Asian commercial hub.

But, what of real war, beyond trade wars? President-elect Trump likely did not give Taiwan much relief when he told Bloomberg Businessweek in a July interview that “Taiwan should pay us for defense. I wouldn’t feel so secure right now if I were them.”

Would China President Xi Jinping view that statement as a green light to possibly blockade Taiwan? Nearly all the world’s advanced chips, critical for modern living, are made in Taiwan. A blockade would be a heavy blow to the global economy and a major challenge to the US policy of strategic ambiguity.

Geopolitical risk analysts today face a dilemma: should we become armchair psychologists to try to get in the heads of President Xi in China or Putin in Russia, or, for that matter President-elect Donald Trump - leaders whose decisions are not easily predictable? That’s probably not a good idea.

What we can say for certain, however, is that we can expect more turbulence in 2025 and beyond in U.S-China ties, but we should not expect similar outcomes. As Mark Twain once famously said: “History does not repeat itself, but it often rhymes.” Within those rhymes, however, a new world is emerging and the China-US relationship will be a defining feature of our new order.

Fasten your seat belts. It will be a bumpy ride.

“You can’t cross the sea merely by standing and staring at the water.”

― Rabindranath Tagore

ft (paywalled) article on friendwashing demonstrates the forces of capitalism MAGA faces when they attempt incoherent economic actions primarily for crony benefits.

it is indeed a complex adaptive machine, and again, allies will be punished more than enemies.

https://www.ft.com/content/5583db36-5141-413f-9687-2c3f4968ff07